W&T Offshore, Inc. (NYSE: WTI) (“W&T” or the “Company”)

today provided operational and financial updates on recent

developments.

- Recently

signed a purchase and sale agreement (“PSA”) to sell a non-core

interest in Garden Banks Blocks 385 and 386 which included latest

net production of approximately 195 barrels of oil equivalent per

day (“Boe/d”) (72% oil) for $12.3 million;

- Announces

that the West Delta 73 field, which W&T acquired in January

2024, is expected to come back online by mid-second quarter

2025;

- Announces

that the Main Pass 108 and 98 fields, which have been shut in since

June 2024, are expected to return to production by early second

quarter of 2025.

- Net

production at these fields averaged a combined 6.1 million cubic

feet of natural gas equivalent per day (“MMcfe/d”) (78% gas) in

June 2024 prior to being shut-in due to third-party operator

related bankruptcy matters;

- Scheduled

to receive a $58.5 million cash insurance settlement payment in

January 2025 related to a casualty loss event at its Mobile Bay

78-1 well in 2023; and

- Does not

expect any impact on ongoing operations from the Presidential ban

announced on January 6, 2025 on new offshore oil and gas

drilling.

Tracy W. Krohn, W&T’s Chairman and Chief

Executive Officer, commented, “We believe that these recent

developments will have a positive impact to our balance sheet and

provide upside as we enter 2025. The sale of our non-core interests

in Garden Banks 385 and 386 at over $60,000 per flowing barrel is

highly accretive to W&T. This further demonstrates the value of

our assets and our ability to divest our properties at attractive

multiples. We are pleased that we have a pathway to bring the West

Delta 73 field and the Main Pass 108 and 98 fields back online and

believe these returns to production will be a strong catalyst in

the second half of 2025. We remain committed to executing our

strategic vision focused on free cash flow generation, maintaining

solid production and maximizing margins and believe that our proven

and successful strategy should help us continue to produce solid

results in 2025.”

Additional Information

W&T recently signed a PSA to sell a non-core

interest in Garden Banks Blocks 385 and 386 which included net

production of approximately 195 Boe/d for $12.3 million, subject to

normal purchase price adjustments. The effective date of the sale

was December 1, 2024 and the transaction is expected to close in

January 2025. W&T estimates that the impact to its reserves for

year-end 2024 will be approximately 0.12 million barrels of oil

equivalent (based on the mid-year 2024 reserve report adjusted for

July to November 2024 actual production).

W&T entered into a resolution with the

third-party pipeline operator at its West Delta 73 field. Although

a few details remain subject to finalization by the Court, W&T

expects to restart production from the field by the middle of the

second quarter of 2025. The West Delta 73 Field was originally

acquired by W&T from Cox Operating, LLC and certain of its

affiliates in January 2024.

In June 2024, W&T received notice from the

U.S. Department of Interior, Bureau of Safety and Environmental

Enforcement, that it would be required to cease production at its

Main Pass 108 and 98 fields as the result of a shut-in of midstream

infrastructure not owned by W&T. W&T signed a purchase

agreement and other arrangements to acquire the necessary midstream

infrastructure, which is expected to allow the Company to return

the Main Pass 108 and 98 fields to production by early second

quarter of 2025. The return to production is subject to W&T

obtaining necessary governmental approvals and permits in

connection with the acquisitions, in addition to customary closing

conditions.

In February 2023, during the Mobile Bay plant

turnaround, the MB 78-1 well was shut-in and did not return to

production following completion of the planned maintenance. W&T

filed a claim under its Energy Package Policy and in December

2024, the Company and the Underwriters of the Energy Package Policy

agreed to a settlement of claims in the amount of $58.5 million.

The settlement funds are scheduled to be received in January 2025.

Prior to the planned turnaround, MB 78-1 produced approximately 6.7

MMcfe/d net (almost 90% gas) in January 2023. The Mobile Bay net

production, excluding the two fields (MO 904 and MO 916) acquired

in January 2024, averaged around 72.8 MMcfe/d (81% gas) over the

twelve months period from October 2023 to September 2024.

On January 6, 2025 there was a Presidential ban

announced on new oil and gas drilling in certain U.S. offshore

areas. The ban covers the Atlantic coast and eastern Gulf of

Mexico, as well as the Pacific coast off California, Oregon and

Washington, as well as a section of the Bering Sea off Alaska.

W&T does not have any production nor leases that are impacted

by this action.

About W&T Offshore

W&T Offshore, Inc. is an independent oil and

natural gas producer, active in the exploration, development and

acquisition of oil and natural gas properties in the Gulf of

Mexico. As of September 30, 2024, the Company had working

interests in 53 producing offshore fields in federal and state

waters (which include 46 fields in federal waters and seven in

state waters). The Company has under lease approximately 673,100

gross acres (515,400 net acres) spanning across the outer

continental shelf off the coasts of Louisiana, Texas, Mississippi

and Alabama, with approximately 514,000 gross acres on the

conventional shelf, approximately 153,500 gross acres in the

deepwater and 5,600 gross acres in Alabama state waters. A majority

of the Company’s daily production is derived from wells it

operates. For more information on W&T, please visit the

Company’s website at www.wtoffshore.com.

Forward-Looking and Cautionary

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements other than statements of

historical facts included in this release regarding the Company’s

financial position, operating and financial performance, business

strategy, plans and objectives of management for future operations,

closing of acquisitions, expected returns to production, and future

results, are forward-looking statements. When used in this release,

forward-looking statements are generally accompanied by terms or

phrases such as “estimate,” “project,” “predict,” “believe,”

“expect,” “continue,” “anticipate,” “target,” “could,” “plan,”

“intend,” “seek,” “goal,” “will,” “should,” “may” or other words

and similar expressions that convey the uncertainty of future

events or outcomes, although not all forward-looking statements

contain such identifying words. Items contemplating or making

assumptions about actual or potential future production and sales,

prices, market size, and trends or operating results also

constitute such forward-looking statements.

These forward-looking statements are based on

the Company’s current expectations and assumptions about future

events and speak only as of the date of this release. While

management considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies

and uncertainties, most of which are difficult to predict and many

of which are beyond the Company’s control. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements, as results actually achieved may differ materially from

expected results described in these statements. The Company does

not undertake, and specifically disclaims, any obligation to update

any forward-looking statements to reflect events or circumstances

occurring after the date of such statements, unless required by

law.

Forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially including, among other things, the regulatory

environment, including availability or timing of, and conditions

imposed on, obtaining and/or maintaining permits and approvals,

including those necessary for drilling and/or development projects;

the impact of current, pending and/or future laws and regulations,

and of legislative and regulatory changes and other government

activities, including those related to permitting, drilling,

completion, well stimulation, operation, maintenance or abandonment

of wells or facilities, managing energy, water, land, greenhouse

gases or other emissions, protection of health, safety and the

environment, or transportation, marketing and sale of the Company’s

products; inflation levels; global economic trends, geopolitical

risks and general economic and industry conditions, such as the

global supply chain disruptions and the government interventions

into the financial markets and economy in response to inflation

levels and world health events; volatility of oil, NGL and natural

gas prices; the global energy future, including the factors and

trends that are expected to shape it, such as concerns about

climate change and other air quality issues, the transition to a

low-emission economy and the expected role of different energy

sources; supply of and demand for oil, natural gas and NGLs,

including due to the actions of foreign producers, importantly

including OPEC and other major oil producing companies (“OPEC+”)

and change in OPEC+’s production levels; disruptions to, capacity

constraints in, or other limitations on the pipeline systems that

deliver the Company’s oil and natural gas and other processing and

transportation considerations; inability to generate sufficient

cash flow from operations or to obtain adequate financing to fund

capital expenditures, meet the Company’s working capital

requirements or fund planned investments; price fluctuations and

availability of natural gas and electricity; the Company’s ability

to use derivative instruments to manage commodity price risk; the

Company’s ability to meet the Company’s planned drilling schedule,

including due to the Company’s ability to obtain permits on a

timely basis or at all, and to successfully drill wells that

produce oil and natural gas in commercially viable quantities;

uncertainties associated with estimating proved reserves and

related future cash flows; the Company’s ability to replace the

Company’s reserves through exploration and development activities;

drilling and production results, lower–than–expected production,

reserves or resources from development projects or

higher–than–expected decline rates; the Company’s ability to obtain

timely and available drilling and completion equipment and crew

availability and access to necessary resources for drilling,

completing and operating wells; changes in tax laws; effects of

competition; uncertainties and liabilities associated with acquired

and divested assets; the Company’s ability to make acquisitions and

successfully integrate any acquired businesses; asset impairments

from commodity price declines; large or multiple customer defaults

on contractual obligations, including defaults resulting from

actual or potential insolvencies; geographical concentration of the

Company’s operations; the creditworthiness and performance of the

Company’s counterparties with respect to its hedges; impact of

derivatives legislation affecting the Company’s ability to hedge;

failure of risk management and ineffectiveness of internal

controls; catastrophic events, including tropical storms,

hurricanes, earthquakes, pandemics and other world health events;

environmental risks and liabilities under U.S. federal, state,

tribal and local laws and regulations (including remedial actions);

potential liability resulting from pending or future litigation;

the Company’s ability to recruit and/or retain key members of the

Company’s senior management and key technical employees;

information technology failures or cyberattacks; and governmental

actions and political conditions, as well as the actions by other

third parties that are beyond the Company’s control, and other

factors discussed in W&T Offshore’s most recent Annual Report

on Form 10-K and subsequent Quarterly Reports on Form 10-Q found at

www.sec.gov or at the Company’s website at www.wtoffshore.com under

the Investor Relations section.

|

|

|

|

|

CONTACT: |

Al Petrie |

Sameer Parasnis |

| |

Investor Relations

Coordinator |

Executive VP and CFO |

| |

investorrelations@wtoffshore.com |

sparasnis@wtoffshore.com |

| |

713-297-8024 |

713-513-8654 |

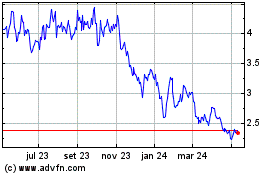

W and T Offshore (NYSE:WTI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

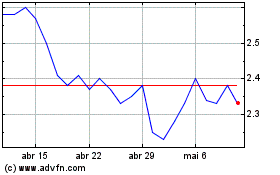

W and T Offshore (NYSE:WTI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025