Adams Natural Resources Fund Reports Nine Month Results

17 Outubro 2024 - 5:05PM

Adams Natural Resources Fund, Inc. (NYSE: PEO) today announced the

Fund’s results for the nine months ended September 30th. The total

return on Adams Natural Resources’ net asset value, with dividends

and capital gains reinvested, was 10.2%. This compares to a total

return of 9.5% for the Fund’s benchmark, which is comprised of the

S&P 500 Energy Sector (80% weight) and the S&P 500

Materials Sector (20% weight), over the same period. The total

return on the market price of the Fund’s shares for the period was

16.3%.

For the twelve months ended September 30th, the total return on

Adams Natural Resources’ net asset value, with dividends and

capital gains reinvested, was 6.2%. Comparable return for the

Fund’s benchmark was 4.9%. The total return on the market

price of the Fund’s shares for the period was 9.2%.

The Third Quarter Report to Shareholders is expected to be

available on or about October 23, 2024.

|

|

|

ANNUALIZED COMPARATIVE RETURNS (9/30/2024) |

|

|

|

|

1 Year |

3 Year |

5 Year |

10 Year |

|

Adams Natural Resources Fund (NAV) |

6.2% |

21.8% |

14.6% |

4.4% |

| Adams Natural Resources Fund

(market price) |

9.2% |

22.1% |

15.5% |

4.8% |

| S&P 500 Energy Sector |

0.9% |

24.1% |

13.9% |

4.0% |

| S&P 500 Materials

Sector |

25.2% |

9.1% |

13.0% |

9.1% |

| |

|

|

|

|

|

NET ASSET VALUE ANNOUNCED |

|

|

|

The Fund’s net asset value at September 30, 2024, compared with the

year earlier, was: |

|

|

|

|

9/30/2024 |

9/30/2023 |

| Net assets |

$681,420,546 |

$678,249,981 |

|

Shares outstanding |

25,728,942 |

25,024,860 |

| Net asset value per share |

$26.48 |

$27.10 |

| |

|

|

|

TEN LARGEST EQUITY PORTFOLIO HOLDINGS

(9/30/2024) |

|

|

|

|

% of Net Assets |

|

Exxon Mobil Corporation |

25.6% |

|

Chevron Corporation |

11.2% |

|

ConocoPhillips |

5.4% |

| Linde

plc |

4.7% |

| EOG

Resources, Inc. |

3.9% |

|

Marathon Petroleum Corporation |

3.3% |

|

Williams Companies, Inc. |

3.0% |

| Hess

Corporation |

2.8% |

|

ONEOK, Inc. |

2.5% |

|

Valero Energy Corporation |

2.4% |

|

Total |

64.8% |

| |

|

|

INDUSTRY WEIGHTINGS (9/30/2024) |

|

|

|

|

% of Net Assets |

|

Energy |

|

|

Integrated Oil & Gas |

37.4% |

|

Exploration & Production |

18.3% |

|

Storage & Transportation |

8.2% |

|

Refining & Marketing |

7.6% |

|

Equipment & Services |

5.9% |

|

Energy Related |

1.0% |

|

Materials |

|

|

Chemicals |

14.2% |

|

Metals & Mining |

4.0% |

|

Construction Materials |

1.3% |

|

Containers & Packaging |

1.2% |

|

|

|

About Adams Funds

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 85 years across many

market cycles. The Funds are committed to paying a minimum annual

distribution rate of 8% of NAV paid evenly each quarter throughout

the year, providing reliability for long-term shareholders. A

portion of any distribution may be treated as paid from sources

other than net income, including but not limited to short-term

capital gain, long-term capital gain, and return of capital. The

final determination of the source of all distributions for tax

reporting purposes in a calendar year, including the percentage of

qualified dividend income, will be made after year-end. Shares can

be purchased through our transfer agent or through a broker. For

more information about Adams Funds, please

visit: adamsfunds.com.

For further information please contact:

adamsfunds.com/about/contact │800.638.2479

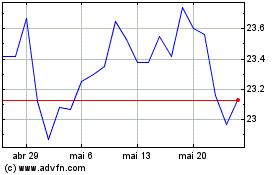

Adams Natural Resources (NYSE:PEO)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Adams Natural Resources (NYSE:PEO)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024