Boralex announces the closing of a $95 million financing for the Témiscouata II wind farm in Quebec

20 Agosto 2024 - 8:00AM

Boralex inc. (“Boralex” or the “Company”) (TSX: BLX) is pleased to

announce the closing of a $95 million financing for the 52 MW

Témiscouata II wind farm, located on public lands in the

municipalities of Saint-Elzéar-de-Témiscouata and

Saint-Honoré-de-Témiscouata, Quebec, and in operation since 2015.

This financing was provided by Desjardins, as Sole Lender and Sole

Arranger.

The financing for the site comprises:

- An $85 million term loan, amortized

over 11 years;

- A letter of credit facility,

totaling $9.7 million, for guarantees under contracts with

Hydro-Québec and financing reserves;

- A significant portion of the

long-term financing component bears interest at a rate fixed under

an interest rate hedging arrangement.

- An ESG swap which includes a cash

back, designed by Desjardins, to cover the debt's interest rate

risk and to reward the achievement of ESG key performance

indicators. Specifically, the measures monitored are CO2 emissions

avoided by Boralex’s renewable energy production worldwide and

female representation in management positions.

“This financing is perfectly in line with our

focus on optimizing our capital structure, in addition to

demonstrating the financial community's strong support for our

projects. I would like to applaud the work of the Boralex and

Desjardins teams, who once again collaborated to set up this loan

with advantageous conditions, including the ESG swap, a tool

aligned with our strong commitment to corporate social

responsibility,” said Bruno Guilmette, Executive Vice President and

Chief Financial Officer of Boralex.

“This financing is yet another example of our

leadership in the renewable energy ecosystem in Quebec and across

the country. At Desjardins, our goal is to actively contribute to

the creation of a more inclusive, low-carbon economy. After our

participation in the financing of the Apuiat wind farm, in

collaboration with the Innu communities of the Côte-Nord region, we

are very proud to continue our relationship of trust with Boralex.

By adding a green cash back to this financing product, Desjardins

wishes to support the efforts of companies in integrating

environmental, social and governance criteria into their

operations. We would like to highlight Boralex's commitment in this

regard,” said Guy Cormier, President and Chief Executive Officer of

Desjardins Group.

Caution Regarding Forward-Looking

Statements

Some of the statements contained in this press

release are forward-looking statements based on current

expectations, within the meaning of securities legislation. Boralex

would like to point out that, by their very nature, forward-looking

statements involve risks and uncertainties such that its results or

the measure it adopts could differ materially from those indicated

by or underlying these statements, or could have an impact on the

degree of realization of a particular forward looking statement.

Unless otherwise specified by the Company, the forward-looking

statements do not take into account the possible impact on its

activities, transactions, non-recurring items or other exceptional

items announced or occurring after the statements are made. There

can be no assurance as to the materialization of the results,

performance or achievements as expressed or implied by

forward-looking statements. The reader is cautioned not to place

undue reliance on such forward-looking statements. Unless required

to do so under applicable securities legislation, Boralex

management does not assume any obligation to update or revise

forwardlooking statements to reflect new information, future events

or other changes.

About Boralex

At Boralex, we have been providing affordable

renewable energy accessible to everyone for over 30 years. As

a leader in the Canadian market and France’s largest independent

producer of onshore wind power, we also have facilities in the

United States and development projects in the United Kingdom. Over

the past five years, our installed capacity has more than doubled

to over 3 GW. We are developing a portfolio of more than

6.8 GW in wind, solar projects and storage projects, guided by

our values and our corporate social responsibility (CSR) approach.

Through profitable and sustainable growth, Boralex is actively

participating in the fight against global warming. Thanks to our

fearlessness, our discipline, our expertise and our diversity, we

continue to be an industry leader. Boralex’s shares are listed on

the Toronto Stock Exchange under the ticker symbol BLX.

For more information, visit boralex.com or

sedarplus.com. Follow us on Facebook, Twitter, LinkedIn and

Instagram.

For more information

|

MEDIA |

INVESTOR RELATIONS |

|

Camille LaventureAdvisor, Public Affairs and

External CommunicationsBoralex

Inc.438 883-8580camille.laventure@boralex.com |

Stéphane MilotVice President, Investor

RelationsBoralex Inc.514

213-1045stephane.milot@boralex.com |

Source: Boralex inc.

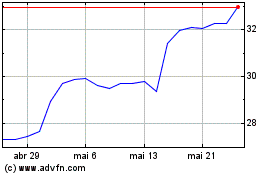

Boralex (TSX:BLX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Boralex (TSX:BLX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025