SEACOR Marine Announces Complete Debt Refinancing, Newbuild Orders, and Vessel Sales

02 Dezembro 2024 - 8:00AM

SEACOR Marine Holdings Inc. (NYSE: SMHI) (the “Company” or “SEACOR

Marine”), a leading provider of marine and support transportation

services to offshore energy facilities worldwide, today announced

that it has entered into a new senior secured term loan of up to

$391.0 million with an affiliate of EnTrust Global (the “2024 SMFH

Credit Facility”) and separate agreements to build two platform

supply vessels (“PSVs”) for a contract price of $41.0 million per

vessel (the “Shipbuilding Contracts”). The PSVs are each 4,650 tons

deadweight with a 1,000 square meter deck area and equipped with

medium speed diesel engines and an integrated battery energy

storage system for higher fuel efficiency and lower running costs.

The 2024 SMFH Credit Facility consolidates the Company’s debt

capital structure into a single credit facility maturing in the

fourth quarter of 2029 and provides financing for the Shipbuilding

Contracts. The Company also announced the entry into definitive

agreements to sell two anchor handling towing and supply (“AHTS”)

vessels for total proceeds of $22.5 million.

The proceeds from the 2024 SMFH Credit Facility

will be used to, among other things, refinance $203.7 million of

principal indebtedness under multiple secured debt facilities and

$125.0 million of unsecured indebtedness due in 2026, inclusive of

$35.0 million of convertible debt. The 2024 SMFH Credit Facility

also provides up to $41.0 million in borrowings to finance up to

50% of the Shipbuilding Contracts. Borrowings under the 2024 SMFH

Credit Facility will bear interest at a rate of 10.30% per annum

and principal will be repaid in an initial quarterly installment of

$5.0 million in March 2025, followed by quarterly installments of

$7.5 million for the refinanced indebtedness and 2.13% of the

principal amount borrowed to fund the Shipbuilding Contracts.

Additional information about the terms of the

2024 SMFH Credit Facility can be found in our Current Report on

Form 8-K filed today with the U.S. Securities and Exchange

Commission.

John Gellert, SEACOR Marine’s Chief Executive

Officer, commented: “I am pleased to announce these transactions of

strategic importance to the Company. The new financing with EnTrust

Global consolidates all our debt under a single facility maturing

in 2029 and addresses $125.0 million of near-term maturities

previously due in 2026 to The Carlyle Group. The early redemption

of $35.0 million of convertible debt eliminates approximately 10%

of dilution overhang on the Company’s common stock. The new

financing also allows us to retain financial flexibility and

support our growth initiatives by financing up to 50% of our order

of two PSVs. This order comes at a competitive price point and with

an attractive delivery schedule of the fourth quarter of 2026 and

first quarter of 2027 for each of the PSVs. These vessels expand

and complement our PSV fleet as we implement our asset rotation

strategy aimed at renewing our fleet with high-specification,

environmentally efficient assets to replace older, lower

specification assets. We will partly fund this new construction

program with $22.5 million of proceeds from the sales of our last

remaining AHTS vessels, marking our exit from the AHTS asset class

effective January 2025. I would like to extend my gratitude to

EnTrust Global, our sole lender, for their continuing support, as

well as The Carlyle Group, for their partnership as a lender since

2015.”

SEACOR Marine provides global marine and support

transportation services to offshore energy facilities worldwide.

SEACOR Marine operates and manages a diverse fleet of offshore

support vessels that deliver cargo and personnel to offshore

installations, including offshore wind farms; assist offshore

operations for production and storage facilities; provide

construction, well work-over, offshore wind farm installation and

decommissioning support; carry and launch equipment used underwater

in drilling and well installation, maintenance, inspection and

repair; and handle anchors and mooring equipment for offshore rigs

and platforms. Additionally, SEACOR Marine’s vessels provide

emergency response services and accommodations for technicians and

specialists.

Certain statements discussed in this release as

well as in other reports, materials and oral statements that the

Company releases from time to time to the public constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Generally, words

such as “anticipate,” “estimate,” “expect,” “project,” “intend,”

“believe,” “plan,” “target,” “forecast” and similar expressions are

intended to identify forward-looking statements. Such

forward-looking statements concern management’s expectations,

strategic objectives, business prospects, anticipated economic

performance and financial condition and other similar

matters. Forward-looking statements are inherently uncertain

and subject to a variety of assumptions, risks and uncertainties

that could cause actual results to differ materially from those

anticipated or expected by the management of the Company.

These statements are not guarantees of future performance and

actual events or results may differ significantly from these

statements. Actual events or results are subject to

significant known and unknown risks, uncertainties and other

important factors, many of which are beyond the Company’s control

and are described in the Company’s filings with the U.S. Securities

and Exchange Commission. It should be understood that it is

not possible to predict or identify all such factors.

Consequently, the preceding should not be considered to be a

complete discussion of all potential risks or uncertainties.

Given these risk factors, investors and analysts should not place

undue reliance on forward-looking statements. Forward-looking

statements speak only as of the date of the document in which they

are made. The Company disclaims any obligation or undertaking

to provide any updates or revisions to any forward-looking

statement to reflect any change in the Company’s expectations or

any change in events, conditions or circumstances on which the

forward-looking statement is based, except as required by

law. It is advisable, however, to consult any further

disclosures the Company makes on related subjects in its filings

with the Securities and Exchange Commission, including Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K (if any). These statements constitute the

Company’s cautionary statements under the Private Securities

Litigation Reform Act of 1995.

Please visit SEACOR Marine’s website at

www.seacormarine.com for additional information.For all other

requests, contact InvestorRelations@seacormarine.com

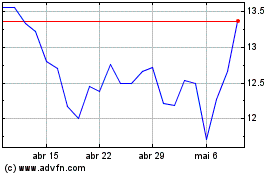

SEACOR Marine (NYSE:SMHI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

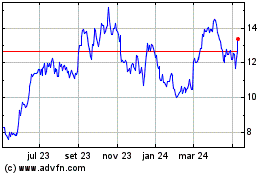

SEACOR Marine (NYSE:SMHI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025