Alpine Income Property Trust Announces Fourth Quarter Investment Activity

12 Novembro 2024 - 6:10PM

Alpine Income Property Trust, Inc. (NYSE: PINE) (the “Company” or

“PINE”), an owner and operator of single tenant net leased

commercial income properties, today announced updated fourth

quarter and year-to-date 2024 investment and disposition

activities.

2024 Investment

Activity

- In November 2024, the Company

completed a $28 million purchase of a portfolio of 5 single-tenant

properties anchored by BJ’s Wholesale Club, all of which are

located in the greater Charlotte, North Carolina area. The

portfolio is located near the 1.4 million square foot Concord Mills

mall. With the addition of this investment, Charlotte, North

Carolina now enters PINE’s top 5 markets based on annual ABR.

- The Company’s year-to-date total

investment activity, including acquisitions and structured

investment activity, now totals $112.2 million at a weighted

average initial investment yield of 9.3%, exceeding the high end of

investment activity given with the third quarter reporting.

2024 Disposition

Activity

- In October 2024, the Company sold

two former Mountain Express convenience stores for a total of $1.4

million.

- The Company’s year-to-date

disposition volume, inclusive of property and structured investment

sales, now totals $70.2 million at a weighted average exit cash cap

rate of 7.1%.

About Alpine Income Property Trust,

Inc.

Alpine Income Property Trust, Inc. (NYSE: PINE)

is a publicly traded real estate investment trust that seeks to

deliver attractive risk-adjusted returns and dependable cash

dividends by investing in, owning and operating a portfolio of

single tenant net leased commercial income properties that are

predominately leased to high-quality publicly traded and

credit-rated tenants.

|

Contact: |

Philip R. MaysSenior Vice President, Chief Financial Officer and

Treasurer(407) 904-3324pmays@alpinereit.com |

| |

|

Safe Harbor

This press release may contain “forward-looking

statements.” Forward-looking statements include statements that may

be identified by words such as “continued,” “could,” “may,”

“might,” “will,” “likely,” “anticipates,” “intends,” “plans,”

“seeks,” “believes,” “estimates,” “expects,” “continues,”

“projects” and similar references to future periods, or by the

inclusion of forecasts or projections. Forward-looking statements

are based on the Company’s current expectations and assumptions

regarding capital market conditions, the Company’s business, the

economy and other future conditions. Because forward-looking

statements relate to the future, by their nature, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. As a result, the Company’s actual results

may differ materially from those contemplated by the

forward-looking statements. Important factors that could cause

actual results to differ materially from those in the

forward-looking statements include general business and economic

conditions, continued volatility and uncertainty in the credit

markets and broader financial markets, risks inherent in the real

estate business, including tenant defaults, potential liability

relating to environmental matters, credit risk associated with the

Company investing in first mortgage investments, illiquidity of

real estate investments and potential damages from natural

disasters, the impact of epidemics or pandemics (such as the

COVID-19 Pandemic and its variants) on the Company’s business and

the business of its tenants and the impact of such epidemics or

pandemics on the U.S. economy and market conditions generally,

other factors affecting the Company’s business or the business of

its tenants that are beyond the control of the Company or its

tenants, and the factors set forth under “Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 and other risks and uncertainties discussed from time to

time in the Company’s filings with the U.S. Securities and Exchange

Commission. Any forward-looking statement made in this press

release speaks only as of the date on which it is made. The Company

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise.

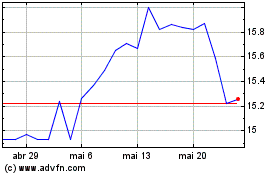

Alpine Income Property (NYSE:PINE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Alpine Income Property (NYSE:PINE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024