Kura Sushi USA Announces Closing of $68.0 Million Public Offering of Common Stock

13 Novembro 2024 - 6:05PM

Kura Sushi USA, Inc. (“Kura Sushi” or the “Company”) (NASDAQ:

KRUS), a technology-enabled Japanese restaurant concept, today

announced the closing of its underwritten public offering of

800,328 shares of its Class A common stock at a public offering

price of $85.00 per share, including the exercise in full by the

underwriters of their option to purchase an additional 104,390

shares of Class A common stock. The Company received proceeds from

the offering, net of the underwriters’ discount, of approximately

$64.6 million.

Kura Sushi intends to use the net proceeds from

the offering for general corporate purposes, including capital

expenditures, working capital, and other business purposes.

William Blair & Company, L.L.C., Barclays

Capital Inc. and TD Securities (USA) LLC are acting as joint

book-running managers for the offering. Craig-Hallum Capital Group

LLC, Roth Capital Partners and The Benchmark Company, LLC are

acting as co-managers for the offering.

The offering was made pursuant to an effective

shelf registration statement including a base prospectus that has

been filed with the Securities and Exchange Commission (the “SEC”)

and declared effective and is available on the SEC website. A

prospectus supplement and the accompanying base prospectus related

to the offering have been filed with the SEC and are available on

the SEC website. Copies of these documents may be obtained from

William Blair & Company, L.L.C., Attn: Prospectus Department,

150 North Riverside Plaza, Chicago, Illinois 60606, by telephone at

1-800-621-0687 or by email at: prospectus@williamblair.com;

Barclays Capital Inc. c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, New York 11717, by telephone at

1-888-603-5847 or by email at: barclaysprospectus@broadridge.com;

or TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, NY

10017, by telephone at 1-855-495-9846 or by email at

TD.ECM_Prospectus@tdsecurities.com.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Kura Sushi USA, Inc.

Kura Sushi USA, Inc. is a technology-enabled

Japanese restaurant concept with 70 locations across 20 states and

Washington DC. The Company offers guests a distinctive dining

experience built on authentic Japanese cuisine and an engaging

revolving sushi service model. Kura Sushi USA, Inc. was established

in 2008 as a subsidiary of Kura Sushi, Inc., a Japan-based

revolving sushi chain with over 550 restaurants and 40 years of

brand history.

Forward-Looking Statements

Except for historical information contained

herein, the statements in this press release or otherwise made by

the Company’s management in connection with the subject matter of

this press release are forward-looking statements (as such term is

defined in the Private Securities Litigation Reform Act of 1995)

and involve risks and uncertainties and are subject to change based

on various important factors. This press release includes

forward-looking statements that are based on management’s current

estimates or expectations of future events or future results. These

statements are not historical in nature and can generally be

identified by such words as “target,” “may,” “might,” “will,”

“objective,” “intend,” “should,” “could,” “can,” “would,” “expect,”

“believe,” “design,” “estimate,” “continue,” “predict,”

“potential,” “plan,” “anticipate” or the negative of these terms,

and similar expressions. Management’s expectations and assumptions

regarding future results are subject to risks, uncertainties and

other factors that could cause actual results to differ materially

from the anticipated results or other expectations expressed in the

forward-looking statements included in this press release. These

risks and uncertainties include but are not limited to: the

Company’s discretion as to the use of proceeds from the offering;

the Company’s ability to successfully maintain increases in its

comparable restaurant sales and average unit volumes; the Company’s

ability to successfully execute its growth strategy and open new

restaurants that are profitable; the Company’s ability to expand in

existing and new markets; the Company’s projected growth in the

number of its restaurants; macroeconomic conditions and other

economic factors, including rising interest rates, the possibility

of a recession and instability in financial markets; the Company’s

ability to compete with many other restaurants; the Company’s

reliance on vendors, suppliers and distributors, including its

majority stockholder Kura Sushi, Inc.; changes in food and supply

costs, including the impact of inflation and tariffs; concerns

regarding food safety and foodborne illness; changes in consumer

preferences and the level of acceptance of the Company’s restaurant

concept in new markets; minimum wage increases and mandated

employee benefits that could cause a significant increase in labor

costs, as well as the impact of labor availability; the failure of

the Company’s automated equipment or information technology systems

or the breach of its network security; the loss of key members of

the Company’s management team; the impact of governmental laws and

regulations; volatility in the price of the Company’s common stock;

and other risks and uncertainties as described in the Company’s

filings with the SEC. These and other factors that could cause

results to differ materially from those described in the

forward-looking statements contained in this press release can be

found in the Company’s other filings with the SEC. Undue reliance

should not be placed on forward-looking statements, which are only

current as of the date they are made. The Company assumes no

obligation to update or revise its forward-looking statements,

except as may be required by applicable law.

Investor Relations Contact:Jeff Priester(657)

333-4010investor@kurausa.com

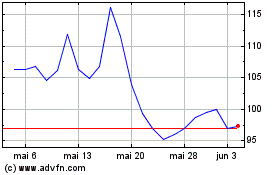

Kura Sushi USA (NASDAQ:KRUS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Kura Sushi USA (NASDAQ:KRUS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024