BTB Real Estate Investment Trust (

TSX: BTB.UN)

(“

BTB” or the “

REIT”) announces

today that it has reached an agreement with a syndicate of

underwriters led by National Bank Financial Inc. (the

“

Bookrunner”, and together with the syndicate of

underwriters, the “

Underwriters”) to issue to the

public, subject to regulatory approval, on a bought deal basis $30

million aggregate principal amount of

Series I

convertible unsecured subordinated debentures (the

“

Offering”) due February 28, 2030 (the

“

Debentures”). The REIT has also granted the

Underwriters an over-allotment option exercisable in whole or in

part at any time up to 30 days after closing to purchase up to an

additional $4.5 million of aggregate principal amount of Debentures

at the same price.

The net proceeds from the Offering (after

deducting the Underwriters’ fee and expenses of the Offering) will

be used to repay the outstanding Series H 7.00% convertible

unsecured subordinated debentures maturing on October 31, 2025 and

to repay a portion of the outstanding amount on BTB’s credit

facility. BTB will file its notice of redemption for all

outstanding Series H unsecured subordinated convertible debentures

on or before the closing of the Offering.

The Debentures will bear an interest rate of

7.25% per annum payable semi-annually in arrears on February 28 and

August 31 in each year commencing on February 28, 2025 and will

mature on February 28, 2030 (the "Maturity Date").

The Debentures will be convertible at the holder's option into

trust units of BTB (the "Units") at any time prior

to the earlier of the Maturity Date and the date fixed for

redemption at a conversion price of $4.10 per Unit (the

"Conversion Price"), being a ratio of

approximately 243.9024 Units per $1,000 principal amount of

Debentures. The Debentures will not be redeemable before February

28, 2028. On and after February 28, 2028 and prior to February 28,

2029, the Debentures may be redeemed in whole or in part from time

to time at BTB's option provided that the volume weighted average

trading price for the Units is not less than 125% of the Conversion

Price. On and after February 28, 2029 and prior to the Maturity

Date, the Debentures may be redeemed in whole or in part from time

to time at BTB’s option at a price equal to their principal amount

plus accrued and unpaid interest. Subject to regulatory approval

and provided that no event of default has occurred and is

continuing, BTB may satisfy its obligation to repay the principal

amount of the Debentures on redemption or at maturity, in whole or

in part, by delivering that number of Units equal to the amount due

divided by 95% of the market price for the Units at that time, plus

accrued and unpaid interest in cash.

The Debentures will be offered in Canada by way

of a prospectus supplement to the REIT’s short form base shelf

prospectus dated June 9th, 2023, which prospectus supplement is

expected to be filed with the securities commissions and other

similar regulatory authorities in each of the provinces and

territories of Canada on or about January 16, 2025, and by way of a

private placement in the United States to “qualified institutional

buyers” in reliance upon Rule 144A of the U.S. Securities Act of

1933. Closing of the Offering is expected to take place on or about

January 23, 2025 and is subject to certain conditions, including,

but not limited to, the receipt of all necessary approvals,

including the approval of the Toronto Stock Exchange (“TSX”).

The shelf prospectus supplement, the

corresponding base shelf prospectus and any amendment to the

documents is provided in accordance with securities legislation

relating to procedures for providing access to a shelf prospectus

supplement, a base shelf prospectus and any amendment. The shelf

prospectus supplement, the corresponding base shelf prospectus and

any amendment to the documents is accessible through SEDAR+ or will

be accessible through SEDAR+ within 2 business days, as applicable,

at www.sedarplus.com. An electronic or paper copy of the shelf

prospectus supplement, the corresponding base shelf prospectus and

any amendment to the documents may be obtained, without charge,

from National Bank Financial Inc. by phone at (416)-869-6534 or

email at NBF-Syndication@bnc.ca by providing the contact with an

email address or address, as applicable.

This press release is for information purposes

only and does not constitute an offer to sell securities, nor is it

a solicitation of an offer to buy securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful. This news

release does not constitute an offer of securities for sale in the

United States and the securities referred to in this news release

may not be offered or sold in the United States absent a

registration or an exemption from registration. No securities

regulatory authority has either approved or disapproved of the

contents of this news release.

About BTB

BTB is a real estate investment trust listed on

the TSX. BTB REIT invests in industrial, suburban office and

necessity-based retail properties across Canada for the benefit of

their investors. As of today, BTB owns and manages 75

properties, representing a total leasable area of

approximately 6.1 million square feet.

For more detailed information, visit BTB’s

website at www.btbreit.com.

For further information

Marc-André Lefebvre, Vice

President & Chief Financial Officer

(T) 514-286-0188 x244

(E) malefebvre@btbreit.com

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of applicable securities legislation.

Forward-looking statements are based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond BTB’s control, that could cause actual results and

events to differ materially from those that are disclosed in or

implied by such forward-looking statements.

Forward-looking statements contained in this

press release include, without limitation, statements pertaining to

the closing of the Offering and the use of the net proceeds of the

Offering. The forward-looking statements contained in this news

release are expressly qualified in their entirety by this

cautionary statement. All forward-looking statements in this news

release are made as of the date of this news release. BTB does not

undertake to update any such forward-looking information whether as

a result of new information, future events.

Forward-looking statements are necessarily based

on a number of estimates and assumptions that, while considered

reasonable by management as of the date hereof, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. When relying on forward-looking

statements to make decisions, the REIT cautions readers not to

place undue reliance on these statements, as forward-looking

statements involve significant risks and uncertainties and should

not be read as guarantees of future performance or results, and

will not necessarily be accurate indications of whether or not the

times at or by which such performance or results will be achieved.

A number of factors could cause actual results to differ, possibly

materially, from the results discussed in the forward-looking

statements.

Additional information about these assumptions

and risks and uncertainties is contained in the filings of the REIT

with securities regulators, including under “Risk Factors” in the

REIT’s latest annual information form, which is available on SEDAR+

at www.sedarplus.com.

Neither the TSX nor its Regulation Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy of this release.

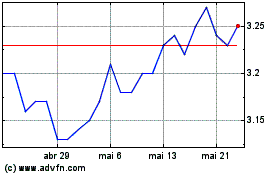

BTB Real Estate Investment (TSX:BTB.UN)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

BTB Real Estate Investment (TSX:BTB.UN)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025