Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (the

"Company" or "Calibre") is pleased to announce operating results

for the three months (“Q4”) and year ended (“Full Year”) December

31, 2024, an update on the Valentine Gold Mine (“Valentine”),

located in Newfoundland & Labrador, Canada and initial 2025

guidance. All figures are expressed in U.S. dollars unless

otherwise stated.

Q4 & Full Year 2024 Production

Results and Exploration Highlights

- Record consolidated Q4 gold

production of 76,269 ounces; Nicaragua 66,578 ounces and Nevada

9,691 ounces;

- Consolidated Full Year gold

production of 242,487 ounces, exceeding updated 2024 guidance

(230,000 – 240,000 ounces); Nicaragua 207,220 ounces and Nevada

35,267 ounces;

- Q4 delivered the strongest

production of the year, setting a solid foundation for a promising

start to 2025;

- Cash $186.7 million ($131.1 million

in cash and $55.6 million in restricted cash);

- Calibre continued to strengthen its

leadership team in Q4 with the appointments of a Chief Operating

Officer, and a Vice President Technical Services for

Nicaragua;

- High grade gold mineralization and

new discoveries continue across the Limon Mine Complex with

quarterly drill results among the best to-date at both Talavera and

the VTEM Gold Corridor, signaling the exceptional potential at

Limon:

- 12.57 g/t Au over 7.1 metres

including 26.65 g/t Au over 3.3 metres;

- 12.96 g/t Au over 19.9 metres;

10.59 g/t Au over 13.5 metres; and

- 9.97 g/t Au over 6.9 metres; 14.64

g/t Au over 7.5 metres;

- Drill results from the expanded

100,000 metre drill program at Valentine yield significant gold

mineralization outside of known Mineral Resources and up to 1,000

metres southwest of the known Leprechaun open pit with grades more

than 40% above Mineral Reserve grade:

- 2.43 g/t Au over 172.8 metres

including 3.84 g/t Au over 90.9 metres;

- 2.12 g/t Au over 95.4 metres; 2.26

g/t Au over 78.3 metres;

- Given the exceptional exploration

success to date, additional drill rigs are planned to be added in

2025 to accelerate the 100,000-metre discovery and resource

expansion drill program.

Valentine Remains on Track for Q2, 2025

Gold Production

- Tailings Management Facility is

complete and receiving water;

- SAG and Ball Mill continue to

advance towards pre-commissioning;

- Structural, mechanical and piping

activities continue to advance in the Grinding, ADR, Reagents, and

Gold Room areas;

- CIL leaching tanks construction is

complete and mechanical/electrical work has commenced;

- Overland and coarse ore stockpile

conveyor is progressing and reclaim tunnel is preparing for apron

feeders;

- Primary crusher installation is

complete and preparing for commissioning;

- Pre-commissioning is well underway;

and

- Initial project capital costs,

exclusive of sunk costs, remains at approximately C$744

million.

Darren Hall, President and Chief

Executive Officer of Calibre, stated: “Calibre achieved

total gold production of 242,487 ounces in 2024. After addressing

challenges in the third quarter, we delivered an exceptional fourth

quarter, producing a record 76,269 ounces.

Looking ahead, 2025 is shaping up to be a

transformational year for Calibre with first gold production from

Valentine on schedule for Q2. With Valentine fully operational,

Calibre transitions into a robust, multi-asset, diversified

mid-tier gold producer. Valentine is poised to become a long-life,

cornerstone asset in Canada, initially delivering approximately

200,000 ounces of gold annually with significant exploration

upside.

We have made substantial progress on technical

studies to increase Valentine’s throughput in a phase two

expansion. While the original design envisioned an increase in

throughput from the currently planned 2.5 million tonnes per year

to 4 million tonnes per year starting in 2029, we are now actively

advancing plans to accelerate the timeline for scaling up

production to as much as 5.4 million tonnes per year. In 2025, we

will focus on detailed engineering and schedule with the intent of

committing to long lead time items before year end.

Considering these developments, Valentine has

the potential to exceed the production levels outlined in the 2022

feasibility study, especially given the promising results emerging

from our ongoing exploration efforts. This positions Calibre for

substantial growth and value creation in the coming months and

years.

As previously announced, our exploration

investment at Valentine has delivered very exciting results.

November’s discovery of broad widths of gold mineralization outside

mineral resources at the Frank Zone, approximately 1 km

south of the Valentine Gold Mine demonstrates the upside potential.

Results included 2.43 g/t gold over 172.8 metres including 3.84 g/t

gold over 90.9 metres, 2.12 g/t gold over 95.4 metres and 2.26 g/t

gold over 78.3 metres from the initial discovery. Our 2024

drilling program wrapped up in mid December, and we anticipate

providing additional results surrounding the Frank Zone discovery

as assays become available. Exploration is ramping up and as

construction activity progresses to completion, we expect to add

drills to increase the Valentine exploration activity throughout

the year. In 2025, we expect to execute the largest annual

exploration drill program in the property’s history. The geologic

setting at Valentine is similar to the prolific Val d’Or and

Timmins camps in the Abitibi gold belt. This, in combination with

the significant prospectivity of the 32-kilometre Valentine Lake

Shear Zone (“VLSZ”), I am confident that we will continue to

deliver strong exploration results, unlocking the potential of this

highly prospective region.

Additionally, we are very encouraged by the

continued exploration success across our assets in Nicaragua.

During 2024, we announced numerous high-grade results from the

Talavera Gold Zone and the VTEM Gold Corridor within the Limon Mine

Complex demonstrating the exceptional potential for rapid resource

growth. During 2025, I anticipate additional success as we expand

our exploration efforts and again advance a multi-rig 100,000 metre

drill program.”

Significant Exploration Beyond Known

Resources at the Valentine Gold Mine, Newfoundland & Labrador,

CanadaOn July 15, 2024, Calibre announced an expanded

100,000 metre discovery and resource expansion program on

high-priority targets across the exceptionally prospective

32-kilometre VLSZ. To date, diamond drilling has predominately

occurred along 8 kilometres of the VLSZ which has outlined 64.6 Mt

grading 1.90 g/t gold containing 3.95 Moz of Measured and Indicated

Resources and 20.7 Mt grading 1.65 g/t gold containing 1.10 Moz of

Inferred Resources (see news release dated Nov 13, 2023). On

November 25, 2024, Calibre announced the discovery of new broad

zones of gold mineralization. The drill results included numerous

intercepts with visible gold and both high grade intersections and

broad zones of continuous mineralization in several holes, all of

which are located outside of known mineral resources.

Highlights from the Frank Zone drill

program, southwest of the Leprechaun pit,

include:

- 2.43 g/t

Au over 172.8 metres Estimated True Width (“ETW”) including 3.84

g/t Au over 90.9 metres ETW;

- 2.12 g/t

Au over 95.4 metres ETW; 2.26 g/t Au over 78.3 metres

ETW;

- 10.21

g/t Au over 2.9 metres ETW; 5.50 g/t Au over 6.0 metres

ETW;

- 1.73 g/t

Au over 11.0 metres ETW; 13.39 g/t Au over 0.9 metres;

and

- 8.34 g/t

Au over 1.0 metres ETW; and 11.15 g/t Au over 0.9 metres

ETW.

2025 GuidanceThe 2025 guidance

currently covers gold production, Total Cash Cost (“TCC”), All-In

Sustaining Cost (“AISC”), and growth capital for operations in

Nicaragua and Nevada. Additionally, the consolidated exploration

guidance includes drilling activities in Newfoundland &

Labrador, Canada. Guidance for Valentine, including production,

TCC, AISC, growth capital, and full-year consolidated details, will

be provided after the first gold is produced from Valentine, which

is expected in Q2 2025.

|

|

CONSOLIDATED |

NICARAGUA |

NEWFOUNDLAND |

NEVADA |

|

Gold Production/Sales (ounces) |

230,000 - 280,000 |

200,000 - 250,000 |

N/A |

30,000 - 40,000 |

|

TCC ($/ounce)1 |

$1,300 - $1,400 |

$1,200 - $1,300 |

N/A |

$1,600 - $1,700 |

|

AISC ($/ounce)1 |

$1,500 - $1,600 |

$1,400 - $1,500 |

N/A |

$1,600 - $1,700 |

|

Growth Capital ($ million) |

$70 - $80 |

$60 - $70 |

N/A |

$5 - $10 |

|

Exploration ($ million) |

$50 - $60 |

$25 - $30 |

$15 - $20 |

$5 - $10 |

Valentine Gold Mine Construction

Progress Photos

Stockpile Feed Conveyor – December

2024

CIL Leaching Tanks – December

2024

SAG and Ball Mill – December

2024

Q4 and Full Year 2024 Conference

Call

| Date:

|

Thursday,

February 20, 2025 |

| Time: |

10:00 am ET |

| Webcast link: |

https://edge.media-server.com/mmc/p/4zd24xmm |

Instructions for obtaining conference call

dial-in number:

- All parties must register at the link below to participate in

Calibre’s Q4 and Full Year 2024 Conference Call.

- To register click

https://dpregister.com/sreg/10191038/fd1cb8c35e and complete the

online registration form.

- Once registered you will receive the dial-in numbers and PIN

number for input at the time of the call.

The live webcast and registration link can be

accessed here and at www.calibremining.com under the Events section

under the Investors tab. The live audio webcast will be archived

and available for replay for 12 months after the event at

www.calibremining.com. Presentation slides that will accompany the

conference call will be made available in the Investors section of

the Calibre website under Presentations prior to the conference

call.

Qualified Person

The scientific and technical information

contained in this news release was approved by David Schonfeldt

P.GEO, Calibre Mining’s Corporate Chief Geologist and a "Qualified

Person" under National Instrument 43-101.

About Calibre

Calibre (TSX: CXB) is a Canadian-listed,

Americas focused, growing mid-tier gold producer with a strong

pipeline of development and exploration opportunities across

Newfoundland & Labrador in Canada, Nevada and Washington in the

USA, and Nicaragua. Calibre is focused on delivering sustainable

value for shareholders, local communities and all stakeholders

through responsible operations and a disciplined approach to

growth. With a strong balance sheet, a proven management team,

strong operating cash flow, accretive development projects and

district-scale exploration opportunities Calibre will unlock

significant value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President & Chief Executive Officer

For further information, please

contact:

Ryan KingSVP Corporate Development & IRT:

604.628.1012E: calibre@calibremining.comW:

www.calibremining.com

Calibre’s head office is located at Suite 1560, 200 Burrard St.,

Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed

nor accepts responsibility for the adequacy or accuracy of this

news release.

Notes

(1) NON-IFRS FINANCIAL

MEASURESThe Company believes that investors use certain

non-IFRS measures as indicators to assess gold mining companies,

specifically TCC per Ounce of Gold and AISC per Ounce of Gold. In

the gold mining industry, these are common performance measures but

do not have any standardized meaning. The Company believes that, in

addition to conventional measures prepared in accordance with IFRS,

certain investors use this information to evaluate the Company’s

performance and ability to generate cash flow. Accordingly, it is

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS.

TCC per Ounce

of Gold: TCC include mine site operating

costs such as mining, processing, and local administrative costs

(including stock-based compensation related to mine operations),

royalties, production taxes, mine standby costs and current

inventory write downs, if any. Production costs are exclusive

of depreciation and depletion, reclamation, capital, and

exploration costs. TCC per gold ounce are net of by-product

silver sales and are divided by gold ounces sold to arrive at a per

ounce figure.

AISC per

Ounce of Gold: A performance measure that

reflects all of the expenditures that are required to produce an

ounce of gold from current operations. While there is no

standardized meaning of the measure across the industry, the

Company’s definition is derived from the AISC definition as set out

by the World Gold Council in its guidance dated June 27, 2013, and

November 16, 2018. The World Gold Council is a non-regulatory,

non-profit organization established in 1987 whose members include

global senior mining companies and the Company. The Company

believes that this measure will be useful to external users in

assessing operating performance and the ability to generate free

cash flow from current operations. The Company defines AISC as the

sum of TCC (per above), sustaining capital (capital required to

maintain current operations at existing levels), capital lease

repayments, corporate general and administrative expenses,

exploration expenditures designed to increase resource confidence

at producing mines, amortization of asset retirement costs and

rehabilitation accretion related to current operations. AISC

excludes capital expenditures for significant improvements at

existing operations deemed to be expansionary in nature,

exploration and evaluation related to resource growth,

rehabilitation accretion and amortization not related to current

operations, financing costs, debt repayments, and taxes. Total AISC

are divided by gold ounces sold to arrive at a per ounce

figure.

Cautionary Note Regarding Forward

Looking Information

This news release includes certain

"forward-looking information" and "forward-looking statements"

(collectively "forward-looking statements") within the meaning of

applicable Canadian securities legislation. All statements in this

news release that address events or developments that we expect to

occur in the future are forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

identified by words such as "expect", "plan", "anticipate",

"project", "target", "potential", "schedule", "forecast", "budget",

"estimate", “assume”, "intend", “strategy”, “goal”, “objective”,

“possible”, or "believe" and similar expressions or their negative

connotations, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. Forward-looking statements in

this news release include, but are not limited to, the Company’s

ability to achieve gold production, cost, development and

exploration expectations for its operations and projects; the

upside potential of the Valentine Gold Mine and additional

exploration success in Nicaragua; the initial project costs to

complete the Valentine Gold Mine; construction of Valentine Gold

Mine being completed and performed in accordance with current

expectations to achieve first gold production during the second

quarter of 2025; the phase two expansion project at Valentine Gold

Mine proceeding in accordance with current expectations; the

Company’s reinvestment into its existing portfolio of properties

for further exploration and growth; statements relating to the

Company’s priority resource expansion opportunities; and the

Company’s metal price and cut-off grade assumptions.

Forward-looking statements necessarily involve assumptions, risks

and uncertainties, certain of which are beyond Calibre's control.

For a listing of risk factors applicable to the Company, please

refer to Calibre's annual information form (“AIF”) for the year

ended December 31, 2023, and its management discussion and analysis

(“MD&A”) for the year ended December 31, 2023, and other

disclosure documents of the Company filed on the Company’s SEDAR+

profile at www.sedarplus.ca.

Calibre's forward-looking statements are based

on the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. Calibre does not assume any

obligation to update forward-looking statements if circumstances or

management's beliefs, expectations or opinions should change other

than as required by applicable securities laws. There can be no

assurance that forward-looking statements will prove to be

accurate, and actual results, performance or achievements could

differ materially from those expressed in, or implied by, these

forward-looking statements. Accordingly, undue reliance should not

be placed on forward-looking statements.

Photos accompanying this announcement are

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1911b17d-4611-4f5d-a3d0-b1457b856278

https://www.globenewswire.com/NewsRoom/AttachmentNg/30587473-c411-473b-93d1-f29c2571d903

https://www.globenewswire.com/NewsRoom/AttachmentNg/b49b637e-a820-4719-848e-5bb6f4c10413

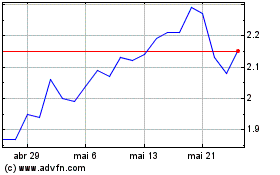

Calibre Mining (TSX:CXB)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Calibre Mining (TSX:CXB)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025