IREN (Iris Energy Limited) (NASDAQ: IREN) (together with its

subsidiaries, “IREN” or “the Company”), a leading next-generation

data center business powering the future of Bitcoin, AI and beyond,

today reported its financial results for the full year ended June

30, 2024. All $ amounts are in United States Dollars (“USD”) unless

otherwise stated.

“We are pleased to report our full year FY24 results, which

highlights continued growth across revenue, earnings and cashflow,”

said Daniel Roberts, Co-Founder and Co-CEO of IREN. “Our 2024

guidance remains unchanged. With 15 EH/s installed, we are well on

track to achieve our 20 EH/s milestone next month and 30 EH/s this

year.”

Full Year FY24 Results

- EBITDA of $19.6

million, as compared to $(123.2) million in fiscal year 20231

- Adjusted EBITDA of

$54.7 million, as compared to $1.4 million in fiscal year

20231

- Record Bitcoin

mining revenue of $184.1 million, as compared to $75.5 million in

fiscal year 2023, driven by growth in operating hashrate and higher

Bitcoin prices

- Record 4,191 Bitcoin

mined, as compared to 3,259 Bitcoin in fiscal year 2023, primarily

driven by growth in operating hashrate

- AI Cloud Services

revenue of $3.1 million, servicing multiple customers across the

reserved and on-demand market

- Net electricity

costs2 of $76.0 million, as compared to $35.8 million in fiscal

year 2023, primarily driven by an increase in operating hashrate,

with 80MW of additional capacity commissioned during the year

- Other costs of $56.5

million, as compared to $38.4 million in fiscal year 20233

- Reflects a larger

business today that is delivering significant growth, and

projecting continued expansion over the coming years

- Procurement of RECs,

consistent with our commitment to utilizing 100% renewable

energy

- Additional head

office resources to support growth, and expanded risk, compliance

and reporting obligations

- Increased site

expenses to support design, management and delivery of our

Childress operations

- Includes $6.3

million provision for Canadian non-refundable sales tax

- Net loss after

income tax of $29.0 million, as compared to a loss of $171.9

million in fiscal year 2023

- Operating cash

inflow of $52.7 million, as compared to $6.0 million in fiscal year

2023

- Cash and cash

equivalents of $404.6 million as of June 30, 2024 and no debt

facilities4

Recent Operational Highlights

Data Centers

- Morgan Stanley

process to evaluate AI data center opportunities in relation to

1.4GW West Texas site underway:

- Non-disclosure

agreements signed

- Information being

provided to interested parties

- Colocation, AI Cloud

Services and other structures also being discussed with prospective

partners in relation to British Columbia and Childress sites

- Increased

grid-connected power secured from 760MW to 2,310MW over the last 12

months

- Date center

expansion to 510MW in 2024

- Childress Phase 2

(100MW, 3Q CY24) – 100MW substation energized, 40MW data centers

commissioned

- Childress Phase 3

(150MW, 4Q CY24) – Foundational, structural and electrical works

ongoing for 6 x 25MW data centers

Bitcoin Mining

- Increased

self-mining capacity from 5.6 EH/s to 10 EH/s through FY245

- Successful

transition to spot pricing from August 2024

- Historically

challenging for energy retailers to provide spot power to Bitcoin

miners

- Scale and

demonstrated robustness of IREN curtailment systems has now enabled

transition to a spot pricing contract effective August 1, 2024

- Spot pricing with

curtailment allows IREN to optimize power costs in real-time,

avoiding prior hedging costs and risks

- One-off cost of $7.2

million to close out August and September 2024 hedges

- Childress August

2024 month-to-date electricity cost of 3.1 c/kWh (~$23k electricity

cost per Bitcoin mined)6

- On track for 30 EH/s

in 2024

- 15 EH/s installed

(August 28, 2024)

- 20 EH/s next month,

30 EH/s in next 4 months (fully funded)

- Secured 10.5 EH/s of

latest-generation Bitmain S21 XP miners

- Purchase price of

$21.5/TH,7 with 20% deferred until 9 months after shipping

- Shipping scheduled

for October and November 2024, to support expansion to 30 EH/s

- Improves overall

nameplate fleet efficiency to 15 J/TH at 30 EH/s

- Supports indicative

electricity cost per Bitcoin mined of ~$19k8 at 30 EH/s

- Pathway from 30 EH/s

to 50 EH/s secured via existing Bitmain S21 Pro miner purchase

options

- Purchase price of

$18.9/TH9 (option fee of 10% of purchase price)

- Options expiring in

March 2025 and May 2025

AI Cloud Services

- 816 NVIDIA H100

GPUs, servicing multiple customers

- AI Cloud Services

revenue continues to scale

- Launching Childress

GPU pilot in H2 2024

- Poolside recently

extended contract, expected to roll-off August 30, 2024:

- Consolidating

clusters with other providers for strategic reasons

- Continuing to

provide testimonials and customer references

- Strong customer

demand and pipeline

Corporate

- The Full Year FY24

Results webcast will be recorded, and the replay will be accessible

shortly after the event at

https://iren.com/investor/events-and-presentations

Non-IFRS metric reconciliation

|

Adjusted EBITDA

Reconciliation(USD$m)1 |

Year ended June 30, 2024 |

Year ended June 30, 2023 |

|

Bitcoin mining revenue |

184.1 |

|

75.5 |

|

|

AI Cloud Service revenue |

3.1 |

|

- |

|

|

Other income |

1.6 |

|

- |

|

|

Electricity charges |

(81.6) |

|

(35.8) |

|

|

Realized gain on financial asset |

4.1 |

|

- |

|

|

Other costs |

(56.5) |

|

(38.4) |

|

|

Adjusted EBITDA |

54.7 |

|

1.4 |

|

|

Adjusted EBITDA Margin |

29% |

|

2% |

|

|

|

|

|

|

Reconciliation to consolidated statement of profit or

loss |

|

|

|

Add/(deduct): |

|

|

|

Unrealized loss on financial asset |

(3.4) |

|

- |

|

|

Share-based payment expense - $75 exercise price options |

(11.8) |

|

(12.2) |

|

|

Share-based payment expense - other |

(11.8) |

|

(2.2) |

|

|

Impairment of assets |

- |

|

(105.2) |

|

|

Reversal of impairment of assets |

0.1 |

|

- |

|

|

Foreign exchange loss |

(4.7) |

|

(0.2) |

|

|

Other non-recurring income |

- |

|

3.1 |

|

|

Gain on disposal of subsidiaries |

- |

|

3.3 |

|

|

Gain/(loss) on disposal of property, plant and equipment |

0.0 |

|

(6.6) |

|

|

Other expense items2 |

(3.5) |

|

(4.6) |

|

|

EBITDA |

19.6 |

|

(123.2) |

|

|

Finance expense |

(0.3) |

|

(16.4) |

|

|

Interest income |

5.8 |

|

0.9 |

|

|

Depreciation |

(50.7) |

|

(30.9) |

|

|

Loss before income tax expense for the period |

(25.5) |

|

(169.5) |

|

|

Income tax expense |

(3.5) |

|

(2.4) |

|

|

Loss after income tax expense for the period |

(29.0) |

|

(171.9) |

|

1) For further detail, see our audited financial statements for

the year ended June 30, 2024, included in our Form 20-F filed with

the SEC on August 28, 2024.2) Other expense items include one-off

professional fees including legal fees.

|

Reconciliation of Electricity charges to Net electricity

costs(USD$m) |

Year endedJune 30, 2024 |

Year endedJune 30, 2023 |

|

Electricity charges |

(81.6) |

(35.8) |

|

Add/(deduct) the following: |

|

- |

|

Realized gain on financial asset |

4.1 |

- |

|

ERS revenue (included in Other income) |

1.6 |

- |

|

ERS fees (included in Other operating expenses) |

(0.1) |

- |

|

Net electricity costs1 |

(76.0) |

(35.8) |

1) Net electricity costs exclude the cost of Renewable Energy

Certificates (RECs).

Forward-Looking Statements

This investor update includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or IREN’s future financial or operating performance.

For example, forward-looking statements include but are not limited

to the Company’s business strategy, expected operational and

financial results, and expected increase in power capacity and

hashrate. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,” “believe,” “may,”

“can,” “should,” “could,” “might,” “plan,” “possible,” “project,”

“strive,” “budget,” “forecast,” “expect,” “intend,” “target”,

“will,” “estimate,” “predict,” “potential,” “continue,” “scheduled”

or the negatives of these terms or variations of them or similar

terminology, but the absence of these words does not mean that

statement is not forward-looking. Such forward-looking statements

are subject to risks, uncertainties, and other factors which could

cause actual results to differ materially from those expressed or

implied by such forward-looking statements. In addition, any

statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking.

These forward-looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

IREN’s actual results, performance or achievements to be materially

different from any future results performance or achievements

expressed or implied by the forward looking statements, including,

but not limited to: Bitcoin price and foreign currency exchange

rate fluctuations; IREN’s ability to obtain additional capital on

commercially reasonable terms and in a timely manner to meet its

capital needs and facilitate its expansion plans; the terms of any

future financing or any refinancing, restructuring or modification

to the terms of any future financing, which could require IREN to

comply with onerous covenants or restrictions, and its ability to

service its debt obligations, any of which could restrict its

business operations and adversely impact its financial condition,

cash flows and results of operations; IREN’s ability to

successfully execute on its growth strategies and operating plans,

including its ability to continue to develop its existing data

center sites and to diversify and expand into the market for high

performance computing (“HPC”) solutions it may offer (including the

market for AI Cloud Services); IREN’s limited experience with

respect to new markets it has entered or may seek to enter,

including the market for HPC solutions (including AI Cloud

Services); expectations with respect to the ongoing profitability,

viability, operability, security, popularity and public perceptions

of the Bitcoin network; expectations with respect to the

profitability, viability, operability, security, popularity and

public perceptions of any current and future HPC solutions

(including AI Cloud Services) that IREN offers; IREN’s ability to

secure and retain customers on commercially reasonable terms or at

all, particularly as it relates to its strategy to expand into

markets for HPC solutions (including AI Cloud Services); IREN’s

ability to manage counterparty risk (including credit risk)

associated with any current or future customers, including

customers of its HPC solutions (including AI Cloud Services) and

other counterparties; the risk that any current or future

customers, including customers of its HPC solutions (including AI

Cloud Services), or other counterparties may terminate, default on

or underperform their contractual obligations; Bitcoin global

hashrate fluctuations; IREN’s ability to secure renewable energy,

renewable energy certificates, power capacity, facilities and sites

on commercially reasonable terms or at all; delays associated with,

or failure to obtain or complete, permitting approvals, grid

connections and other development activities customary for

greenfield or brownfield infrastructure projects; IREN’s reliance

on power and utilities providers, third party mining pools,

exchanges, banks, insurance providers and its ability to maintain

relationships with such parties; expectations regarding

availability and pricing of electricity; IREN’s participation and

ability to successfully participate in demand response products and

services and other load management programs run, operated or

offered by electricity network operators, regulators or electricity

market operators; the availability, reliability and/or cost of

electricity supply, hardware and electrical and data center

infrastructure, including with respect to any electricity outages

and any laws and regulations that may restrict the electricity

supply available to IREN; any variance between the actual operating

performance of IREN’s miner hardware achieved compared to the

nameplate performance including hashrate; IREN’s ability to curtail

its electricity consumption and/or monetize electricity depending

on market conditions, including changes in Bitcoin mining economics

and prevailing electricity prices; actions undertaken by

electricity network and market operators, regulators, governments

or communities in the regions in which IREN operates; the

availability, suitability, reliability and cost of internet

connections at IREN’s facilities; IREN’s ability to secure

additional hardware, including hardware for Bitcoin mining and any

current or future HPC solutions (including AI Cloud Services) it

offers, on commercially reasonable terms or at all, and any delays

or reductions in the supply of such hardware or increases in the

cost of procuring such hardware; expectations with respect to the

useful life and obsolescence of hardware (including hardware for

Bitcoin mining as well as hardware for other applications,

including any current or future HPC solutions (including AI Cloud

Services) IREN offers); delays, increases in costs or reductions in

the supply of equipment used in IREN’s operations; IREN’s ability

to operate in an evolving regulatory environment; IREN’s ability to

successfully operate and maintain its property and infrastructure;

reliability and performance of IREN’s infrastructure compared to

expectations; malicious attacks on IREN’s property, infrastructure

or IT systems; IREN’s ability to maintain in good standing the

operating and other permits and licenses required for its

operations and business; IREN’s ability to obtain, maintain,

protect and enforce its intellectual property rights and

confidential information; any intellectual property infringement

and product liability claims; whether the secular trends IREN

expects to drive growth in its business materialize to the degree

it expects them to, or at all; any pending or future acquisitions,

dispositions, joint ventures or other strategic transactions; the

occurrence of any environmental, health and safety incidents at

IREN’s sites, and any material costs relating to environmental,

health and safety requirements or liabilities; damage to IREN’s

property and infrastructure and the risk that any insurance IREN

maintains may not fully cover all potential exposures; ongoing

proceedings relating to the default by two of IREN’s wholly-owned

special purpose vehicles under limited recourse equipment financing

facilities; ongoing securities litigation relating in part to the

default; and any future litigation, claims and/or regulatory

investigations, and the costs, expenses, use of resources,

diversion of management time and efforts, liability and damages

that may result therefrom; IREN's failure to comply with any laws

including the anti-corruption laws of the United States and various

international jurisdictions; any failure of IREN's compliance and

risk management methods; any laws, regulations and ethical

standards that may relate to IREN’s business, including those that

relate to Bitcoin and the Bitcoin mining industry and those that

relate to any other services it offers, including laws and

regulations related to data privacy, cybersecurity, the storage,

use or processing of information and consumer laws; IREN’s ability

to attract, motivate and retain senior management and qualified

employees; increased risks to IREN’s global operations including,

but not limited to, political instability, acts of terrorism, theft

and vandalism, cyberattacks and other cybersecurity incidents and

unexpected regulatory and economic sanctions changes, among other

things; climate change, severe weather conditions and natural and

man-made disasters that may materially adversely affect IREN’s

business, financial condition and results of operations; public

health crises, including an outbreak of an infectious disease (such

as COVID-19) and any governmental or industry measures taken in

response; IREN’s ability to remain competitive in dynamic and

rapidly evolving industries; damage to IREN’s brand and reputation;

expectations relating to Environmental, Social or Governance issues

or reporting; the costs of being a public company; and other

important factors discussed under the caption “Risk Factors” in

IREN’s annual report on Form 20-F filed with the SEC on August 28,

2024 as such factors may be updated from time to time in its other

filings with the SEC, accessible on the SEC’s website at

www.sec.gov and the Investor Relations section of IREN’s website at

https://investors.iren.com.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this investor update. Any

forward-looking statement that IREN makes in this investor update

speaks only as of the date of such statement. Except as required by

law, IREN disclaims any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise.

Non-IFRS Financial Measures

This press release includes non-IFRS financial

measures, including Net electricity costs, Adjusted EBITDA and

Adjusted EBITDA Margin. We provide these measures in addition to,

and not as a substitute for, measures of financial performance

prepared in accordance with IFRS.

There are a number of limitations related to the

use of Net electricity costs, Adjusted EBTIDA and Adjusted EBITDA

Margin. For example, other companies, including companies in our

industry, may calculate these measures differently. The Company

believes that these measures are important and supplement

discussions and analysis of its results of operations and enhances

an understanding of its operating performance.

EBITDA is calculated as our IFRS profit/(loss)

after income tax expense, excluding interest income, finance

expense and non-cash fair value loss and interest expense on hybrid

financial instruments, income tax expense, depreciation and

amortization, which are important components of our IFRS

profit/(loss) after income tax expense. Further, “Adjusted EBITDA”

also excludes share-based payments expense, which is an important

component of our IFRS profit/(loss) after income tax expense,

foreign exchange gains and losses, impairment of assets, certain

other non-recurring income, loss on disposal of property, plant and

equipment, gain on disposal of subsidiaries, unrealized fair value

gains and losses on financial assets and certain other expense

items.

Net electricity costs is calculated as our IFRS

Electricity charges net of Realized gain/(loss) on financial asset,

ERS revenue (included in Other income) and ERS fees (included in

Other operating expenses), and excludes the cost of Renewable

Energy Certificates (RECs).

About IREN

IREN is a leading next-generation data center business powering

the future of Bitcoin, AI and beyond utilizing 100% renewable

energy.

- Bitcoin Mining:

providing security to the Bitcoin network, expanding to 30 EH/s in

2024. Operations since 2019.

- AI Cloud Services:

providing cloud compute to AI customers, 816 NVIDIA H100 GPUs.

Operations since 2024.

- Next-Generation Data

Centers: 300MW of operating data centers, expanding to 510MW in

2024. Specifically designed and purpose-built infrastructure for

high-performance and power-dense computing applications.

- Technology:

technology stack for performance optimization of AI Cloud Services,

Bitcoin Mining and energy trading operations.

- Development

Portfolio: 2,310MW of grid-connected power secured across North

America, >1,000 acre property portfolio and additional

development pipeline.

- 100% Renewable

Energy (from clean or renewable energy sources or through the

purchase of RECs): targets sites with low-cost & underutilized

renewable energy, and supports electrical grids and local

communities.

Contacts

|

MediaJon Snowball Domestique +61 477 946

068Danielle GhiglieraAircover Communications+1 510 333 2707 |

InvestorsLincoln Tan IREN+61 407 423 395

lincoln.tan@iren.com |

To keep updated on IREN’s news releases and SEC filings, please

subscribe to email alerts at

https://iren.com/investor/ir-resources/email-alerts.

1 EBITDA and Adjusted EBITDA are non-IFRS metrics. See page 4

for a reconciliation to the nearest IFRS metric.2 Net electricity

cost is a non-IFRS metric. See page 4 for a reconciliation to the

nearest IFRS metric.3 Other costs exclude one-off other expense

items. See page 4 for a reconciliation to the nearest IFRS metric.4

Reflects USD equivalent, audited cash and cash equivalents as of

June 30, 2024.5 Comparative period: June 2023 vs. June 2024

self-mining.6 Childress August 2024 month-to-date electricity cost

and cost per Bitcoin mined calculated between August 1 - 22, 2024

and based on actual Bitcoin mined, energy usage and real-time power

prices in ERCOT West Load Zone, including net ERS revenue, ERCOT,

retail electric provider (REP) and network fees, and adjusted for

now eligible 4CP benefit.7 Purchase price excludes shipping and

taxes.8 Cost per bitcoin mined represents indicative electricity

cost per bitcoin mined assuming 30 EH/s, nameplate fleet efficiency

of 15 J/TH, weighted average power cost of $0.04/kWh ($0.045/kWh in

BC and $0.037/kWh in Texas – latter calculated using actual monthly

average net power price at Childress during FY24 (with hedging and

curtailment), including net ERS revenue and adjusted for now

eligible 4CP benefit), current global hashrate of 621.7 EH/s, block

reward of 3.125 BTC per block and transaction fees of 0.1 BTC per

block.9 Purchase price excludes shipping and taxes.

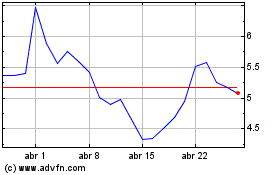

IREN (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

IREN (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024