Awards under Restricted Share Unit Plan and Notification of Major Holdings

19 Dezembro 2024 - 11:40AM

(“

Amaroq” or the “

Company”)

Awards under Restricted Share Unit Plan

(the “RSU Plan”) and Notification of Major

Holdings

TORONTO, ONTARIO – 19 December

2024 – Amaroq Minerals Ltd. (AIM, TSX-V, NASDAQ Iceland:

AMRQ), an independent mining company with a substantial land

package of gold and strategic mineral assets in Southern Greenland,

announces that in alignment with the Company’s RSU Plan, the

Company granted an award (the “Award”) to employees of the

Company.

The RSU plan, communicated to the market

following the Company’s Admission to AIM in 2020, was developed

with input from PwC. The RSU plan was initially approved by the

Company's shareholders at the AGM held on 16 June 2022 and further

amended and approved by the AGM resolution on 15 June 2023 and 14

June 2024.

Full details of the RSU Plan are available on the Company’s website at https://www.amaroqminerals.com/about/corporate-governance/.

The details of the Award are as follows:

|

Grant Date |

19 December 2024 |

|

Total Number of RSUs |

953,449 |

|

Vesting Schedule |

100% of the RSUs will vest on the first anniversary of grant |

Notification of Major

Holdings

TR-1: Standard form for notification of major

holdings

|

NOTIFICATION OF MAJOR HOLDINGS |

|

1a. Identity of the issuer or the underlying issuer of existing

shares to which voting rights are attached: |

Amaroq Minerals Ltd. |

|

1b. Please indicate if the issuer is a non-UK issuer (please mark

with an “X” if appropriate) |

|

Non-UK issuer |

X |

|

2. Reason for the notification (please mark the appropriate box or

boxes with an “X”) |

|

An acquisition or disposal of voting rights |

X |

|

An acquisition or disposal of financial instruments |

|

|

An event changing the breakdown of voting rights |

|

|

Other (please specify): |

|

|

3. Details of person subject to the notification obligation |

|

Name |

Kvika banki hf. |

|

City and country of registered office (if applicable) |

Reykjavík, Iceland |

|

4. Full name of shareholder(s) (if different from 3.) |

|

Name |

|

|

City and country of registered office (if applicable) |

|

|

5. Date on which the threshold was crossed or reached: |

11 December 2024 |

|

6. Date on which issuer notified (DD/MM/YYYY): |

17 December 2024 |

|

7. Total positions of person(s) subject to the notification

obligation |

|

|

% of voting rights attached to shares (total of 8. A) |

% of voting rights through financial instruments (total of 8.B 1 +

8.B 2) |

Total of both in % (8.A + 8.B) |

Total number of voting rights held in issuer (8.A + 8.B) |

|

Resulting situation on the date on which threshold was crossed or

reached |

5.09% |

|

5.09% |

20,229,146 |

|

Position of previous notification (if applicable) |

3,55% |

|

3,55% |

12,995,054 |

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached |

|

A: Voting rights attached to shares |

|

Class/type ofsharesISIN code (if possible) |

Number of voting rights |

% of voting rights |

|

Direct(DTR5.1) |

Indirect(DTR5.2.1) |

Direct(DTR5.1) |

Indirect(DTR5.2.1) |

|

CA02312A1066 |

20,229,146 |

|

5,09% |

|

|

SUBTOTAL 8. A |

20,229,146 |

5,09% |

|

B 1: Financial Instruments according to DTR5.3.1R (1) (a) |

|

Type of financial instrument |

Expirationdate |

Exercise/ Conversion Period |

Number of voting rights that may be acquired if the instrument is

exercised/converted. |

% of voting rights |

|

|

|

|

|

|

|

|

|

SUBTOTAL 8. B 1 |

|

|

|

B 2: Financial Instruments with similar economic effect according

to DTR5.3.1R (1) (b) |

|

Type of financial instrument |

Expirationdate |

Exercise/ Conversion Period |

Physical or cash Settlement |

Number of voting rights |

% of voting rights |

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8.B.2 |

|

|

|

9. Information in relation to the person subject to the

notification obligation (please mark the applicable box with an

“X”) |

|

Person subject to the notification obligation is not controlled by

any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer |

|

|

Full chain of controlled undertakings through which the voting

rights and/or thefinancial instruments are effectively held

starting with the ultimate controlling natural person or legal

entity (please add additional rows as necessary) |

X |

|

Name |

% of voting rights if it equals or is higher than the notifiable

threshold |

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold |

Total of both if it equals or is higher than the notifiable

threshold |

|

Kvika banki hf. |

|

|

1,67% (6,660,451) |

|

Kvika Asset Management. |

|

|

2,40% (9,563,129) |

|

TM TM tryggingar hf. |

|

|

1,01% (4,005,566) |

|

10. In case of proxy voting, please identify: |

|

Name of the proxy holder |

N/A |

|

The number and % of voting rights held |

|

|

The date until which the voting rights will be held |

|

|

11. Additional information |

|

|

|

Place of completion |

Reykjavík, Iceland |

|

Date of completion |

19 December 2024 |

Enquiries:

Amaroq Minerals

Ltd.Eldur Olafsson, Executive Director and

CEOeo@amaroqminerals.com

Eddie Wyvill, Corporate Development+44

(0)7713 126727ew@amaroqminerals.com

Panmure Liberum Limited (Nominated Adviser and Corporate

Broker)Scott MathiesonNikhil VargheseKieron HodgsonJosh

Moss+44 (0) 20 7886 2500

Canaccord Genuity Limited (Corporate

Broker)James AsensioHarry ReesGeorge Grainger+44 (0) 20

7523 8000

Camarco (Financial PR)Billy CleggElfie

KentFergus Young+44 (0) 20 3757 4980

For Corporation updates:Follow @Amaroq_Minerals

on X (Formerly known as Twitter)Follow Amaroq Minerals Ltd. on

LinkedIn

Further Information:

About Amaroq MineralsAmaroq

Minerals' principal business objectives are the identification,

acquisition, exploration, and development of gold and strategic

metal properties in South Greenland. The Company's principal asset

is a 100% interest in the Nalunaq Gold mine. The Company has a

portfolio of gold and strategic metal assets in Southern Greenland

covering the two known gold belts in the region as well as advanced

exploration projects at Stendalen and the Sava Copper Belt

exploring for Strategic metals such as Copper, Nickel, Rare Earths

and other minerals. Amaroq Minerals is continued under the Business

Corporations Act (Ontario) and wholly owns Nalunaq A/S,

incorporated under the Greenland Public Companies Act. Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Inside InformationThis announcement does not

contain inside information.

Amaroq Minerals (TSXV:AMRQ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

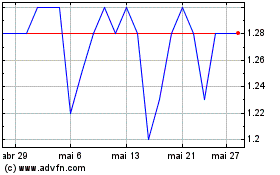

Amaroq Minerals (TSXV:AMRQ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024