Coherent Corp. (NYSE: COHR) (“Coherent,” “We,” or the “Company”), a

global leader in materials, networking, and lasers, announced

financial results today for its fiscal first quarter ended

September 30, 2024.

Revenue for the first quarter of fiscal 2025 was $1.35 billion,

with GAAP gross margin of 34.1% and GAAP net loss of $(0.04) per

diluted share. On a non-GAAP basis, gross margin was 37.7% with net

income per diluted share of $0.74.

Jim Anderson, CEO, said, “We delivered solid growth in the

September quarter on both a sequential and year-over-year basis,

driven primarily by our AI-related Datacom transceivers. We also

drove higher gross margin and operating margin. I continue to be

excited by the opportunity to unlock significant long-term

shareholder value.”

Sherri Luther, CFO, said, “I am pleased by our strong EPS

growth, cash generation and debt reduction in the first quarter.

Revenue growth and margin expansion drove strong sequential and

year-over-year increases in our GAAP and Non-GAAP EPS. We also paid

down $118 million of our outstanding debt.”

|

|

|

|

|

|

|

|

|

| Selected

First Quarter Financial Results and Comparisons (in millions,

except per share data) |

| Table 1 |

|

|

|

|

|

|

|

| |

|

GAAP Financial Results (unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q1 FY25 |

|

Q4 FY24 |

|

Q1 FY24 |

|

Q/Q |

|

Y/Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

1,348 |

|

|

$ |

1,314 |

|

|

$ |

1,053 |

|

|

|

2.6 |

% |

|

|

28.0 |

% |

|

| Gross Margin

% |

|

|

34.1 |

% |

|

|

32.9 |

% |

|

|

29.1 |

% |

|

126 bps |

|

499 bps |

|

| R&D Expense

% |

|

|

9.8 |

% |

|

|

9.6 |

% |

|

|

10.8 |

% |

|

12 bps |

|

(102) bps |

|

| SG&A Expense

% |

|

|

17.0 |

% |

|

|

17.3 |

% |

|

|

20.1 |

% |

|

(36) bps |

|

(312) bps |

|

| Operating

Expenses |

|

$ |

385 |

|

|

$ |

369 |

|

|

$ |

328 |

|

|

|

4.4 |

% |

|

|

17.3 |

% |

|

| Operating Income

(Loss)(1) |

|

$ |

75 |

|

|

$ |

63 |

|

|

$ |

(21 |

) |

|

|

19.0 |

% |

|

(453.1) |

|

| Operating Margin

(Loss) |

|

|

5.6 |

% |

|

|

4.8 |

% |

|

(2.0)% |

|

77 bps |

|

760 bps |

|

| Net Earnings (Loss)

Attributable to Coherent Corp. |

|

$ |

26 |

|

|

$ |

(48 |

) |

|

$ |

(68 |

) |

|

(153.4) |

|

(138.3) |

|

| Diluted Loss Per

Share |

|

$ |

(0.04 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.65 |

) |

|

$ |

0.48 |

|

$ |

0.61 |

|

(1) Operating Income (Loss) is defined as earnings (loss) before

income taxes, interest expense, and other expense or income,

net.

|

|

|

|

|

|

|

|

|

| Selected

First Quarter Financial Results and Comparisons (in millions,

except per share data) |

| Table 1,

continued |

|

|

|

|

|

|

|

| |

|

Non-GAAP Financial Results

(unaudited)(1) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q1 FY25 |

|

Q4 FY24 |

|

Q1 FY24 |

|

Q/Q |

|

Y/Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

1,348 |

|

|

$ |

1,314 |

|

|

$ |

1,053 |

|

|

|

2.6 |

% |

|

|

28.0 |

% |

|

| Gross Margin

% |

|

|

37.7 |

% |

|

|

37.2 |

% |

|

|

34.8 |

% |

|

49 bps |

|

293 bps |

|

| R&D Expense

% |

|

|

9.2 |

% |

|

|

9.0 |

% |

|

|

9.8 |

% |

|

27 bps |

|

(57) bps |

|

| SG&A Expense

% |

|

|

11.3 |

% |

|

|

11.3 |

% |

|

|

12.4 |

% |

|

(4) bps |

|

(117) bps |

|

| Operating

Expenses |

|

$ |

276 |

|

|

$ |

266 |

|

|

$ |

234 |

|

|

|

3.7 |

% |

|

|

18.0 |

% |

|

| Operating

Income |

|

$ |

233 |

|

|

$ |

223 |

|

|

$ |

132 |

|

|

|

4.2 |

% |

|

|

75.7 |

% |

|

| Operating

Margin |

|

|

17.3 |

% |

|

|

17.0 |

% |

|

|

12.6 |

% |

|

27 bps |

|

468 bps |

|

| Net Earnings

Attributable to Coherent Corp. |

|

$ |

150 |

|

|

$ |

127 |

|

|

$ |

55 |

|

|

|

18.2 |

% |

|

|

172.2 |

% |

|

| Diluted Earnings Per

Share |

|

$ |

0.74 |

|

|

$ |

0.61 |

|

|

$ |

0.16 |

|

|

$ |

0.13 |

|

$ |

0.58 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) The Company has disclosed financial

measurements in earnings release that present financial information

considered to be non-GAAP financial measures. These measurements

are not a substitute for GAAP measurements, although the Company's

management uses these measurements as an aid in monitoring the

Company's on-going financial performance. The non-GAAP net earnings

attributable to Coherent Corp., the non-GAAP diluted earnings per

share, the non-GAAP operating income, the non-GAAP gross margin,

the non-GAAP research and development, the non-GAAP selling,

general and administration, the non-GAAP operating expenses, the

non-GAAP interest and other (income) expense, and the non-GAAP

income tax (benefit), measure earnings and operating income (loss),

respectively, excluding non-recurring or unusual items that are

considered by management to be outside the Company’s standard

operation and excluding certain non-cash items. EBITDA is an

adjusted non-GAAP financial measurement that is considered by

management to be useful in measuring the profitability between

companies within the industry by reflecting operating results of

the Company excluding non-operating factors. There are limitations

associated with the use of non-GAAP financial measures, including

that such measures may not be entirely comparable to similarly

titled measures used by other companies, due to potential

differences among calculation methodologies. Thus, there can be no

assurance whether (i) items excluded from the non-GAAP financial

measures will occur in the future or (ii) there will be cash costs

associated with items excluded from the non-GAAP financial

measures. The Company compensates for these limitations by using

these non-GAAP financial measures as supplements to GAAP financial

measures and by providing the reconciliations of the non-GAAP

financial measures to their most comparable GAAP financial

measures. Investors should consider adjusted measures in addition

to, and not as a substitute for, or superior to, financial

performance measures prepared in accordance with GAAP. All non-GAAP

amounts exclude certain adjustments for share-based compensation,

acquired intangible amortization expense, restructuring charges

(recoveries), integration and site consolidation expenses,

integration transaction expenses, start-up costs related to the

start-up of new devices for new customer applications, and various

one-time adjustments. See Table 6 for the Reconciliation of GAAP

measures to non-GAAP measures.

Product Highlights First Quarter Fiscal

2025

- Lasers for silicon

photonics: We announced a family of high-efficiency lasers

to power 1.6T optical transceivers based on silicon photonics.

- Datacom transceiver

multi-technology demonstration: At the European Conference

on Optical Communications (ECOC’ 24) we demonstrated optical

transceivers showcasing our differential EML and silicon photonics

platforms

- ECOC’24 award for Data

Center Innovation: Our Optical Circuit Switch (OCS) won

the Best Product award.

- Launched industry’s

first high optical output power L-band 800G ZR/ZR+

coherent transceiver.

- New industrial fiber laser: We announced our

EDGE fiber laser series, a culmination of innovations to redefine

value with best-in-class performance.

Business Outlook – Second Quarter Fiscal

2025

- Revenue for the second quarter of fiscal 2025 is expected to be

between $1.33 billion and $1.41 billion.

- Gross margin percentage for the second quarter of fiscal 2025

is expected to be between 36% and 38% on a non-GAAP basis.

- Total operating expenses for the second quarter of fiscal 2025

are expected to be between $275 million and $295 million on a

non-GAAP basis.

- Tax rate for the second quarter of fiscal 2025 is expected to

be between 19% and 22% on a non-GAAP basis.

- EPS for the second quarter of fiscal 2025 is expected to be

between $0.61 and $0.77 on a non-GAAP basis.

Investor Conference Call / Webcast Details

Coherent will review the Company’s financial results for its

first quarter of fiscal 2025 and business outlook on Wednesday,

November 6, at 5:00 p.m. ET. A live webcast of the conference call

will be available on the Investor Relations section of the

Company’s website at coherent.com/company/investor-relations. The

Company’s financial guidance will be limited to the comments on its

public quarterly earnings call and the public business outlook

statements contained in this press release.

The conference call will be recorded, and a replay will be

available to interested parties who are unable to attend the live

webcast starting on or about November 7, 2024.

Additional Information and Where to Find It

In connection with the conference call described above, the

Company intends to post an investor presentation on the Company’s

website at

coherent.com/company/investor-relations/investor-presentations

after market close on November 6, 2024. We also from time to time

may post important information for investors on our website at

coherent.com/company/investor-relations. We intend to use our

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD. Accordingly, investors should review the Investor Relations

page of our website referenced above, in addition to following the

Company’s press releases, SEC filings, and public conference calls,

presentations, and webcasts. Investors and security holders are

able to obtain free copies of these documents through the Company’s

website referenced above. Copies of the documents filed by the

Company with the SEC may be obtained free of charge on the

Company’s website at

coherent.com/company/investor-relations/sec-filings. The

information contained on, or that may be accessed through, the

Company’s website is not incorporated by reference into, and is not

part of, this release.

Forward-Looking Statements

This press release contains statements, estimates and

projections that constitute “forward-looking statements” as defined

under U.S. federal securities laws – including statements about our

ability to unlock significant long-term shareholder value and our

estimates and projections for our business outlook for the second

quarter of fiscal 2025, each of which is made pursuant to the safe

harbor provisions of the U.S. Private Securities Litigation Reform

Act of 1995 and relate to the Company’s performance on a

going-forward basis. The forward-looking statements contained

herein are subject to certain risks and uncertainties that could

cause the Company’s actual results to differ materially from its

historical experience and our present expectations or

projections.

The Company believes that all forward-looking statements made by

it herein have a reasonable basis, but there can be no assurance

that management’s expectations, beliefs, or projections as

expressed in the forward-looking statements will actually occur or

prove to be correct. In addition to general industry and global

economic conditions, factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements herein include but are not limited to: (i) the failure

of any one or more of the assumptions stated herein to prove to be

correct; (ii) the risks relating to forward-looking statements and

other “Risk Factors” identified from time to time in our filings

with the Securities and Exchange Commission (“SEC”), including our

Annual Report on Form 10-K for the year ended June 30, 2024, and

subsequently filed Quarterly Reports on Form 10-Q, which filings

are available from the SEC; (iii) the substantial indebtedness the

Company incurred in connection with its acquisition of Coherent,

Inc. (the “Transaction”), the need to generate sufficient cash

flows to service and repay such debt, and the Company’s ability to

generate sufficient funds to meet its anticipated debt reduction

goals; (iv) the possibility that the Company may not be able to

continue its integration progress and/or take other restructuring

actions, or otherwise be able to achieve expected synergies,

operating efficiencies including greater scale, focus, resiliency,

and lower operating costs, and other benefits within the expected

time frames or at all and ultimately to successfully fully

integrate the operations of Coherent with those of the Company; (v)

the possibility that such integration and/or the restructuring

actions may be more difficult, time-consuming, or costly than

expected or that operating costs and business disruption

(including, without limitation, disruptions in relationships with

employees, customers, or suppliers) may be greater than expected in

connection with the Transaction and/or the restructuring actions;

(vi) any unexpected costs, charges, or expenses resulting from the

Transaction and/or the restructuring actions; (vii) the risk that

disruption from the Transaction and/or the restructuring actions

materially and adversely affects the respective businesses and

operations of the Company and Coherent, Inc.; (viii) potential

adverse reactions or changes to business relationships resulting

from the completion of the Transaction and/or the restructuring

actions; (ix) the ability of the Company to retain and hire key

employees; (x) the purchasing patterns of customers and end users;

(xi) the timely release of new products and acceptance of such new

products by the market; (xii) the introduction of new products by

competitors and other competitive responses; (xiii) the Company’s

ability to assimilate other recently acquired businesses, and

realize synergies, cost savings, and opportunities for growth in

connection therewith, together with the risks, costs, and

uncertainties associated with such acquisitions; (xiv) the

Company’s ability to devise and execute strategies to respond to

market conditions; (xv) the risks to realizing the benefits of

investments in R&D and commercialization of innovations; (xvi)

the risks that the Company’s stock price will not trade in line

with industrial technology leaders; and/or (xvii) the risks of

business and economic disruption related to worldwide health

epidemics or outbreaks that may arise. You should not place undue

reliance on forward-looking statements, which speak only as of the

date they are made. The Company disclaims any obligation to update

information contained in these forward-looking statements, whether

as a result of new information, future events or developments, or

otherwise.

About Coherent

Coherent empowers market innovators to define the future through

breakthrough technologies, from materials to systems. We deliver

innovations that resonate with our customers in diversified

applications for the industrial, communications, electronics, and

instrumentation markets. Coherent has research and development,

manufacturing, sales, service, and distribution facilities

worldwide. For more information, please visit us at

coherent.com.

Contact:

Paul SilversteinSenior VP, Investor Relations & Corporate

Communicationsinvestor.relations@coherent.com

|

Table 2 |

|

|

| Coherent Corp. and

Subsidiaries |

|

|

| Condensed Consolidated

Statements of Earnings (Loss)* |

|

|

| |

|

THREE MONTHS ENDED |

| |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

| $ Millions, except per share

amounts (unaudited) |

|

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Revenues |

|

$ |

1,348.1 |

|

|

$ |

1,314.4 |

|

|

$ |

1,053.1 |

|

| |

|

|

|

|

|

|

| Costs, Expenses &

Other Expense (Income) |

|

|

|

|

|

|

|

Cost of goods sold |

|

|

888.0 |

|

|

|

882.4 |

|

|

|

746.2 |

|

|

Research and development |

|

|

131.6 |

|

|

|

126.7 |

|

|

|

113.5 |

|

|

Selling, general and administrative |

|

|

229.0 |

|

|

|

228.0 |

|

|

|

211.7 |

|

|

Restructuring charges |

|

|

24.4 |

|

|

|

14.1 |

|

|

|

3.0 |

|

|

Interest expense |

|

|

66.6 |

|

|

|

67.8 |

|

|

|

73.3 |

|

|

Other expense (income), net |

|

|

(10.7 |

) |

|

|

(14.5 |

) |

|

|

(6.3 |

) |

| Total Costs, Expenses,

& Other Expense |

|

|

1,328.8 |

|

|

|

1,304.5 |

|

|

|

1,141.4 |

|

| |

|

|

|

|

|

|

| Earnings (Loss) Before

Income Taxes |

|

|

19.3 |

|

|

|

9.9 |

|

|

|

(88.3 |

) |

| |

|

|

|

|

|

|

| Income

Taxes |

|

|

(5.6 |

) |

|

|

56.9 |

|

|

|

(20.8 |

) |

| |

|

|

|

|

|

|

| Net Earnings

(Loss) |

|

|

24.9 |

|

|

|

(47.0 |

) |

|

|

(67.5 |

) |

| Net Earnings (Loss)

Attributable to Noncontrolling Interests |

|

|

(1.0 |

) |

|

|

1.4 |

|

|

|

— |

|

| Net Earnings (Loss)

Attributable to Coherent Corp. |

|

$ |

25.9 |

|

|

$ |

(48.4 |

) |

|

$ |

(67.5 |

) |

| |

|

|

|

|

|

|

| Less: Dividends on

Preferred Stock |

|

|

31.8 |

|

|

|

31.4 |

|

|

|

30.2 |

|

| Net Loss Available to

the Common Shareholders |

|

$ |

(5.9 |

) |

|

$ |

(79.9 |

) |

|

$ |

(97.7 |

) |

| |

|

|

|

|

|

|

| Basic Loss Per

Share |

|

$ |

(0.04 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.65 |

) |

| |

|

|

|

|

|

|

| Diluted Loss Per

Share |

|

$ |

(0.04 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.65 |

) |

| |

|

|

|

|

|

|

| Average Shares

Outstanding - Basic |

|

|

153.6 |

|

|

|

152.6 |

|

|

|

150.3 |

|

| Average Shares

Outstanding - Diluted |

|

|

153.6 |

|

|

|

152.6 |

|

|

|

150.3 |

|

|

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to rounding. |

|

|

|

|

|

|

|

Table 3 |

|

|

| Coherent Corp. and

Subsidiaries |

|

|

| Condensed Consolidated

Balance Sheets* |

|

|

| |

|

|

| |

|

September 30 3030, |

|

June 30, |

| $ Millions (unaudited) |

|

2024 |

|

2024 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| Assets |

|

|

|

|

|

Current Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,019.6 |

|

$ |

926.0 |

|

|

Restricted cash, current |

|

|

51.4 |

|

|

174.0 |

|

|

Accounts receivable |

|

|

819.7 |

|

|

848.5 |

|

|

Inventories |

|

|

1,386.1 |

|

|

1,286.4 |

|

|

Prepaid and refundable income taxes |

|

|

25.2 |

|

|

26.9 |

|

|

Prepaid and other current assets |

|

|

328.1 |

|

|

398.2 |

|

| Total Current

Assets |

|

|

3,630.3 |

|

|

3,660.1 |

|

|

Property, plant & equipment, net |

|

|

1,875.3 |

|

|

1,817.3 |

|

|

Goodwill |

|

|

4,595.6 |

|

|

4,464.3 |

|

|

Other intangible assets, net |

|

|

3,514.7 |

|

|

3,503.2 |

|

|

Deferred income taxes |

|

|

53.6 |

|

|

41.0 |

|

|

Restricted cash, non-current |

|

|

711.4 |

|

|

689.6 |

|

|

Other assets |

|

|

318.4 |

|

|

313.1 |

|

| Total

Assets |

|

$ |

14,699.3 |

|

$ |

14,488.6 |

|

| |

|

|

|

|

| Liabilities, Mezzanine

Equity and Equity |

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

Current portion of long-term debt |

|

$ |

69.9 |

|

$ |

73.8 |

|

|

Accounts payable |

|

|

689.7 |

|

|

631.5 |

|

|

Operating lease current liabilities |

|

|

41.9 |

|

|

40.6 |

|

|

Accruals and other current liabilities |

|

|

556.5 |

|

|

597.9 |

|

|

Total Current Liabilities |

|

|

1,358.0 |

|

|

1,343.8 |

|

|

Long-term debt |

|

|

3,918.8 |

|

|

4,026.4 |

|

|

Deferred income taxes |

|

|

751.1 |

|

|

784.4 |

|

|

Operating lease liabilities |

|

|

176.4 |

|

|

162.4 |

|

|

Other liabilities |

|

|

226.3 |

|

|

225.4 |

|

|

Total Liabilities |

|

|

6,430.7 |

|

|

6,542.4 |

|

|

Total Mezzanine Equity |

|

|

2,396.6 |

|

|

2,364.8 |

|

|

Total Coherent Corp. Shareholders' Equity |

|

|

5,501.1 |

|

|

5,210.1 |

|

|

Noncontrolling interests |

|

|

370.9 |

|

|

371.4 |

|

|

Total Equity |

|

|

5,872.0 |

|

|

5,581.5 |

|

| Total Liabilities,

Mezzanine Equity and Equity |

|

$ |

14,699.3 |

|

$ |

14,488.6 |

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to rounding. |

|

|

|

|

|

Table 4 |

|

|

| Coherent Corp. and

Subsidiaries |

|

|

| Condensed Consolidated

Statements of Cash Flows* |

|

THREE MONTHS ENDED |

| |

|

|

|

|

| |

|

Sep 30, |

|

Sep 30, |

| $ Millions (unaudited) |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| Cash Flows from

Operating Activities |

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

153.0 |

|

|

$ |

198.8 |

|

| |

|

|

|

|

| Cash Flows from

Investing Activities |

|

|

|

|

|

Additions to property, plant & equipment |

|

|

(92.0 |

) |

|

|

(62.2 |

) |

|

Proceeds from the sale of business |

|

|

27.0 |

|

|

|

— |

|

|

Other investing activities |

|

|

(0.8 |

) |

|

|

(2.0 |

) |

|

Net cash used in investing activities |

|

|

(65.7 |

) |

|

|

(64.2 |

) |

| |

|

|

|

|

| Cash Flows from

Financing Activities |

|

|

|

|

|

Payments on existing debt |

|

|

(117.9 |

) |

|

|

(18.7 |

) |

|

Proceeds from exercises of stock options and purchases under

employee stock purchase plan |

|

|

24.4 |

|

|

|

14.9 |

|

|

Payments in satisfaction of employees' minimum tax obligations |

|

|

(32.0 |

) |

|

|

(13.9 |

) |

|

Other financing activities |

|

|

(0.2 |

) |

|

|

(0.3 |

) |

|

Net cash used in financing activities |

|

|

(125.7 |

) |

|

|

(17.9 |

) |

| |

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

31.2 |

|

|

|

(9.5 |

) |

| |

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

(7.2 |

) |

|

|

107.3 |

|

| |

|

|

|

|

|

Cash, Cash Equivalents, and Restricted Cash at Beginning of

Period |

|

|

1,789.7 |

|

|

|

837.6 |

|

| |

|

|

|

|

|

Cash, Cash Equivalents, and Restricted Cash at End of

Period |

|

$ |

1,782.5 |

|

|

$ |

944.9 |

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to rounding. |

|

|

|

|

|

Table 5 |

|

|

|

| Segment

Revenues* |

|

|

|

| |

THREE MONTHS ENDED |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ Millions, except

percentage amounts (unaudited) |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

|

| |

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

Networking |

|

$ |

762.9 |

|

$ |

679.8 |

|

$ |

472.9 |

|

|

Materials |

|

|

237.4 |

|

|

279.3 |

|

|

244.6 |

|

|

Lasers |

|

|

347.8 |

|

|

355.3 |

|

|

335.6 |

|

|

Consolidated |

|

$ |

1,348.1 |

|

$ |

1,314.4 |

|

$ |

1,053.1 |

|

|

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to

rounding.

|

Table 6 |

|

|

|

|

Reconciliation of GAAP Measures to Non-GAAP

Measures* |

|

|

|

| |

THREE MONTHS ENDED |

|

| |

|

|

|

|

|

|

|

| |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

|

|

$ Millions, except per share amounts (unaudited) |

|

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Gross margin on GAAP basis |

|

$ |

460.1 |

|

|

$ |

432.0 |

|

|

$ |

306.9 |

|

|

|

Share-based compensation |

|

|

5.7 |

|

|

|

5.0 |

|

|

|

7.4 |

|

|

|

Amortization of acquired intangibles |

|

|

30.4 |

|

|

|

30.4 |

|

|

|

30.8 |

|

|

|

Integration, site consolidation and other(1) |

|

|

12.4 |

|

|

|

22.0 |

|

|

|

21.3 |

|

|

|

Gross margin on non-GAAP basis |

|

$ |

508.6 |

|

|

$ |

489.4 |

|

|

$ |

366.4 |

|

|

| |

|

|

|

|

|

|

|

|

Research and development on GAAP basis |

|

$ |

131.6 |

|

|

$ |

126.7 |

|

|

$ |

113.5 |

|

|

|

Share-based compensation |

|

|

(5.3 |

) |

|

|

(5.2 |

) |

|

|

(8.0 |

) |

|

|

Amortization of acquired intangibles |

|

|

(0.7 |

) |

|

|

(0.6 |

) |

|

|

(0.6 |

) |

|

|

Start-up costs(2) |

|

|

— |

|

|

|

— |

|

|

|

(0.4 |

) |

|

|

Integration, site consolidation and other(1) |

|

|

(1.3 |

) |

|

|

(3.2 |

) |

|

|

(1.4 |

) |

|

|

Research and development on non-GAAP basis |

|

$ |

124.3 |

|

— |

$ |

117.7 |

|

|

$ |

103.1 |

|

|

| |

|

|

|

|

|

|

|

|

Selling, general and administrative on GAAP

basis |

|

$ |

229.0 |

|

|

$ |

228.0 |

|

|

$ |

211.7 |

|

|

|

Share-based compensation |

|

|

(24.5 |

) |

|

|

(18.5 |

) |

|

|

(29.1 |

) |

|

|

Amortization of acquired intangibles |

|

|

(40.8 |

) |

|

|

(40.7 |

) |

|

|

(41.3 |

) |

|

|

Integration, site consolidation and other(1) |

|

|

(11.9 |

) |

|

|

(20.3 |

) |

|

|

(10.4 |

) |

|

|

Selling, general and administrative on non-GAAP

basis |

|

$ |

151.8 |

|

|

$ |

148.5 |

|

|

$ |

130.9 |

|

|

| |

|

|

|

|

|

|

|

|

Restructuring charges on GAAP basis |

|

$ |

24.4 |

|

|

$ |

14.1 |

|

|

$ |

3.0 |

|

|

|

Restructuring charges(3) |

|

|

(24.4 |

) |

|

|

(14.1 |

) |

|

|

(3.0 |

) |

|

|

Restructuring charges on non-GAAP basis |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

| |

|

|

|

|

|

|

|

|

Operating income (loss) on GAAP basis |

|

$ |

75.2 |

|

|

$ |

63.2 |

|

|

$ |

(21.3 |

) |

|

|

Share-based compensation |

|

|

35.5 |

|

|

|

28.7 |

|

|

|

44.5 |

|

|

|

Amortization of acquired intangibles |

|

|

71.9 |

|

|

|

71.7 |

|

|

|

72.7 |

|

|

|

Start-up costs(2) |

|

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

|

Restructuring charges(3) |

|

|

24.4 |

|

|

|

14.1 |

|

|

|

3.0 |

|

|

|

Integration, site consolidation and other(1) |

|

|

25.6 |

|

|

|

45.5 |

|

|

|

33.1 |

|

|

|

Operating income on non-GAAP basis |

|

$ |

232.6 |

|

|

$ |

223.2 |

|

|

$ |

132.4 |

|

|

|

|

|

|

|

|

|

|

|

|

Table 6 |

|

|

| Reconciliation of GAAP

Measures to Non-GAAP Measures* |

|

|

|

(Continued) |

|

THREE MONTHS ENDED |

| |

|

|

|

|

|

|

| |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

| $ Millions, except per share

amounts (unaudited) |

|

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Interest and other (income) expense, net on GAAP

basis |

|

$ |

55.9 |

|

|

$ |

53.3 |

|

|

$ |

67.0 |

|

|

Foreign currency exchange gains (losses), net |

|

|

(9.8 |

) |

|

|

(0.9 |

) |

|

|

0.7 |

|

|

Transaction fees and financing(4) |

|

|

— |

|

|

|

(2.0 |

) |

|

|

— |

|

| Interest and other

(income) expense, net on non-GAAP basis |

|

$ |

46.1 |

|

|

$ |

50.4 |

|

|

$ |

67.7 |

|

| |

|

|

|

|

|

|

| Income taxes on GAAP

basis |

|

$ |

(5.6 |

) |

|

$ |

56.9 |

|

|

$ |

(20.8 |

) |

|

Tax impact of non-GAAP measures |

|

|

31.9 |

|

|

|

33.8 |

|

|

|

30.5 |

|

|

Tax windfall from share-based compensation(5) |

|

|

10.9 |

|

|

|

— |

|

|

|

— |

|

|

Tax impact of valuation allowance for deferred tax assets(6) |

|

|

0.6 |

|

|

|

(46.0 |

) |

|

|

— |

|

| Income taxes on

non-GAAP basis |

|

$ |

37.8 |

|

|

$ |

44.7 |

|

|

$ |

9.7 |

|

| |

|

|

|

|

|

|

| Net earnings (loss)

attributable to Coherent Corp. on GAAP basis |

|

$ |

25.9 |

|

|

$ |

(48.4 |

) |

|

$ |

(67.5 |

) |

|

Share-based compensation |

|

|

35.5 |

|

|

|

28.7 |

|

|

|

44.5 |

|

|

Amortization of acquired intangibles |

|

|

71.9 |

|

|

|

71.7 |

|

|

|

72.7 |

|

|

Foreign currency exchange (gains) losses |

|

|

9.8 |

|

|

|

0.9 |

|

|

|

(0.7 |

) |

|

Restructuring charges(3) |

|

|

24.4 |

|

|

|

14.2 |

|

|

|

3.0 |

|

|

Integration, site consolidation and other(1) |

|

|

25.6 |

|

|

|

45.5 |

|

|

|

33.1 |

|

|

Transaction fees and financing(4) |

|

|

— |

|

|

|

2.0 |

|

|

|

— |

|

|

Start-up costs(2) |

|

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

Tax impact of non-GAAP measures |

|

|

(31.9 |

) |

|

|

(33.8 |

) |

|

|

(30.5 |

) |

|

Tax windfall from share-based compensation(5) |

|

|

(10.9 |

) |

|

|

— |

|

|

|

— |

|

|

Tax impact of valuation allowance for deferred tax assets(6) |

|

|

(0.6 |

) |

|

|

46.0 |

|

|

|

— |

|

| Net earnings

attributable to Coherent Corp. on non-GAAP basis |

|

$ |

149.7 |

|

|

$ |

126.6 |

|

|

$ |

55.0 |

|

| |

|

|

|

|

|

|

| Per share data: |

|

|

|

|

|

|

| Net loss on GAAP

basis |

|

|

|

|

|

|

|

Basic Loss Per Share |

|

$ |

(0.04 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.65 |

) |

|

Diluted Loss Per Share |

|

$ |

(0.04 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.65 |

) |

| |

|

|

|

|

|

|

| Net earnings on

non-GAAP basis |

|

|

|

|

|

|

|

Basic Earnings Per Share |

|

$ |

0.77 |

|

|

$ |

0.62 |

|

|

$ |

0.16 |

|

|

Diluted Earnings Per Share |

|

$ |

0.74 |

|

|

$ |

0.61 |

|

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to rounding.

(1) Integration, site consolidation and other costs include

retention and severance payments, expenses not included in

restructuring charges related to site closures as well as other

integration costs related to the acquisition of Coherent, Inc.

Refer to table 7 for a more detailed description of these costs on

a consolidated basis.(2) Start-up costs in operating expenses were

related to the start-up of new devices for new customer

applications.(3) Restructuring charges include loss on sale of a

facility, severance, non-cash impairment charges for production

assets and improvements on leased facilities and other costs

related to the 2023 Restructuring Plan.(4) Transaction fees and

financing includes debt extinguishment costs and various fees

related to closing the Coherent transaction. (5) Windfall tax

benefits were recorded on the vesting of share-based

compensation.(6) Valuation allowance adjustments were related to an

increase (decrease) in valuation allowance related to certain

deferred tax assets resulting from the Company’s cumulative GAAP

net loss that is not recognized for non-GAAP purposes given the

historical non-GAAP net earnings.

|

Table 7 |

|

|

|

| Components of

Integration, Site Consolidation and Other Costs Excluded from

Non-GAAP Operating Income* |

|

|

|

| |

|

THREE MONTHS ENDED |

|

| |

|

|

|

|

|

|

|

| |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

|

|

$ Millions (unaudited) |

|

|

2024 |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Integration, site

consolidation and other costs |

|

|

|

|

|

|

|

|

Consulting costs related to projects to integrate recent

acquisitions into common technology systems and simplify legal

entity structure |

|

$ |

11.4 |

|

|

$ |

6.5 |

|

$ |

6.6 |

|

|

Manufacturing inefficiencies related to sites being shut down as

part of our 2023 Restructuring Plan or Synergy and Site

Consolidation Plan |

|

|

6.7 |

|

|

|

10.3 |

|

|

9.8 |

|

|

Charges for products that are end-of-life, including inventory,

production equipment to produce those products |

|

|

4.4 |

|

|

|

4.9 |

|

|

6.5 |

|

|

Overlapping labor and travel for consolidation of sites |

|

|

3.8 |

|

|

|

6.4 |

|

|

2.8 |

|

|

Employee severance and retention costs for site consolidations as

part of our Synergy and Site Consolidation Plan or other

actions |

|

|

(1.3 |

) |

|

|

4.2 |

|

|

3.5 |

|

|

Severance costs related to the retirement of our

CEO/CFO/President |

|

|

0.6 |

|

|

|

13.2 |

|

|

1.7 |

|

|

Accelerated depreciation for equipment and leasehold improvements

at sites included in our Synergy and Site Consolidation Plan |

|

|

— |

|

|

|

— |

|

|

1.9 |

|

|

Direct damages from substation power failure/fire at manufacturing

sites |

|

|

— |

|

|

|

— |

|

|

0.3 |

|

| Integration, site

consolidation and other costs |

|

$ |

25.6 |

|

|

$ |

45.5 |

|

$ |

33.1 |

|

| |

|

|

|

|

|

|

|

|

Table 8 |

|

|

|

|

Reconciliation of GAAP Net Earnings (Loss), EBITDA and

Adjusted EBITDA * |

|

|

|

| |

THREE MONTHS ENDED |

|

| |

|

|

|

|

|

|

|

| $ Millions, except

percentage amounts (unaudited) |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

|

| |

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net earnings (loss) on

GAAP basis |

|

$ |

24.9 |

|

|

$ |

(47.0 |

) |

|

$ |

(67.5 |

) |

|

|

Income taxes |

|

|

(5.6 |

) |

|

|

56.9 |

|

|

|

(20.8 |

) |

|

|

Depreciation and amortization |

|

|

137.7 |

|

|

|

143.7 |

|

|

|

138.4 |

|

|

|

Interest expense |

|

|

66.6 |

|

|

|

67.8 |

|

|

|

73.3 |

|

|

|

Interest income |

|

|

(12.8 |

) |

|

|

(13.1 |

) |

|

|

(3.7 |

) |

|

|

EBITDA(1) |

|

$ |

210.8 |

|

|

$ |

208.3 |

|

|

$ |

119.7 |

|

|

|

EBITDA margin |

|

|

15.6 |

% |

|

|

15.8 |

% |

|

|

11.4 |

% |

|

| |

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

35.5 |

|

|

|

28.7 |

|

|

|

44.5 |

|

|

|

Foreign currency exchange (gains) losses |

|

|

9.8 |

|

|

|

0.9 |

|

|

|

(0.7 |

) |

|

|

Start-up costs(3) |

|

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

|

Restructuring charges(4) |

|

|

24.4 |

|

|

|

14.2 |

|

|

|

3.0 |

|

|

|

Transaction fees and financing(5) |

|

|

— |

|

|

|

2.0 |

|

|

|

— |

|

|

|

Integration, site consolidation and other(6) |

|

|

25.6 |

|

|

|

45.5 |

|

|

|

33.1 |

|

|

| Adjusted

EBITDA(2) |

|

|

306.1 |

|

|

|

299.5 |

|

|

|

200.0 |

|

|

|

Less: adjusted EBITDA attributable to noncontrolling interests |

|

|

0.6 |

|

|

|

(1.9 |

) |

|

|

— |

|

|

| Adjusted EBITDA

attributable to Coherent Corp. |

|

$ |

306.7 |

|

|

$ |

297.6 |

|

|

$ |

200.0 |

|

|

|

Adjusted EBITDA margin attributable to Coherent Corp. |

|

|

22.8 |

% |

|

|

22.6 |

% |

|

|

19.0 |

% |

|

|

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to

rounding.

(1) EBITDA is defined as earnings before

interest expense, interest income, income taxes, depreciation and

amortization.(2) Adjusted EBITDA excludes non-GAAP adjustments for

share-based compensation, certain restructuring, integration, and

transaction expenses, debt extinguishment charges, start-up costs,

and the impact of foreign currency exchange gains and losses.(3)

Start-up costs in operating expenses were related to the start-up

of new devices for new customer applications.(4) Restructuring

charges include loss on sale of a facility, severance, non-cash

impairment charges for production assets and improvements on leased

facilities and other costs related to the 2023 Restructuring

Plan.(5) Transaction fees and financing includes debt

extinguishment costs and various fees related to closing the

Coherent transaction.(6) Integration, site consolidation and other

costs include retention and severance payments, expenses not

included in restructuring charges related to site closures as well

as other integration costs related to the acquisition of Coherent,

Inc. Refer to table 7 for a more detailed description of these

costs on a consolidated basis.

|

Table 9 |

|

|

|

| GAAP

Earnings (Loss) Per Share Calculation* |

|

|

|

| |

THREE MONTHS ENDED |

|

| |

|

|

|

|

|

|

|

| $ Millions, except

per share amounts (unaudited) |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

|

| |

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Numerator |

|

|

|

|

|

|

|

|

Net loss attributable to Coherent Corp. |

|

$ |

25.9 |

|

|

$ |

(48.4 |

) |

|

$ |

(67.5 |

) |

|

|

Deduct Series B redeemable preferred dividends |

|

|

(31.8 |

) |

|

|

(31.4 |

) |

|

|

(30.2 |

) |

|

| Basic loss available

to common shareholders |

|

$ |

(5.9 |

) |

|

$ |

(79.9 |

) |

|

$ |

(97.7 |

) |

|

| |

|

|

|

|

|

|

|

| Diluted loss available

to common shareholders |

|

$ |

(5.9 |

) |

|

$ |

(79.9 |

) |

|

$ |

(97.7 |

) |

|

| |

|

|

|

|

|

|

|

|

Denominator |

|

|

|

|

|

|

|

| Diluted weighted

average common shares |

|

|

153.6 |

|

|

|

152.6 |

|

|

|

150.3 |

|

|

| |

|

|

|

|

|

|

|

| Basic loss per common

share |

|

$ |

(0.04 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.65 |

) |

|

| |

|

|

|

|

|

|

|

| Diluted loss per

common share |

|

$ |

(0.04 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.65 |

) |

|

|

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to rounding.

|

Table 10 |

|

|

|

| Non-GAAP Earnings Per

Share Calculation* |

|

|

|

| |

|

THREE MONTHS ENDED |

|

| |

|

|

|

|

|

|

|

| $ Millions, except

per share amounts (unaudited) |

|

Sep 30, |

|

Jun 30, |

|

Sep 30, |

|

| |

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Numerator |

|

|

|

|

|

|

|

|

Net earnings attributable to Coherent Corp. on non-GAAP basis |

|

$ |

149.7 |

|

|

$ |

126.6 |

|

|

$ |

55.0 |

|

|

|

Deduct Series B redeemable preferred dividends |

|

|

(31.8 |

) |

|

|

(31.4 |

) |

|

|

(30.2 |

) |

|

| Basic earnings

available to common shareholders |

|

$ |

117.9 |

|

|

$ |

95.2 |

|

|

$ |

24.8 |

|

|

| |

|

|

|

|

|

|

|

| Diluted earnings

available to common shareholders |

|

$ |

117.9 |

|

|

$ |

95.2 |

|

|

$ |

24.8 |

|

|

| |

|

|

|

|

|

|

|

|

Denominator |

|

|

|

|

|

|

|

| Weighted average shares |

|

|

153.6 |

|

|

|

152.6 |

|

|

|

150.3 |

|

|

| Effect of dilutive

securities: |

|

|

|

|

|

|

|

|

Common stock equivalents |

|

|

4.9 |

|

|

|

3.8 |

|

|

|

1.9 |

|

|

| Diluted weighted

average common shares |

|

|

158.6 |

|

|

|

156.3 |

|

|

|

152.2 |

|

|

| |

|

|

|

|

|

|

|

| Basic earnings per

common share on non-GAAP basis |

|

$ |

0.77 |

|

|

$ |

0.62 |

|

|

$ |

0.16 |

|

|

| |

|

|

|

|

|

|

|

| Diluted earnings per

common share on non-GAAP basis |

|

$ |

0.74 |

|

|

$ |

0.61 |

|

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

|

|

*Amounts may not recalculate due to rounding.

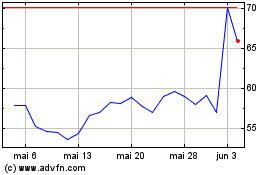

Coherent (NYSE:COHR)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Coherent (NYSE:COHR)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024