Conavi Medical Corp. (formerly, “

Titan Medical

Inc.”) (“the “

Resulting Issuer” or the

“

Corporation”) (TSX: TMD; OTC: TMDIF) is pleased

to announce the completion of the previously announced business

combination between Conavi Medical Inc. (“

Conavi”)

and the Corporation in an all-stock transaction, which constituted

a reverse takeover of the Corporation (the

“

Transaction”). The combined company (the

Resulting Issuer) will focus on continuing to commercialize and

develop Conavi’s Novasight Hybrid™ System designed to guide common

minimally invasive coronary procedures.

Completion of Concurrent

Financing

As previously announced, on October 8, 2024,

Conavi completed a concurrent private placement of subscription

receipts (“Subscription Receipts”) for gross

proceeds of US$7.7 million (the “Offering”).

Pursuant to the Offering, Conavi issued 7,729,300 Subscription

Receipts at a price of US$1.00 per Subscription Receipt to certain

institutional and accredited investors. The brokered portion of the

Offering was led by Bloom Burton Securities Inc. (the

“Agent”) as exclusive agent and financial advisor.

Upon closing of the Transaction, each Subscription Receipt was

automatically exchanged for one common share of Conavi

(“Conavi Share”) and one common share purchase

warrant of Conavi (“Conavi Warrant”) provided that

each such Conavi Share and Conavi Warrant was automatically

exchanged and adjusted, on the basis of the Exchange Ratio (as

defined in the Amalgamation Agreement) for equivalent securities in

the capital of the Resulting Issuer, being common shares in the

capital of the Resulting Issuer (each a “Resulting Issuer

Share”) and common share purchase warrants of the

Resulting Issuer (each whole common share purchase warrant, a

“Resulting Issuer Warrant”). An aggregate of

7,152,841 Resulting Issuer Shares and 7,152,841 Resulting Issuer

Warrants were issued upon conversion of the Subscription Receipts

upon completion of the Transaction.

The proceeds from the Offering, less certain

expenses, were placed into escrow on completion of the Offering.

The escrowed proceeds from the Offering, less the commission of the

Agent and certain fees and expenses, have been released from escrow

to Conavi further to the closing of the Transaction.

Name Change and

Consolidation

Completion of the Transaction was subject to the

satisfaction or waiver of a number of customary closing conditions.

In connection with closing of the Transaction, immediately prior to

closing of the Transaction, the Corporation changed its name from

“Titan Medical Inc.” to “Conavi Medical Corp.” and completed a

share consolidation on the basis of 1 post-consolidation common

share of the Corporation for each 25 pre-consolidation common

shares of the Corporation. In addition, immediately prior to the

closing of the Transaction, Conavi completed a share consolidation

on the basis of 1 post-consolidation share of the Corporation for

each 1.34926854040323 pre-consolidation shares of the Corporation,

and its preferred shares were converted to common shares.

Completion of Transaction

The Transaction was completed according to the

terms of a definitive amalgamation agreement dated March 17, 2024,

as amended (the “Amalgamation Agreement”).

Pursuant to the Amalgamation Agreement, 1000824255 Ontario Inc., a

wholly owned subsidiary of Titan, amalgamated with Conavi and

Conavi shareholders received 39,542,499 post-consolidation common

shares of Titan (7,152,841 of which were issued to former holders

of Conavi Subscription Receipts), resulting in the reverse takeover

of the Corporation by Conavi. Conavi shareholders received common

shares of Titan based on an Exchange Ratio of 0.925420380977936

post-consolidation common shares of Titan for each

post-consolidation common share of Conavi.

Additionally, pursuant to the Transaction, the

Resulting Issuer issued 16,259,406 warrants to purchase common

shares of the Corporation to the former warrantholders of Conavi

(32,693 of which were issued in exchange for broker warrants issued

in the Offering and 7,152,841 of which were issued to former

holders of Conavi Subscription Receipts). The Resulting Issuer

Warrants, issued under a warrant indenture dated October 11, 2024

entered into by the Resulting Issuer with Computershare Trust

Company of Canada as warrant agent, are exercisable at a price of

US$1.35073749 per share until October 11, 2029, while the Resulting

Issuer broker warrants are exercisable at a price of US$1.08059 per

share until October 11, 2026.

A summary of material changes resulting from the

Transaction are provided herein. For further information, readers

are referred to the joint management information circular of Conavi

and Titan dated August 30, 2024 (the “Circular”),

which was filed under the Corporation’s SEDAR+ profile at

www.sedarplus.ca.

Listing and Trading of Conavi Medical

Common Shares on the TSX Venture Exchange

In addition, further to the press release dated

September 30, 2024, the Resulting Issuer intends to voluntarily

delist from the Toronto Stock Exchange (“TSX”) and

has applied for a new listing of its shares on the TSX Venture

Exchange (“TSXV”). It is expected that the

Resulting Issuer’s shares will continue to trade under the symbol

“TMD” on a pre-consolidation and pre-Transaction basis until the

Resulting Issuer’s common shares are delisted from the TSX,

expected to be effective as of close of markets on or around

October 15, 2024. The Resulting Issuer has received final approval

from the TSXV for the listing of its common shares under the symbol

“CNVI”, and trading on the TSXV (which will give effect to Titan’s

name and symbol change, 25-to-1 share consolidation and closing of

the Transaction) is expected to commence immediately on the trading

day following delisting from the TSX without any interruption in

trading.

Consolidated Capitalization

After giving effect to the Transaction and the

Offering, the following securities of the Resulting Issuer are

issued and outstanding as of the date hereof: (i) 44,250,086

Resulting Issuer common shares (“Resulting Issuer

Shares”) (of which approximately 4,561,592 Resulting

Issuer Shares (being approximately 10% of the outstanding Resulting

Issuer Shares) are held by the holders of pre-consolidation,

pre-Transaction common shares of Titan Medical Inc.); (ii)

16,390,999 Resulting Issuer Warrants to purchase Resulting Issuer

Shares; and (iii) 264,870 Resulting Issuer Options.

In connection with the Transaction, the

Resulting Issuer has adopted a new Omnibus Equity Incentive Plan.

There are 8,850,017 Resulting Issuer Shares reserved for issuance

under the Omnibus Equity Incentive Plan and all other

securities-based compensation plans of the Resulting Issuer, being

20% of the total issued and outstanding Resulting Issuer

Shares.

Board and Management of Resulting

Issuer

In connection with the completion of the

Transaction, the officers and Board of Directors of the Corporation

have resigned.

Joining the Board of Directors of the Resulting

Issuer from the board of Conavi are Thomas Looby, Craig Podolsky,

Aaron Davidson, Susan Allen and Robert D. Mitchell.

In addition, consistent with the terms of the

Transaction provided for in the Amalgamation Agreement and as

disclosed in the Circular, the Conavi board members have determined

to also re-appoint former board members Anthony Giovinazzo and

Cathy Steiner to the Board of Directors of the Resulting

Issuer.

The Resulting Issuer’s new management team will

be led by Thomas Looby, Chief Executive Officer and Stefano Picone,

Chief Financial Officer.

Brief biographies of the members of the Board of

Directors and key members of management are set out in the

Circular.

About Conavi Medical

Conavi Medical is focused on designing,

manufacturing, and marketing imaging technologies to guide common

minimally invasive cardiovascular procedures. Its patented

Novasight Hybrid™ System is the first system to combine both

intravascular ultrasound (IVUS) and optical coherence tomography

(OCT) to enable simultaneous and co-registered imaging of coronary

arteries. The Novasight Hybrid System has 510(k) clearance from the

U.S. Food and Drug Administration; and regulatory approval for

clinical use from Health Canada, China’s National Medical Products

Administration, and Japan’s Ministry of Health, Labor and Welfare.

For more information, visit http://www.conavi.com/.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains “forward-looking

statements” within the meaning of applicable Canadian and U.S.

securities laws, which reflect the current expectations of

management of Titan’s future growth, results of operations,

performance and business prospects and opportunities.

Forward-looking statements are frequently, but not always,

identified by words such as “may”, “would”, “could”, “will”,

“anticipate”, “believe”, “plan”, “expect”, “intend”, “estimate”,

“potential for” and similar expressions, although these words may

not be present in all forward-looking statements. Forward-looking

statements that appear in this release may include, without

limitation, references to the Resulting Issuer’s plans for the

commercialization of Conavi’s Novasight Hybrid™ System.

These forward-looking statements reflect

management’s current beliefs with respect to future events, and are

based on information currently available to management that, while

considered reasonable by management as of the date on which the

statements are made, are inherently subject to significant

business, economic and competitive uncertainties and contingencies

which could result in actions, events, conditions, results,

performance or achievements to be materially different from those

projected in the forward-looking statements. Forward-looking

statements involve significant risks, uncertainties and assumptions

and many factors could cause the Resulting Issuer’s actual results,

performance or achievements to be materially different from any

future results, performance or achievements that may be expressed

or implied by such forward-looking statements. Such factors and

assumptions include, but are not limited to, the Resulting Issuer’s

ability to retain key personnel; its ability to execute on its

business plans and strategies; and other factors listed in the

“Risk Factors” sections of the Circular (which may be viewed at

www.sedarplus.com). Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking statements prove incorrect, actual results,

performance, or achievements may vary materially from those

expressed or implied by the forward-looking statements contained in

this news release. These factors should be considered carefully,

and prospective investors should not place undue reliance on the

forward-looking statements.

Although the forward-looking statements

contained in the news release are based upon what management

currently believes to be reasonable assumptions and the Resulting

Issuer has attempted to identify important factors that could cause

actual actions, events, conditions, results, performance or

achievements to differ materially from those described in

forward-looking statements, the Resulting Issuer cannot assure

prospective investors that actual results, performance or

achievements will be consistent with these forward-looking

statements. Except as required by law, the Resulting Issuer

expressly disclaims any intention or obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise. Accordingly, investors

should not place undue reliance on forward-looking statements. All

the forward-looking statements are expressly qualified by the

foregoing cautionary statements.

Contact

Stephen KilmerInvestor Relations(647)

872-4849stephen.kilmer@conavi.com

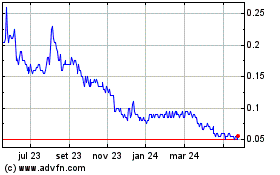

Titan Medical (TSX:TMD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

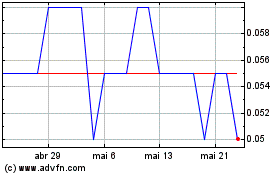

Titan Medical (TSX:TMD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025