Globus Maritime Limited (“Globus”, the “Company”, “we”, or “our”)

(NASDAQ: GLBS), a dry bulk shipping company, today reported its

unaudited consolidated financial results for the second quarter and

six-month period ended June 30, 2024.

- Revenue

- $9.5 million in Q2 2024

- $17.2 million in H1 2024

- Net income

- $3.3 million net income in Q2 2024

- $3 million net income in H1 2024

- Adjusted EBITDA

- $4 million in Q2

2024

- $6 million in H1

2024

- Time Charter

Equivalent

- $14,578 per day in Q2

2024

- $13,246 per day in H1

2024

Current Fleet ProfileAs of the

date of this press release, Globus’ subsidiaries own and operate

seven dry bulk carriers, consisting of one Supramax, four Kamsarmax

and two Ultramax.

|

Vessel |

Year Built |

Yard |

Type |

Month/Year Delivered |

DWT |

Flag |

|

River Globe |

2007 |

Yangzhou Dayang |

Supramax |

Dec 2007 |

53,627 |

Marshall Is. |

|

Galaxy Globe |

2015 |

Hudong-Zhonghua |

Kamsarmax |

October 2020 |

81,167 |

Marshall Is. |

|

Diamond Globe |

2018 |

Jiangsu New Yangzi Shipbuilding Co. |

Kamsarmax |

June 2021 |

82,027 |

Marshall Is. |

|

Power Globe |

2011 |

Universal Shipbuilding Corporation |

Kamsarmax |

July 2021 |

80,655 |

Marshall Is. |

|

Orion Globe |

2015 |

Tsuneishi Zosen |

Kamsarmax |

November 2021 |

81,837 |

Marshall Is. |

|

GLBS Hero |

2024 |

Nihon Shipyard Co., Ltd. |

Ultramax |

January 2024 |

64,000 |

Marshall Is. |

|

GLBS Might |

2024 |

Nantong Cosco KHI Ship Engineering Co., Ltd. |

Ultramax |

August 2024 |

64,000 |

Marshall Is. |

|

Weighted Average Age: 7.9 Years as at September 12, 2024 |

|

507,313 |

|

| |

|

|

|

Current Fleet DeploymentAll our

vessels are currently operating on short-term time charters (“on

spot”).

Management Commentary

“We are pleased to deliver once again positive

half year results whilst maintaining a healthy balance sheet and

remaining committed to renew and expand our fleet with modern and

fuel-efficient vessels.

The chartering market so far in 2024, albeit not

spectacular, has been relatively healthy. Various dynamics and

cargo flows keep shifting constantly, we have managed to remain

profitable and keep our operating costs at reasonable levels and

the fleet utilization high. Notwithstanding the significant

geopolitical challenges around the world, we are navigating through

these challenges without having to forego market opportunities that

may appear.

2024 so far has been a significant year for the

Company, having taken delivery of two newbuilding Ultramaxes and

expecting to take delivery of a third one shortly. In addition to

these vessels, we also have two newbuilding vessels being built in

Japan to be delivered in 2026. At the same time, we have disposed

of a 2005 Panamax for a gain. Furthermore, we managed to

finance the new vessels acquired under what we view as favorable

terms and conditions.

It is so satisfactory to see our new vessels

competitive and sought after by reputable charterers and currently

trading at premiums to the BSI 58 index; additionally, and so far,

they have proven to be significantly more efficient than the older

Supramaxes replaced in the fleet.

We continue to evaluate newbuildings of

larger size as well as alternative fuel options and at the same

time keep an eye in the secondhand market examining possibilities

for further expansion of the fleet with fuel-efficient

vessels.

Internal discussions are ongoing regarding the

options we see in the market, the prices and the delivery

positions. At the same time, we are exploring various financing

opportunities that open up to new markets across the globe. Our

goal is to create and expand shareholder value while maintaining a

healthy balance sheet as well as meeting or exceeding the safety

and quality standards of our industry and customers.”

Recent Developments

Delivery of new building

vessel

On January 22, 2024, the Company paid the

remaining $18.5 million at Nihon Shipyard Co. in Japan and on

January 25, 2024, the Company took delivery of a new Ultramax with

carrying capacity of approximately 64,000 DWT, of which the Company

had previously announced on May 10, 2022, and was named “m/v GLBS

Hero”. The total cost of the new vessel was approximately $37.5

million.

On August 12, 2024, the Company paid the

remaining $18.0 million at Nantong Cosco KHI Ship Engineering Co.,

Ltd. and on August 20, 2024, the Company took delivery of a new

Ultramax with carrying capacity of approximately 64,000 DWT, of

which the Company had previously announced on August 23, 2023, and

was named “m/v GLBS Might”. The total cost of the new vessel was

approximately $35.3 million.

Debt financing & Financial

Liability

On February 23, 2024, the Company, through its

subsidiary Daxos Maritime Limited, entered into a $28 million sale

and leaseback agreement with SK Shipholding S.A., a subsidiary of

Shinken Bussan Co., Ltd. of Japan, with respect to the

approximately 64,000 dwt bulk carrier “GLBS Might” which was

delivered from the relevant shipyard on August 20, 2024. The

Company has an obligation to purchase back the vessel at the end of

the ten-year charter period. On February 28, 2024, the Company drew

down the amount of $2.8 million, being the 10% deposit of the

purchase price and on August 16, 2024, the Company drew down the

remaining 90% of the purchase price, being $25.2 million.

On May 23, 2024, the Company reached an

agreement with Marguerite Maritime S.A., a Panamanian subsidiary of

a Japanese leasing company unaffiliated with us, for a loan

facility of $23 million bearing interest at Term SOFR plus a margin

of 2.3% per annum. This loan agreement provides that it is to be

repaid by 20 consecutive quarterly instalments of $295,000 each,

and $17.1 million to be paid together with the 20th (and last)

instalment. The proceeds of this financing will be used for general

corporate purposes. As collateral for the loan, among other things,

a mortgage over the m/v GLBS Hero was granted, and a general

assignment was granted over the earnings, the insurances, any

requisition compensation, any charter and any charter guarantee

with respect to the m/v GLBS Hero. Globus Maritime Limited

guaranteed the loan. On May 30, 2024, the Company drew down the

amount of $22.65 million, being the loan amount minus the upfront

fee of $0.35 million.

Sale of vessel

On May 28, 2024, the Company, through a wholly

owned subsidiary, entered into an agreement to sell the 2005-built

Moon Globe for a gross price of $11.5 million, before commissions,

to an unaffiliated third party. The vessel was delivered to its new

owners on July 8, 2024.

Miscellaneous Developments

On March 13, 2024, the Company awarded a

consultant affiliated with our chief executive officer a one-time

bonus of $3 million, half of which is payable immediately upon the

delivery of the newbuilding vessel Hull NE442 (i.e., the vessel

being constructed by Nantong Cosco Khi Ship Engineering pursuant to

the agreement dated May 13, 2022) and the balance at the delivery

of Hull NE443 (i.e., the vessel being constructed by Nantong Cosco

Khi Ship Engineering pursuant to the other agreement dated May 13,

2022), in each case assuming Athanasios Feidakis remains Chief

Executive Officer at each such relevant time, i.e. August 20, 2024

and September 20, 2024, respectively.

Following the successful delivery of the

newbuilding vessel Hull NE442, named GLBS Might, the Company paid

the $1.5 million bonus on August 26, 2024, to the consultant as per

the aforementioned award.

On March 13, 2024, the Board of Directors

adopted the Globus Maritime Limited 2024 Equity Incentive Plan, or

the Plan. The purpose of the Plan is to provide Company’s officers,

key employees, directors, consultants and service provider, whose

initiative and efforts are deemed to be important to the successful

conduct of Company’s business, with incentives to (a) enter into

and remain in the service of the Company or affiliates, (b) acquire

a proprietary interest in the success of the Company, (c) maximize

their performance and (d) enhance the long-term performance of the

Company. The number of common shares reserved for issuance under

the Plan is 2,000,000 shares. No shares have been issued under the

plan.

Earnings Highlights

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

(Expressed in thousands of U.S dollars except for daily rates and

per share data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Revenue |

9,516 |

|

7,835 |

|

17,229 |

|

16,414 |

|

| Net income/(loss) |

3,279 |

|

(1,161 |

) |

2,980 |

|

1,425 |

|

| Adjusted EBITDA (1) |

3,966 |

|

907 |

|

5,974 |

|

2,248 |

|

| Basic income/(loss) per

share (2) |

0.16 |

|

(0.06 |

) |

0.14 |

|

0.07 |

|

| |

|

|

|

|

|

|

|

|

(1) Adjusted EBITDA is a measure not in

accordance with generally accepted accounting principles (“GAAP”).

See a later section of this press release for a reconciliation of

Adjusted EBITDA to net income/(loss) and net cash generated from

operating activities, which are the most directly comparable

financial measures calculated and presented in accordance with the

GAAP measures.(2) The weighted average number of shares for the

six-month period ended June 30, 2024, and 2023 was 20,582,301. The

weighted average number of shares for the three-month period ended

June 30, 2024, and 2023 was 20,582,301.

Second quarter of the year 2024 compared

to the second quarter of the year 2023

Net income for the second quarter of the year

2024 amounted to $3.3 million or $0.16 basic income per share based

on 20,582,301 weighted average number of shares compared to net

loss of $1.2 million or $0.06 basic loss per share based on

20,582,301 weighted average number of shares for the same period

last year.

RevenueDuring the three-month

period ended June 30, 2024, and 2023, our Revenues reached $9.5

million and $7.8 million, respectively. The 22% increase in

Revenues was mainly attributed to the increase in the average time

charter rates achieved by our vessels during the second quarter of

2024 compared to the same period in 2023. Daily Time Charter

Equivalent rate (TCE) for the second quarter of 2024 was $14,578

per vessel per day against $8,244 per vessel per day during the

same period in 2023 corresponding to an increase of 77%.

First half of the year 2024 compared to

the first half of the year 2023

Net income for the six-month period ended June

30, 2024, amounted to $3 million or $0.14 basic income per share

based on 20,582,301 weighted average number of shares, compared to

$1.4 million for the same period last year or $0.07 basic income

per share based on 20,582,301 weighted average number of

shares.

RevenueDuring the six-month

period ended June 30, 2024, and 2023, our Revenues reached $17.2

million and $16.4 million, respectively. The 5% increase in

Revenues was mainly attributed to the increase in the average time

charter rates achieved by our vessels during the six-month period

ended June 30, 2024, compared to the same period in 2023. Daily

Time Charter Equivalent rate (TCE) for the six-month period of 2024

was $13,246 per vessel per day against $8,518 per vessel per day

during the same period in 2023, corresponding to an increase of

56%, which is attributed to the better conditions throughout the

bulk market for the first half of 2024.

Fleet Summary data

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Ownership days (1) |

|

637 |

|

|

793 |

|

|

1,250 |

|

|

1,603 |

|

|

Available days (2) |

|

637 |

|

|

748 |

|

|

1,250 |

|

|

1,531 |

|

|

Operating days (3) |

|

635 |

|

|

730 |

|

|

1,239 |

|

|

1,507 |

|

|

Fleet utilization (4) |

|

99.7% |

|

|

97.6% |

|

|

99.1% |

|

|

98.5% |

|

|

Average number of vessels (5) |

|

7.0 |

|

|

8.7 |

|

|

6.9 |

|

|

8.9 |

|

|

Daily time charter equivalent (TCE) rate (6) |

$14,578 |

|

$8,244 |

|

$13,246 |

|

$8,518 |

|

|

Daily operating expenses (7) |

$5,060 |

|

$5,464 |

|

$5,082 |

|

$5,522 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:(1) Ownership days are

the aggregate number of days in a period during which each vessel

in our fleet has been owned by us.(2) Available days are the number

of ownership days less the aggregate number of days that our

vessels are off-hire due to scheduled repairs or repairs under

guarantee, vessel upgrades or special surveys.(3) Operating days

are the number of available days less the aggregate number of days

that the vessels are off-hire due to any reason, including

unforeseen circumstances but excluding days during which vessels

are seeking employment.(4) We calculate fleet utilization by

dividing the number of operating days during a period by the number

of available days during the period.(5) Average number of vessels

is measured by the sum of the number of days each vessel was part

of our fleet during a relevant period divided by the number of

calendar days in such period.(6) TCE rates are our voyage revenues

less net revenues from our bareboat charters less voyage expenses

during a period divided by the number of our available days during

the period which is consistent with industry standards. TCE is a

measure not in accordance with IFRS.(7) We calculate daily vessel

operating expenses by dividing vessel operating expenses by

ownership days for the relevant time period.

Selected Consolidated Financial &

Operating Data

| |

Three months ended |

|

Six months ended |

|

| |

June 30, |

|

June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

(In thousands of U.S. dollars, except per share data) |

(unaudited) |

(unaudited) |

|

Consolidated Condensed Statements of

Operations: |

|

|

|

|

| Revenue |

9,516 |

|

7,835 |

|

17,229 |

|

16,414 |

|

| Voyage and Operating vessel

expenses |

(3,362 |

) |

(5,915 |

) |

(6,842 |

) |

(12,048 |

) |

| General and administrative

expenses |

(2,148 |

) |

(998 |

) |

(4,380 |

) |

(2,112 |

) |

| Depreciation and

amortization |

(2,130 |

) |

(2,329 |

) |

(4,385 |

) |

(4,767 |

) |

| Reversal of Impairment |

1,891 |

|

- |

|

1,891 |

|

4,400 |

|

| Other (expenses)/income &

gain from sale of vessel, net |

(40 |

) |

56 |

|

(33 |

) |

65 |

|

| Interest expense/income,

finance cost and foreign exchange (losses) / gains, net |

(578 |

) |

(503 |

) |

(1,042 |

) |

(1,009 |

) |

| Gain on derivative financial

instruments, net |

130 |

|

693 |

|

542 |

|

482 |

|

| Net income/(loss) for

the period |

3,279 |

|

(1,161 |

) |

2,980 |

|

1,425 |

|

|

|

|

|

|

|

| Basic net income/(loss) per

share for the period (1) |

0.16 |

|

(0.06 |

) |

0.14 |

|

0.07 |

|

|

Adjusted EBITDA (2) |

3,966 |

|

907 |

|

5,974 |

|

2,248 |

|

|

|

|

|

|

|

|

|

|

|

(1) The weighted average number of shares for

the six-month period ended June 30, 2024, and 2023 was 20,582,301.

The weighted average number of shares for the three-month period

ended June 30, 2024, and 2023 was 20,582,301.

(2) Adjusted EBITDA represents net earnings

before interest and finance costs net, gains or losses from the

change in fair value of derivative financial instruments, foreign

exchange gains or losses, income taxes, depreciation, depreciation

of dry-docking costs, amortization of fair value of time charter

acquired, impairment and gains or losses on sale of vessels.

Adjusted EBITDA does not represent and should not be considered as

an alternative to net income/(loss) or cash generated from

operations, as determined by IFRS, and our calculation of Adjusted

EBITDA may not be comparable to that reported by other companies.

Adjusted EBITDA is not a recognized measurement under IFRS.

Adjusted EBITDA is included herein because it is

a basis upon which we assess our financial performance and because

we believe that it presents useful information to investors

regarding a company’s ability to service and/or incur indebtedness

and it is frequently used by securities analysts, investors and

other interested parties in the evaluation of companies in our

industry.

Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation, or as a

substitute for analysis of our results as reported under IFRS. Some

of these limitations are:

- Adjusted EBITDA

does not reflect our cash expenditures or future requirements for

capital expenditures or contractual commitments;

- Adjusted EBITDA

does not reflect the interest expense or the cash requirements

necessary to service interest or principal payments on our

debt;

- Adjusted EBITDA

does not reflect changes in or cash requirements for our working

capital needs; and

- Other companies in

our industry may calculate Adjusted EBITDA differently than we do,

limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA

should not be considered a measure of discretionary cash available

to us to invest in the growth of our business.

The following table sets forth a

reconciliation of Adjusted EBITDA to net income/(loss) and net cash

generated from operating activities for the periods

presented:

| |

Three months ended |

|

Six months ended |

|

| |

June 30, |

|

June 30, |

|

|

(Expressed in thousands of U.S. dollars) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

(Unaudited) |

(Unaudited) |

| |

|

|

|

|

| Net income/(loss) for the

period |

3,279 |

|

(1,161 |

) |

2,980 |

|

1,425 |

|

| Interest expense/income, finance

cost and foreign exchange (losses) / gains, net |

578 |

|

503 |

|

1,042 |

|

1,009 |

|

| Gain on derivative financial

instruments, net |

(130 |

) |

(693 |

) |

(542 |

) |

(482 |

) |

| Depreciation and

amortization |

2,130 |

|

2,329 |

|

4,385 |

|

4,767 |

|

| Reversal of Impairment loss |

(1,891 |

) |

- |

|

(1,891 |

) |

(4,400 |

) |

| Gain from sale of vessel |

- |

|

(71 |

) |

- |

|

(71 |

) |

| Adjusted EBITDA |

3,966 |

|

907 |

|

5,974 |

|

2,248 |

|

| Payment of deferred dry-docking

costs |

(10 |

) |

(2,441 |

) |

(537 |

) |

(6,387 |

) |

| Net decrease/(increase) in

operating assets |

1,131 |

|

912 |

|

(126 |

) |

988 |

|

| Net (increase)/decrease in

operating liabilities |

1,169 |

|

(1,036 |

) |

2,371 |

|

(1,082 |

) |

| Provision for staff retirement

indemnities |

(35 |

) |

(1 |

) |

32 |

|

26 |

|

| Foreign exchange (losses)/gains

net, not attributed to cash & cash equivalents |

13 |

|

(10 |

) |

13 |

|

(17 |

) |

| Net cash generated

from/(used in) operating activities |

6,234 |

|

(1,669 |

) |

7,727 |

|

(4,224 |

) |

| |

Three months ended |

|

Six months ended |

|

| |

June 30, |

|

June 30, |

|

|

(Expressed in thousands of U.S. dollars) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

(Unaudited) |

(Unaudited) |

| Statement of cash flow

data: |

|

|

|

| Net cash generated from/ (used

in) operating activities |

6,234 |

|

(1,669 |

) |

7,727 |

|

(4,224 |

) |

| Net cash (used in) / generated

from investing activities |

(10,121 |

) |

14,059 |

|

(29,244 |

) |

10,705 |

|

| Net cash generated from/ (used

in) financing activities |

17,964 |

|

(5,313 |

) |

18,080 |

|

(6,080 |

) |

|

|

As at June 30, |

|

As at December 31, |

|

|

(Expressed in thousands of U.S. Dollars) |

2024 |

|

2023 |

|

|

|

(Unaudited) |

|

Consolidated Condensed Balance Sheet Data: |

|

|

|

|

|

Vessels and other fixed assets, net |

164,830 |

|

147,803 |

|

|

Cash and cash equivalents (including current restricted cash) |

74,370 |

|

77,822 |

|

|

Other current and non-current assets & Held for sale |

17,115 |

|

5,776 |

|

|

Total assets |

256,315 |

|

231,401 |

|

|

Total equity |

178,950 |

|

175,970 |

|

|

Total debt & Finance liabilities, net of unamortized debt

discount |

72,305 |

|

52,259 |

|

|

Other current and non-current liabilities |

5,060 |

|

3,172 |

|

|

Total equity and liabilities |

256,315 |

|

231,401 |

|

|

|

|

|

|

|

About Globus Maritime

Limited

Globus is an integrated dry bulk shipping

company that provides marine transportation services worldwide and

presently owns, operates and manages a fleet of seven dry bulk

vessels that transport iron ore, coal, grain, steel products,

cement, alumina and other dry bulk cargoes internationally. Globus’

subsidiaries own and operate seven vessels with a total carrying

capacity of 507,313 Dwt and a weighted average age of 7.9 years as

at September 12, 2024.

Safe Harbor Statement

This communication contains “forward-looking

statements” as defined under U.S. federal securities laws.

Forward-looking statements provide the Company’s current

expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts or that are not present

facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “intend,” “may,”

“ongoing,” “plan,” “potential,” “predict,” “project,” “will” or

similar words or phrases, or the negatives of those words or

phrases, may identify forward-looking statements, but the absence

of these words does not necessarily mean that a statement is not

forward-looking. Forward-looking statements are subject to known

and unknown risks and uncertainties and are based on potentially

inaccurate assumptions that could cause actual results to differ

materially from those expected or implied by the forward-looking

statements. The Company’s actual results could differ materially

from those anticipated in forward-looking statements for many

reasons specifically as described in the Company’s filings with the

Securities and Exchange Commission. Accordingly, you should not

unduly rely on these forward-looking statements, which speak only

as of the date of this communication. Globus undertakes no

obligation to publicly revise any forward-looking statement to

reflect circumstances or events after the date of this

communication or to reflect the occurrence of unanticipated events.

You should, however, review the factors and risks Globus describes

in the reports it will file from time to time with the Securities

and Exchange Commission after the date of this communication.

| |

|

| For further information please contact: |

|

| Globus Maritime Limited |

+30 210 960 8300 |

| Athanasios Feidakis, CEO |

a.g.feidakis@globusmaritime.gr |

| |

|

| Capital Link – New York |

+1 212 661 7566 |

| Nicolas Bornozis |

globus@capitallink.com |

| |

|

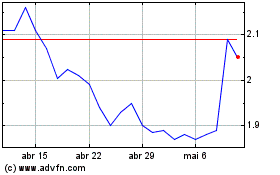

Globus Maritime (NASDAQ:GLBS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Globus Maritime (NASDAQ:GLBS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024