Eldorado Gold Corporation (“Eldorado” or “the Company”) today

releases its updated Mineral Reserve and Mineral Resource (“MRMR”)

estimates as of September 30, 2024.

“Our updated Mineral Reserves estimate provides

a solid foundation and underpins our production profile over the

next decade and beyond,” said George Burns, President and CEO. “We

were pleased to increase our Mineral Reserves by approximately 2%

overall, driven by increases at the Lamaque Complex and Efemcukuru

that extends Reserve mine life significantly and complements our

already long mine life assets at Skouries, Kisladag and Olympias.

The Lamaque Complex Mineral Reserve increased by 45%, driven

primarily by the declaration of an Inaugural Mineral Reserve at

Ormaque of 619 thousand ounces. This follows a solid track record

of successfully replacing Mineral Reserves since acquiring the

asset in 2017 and sets up the Lamaque Complex for the long-term

with two underground mines with significant Inferred Mineral

Resource conversion potential and exploration upside.”

“In addition, at Efemcukuru, we increased

Mineral Reserves by 23% resulting in an extension to the mine life

by an additional two years to an updated life of mine of eight

years. Efemcukuru has been a reliable producer since 2011, and our

team remains committed to exploring opportunities to extend mine

life further. During 2025, our focus will continue to be on

extending the mine life at our existing operations and testing

near-mine exploration targets, while seeking a discovery from our

highly prospective portfolio of early stage exploration targets in

Canada and Turkiye.”

Mineral Reserves Update

The Company’s Proven and Probable gold Mineral

Reserves totalled 11.9 million ounces as of September 30, 2024, an

increase of approximately 2% from the previous MRMR statement from

September 30, 2023. The complete MRMR table and notes can be found

at the end of this release.

|

|

Ore Tonnes (t x 1,000) |

|

Gold Grade (g/t) |

|

Total Mineral Reserves (Gold Ounces) x 1,000) |

|

Mineral Reserves as of September 30, 2023(1) |

350,665 |

|

1.04 |

|

11,717 |

|

| Depletion(2) |

(14,667 |

) |

1.57 |

|

(742 |

) |

| Adjustments for metal prices,

cut-off value, mine plan optimization, additions due to new

drilling and conversion of Resources |

8,735 |

|

3.33 |

|

936 |

|

|

Mineral Reserves as of September 30, 2024 |

344,733 |

|

1.07 |

|

11,911 |

|

| |

|

|

|

|

|

|

(1) The Company’s total MRMR excludes Mineral

Reserves at its non-core Romanian asset (Certej). As disclosed in

the Q3 2024 Managements Discussion & Analysis, the Certej

project has been presented as a disposal group held for sale as at

September 30, 2024 and as a discontinued operation for the three

and nine months ended September 30, 2024. On October 7, 2024, the

Company entered into a share purchase agreement to sell the Certej

project. The closing of the disposition is subject to certain

conditions.(2) Depletion declared here are in-situ ounces.

Depletion includes the 12-month period of October 1, 2023, through

September 30, 2024.

Excluding depletion, the increase in Mineral

Reserves is primarily attributable to additions at Kokarpinar South

at Efemcukuru as well as an inaugural Mineral Reserve estimate for

the Ormaque deposit within the Lamaque Complex.

- Lamaque Complex: Mineral Reserves

increased 45% with the addition of Ormaque, partially offset by

depletion at Triangle, resulting in an increase in life of mine to

eight years.

- Ormaque: Inaugural Mineral Reserve of 619 thousand ounces at

Ormaque.

- Triangle: Mineral Reserves decreased primarily as a result of

depletion.

- Kisladag: Mineral Reserves

decreased as a result of depletion, partially offset by positive

design changes.

- Efemcukuru: Mineral Reserves

increased with the addition of Kokarpinar South, increasing the

life of mine by two years to an updated eight year life of

mine.

- Olympias: Mineral Reserves

decreased due to depletion and Resource modelling incorporating

additional drilling.

The following table summarizes the period-over-period changes to

the Company’s Mineral Reserves:

|

Gold Mineral Reserves |

|

|

2023 |

2024 |

Change(1) |

Change excluding depletion |

|

Contained Gold Oz (x 1,000) |

|

Efemcukuru |

550 |

678 |

128 |

224 |

|

Kisladag |

3,759 |

3,559 |

(200) |

144 |

|

Lamaque Complex (Triangle + Parallel) |

877 |

658 |

(219) |

(43) |

|

Lamaque Complex (Ormaque) |

0 |

619 |

619 |

619 |

|

Olympias |

1,907 |

1,770 |

(137) |

(11) |

|

Perama Hill |

995 |

997 |

2 |

2 |

|

Skouries |

3,630 |

3,630 |

0 |

0 |

|

Total |

11,717 |

11,911 |

194 |

936 |

|

|

|

|

|

|

NOTE: Totals may not sum due to

rounding.(1) The Company reports its MRMR as of September 30,

2024. As such, the change year over year is from October 1,

2023 to September 30, 2024.

Mineral Resources

Update

Eldorado’s Measured and Indicated Mineral

Resources (“M&I Mineral Resources”) totalled 22.0 million

ounces gold, as of September 30, 2024. The Company successfully

converted Inferred Mineral Resources to M&I Mineral Resources

at Ormaque, within the Lamaque Complex, and at Efemcukuru. The

total is offset by depletion at the other operating mines. This

resulted in a 3% decrease from the previous MRMR statement from

September 30th, 2023. Eldorado’s Inferred Mineral Resources

totalled 6.8 million ounces as of September 30, 2024, a 10%

decrease from the previous MRMR statement. Detailed MRMR disclosure

tables are included at the end of this news release.

- Lamaque Complex: The increase in

total M&I Mineral Resources is primarily related to conversion

from Inferred Mineral Resources at Ormaque, whilst partially offset

by depletion at Triangle.

- Ormaque: M&I Mineral Resources increased nearly 300%

attributable to significant expansion and conversion of Inferred

Mineral Resources. Inferred Mineral Resources decreased as a result

of the above-mentioned conversion, partially offset by the addition

of new Inferred Mineral Resources.

- Triangle: M&I Mineral Resources decreased due to depletion

and Inferred Mineral Resources decreased due to discontinuities in

C7 vein continuity recognised during in-fill drilling, grade

changes, and cut-off grade assumptions, coupled with conversion to

M&I Mineral Resources.

- Kisladag: The decrease in M&I

Mineral Resources is primarily from depletion. Inferred Mineral

Resources remained relatively unchanged period-over-period.

- Efemcukuru: The decrease in M&I

Mineral Resources is primarily from depletion, partially offset by

the conversion to Mineral Reserves at Kokarpinar South. The slight

decrease in Inferred Mineral Resources is attributable to

conversion to M&I Mineral Resources.

- Olympias: Both M&I Mineral

Resources and Inferred Mineral Resources decreased due to

depletion, model estimation parameters updates, and the exclusion

of un-minable material which were previously included, off-setting

extensional discoveries. As part of the annual review of Mineral

Resources with respect to reasonable prospects for eventual

economic extraction (“RPEEE”), some un-mineable material was

removed due to proximity to existing infrastructure, areas of poor

geotechnical conditions and inaccessibility due to previous mining

activities.

The following table summarizes the period-over-period changes to

the Company’s Mineral Resources:

|

Measured and Indicated Gold Mineral

Resources(1) |

|

Inferred Gold Mineral Resources |

|

|

2023 |

2024 |

Change(2) |

|

2023 |

2024 |

Change(2) |

|

Contained Goldounces (x1000) |

Contained Goldounces (x1000) |

| Lamaque Complex |

|

|

|

|

|

|

|

|

|

|

|

|

Triangle, Parallel & Plug #4 |

1,679 |

|

1,424 |

|

(255 |

) |

|

2,305 |

|

1,731 |

|

(574 |

) |

| Ormaque |

191 |

|

748 |

|

557 |

|

927 |

|

837 |

|

(90 |

) |

| Lamaque Complex Total |

1,870 |

|

2,172 |

|

302 |

|

|

3,232 |

|

2,568 |

|

(664 |

) |

| Kisladag |

6,290 |

|

5,816 |

|

(474 |

) |

|

107 |

|

100 |

|

(7 |

) |

| Efemcukuru |

1,200 |

|

1,155 |

|

(45 |

) |

|

176 |

|

168 |

|

(8 |

) |

| Olympias |

3,198 |

|

2,663 |

|

(535 |

) |

|

589 |

|

457 |

|

(132 |

) |

| Perama Hill |

1,374 |

|

1,374 |

|

- |

|

|

59 |

|

59 |

|

- |

|

| Perama South |

0 |

|

0 |

|

- |

|

|

728 |

|

728 |

|

- |

|

| Piavitsa |

0 |

|

0 |

|

- |

|

|

1,025 |

|

1,025 |

|

- |

|

| Sapes |

0 |

|

0 |

|

- |

|

|

820 |

|

820 |

|

- |

|

|

Skouries |

5,030 |

|

5,030 |

|

- |

|

|

814 |

|

814 |

|

- |

|

|

Subtotal |

18,962 |

|

18,210 |

|

(752 |

) |

|

7,550 |

|

6,739 |

|

|

|

Certej(3) – held for sale |

3,829 |

|

3,829 |

|

- |

|

|

23 |

|

23 |

|

|

|

Total |

22,791 |

|

22,039 |

|

(752 |

) |

|

7,573 |

|

6,762 |

|

(811 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: Totals may not sum due to rounding.(1)

Mineral Resources are inclusive of Mineral Reserves.(2) The Company

Reports on its MRMR as of September 30, 2024. As such, the change

year over year is from October 1, 2023 to September 30, 2024.(3) As

disclosed in the Q3 2024 Managements Discussion & Analysis, the

Certej project has been presented as a disposal group held for sale

as at September 30, 2024 and as a discontinued operation for the

three and nine months ended September 30, 2024. On October 7, 2024,

the Company entered into a share purchase agreement to sell the

Certej project. The closing of the disposition is subject to

certain conditions.

2025 Reporting Schedule

The Company intends to report, and host a

conference call led by senior management, as set out in the table

below. The Company reserves the right to amend the schedule in its

discretion and will inform the market of any changes in

schedule.

|

Event |

Result Date |

Conference Call Date |

|

Fourth Quarter and Full Year 2024 |

February 20, 2025 |

February 21, 2025 |

|

First Quarter 2025 |

May 1, 2025 |

May 2, 2025 |

|

Second Quarter 2025 |

July 31, 2025 |

August 1, 2025 |

|

Third Quarter 2025 |

October 30, 2025 |

October 31, 2025 |

|

|

|

|

About Eldorado

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkiye, Canada

and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lynette Gould, VP, Investor Relations,

Communications & External Affairs647 271 2827 or 1 888 353

8166 lynette.gould@eldoradogold.com

Media

Chad Pederson, Director, Communications and

Public Affairs236 885 6251 or 1 888 353 8166

chad.pederson@eldoradogold.com

| Eldorado

Gold Mineral Reserves as of September 30, 2024 |

|

|

|

|

|

|

|

Project |

Proven Mineral Reserves |

Probable Mineral Reserves |

Total Proven and Probable |

|

Gold |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Efemcukuru |

985 |

5.13 |

162 |

3,436 |

4.67 |

515 |

4,421 |

4.77 |

678 |

|

Kisladag |

151,878 |

0.68 |

3,296 |

15,688 |

0.52 |

263 |

167,566 |

0.66 |

3,559 |

| Triangle,

Parallel |

1,357 |

5.70 |

249 |

1,956 |

6.50 |

409 |

3,313 |

6.19 |

658 |

|

Ormaque |

3 |

7.76 |

1 |

2,661 |

7.22 |

618 |

2,664 |

7.22 |

619 |

|

Lamaque Complex |

1,360 |

5.72 |

250 |

4,617 |

6.92 |

1,027 |

5,977 |

6.65 |

1,277 |

|

Olympias |

3,411 |

7.90 |

868 |

5,930 |

4.70 |

903 |

9,341 |

5.89 |

1,770 |

|

Perama Hill |

3,116 |

4.08 |

409 |

7,196 |

2.54 |

587 |

10,312 |

3.01 |

997 |

|

Skouries |

73,101 |

0.87 |

2,053 |

74,015 |

0.66 |

1,576 |

147,116 |

0.77 |

3,630 |

|

TOTAL GOLD |

233,851 |

0.94 |

7,038 |

110,882 |

1.37 |

4,871 |

344,733 |

1.07 |

11,911 |

|

Silver |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Olympias |

3,411 |

118 |

12,979 |

5,930 |

116 |

22,046 |

9,341 |

117 |

35,024 |

|

Perama Hill |

3,116 |

4.02 |

403 |

7,196 |

5.37 |

1,241 |

10,312 |

4.96 |

1,644 |

|

TOTAL SILVER |

6,527 |

64 |

13,382 |

13,126 |

55 |

23,287 |

19,653 |

58 |

36,668 |

|

Copper |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

|

Skouries |

73,101 |

0.52 |

381 |

74,015 |

0.49 |

359 |

147,116 |

0.50 |

740 |

|

TOTAL COPPER |

73,101 |

0.52 |

381 |

74,015 |

0.49 |

359 |

147,116 |

0.50 |

740 |

|

Lead |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

|

Olympias |

3,411 |

3.7 |

128 |

5,930 |

4.2 |

250 |

9,341 |

4.0 |

378 |

|

TOTAL LEAD |

3,411 |

3.8 |

128 |

5,930 |

4.2 |

250 |

9,341 |

4.0 |

378 |

|

Zinc |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

|

Olympias |

3,411 |

4.6 |

158 |

5,930 |

5.3 |

315 |

9,341 |

5.1 |

474 |

|

TOTAL ZINC |

3,411 |

4.6 |

158 |

5,930 |

5.3 |

315 |

9,341 |

5.1 |

474 |

|

|

|

|

|

|

|

|

|

|

|

| Eldorado

Gold Mineral Reserves as of September 30, 2023 |

|

|

|

|

|

|

Project |

Proven Mineral Reserves |

Probable Mineral Reserves |

Total Proven and Probable |

|

Gold |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Efemcukuru |

1,290 |

5.18 |

215 |

2,082 |

5.01 |

335 |

3,372 |

5.08 |

550 |

|

Kisladag |

163,085 |

0.68 |

3,543 |

13,491 |

0.50 |

216 |

176,576 |

0.67 |

3,759 |

|

Lamaque Complex |

1,033 |

6.07 |

202 |

3,422 |

6.14 |

675 |

4,454 |

6.12 |

877 |

|

Olympias |

2,354 |

8.88 |

672 |

6,502 |

5.91 |

1,235 |

8,856 |

6.70 |

1,907 |

|

Perama Hill |

3,116 |

4.08 |

409 |

7,176 |

2.54 |

586 |

10,292 |

3.01 |

995 |

|

Skouries |

73,101 |

0.87 |

2,053 |

74,015 |

0.66 |

1,576 |

147,116 |

0.77 |

3,630 |

|

TOTAL GOLD |

243,978 |

0.90 |

7,093 |

106,687 |

1.35 |

4,624 |

350,665 |

1.04 |

11,717 |

|

Silver |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Olympias |

2,354 |

126 |

9,568 |

6,502 |

126 |

26,242 |

8,856 |

126 |

35,810 |

|

Perama Hill |

3,116 |

4.0 |

403 |

7,176 |

5.4 |

1,237 |

10,292 |

5.0 |

1,639 |

|

TOTAL SILVER |

5,470 |

57 |

9,971 |

13,678 |

62 |

27,479 |

19,148 |

61 |

37,450 |

|

Copper |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

|

Skouries |

73,101 |

0.52 |

381 |

74,015 |

0.48 |

359 |

147,116 |

0.50 |

740 |

|

TOTAL COPPER |

73,101 |

0.52 |

381 |

74,015 |

0.48 |

359 |

147,116 |

0.50 |

740 |

|

Lead |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

|

Olympias |

2,354 |

4.0 |

94 |

6,502 |

4.3 |

280 |

8,856 |

4.2 |

374 |

|

TOTAL LEAD |

2,354 |

4.0 |

94 |

6,502 |

4.3 |

280 |

8,856 |

4.2 |

374 |

|

Zinc |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

|

Olympias |

2,354 |

4.7 |

111 |

6,502 |

5.5 |

357 |

8,856 |

5.3 |

468 |

|

TOTAL ZINC |

2,354 |

4.7 |

111 |

6,502 |

5.5 |

357 |

8,856 |

5.3 |

468 |

|

|

|

|

|

|

|

|

|

|

|

| Eldorado

Gold Mineral Resources as of September 30, 2024(1) |

|

|

|

|

|

|

|

|

|

Project |

Measured Resources |

Indicated Resources |

Total Measured and Indicated |

Inferred Resources |

|

Gold |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Certej(2) |

29,300 |

1.73 |

1,626 |

58,653 |

1.17 |

2,203 |

87,953 |

1.35 |

3,829 |

842 |

0.86 |

23 |

|

Efemcukuru(3) |

1,556 |

7.23 |

362 |

3,849 |

6.40 |

793 |

5,405 |

6.64 |

1,155 |

1,300 |

4.02 |

168 |

| Kisladag |

260,131 |

0.61 |

5,129 |

42,358 |

0.50 |

687 |

302,489 |

0.59 |

5,816 |

6,656 |

0.47 |

100 |

| Triangle, Plug #4,

Parallel |

2,269 |

6.55 |

477 |

4,367 |

6.74 |

947 |

6,636 |

6.67 |

1,424 |

8,188 |

6.58 |

1,731 |

|

Ormaque(4) |

3 |

7.76 |

1 |

1414 |

16.44 |

747 |

1,417 |

16.41 |

748 |

1,750 |

14.87 |

837 |

| Lamaque

Complex |

2,272 |

6.55 |

478 |

5,781 |

9.12 |

1,694 |

8,053 |

8.39 |

2,172 |

9,938 |

8.04 |

2,568 |

| Olympias |

4,200 |

9.71 |

1,311 |

6,966 |

6.04 |

1,352 |

11,166 |

7.42 |

2,663 |

2,081 |

6.82 |

457 |

| Perama

Hill |

3,093 |

4.15 |

412 |

10,973 |

2.73 |

962 |

14,066 |

3.04 |

1,374 |

1,136 |

1.63 |

59 |

| Perama

South |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

14,870 |

1.52 |

728 |

| Piavitsa |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

6,613 |

4.82 |

1,025 |

| Sapes |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

3,434 |

7.43 |

820 |

| Skouries |

90,714 |

0.85 |

2,479 |

149,260 |

0.53 |

2,551 |

239,974 |

0.65 |

5,030 |

67,657 |

0.37 |

814 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL GOLD |

391,266 |

0.94 |

11,797 |

277,840 |

1.15 |

10,242 |

669,106 |

1.02 |

22,039 |

114,527 |

1.84 |

6,762 |

|

Silver |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Certej(2) |

29,300 |

9 |

8,111 |

58,653 |

10 |

18,103 |

87,953 |

9 |

26,214 |

842 |

4 |

110 |

|

Efemcukuru |

1,556 |

22 |

1,091 |

3,849 |

22 |

2,663 |

5,405 |

22 |

3,754 |

1,300 |

31 |

1,303 |

| Olympias |

4,200 |

147 |

19,846 |

6,966 |

139 |

31,119 |

11,166 |

142 |

50,965 |

2,081 |

135 |

9,028 |

| Perama

Hill |

3,093 |

4 |

415 |

10,973 |

7 |

2,579 |

14,066 |

7 |

2,994 |

1,136 |

2 |

83 |

| Piavitsa |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

6,613 |

54 |

11,389 |

| Stratoni |

0 |

0 |

0 |

1,391 |

152 |

6,785 |

1,391 |

152 |

6,785 |

1,807 |

166 |

9,672 |

|

TOTAL SILVER |

38,149 |

24 |

29,463 |

81,832 |

23 |

61,249 |

119,981 |

24 |

90,712 |

13,779 |

71 |

31,585 |

|

Copper |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

| Skouries |

90,714 |

0.51 |

466 |

149,260 |

0.44 |

652 |

239,974 |

0.47 |

1,118 |

67,657 |

0.40 |

267 |

|

TOTAL COPPER |

90,714 |

0.51 |

466 |

149,260 |

0.44 |

652 |

239,974 |

0.47 |

1,118 |

67,657 |

0.40 |

267 |

|

Lead |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

| Olympias |

4,200 |

4.7 |

197 |

6,966 |

5.0 |

350 |

11,166 |

4.9 |

547 |

2,081 |

5.0 |

105 |

| Stratoni |

0 |

0.0 |

0 |

1,391 |

6.0 |

84 |

1,391 |

7 |

84 |

1,807 |

6.9 |

124 |

|

TOTAL LEAD |

4,200 |

4.69 |

197 |

8,357 |

5.2 |

434 |

12,557 |

5.0 |

631 |

3,888 |

5.9 |

229 |

|

Zinc |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

| Olympias |

4,200 |

5.9 |

247 |

6,966 |

6.5 |

451 |

11,166 |

6.3 |

698 |

2,081 |

5.9 |

123 |

| Stratoni |

0 |

0.0 |

0 |

1,391 |

8.4 |

117 |

1,391 |

8.4 |

117 |

1,807 |

8.3 |

150 |

|

TOTAL ZINC |

4,200 |

5.9 |

247 |

8,357 |

6.8 |

568 |

12,557 |

6.5 |

815 |

3,888 |

7.0 |

273 |

Notes: (1) Resource grades are reported undiluted, however

resources are assessed for reasonable expectation of economic

extraction by applying expected minimum mining shapes. (2) As

disclosed in the Q3 2024 Managements Discussion & Analysis, the

Certej project has been presented as a disposal group held for sale

as at September 30, 2024 and as a discontinued operation for the

three and nine months ended September 30, 2024. On October 7, 2024,

the Company entered into a share purchase agreement to sell the

Certej project. The closing of the disposition is subject to

certain conditions.(3) Mineralized shapes based on RPEEE

identified based on 2.5 g/t Au COG; within shapes material below

incremental COG of 1.0 g/t have been excluded; grades are diluted

by must-take material between 1.0 and 2.5 g/t Au. (4) Due to

narrow veins, continued conversion of Resources to Reserves at

Ormaque will reflect expected lower grades to fully represent

mining modifying factors.

| Eldorado

Gold Mineral Resources as of September 30, 2023(1) |

|

|

|

|

|

|

|

|

|

Project |

Measured Resources |

Indicated Resources |

Total Measured and Indicated |

Inferred Resources |

|

Gold |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

Tonnes |

Au |

Contained Au |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Certej(2) |

29,300 |

1.73 |

1,626 |

58,653 |

1.17 |

2,203 |

87,953 |

1.35 |

3,829 |

842 |

0.86 |

23 |

|

Efemcukuru |

1,588 |

7.15 |

365 |

3,991 |

6.51 |

835 |

5,580 |

6.69 |

1,200 |

1,323 |

4.13 |

176 |

| Kisladag |

286,037 |

0.61 |

5,585 |

44,280 |

0.50 |

705 |

330,317 |

0.59 |

6,290 |

7,529 |

0.44 |

107 |

| Triangle, Plug #4,

Parallel |

1,183 |

8.12 |

309 |

5,627 |

7.58 |

1,370 |

6,810 |

7.67 |

1,679 |

9,728 |

7.37 |

2,305 |

|

Ormaque(3) |

0 |

0.00 |

0.00 |

309 |

19.24 |

191 |

309 |

19.24 |

191 |

1,869 |

15.43 |

927 |

| Lamaque

Complex |

1,183 |

8.12 |

309 |

5,936 |

8.19 |

1,561 |

7,119 |

8.17 |

1,870 |

11,597 |

8.67 |

3,232 |

| Olympias |

3,447 |

10.59 |

1,174 |

8,992 |

7.00 |

2,024 |

12,439 |

8.00 |

3,198 |

2,339 |

7.84 |

589 |

| Perama

Hill |

3,093 |

4.15 |

412 |

10,973 |

2.73 |

962 |

14,066 |

3.04 |

1,374 |

1,136 |

1.63 |

59 |

| Perama

South |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

14,870 |

1.52 |

728 |

| Piavitsa |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

6,613 |

4.82 |

1,025 |

| Sapes |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

0 |

0.00 |

0 |

3,434 |

7.43 |

820 |

| Skouries |

90,714 |

0.85 |

2,479 |

149,260 |

0.53 |

2,551 |

239,974 |

0.65 |

5,030 |

67,657 |

0.37 |

814 |

|

TOTAL GOLD |

415,362 |

0.89 |

11,950 |

282,086 |

1.20 |

10,841 |

697,448 |

1.02 |

22,791 |

117,341 |

2.01 |

7,574 |

|

Silver |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

Tonnes |

Ag |

Contained Ag |

|

|

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

(x1000) |

g/t |

ounces (x1000) |

|

Certej(2) |

29,300 |

9 |

8,111 |

58,653 |

10 |

18,103 |

87,953 |

9 |

26,214 |

842 |

4 |

110 |

| Olympias |

3,447 |

152 |

16,849 |

8,992 |

144 |

41,770 |

12,439 |

147 |

58,619 |

2,339 |

179 |

13,488 |

| Perama

Hill |

3,093 |

4 |

415 |

10,973 |

7 |

2,579 |

14,066 |

7 |

2,994 |

1,136 |

2 |

83 |

| Piavitsa |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

6,613 |

54 |

11,389 |

| Stratoni |

0 |

0 |

0 |

1,391 |

152 |

6,785 |

1,391 |

152 |

6,785 |

1,807 |

166 |

9,672 |

|

TOTAL SILVER |

35,840 |

22 |

25,375 |

80,009 |

27 |

69,237 |

115,849 |

25 |

94,612 |

12,737 |

85 |

34,742 |

|

Copper |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

Tonnes |

Cu |

Contained Cu |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

| Skouries |

90,714 |

0.51 |

466 |

149,260 |

0.44 |

652 |

239,974 |

0.47 |

1,118 |

67,657 |

0.40 |

267 |

|

TOTAL COPPER |

90,714 |

0.51 |

466 |

149,260 |

0.44 |

652 |

239,974 |

0.47 |

1,118 |

67,657 |

0.40 |

267 |

|

Lead |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

Tonnes |

Pb |

Contained Pb |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

| Olympias |

3,447 |

4.8 |

167 |

8,992 |

4.9 |

441 |

12,439 |

4.9 |

608 |

2,339 |

6.2 |

146 |

| Stratoni |

0 |

0.0 |

0 |

1,391 |

6.0 |

84 |

1,391 |

6.0 |

84 |

1,807 |

6.9 |

124 |

|

TOTAL LEAD |

3,447 |

4.84 |

167 |

10,383 |

5.1 |

525 |

13,830 |

5.0 |

692 |

4,146 |

6.5 |

270 |

|

Zinc |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

Tonnes |

Zn |

Contained Zn |

|

|

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

(x1000) |

% |

tonnes (x1000) |

| Olympias |

3,447 |

5.9 |

204 |

8,992 |

6.6 |

593 |

12,439 |

6.4 |

797 |

2,339 |

6.8 |

160 |

| Stratoni |

0 |

0.0 |

0 |

1,391 |

8.4 |

117 |

1,391 |

8.4 |

117 |

1,807 |

8.3 |

150 |

|

TOTAL ZINC |

3,447 |

5.9 |

204 |

10,383 |

6.8 |

710 |

13,830 |

6.6 |

914 |

4,146 |

7.5 |

310 |

Notes: (1) Resource grades are reported undiluted, however

resources are assessed for reasonable expectation of economic

extraction by applying expected minimum mining shapes. (2) As

disclosed in the Q3 2024 Managements Discussion & Analysis, the

Certej project has been presented as a disposal group held for sale

as at September 30, 2024 and as a discontinued operation for the

three and nine months ended September 30, 2024. On October 7, 2024,

the Company entered into a share purchase agreement to sell the

Certej project. The closing of the disposition is subject to

certain conditions.(3) Due to narrow veins, any future potential

conversion of Resources to Reserves at Ormaque will reflect

expected lower grades to fully represent mining modifying

factors.

ADVISORIES AND DETAILED NOTES ON MINERAL

RESERVES AND RESOURCES

General

Mineral Reserves and Mineral Resources are as of

September 30, 2024

The Mineral Reserves and Mineral Resources were

classified using logic consistent with the CIM Definition Standards

for Mineral Resources & Mineral Reserves (2014) incorporated,

by reference, into National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”). Sample preparation,

analytical techniques, laboratories used, and quality assurance and

quality control protocols used during exploration drilling programs

are done consistent with industry standards and independent

certified assay labs are used.

Mineral Reserves are included in the Mineral

Resources.

The Mineral Reserves and Mineral Resources are

disclosed on a total project basis.

Measured and Indicated Mineral Resources which

are not Mineral Reserves, do not have demonstrated economic

viability. With respect to “Inferred Mineral Resources”, there is a

great amount of uncertainty as to their existence and uncertainty

as to their economic and legal feasibility. It cannot be assumed

that all or any part of a “Measured Mineral Resource”, “Indicated

Mineral Resource” or “Inferred Mineral Resource” will ever be

upgraded to a higher category.

Additional information on the Kisladag,

Efemcukuru, Olympias, Skouries and Lamaque mineral properties

mentioned in this news release (all of which are considered to be

material mineral properties to the Company) are contained in

Eldorado’s annual information form for the year ended December 31,

2023 and the following technical reports for each of those

properties, all of which are available under the Company's profile

at www.sedarplus.com and www.sec.gov:

- Technical report entitled "Technical Report, Kisladag Gold

Mine, Turkiye” with an effective date of January 17, 2020.

- Technical report entitled "Technical Report, Efemcukuru Gold

Mine, Turkiye” with an effective date of December 31, 2023.

- Technical report entitled “Technical Report, Olympias Mine,

Greece” with an effective date of December 31, 2023.

- Technical report entitled “Technical Report, Skouries Project,

Greece” with an effective date of January 22, 2022.

- Technical report entitled “Technical Report, for the Lamaque

Project, Quebec, Canada’” with an effective date of December 31,

2021.

- In addition, Eldorado will file a new technical report for the

Lamaque mineral properties (which will include the inaugural

reserves at Ormaque noted above) by the end of January 2025.

Qualified Persons

Simon Hille, FAusIMM, Executive Vice President,

Operations and Technical Services, is the “qualified person” under

NI 43-101 responsible for preparing and supervising the preparation

of the scientific or technical information contained in this news

release and verifying the technical data disclosed in this document

relating to our operating mines and development projects, unless

otherwise noted. Additional qualified persons have approved

disclosures for specific properties as detailed in “Mineral Reserve

Notes” and “Mineral Resource Notes” below. Jessy Thelland, géo (OGQ

No. 758)., Director Technical Services Lamaque, a member in good

standing of the Ordre des Géologues du Québec, is the qualified

person as defined in NI 43-101 responsible for, and has verified

and approved, the scientific and technical disclosure contained in

this news release for the Quebec projects.

Cautionary Note to US Investors

Concerning Estimates of Measured, Indicated and Inferred

ResourcesThere are differences between the standards and

terms used for reporting mineral reserves and resources in Canada,

and in the United States pursuant to the United States Securities

and Exchange Commission’s (the “SEC”). The terms Mineral Resource,

Measured Mineral Resource, Indicated Mineral Resource and Inferred

Mineral Resource are defined by the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) and the CIM Definition Standards on

Mineral Reserves and Mineral Resources adopted by the CIM Council,

and must be disclosed according to Canadian securities

regulations.

These standards differ from the requirements of

the SEC applicable to domestic United States reporting companies.

Accordingly, information contained in this news release with

respect to mineral deposits may not be comparable to similar

information made public by United States companies subject to the

SEC’s reporting and disclosure requirements.

Mineral Reserve Notes

Eldorado reports Mineral Reserves in accordance

with CIM Definition Standards. Mineral Reserves for the operating

sites (Efemcukuru, Kisladag, Olympias, and within the Lamaque

Complex – Ormaque and Triangle) were determined using a long-term

gold price of $1,450/oz while Mineral Reserves for the Skouries and

Perama Hill projects were determined based on a $1,300/oz gold

price. A reserve test is undertaken every year to confirm future

undiscounted cash flow from reserve mine plan is positive.

|

Long-Term Metal Price Assumptions – Mineral

Reserves |

|

2023 |

|

2024 |

|

Gold price ($ per ounce) |

|

1,400 |

|

1,450 |

|

Silver price ($ per ounce) |

|

19.00 |

|

19.00 |

|

Copper price ($ per pound) |

|

2.75 |

|

2.75 |

|

Copper price ($ per tonne) |

|

6,061 |

|

6,061 |

|

Lead price ($ per tonne) |

|

2,000 |

|

2,000 |

|

Zinc price ($ per tonne) |

|

2,500 |

|

2,500 |

|

Cut-off Grades/Values – Mineral Reserves |

2023 |

|

2024 |

|

Efemcukuru |

$123.62/t NSR(long hole stoping), $126.60/t NSR (drift and

fill) |

|

$130.05/t NSR (long hole stoping), $136.10/t NSR (drift and

fill) |

|

Kisladag |

0.173 g/t Au Recoverable |

|

0.179 g/t Au Recoverable |

|

Lamaque Complex |

5.06 g/t Au (Triangle Mine – long hole stoping) |

|

4.99 g/t Au (long hole stoping), 5.67 g/t Au (drift and fill) |

|

Olympias |

$217.63/t NSR |

|

$216.79/t NSR |

|

Perama Hill |

0.81 g/t Au |

|

0.81 g/t Au |

|

Skouries |

$10.60/t NSR (open pit), $33.33/t NSR (underground) |

|

$10.60/t NSR (open pit), $33.33/t NSR (underground) |

|

|

|

|

|

Qualified Persons

The following persons, all of whom are qualified

persons under NI 43-101, have approved the disclosure related to

the Mineral Reserves for the projects noted below contained within

this release:

|

Asset |

Mining Type(s) |

Qualified Person |

Company |

|

Lamaque Complex: Triangle, Parallel, Plug #4 |

Underground |

Jessy Thelland, géo (OGQ No.

758), Technical Services Director Lamaque |

Eldorado Gold |

|

Lamaque Complex: Ormaque |

Underground |

Phillippe Groleau, Eng, (OIQ No.

5032770), Senior Strategic Planner |

Eldorado Gold |

|

Kisladag |

Open Pit |

Herb Ley, SME-RM, Senior Project

Manager |

Stantec |

|

Efemcukuru |

Underground |

Mike Tsafaras, P.Eng., Director,

Mine Planning |

Eldorado Gold |

|

Olympias |

Underground |

Filip Medinac, P.Eng., Technical

Services Manager, Olympias |

Eldorado Gold |

|

Skouries |

Open Pit |

Victor Vdovin, P.Eng., Head of

Technical Services, Kassandra |

Eldorado Gold |

|

Skouries |

Underground |

Mike Tsafaras, P.Eng., Director,

Mine Planning |

Eldorado Gold |

|

Perama Hill |

Open Pit |

Herb Ley, SME-RM, Senior Project Manager |

Stantec |

|

|

|

|

|

Mineral Resource Notes

Eldorado reports Mineral Resources in accordance

with CIM Definition Standards. All Mineral Resources are assessed

for reasonable prospects for eventual economic extraction (RPEEE).

The Resource cut-off grades or values (e.g. gold equivalent) are

determined using a long-term gold price ($1,800/oz) and modifying

factors derived in the resource to reserve conversion process (or

by comparison to similar projects for our resource-only

properties). These values are then used to create constraining

volumes that provide limits to the reported Resources. Resource

grades are reported undiluted from within the constraining volumes

that satisfy RPEEE. At Efemcukuru, mineralized shapes based

on RPEEE identified based on 2.5 g/t Au COG; within shapes material

below incremental COG of 1.0 g/t have been excluded; grades are

diluted by must-take material between 1.0 and 2.5 g/t Au. Due

to the presence of narrow veins, any future potential conversion of

Resources to Reserves at Ormaque will reflect expected lower grades

to fully represent modifying factors associated with mining.

Open Pit Resources used pit shells created with

the long-term gold price to constrain reportable model

blocks. Underground Resources were constrained by volumes

whose design was guided by a combination of the reporting cut-off

grade or value, contiguous areas of mineralization and mineability.

Eldorado’s Mineral Resources are inclusive of Reserves.

|

Long-Term Metal Price Assumptions – Mineral

Resources |

2023 |

2024 |

|

Gold price ($ per ounce) |

1,800 |

1,800 |

|

Silver price ($ per ounce) |

24.00 |

24.00 |

|

Copper price ($ per pound) |

3.25 |

3.25 |

|

Copper price ($ per tonne) |

7,163 |

7,163 |

|

Lead price ($ per tonne) |

2,200 |

2,200 |

|

Zinc price ($ per tonne) |

2,800 |

2,800 |

|

|

|

|

Mineral Resource Reporting and

demonstration of Reasonable Prospects for Eventual Economic

Extraction:

The Mineral Resources used a long term look gold

metal price of $1,800/oz for the determination of resource cut-off

grades or values. This guided execution of the next step where

constraining surfaces or volumes were created to control resource

reporting. Open pit-only projects (Kisladag, Perama Hill, Perama

South, and Certej) used pit shells created with the long-term gold

price to constrain reportable model blocks. Underground

Resources were constrained by 3D volumes whose design was guided by

the reporting cut-off grade or value, contiguous areas of

mineralization and mineability. Only material internal to these

volumes were eligible for reporting. Projects with both open pit

and underground Resources have the open pit Resources constrained

by either the permit (Skouries), and pit shell, or by an open

pit/underground economic crossover surface, and underground

Resources constrained by a reporting shape.

|

Cut-off Grades/Values – Mineral Resources |

2023 |

|

2024 |

|

Certej |

0.60 g/t Au |

|

0.60 g/t Au |

|

Efemcukuru |

2.5 g/t Au |

|

2.5 g/t Au(1) |

|

Kisladag |

0.25 g/t Au (in-situ) |

|

0.27 g/t Au (in-situ) |

|

Lamaque Complex |

Triangle Mine: 3.0 g/t Au; Ormaque 3.5 g/t Au |

|

Triangle, Plug #4, Parallel, Ormaque: 3.5 g/t Au |

|

Olympias |

$125/t NSR |

|

$115/t NSR |

|

Perama Hill and Perama South |

0.50 g/t Au |

|

0.50 g/t Au |

|

Piavitsa |

4.0 g/t Au |

|

4.0 g/t Au |

|

Sapes |

2.5 g/t Au (underground), 1.0 g/t Au (open pit) |

|

2.5 g/t Au (underground), 1.0 g/t Au (open pit) |

|

Skouries |

0.30 g/t Au Equivalent grade (open pit), 0.70 g/t Au Equivalent

grade (underground); Au Equivalent: (=Au g/t + 1.25*Cu%) |

|

0.30 g/t Au Equivalent grade (open pit), 0.70 g/t Au Equivalent

grade (underground); Au Equivalent: (=Au g/t + 1.25*Cu%) |

|

Stratoni |

$200/t NSR |

|

$200/t NSR, based on Zn Equivalent grade of 10% |

|

|

|

|

|

(1) Mineralized shapes based on RPEEE identified

based on 2.5 g/t Au COG; within shapes material below incremental

COG of 1.0 g/t have been excluded; grades are diluted by must-take

material between 1.0 and 2.5 g/t Au.

Qualified Persons

The following persons, all of whom are qualified

persons under NI 43-101, have approved the disclosure related to

the Mineral Resources for the projects noted below contained within

this release:

|

Asset |

Mining Type(s) |

Qualified Person |

Company |

|

Lamaque Complex: Triangle, Parallel, Plug #4 |

Underground |

Jessy Thelland, géo (OGQ No. 758)., Technical Services

Director, Lamaque |

Eldorado Gold |

|

Lamaque Complex: Ormaque |

Underground |

Jessy Thelland, géo (OGQ No. 758)., Technical Services

Director, Lamaque |

Eldorado Gold |

|

Kisladag |

Open Pit |

Hamilton Matias, MAusIMM, Principal Geology Consultant |

Mining Plus |

|

Efemcukuru |

Underground |

Hamilton Matias, MAusIMM, Principal Geology Consultant |

Mining Plus |

|

Olympias |

Underground |

Hamilton Matias, MAusIMM, Principal Geology Consultant |

Mining Plus |

|

Skouries |

Open Pit |

Sean McKinley, P.Geo., Manager, Mine Geology & Advanced

Projects |

Eldorado Gold |

|

Skouries |

Underground |

Sean McKinley, P.Geo., Manager, Mine Geology & Advanced

Projects |

Eldorado Gold |

|

Perama Hill |

Open Pit |

Sean McKinley, P.Geo., Manager, Mine Geology & Advanced

Projects |

Eldorado Gold |

|

Perama South |

Open Pit |

Sean McKinley, P.Geo., Manager, Mine Geology & Advanced

Projects |

Eldorado Gold |

|

Piavitsa |

Underground |

Sean McKinley, P.Geo., Manager, Mine Geology & Advanced

Projects |

Eldorado Gold |

|

Sapes |

Underground & Open Pit |

Sean McKinley, P.Geo., Manager, Mine Geology & Advanced

Projects |

Eldorado Gold |

|

Stratoni |

Underground |

Hamilton Matias, MAusIMM, Principal Geology Consultant |

Mining Plus |

|

Certej |

Open Pit |

Sean McKinley, P.Geo.,

Manager, Mine Geology & Advanced Projects |

Eldorado Gold |

|

|

|

|

|

Cautionary Note about Forward-looking Statements and

Information

Certain of the statements made and information

provided in this news release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as “anticipates”, “believes”, “budget”, “continue”,

“estimates”, “expects”, “forecasts”, “foresee”, “future”, “goal”,

“guidance”, “intends”, “opportunity”, “outlook”, “plans”,

“potential”, “strive”, “target” or “underway” or the negatives

thereof or variations of such words and phrases or statements that

certain actions, events or results “can”, “could”, “likely”, “may”,

“might”, “will” or “would” be taken, occur or be achieved.

Forward-looking statements or information are by

their nature based on a number of assumptions, that management

considers reasonable. However, such assumptions involve both

known and unknown risks, uncertainties and other factors which, if

proven to be inaccurate, may cause actual results, activities,

performance or achievements may be materially different from those

described in the forward-looking statements or information.

Forward-looking statements or information contained in this release

include, but are not limited to, statements or information with

respect to: our Mineral Reserves and Mineral Resources; long term

prospects for the Lamaque Complex, the sale of the Certej project;

exploration opportunities to extend the life of mine at Efemcukuru;

2025 focus on extending mine life, testing near-mine exploration

targets and seeking a discovery from prospective early-stage

exploration targets; the filing of a new technical report for the

Lamaque Complex, the disclosed outlook on long term metal prices;

and generally our strategy, plans and goals.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: our ability to obtain all required approvals and permits in

a timely manner and our ability to comply with all the conditions

that are imposed in such approvals and permits; timing of filing of

a new technical report for the Lamaque mineral properties; timing,

cost and results of our construction and development activities,

improvements and exploration; the future price of gold and other

commodities and the global concentrate market; exchange rates;

anticipated values, costs, expenses and working capital

requirements; production and metallurgical recoveries; Mineral

Reserves and Mineral Resources; our ability to unlock the potential

of our brownfield property portfolio; our ability to address the

negative impacts of climate change and adverse weather; consistency

of agglomeration and our ability to optimize it in the future; the

cost of, and extent to which we use, essential consumables

(including fuel, explosives, cement, and cyanide); the impact and

effectiveness of productivity initiatives; the time and cost

necessary for anticipated overhauls of equipment; expected

by-product grades; the use, and impact or effectiveness, of growth

capital; the impact of acquisitions, dispositions, suspensions or

delays on our business; the sustaining capital required for various

projects; and the geopolitical, economic, permitting and legal

climate that we operate in (including disruptions to shipping

operations and related impacts).

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others,

risks relating to our operations in foreign jurisdictions

(including disruptions to shipping operations) development risks at

Skouries and other development projects; community relations and

social license; liquidity and financing risks; climate change;

inflation risk; environmental matters; production and processing;

waste disposal; geotechnical and hydrogeological conditions or

failures; the global economic environment; risks relating to any

pandemic, epidemic, endemic or similar public health threats;

reliance on a limited number of smelters and off-takers; labour

(including in relation to employee/union relations, the Greek

transformation, employee misconduct, key personnel, skilled

workforce, expatriates, and contractors); indebtedness (including

current and future operating restrictions, implications of a change

of control, ability to meet debt service obligations, the

implications of defaulting on obligations and change in credit

ratings); government regulation; the Sarbanes-Oxley Act; commodity

price risk; mineral tenure; permits; risks relating to

environmental sustainability and governance practices and

performance; financial reporting (including relating to the

carrying value of our assets and changes in reporting standards);

non-governmental organizations; corruption, bribery and sanctions;

information and operational technology systems; litigation and

contracts; estimation of Mineral Reserves and Mineral Resources;

different standards used to prepare and report Mineral Reserves and

Mineral Resources; credit risk; price volatility, volume

fluctuations and dilution risk in respect of our shares; actions of

activist shareholders; reliance on infrastructure, commodities and

consumables (including power and water); currency risk; interest

rate risk; tax matters; dividends; reclamation and long-term

obligations; acquisitions, including integration risks, and

dispositions; regulated substances; necessary equipment;

co-ownership of our properties; the unavailability of insurance;

conflicts of interest; compliance with privacy legislation;

reputational issues; and competition. The reader is directed to

carefully review the detailed risk discussion in our most recent

Annual Information Form & Form 40-F filed on SEDAR+ and EDGAR

under our Company name, for a fuller understanding of the risks and

uncertainties that affect our business and operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change and you are referred to the full discussion of

the Company’s business contained in the Company’s reports filed

with the securities regulatory authorities in Canada and the United

States.

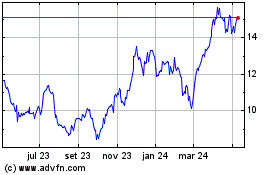

Eldorado Gold (NYSE:EGO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

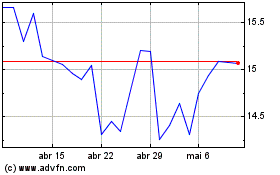

Eldorado Gold (NYSE:EGO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024