Fortis Inc. ("Fortis" or the "Corporation") (TSX/NYSE: FTS)

announced today that it will renew its at-the-market equity program

(the "ATM Program") allowing the Corporation to issue up to

C$500,000,000 (or its U.S. dollar equivalent) of common shares (the

"Common Shares") from treasury to the public from time to time, at

the Corporation's discretion. Any Common Shares sold in the ATM

Program will be sold through the Toronto Stock Exchange

(the "TSX"), the New York Stock Exchange (the "NYSE") or any

other marketplace on which the Common Shares are listed, quoted or

otherwise traded at the prevailing market price at the time of

sale.

The ATM Program provides Fortis with additional

financing flexibility to fund its capital program. The volume and

timing of distributions under the ATM Program, if any, will be

determined at the Corporation's sole discretion. The ATM Program

will be effective until January 10, 2027, unless terminated prior

to such date by the Corporation. Fortis intends to use the net

proceeds from the ATM Program, if any, for general corporate

purposes. As Common Shares sold in the ATM Program will be

distributed at the prevailing market price at the time of the sale,

prices may vary among purchasers during the period of the

distribution.

Distributions of the Common Shares through the

ATM Program will be made pursuant to the terms of an equity

distribution agreement dated December 9, 2024 (the "Equity

Distribution Agreement") entered into with CIBC World Markets Inc.,

RBC Dominion Securities Inc., Scotia Capital Inc. and TD Securities

Inc., as Canadian agents (the "Canadian Agents"), and CIBC World

Markets Corp., RBC Capital Markets, LLC, Scotia Capital (USA) Inc.

and TD Securities (USA) LLC, as U.S. agents (together with the

Canadian Agents, the "Agents").

The ATM Program is being established pursuant

to: (a) a prospectus supplement dated December 9, 2024 (the

"Prospectus Supplement") to the Corporation's Canadian short form

base shelf prospectus (the "Shelf Prospectus") filed today with

securities regulatory authorities in each of the provinces of

Canada; and (b) a prospectus supplement dated December 9, 2024

(the "U.S. Prospectus Supplement") to the Corporation's U.S. base

prospectus (the "U.S. Base Prospectus") included in its U.S.

registration statement on Form F-10 (the "Registration Statement")

filed today with the U.S. Securities and Exchange Commission. The

Corporation's at-the-market equity program, which commenced on

September 19, 2023, terminated upon filing of the Shelf

Prospectus.

The Prospectus Supplement, the Shelf Prospectus

and the Equity Distribution Agreement will be available on SEDAR+

at www.sedarplus.ca. The U.S. Prospectus Supplement, the U.S. Base

Prospectus and the Registration Statement will be available on

EDGAR at www.sec.gov. Alternatively, the Agents will send copies of

the Prospectus Supplement and the Shelf Prospectus or the U.S.

Prospectus Supplement and the U.S. Base Prospectus, as applicable,

upon request by contacting in Canada:

CIBC Capital Markets,

161 Bay Street, 5th Floor, Toronto, Ontario, M5J 2S8 or by

telephone at 1-416-956-6378 or by email at

Mailbox.CanadianProspectus@cibc.com

RBC Dominion

Securities Inc., attn: Distribution Centre, RBC Wellington Square,

8th Floor, 180 Wellington Street West, Toronto, Ontario, M5J OC2,

by email at Distribution.RBCDS@rbc.com

Scotia Capital Inc.,

attn: Equity Capital Markets, 40 Temperance Street, 6th Floor,

Toronto, Ontario, M5H 0B4, by email at

equityprospectus@scotiabank.com

TD Securities Inc.,

attn: Symcor, NPM, 1625 Tech Avenue, Mississauga, Ontario, L4W 5P5,

by email at sdcconfirms@td.com or by phone at 289-360-2009

or in the U.S.:

CIBC Capital Markets,

161 Bay Street, 5th Floor, Toronto, Ontario, M5J 2S8 or by

telephone at 1-416-956-6378 or by email at

Mailbox.USProspectus@cibc.com

RBC Capital Markets,

LLC, attn: Equity Syndicate, 200 Vesey Street, 8th Floor, New York,

New York 10281-8098, by email at equityprospectus@rbccm.com or by

phone at 877-822-4089

Scotia Capital (USA)

Inc., attn: Equity Capital Markets, 250 Vesey Street, 24th Floor,

New York, New York 10281, by email at

equityprospectus@scotiabank.com

TD Securities (USA)

LLC, attn: Equity Capital Markets, 1 Vanderbilt Avenue, New York,

New York 10017, by email at TD.ECM_Prospectus@tdsecurities.com

This news release does not constitute an offer

to sell or the solicitation of an offer to buy the Common Shares,

nor shall there be any sale of these securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Fortis

Fortis is a well-diversified leader in the North

American regulated electric and gas utility industry with 2023

revenue of $12 billion and total assets of $70 billion as at

September 30, 2024. The Corporation's 9,600 employees serve

utility customers in five Canadian provinces, ten U.S. states

and three Caribbean countries.

Fortis shares are listed on the TSX and NYSE and

trade under the symbol FTS. Additional information can be accessed

at www.sedarplus.ca or www.sec.gov.

Forward-Looking Information

Fortis includes "forward-looking information" in

this news release within the meaning of applicable Canadian

securities laws and "forward-looking statements" within the meaning

of the Private Securities Litigation Reform Act of 1995

(collectively referred to as "forward-looking information").

Forward-looking information included in this news release reflects

expectations of Fortis' management regarding future growth, results

of operations, performance and business prospects and

opportunities. Wherever possible, words such as anticipates,

believes, budgets, could, estimates, expects, forecasts, intends,

may, might, plans, projects, schedule, should, target, will, would

and other similar terminology or expressions have been used to

identify the forward-looking information, which includes, without

limitation, the renewal of the Corporation's ATM Program, the

filing by the Corporation of the Prospectus Supplement and U.S.

Prospectus Supplement, the aggregate value of Common Shares which

may be issued pursuant to the ATM Program and the Corporation's

expected use of the net proceeds of the ATM Program, if any.

Forward-looking information involves significant

risks, uncertainties and assumptions. Certain material factors or

assumptions have been applied in drawing the conclusions contained

in the forward-looking information. These factors or assumptions

are subject to inherent risks and uncertainties surrounding future

expectations generally, including those identified from time to

time in the forward-looking information. Fortis cautions readers

that a number of factors could cause actual results, performance or

achievements to differ materially from the results discussed or

implied in the forward-looking information. For additional

information with respect to certain of these risks or factors and

risk factors relating to the Common Shares, reference should be

made to the Prospectus Supplement filed, together with the Shelf

Prospectus and the continuous disclosure materials filed from time

to time by Fortis with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission. All

forward-looking information included in this news release is given

as of the date of this news release and, except as required by law,

we disclaim any intention or obligation to revise or update any

forward-looking information, whether as a result of new

information, future events or otherwise.

A .pdf version of this press release is available

at: http://ml.globenewswire.com/Resource/Download/b4dcd653-6d19-4a3b-b929-54e902a99290

For more information, please

contact:

|

Investor Enquiries:Ms. Stephanie AmaimoVice President, Investor

RelationsFortis

Inc.248.946.3572investorrelations@fortisinc.com |

Media Enquiries:Ms. Karen McCarthyVice President, Communications

& Government RelationsFortis

Inc.709.737.5323media@fortisinc.com |

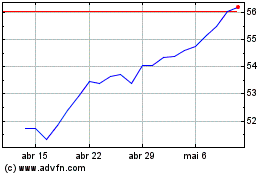

Fortis (TSX:FTS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

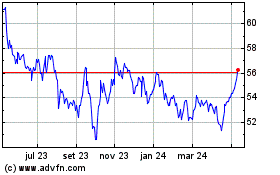

Fortis (TSX:FTS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024