Viper Energy, Inc. (NASDAQ:VNOM) (“Viper” or the “Company”), a

subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG)

(“Diamondback”), today provided an update on Q4 2024 financial and

operating results.

FOURTH QUARTER HIGHLIGHTS

- Q4 2024 average daily production of

29,859 bo/d (56,109 boe/d)

- Q4 2024 average unhedged realized

prices of $69.91 per barrel of oil, $0.84 per Mcf of natural gas,

and $22.15 per barrel of natural gas liquids

- During the fourth quarter of 2024,

the Company recorded total operating income of $228.7 million

- Declared Q4 2024 combined

base-plus-variable dividend of $0.65 per Class A common share;

payable on March 13, 2025 to Class A shareholders of record at the

close of business on March 6, 2025

Additionally, the Company announced today it and

its operating subsidiary Viper Energy Partners LLC (“OpCo”) have

entered into a definitive purchase and sale agreement to acquire

all of the equity interests of certain mineral and royalty-interest

owning subsidiaries of Diamondback in exchange for $1.0 billion of

cash and approximately 69.6 million OpCo units (along with an

accompanying equal amount of Class B common stock of the Company),

subject to customary adjustments (the “Drop Down”). The transaction

was negotiated for the Company by the Audit Committee of its Board

of Directors, which consists solely of independent directors and is

appointed by the Board of Directors to oversee all related party

transactions. The cash portion of this transaction is expected to

be funded through a combination of cash on hand, borrowings under

the Company’s credit facility, and proceeds from one or more

capital markets transactions, subject to market conditions and

other factors. The Company expects the transaction to close in the

second quarter of 2025, subject to the satisfaction of customary

closing conditions, including the approval of the transaction by a

majority of the Company’s stockholders not affiliated with

Diamondback.

The Company today also announced it and OpCo

have entered into a separate definitive purchase and sale agreement

to acquire certain mineral and royalty interests from Morita

Ranches Minerals LLC in exchange for approximately $211 million of

cash and approximately 2.4 million OpCo units (along with an

accompanying equal amount of Class B common stock of the Company),

subject to customary adjustments (the “Quinn Ranch Acquisition” and

together with the Drop Down, the “Pending Acquisitions”). The cash

portion of this transaction is expected to be funded through a

combination of cash on hand and borrowings under the Company’s

credit facility. The Company expects the transaction to close

during the first quarter of 2025, subject to customary closing

conditions.

PENDING ACQUISITIONS COMBINED

HIGHLIGHTS

- Approximately 23,100 net royalty

acres (“NRAs”) in the Midland Basin; additional acreage in the

Delaware and Williston Basins (approximately 1,700 NRAs

combined)

- Diamondback operates >70% of the

Midland Basin NRAs with an approximately 5.0% average net revenue

interest (“NRI”) across high-quality and largely undeveloped

acreage

- Expected average daily oil

production for full year 2025 of approximately 18,000 bo/d (32,000

boe/d); includes contribution from Diamondback’s expected

development plan (11.0-12.0 net 100% royalty interest wells) and

6.7 net existing DUCs and permits operated by third party

operators

- Viper currently expects Diamondback

to complete roughly 300-325 gross locations on the acquired

properties in 2026 with an estimated average ~6.0% NRI; expected to

drive an increase in Diamondback-operated production from an

average of approximately of 11,000 bo/d in 2025 to approximately

14,000 bo/d in 2026

- Third party operated acreage

located primarily in Martin, Midland, and Reagan counties;

ExxonMobil (~35% of third party operated acreage) is the largest

operator with diversified exposure to other leading

well-capitalized operators in the Midland Basin

- Substantial near and long-term

financial accretion; expected to be >10% accretive to cash

available for distribution per Class A share immediately upon

closing

- Each of the Pending Acquisitions

has an effective date of January 1, 2025

PRO FORMA VIPER HIGHLIGHTS

- Giving effect to only the assumed

closing of the Quinn Ranch Acquisition during Q1 2025, initiating

average daily production guidance for Q1 2025 of 30,000 to 31,000

bo/d (54,000 to 56,000 boe/d)

- Upon the assumed closing of the

Drop Down during Q2 2025, expect average daily production for the

balance of 2025 in the range of 47,000 to 49,000 bo/d (85,000 to

88,000 boe/d); the midpoint is approximately 61% higher than

standalone Viper’s Q4 2024 average daily oil production

- Based on Diamondback’s expected

development plans, Viper expects its Diamondback-operated

production to increase to approximately 31,000 bo/d in 2026, up

from approximately 27,000 bo/d on a pro forma basis in 2025

- Viper expects to own an interest in

approximately 75% of the total amount of gross wells that

Diamondback would plan to develop over the next five years at

today’s activity levels; expect to own an estimated ~6.0% NRI in

these wells

- Total inventory of

Diamondback-operated locations with a greater than 10% IRR at $50

WTI of approximately 334 net locations

- Approximately 60,200 NRAs in the

Permian Basin, approximately 36,300 of which are operated by

Diamondback; represents increases of approximately 70% and 90%,

respectively

- Maintaining return of capital

commitment of at least 75% of cash available for distribution

- Conservative leverage of <1.0x

expected at year-end 2025 based on current commodity prices

“We are excited to announce today the highly

anticipated, transformative Drop Down transaction between Viper and

Diamondback. This transaction, combined with the Quinn Ranch

Acquisition, furthers Viper’s alignment with Diamondback’s expected

development plan and positions Viper to continue to deliver organic

growth driven by the Diamondback drillbit for multiple years ahead.

The pro forma size and scale provided to Viper, and the continued

support of our parent company, meaningfully enhances the unmatched

advantage Viper has in the minerals and royalty market,” stated

Travis Stice, Chief Executive Officer of Viper.

Mr. Stice continued, “In addition to being

immediately accretive to all relevant financial metrics, this

conservatively financed transaction also reduces Viper’s pro forma

leverage to below 1.0x. Looking ahead, Viper’s leading scale and

fortress balance sheet will enable the Company to continue to

opportunistically consolidate the highly fragmented minerals market

through a disciplined and focused approach.”

Advisors

Evercore is serving as financial advisor to the Audit Committee

of Viper’s Board of Directors and Hunton Andrews Kurth LLP is

serving as the Audit Committee’s legal advisor for the Drop

Down.

RBC Capital Markets is serving as financial advisor to

Diamondback and Kirkland & Ellis LLP is serving as its legal

advisor for the Drop Down.

For the Quinn Ranch Acquisition, Akin Gump Strauss Hauer &

Feld LLP is serving as Viper’s legal advisor and Vinson &

Elkins LLP is serving as legal advisor for Morita Ranches Minerals

LLC.

About Viper Energy, Inc.

Viper is a corporation formed by Diamondback to

own, acquire and exploit oil and natural gas properties in North

America, with a focus on owning and acquiring mineral and royalty

interests in oil-weighted basins, primarily the Permian Basin. For

more information, please visit www.viperenergy.com.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural

gas company headquartered in Midland, Texas focused on the

acquisition, development, exploration and exploitation of

unconventional, onshore oil and natural gas reserves primarily in

the Permian Basin in West Texas. For more information, please visit

www.diamondbackenergy.com.

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of the federal securities laws, which involve certain

risks, uncertainties and assumptions that could cause the results

to differ materially from those expected by the management of

Viper. All statements, other than historical facts, that address

activities that Viper assumes, plans, expects, believes, intends or

anticipates (and other similar expressions) will, should or may

occur in the future are forward-looking statements. The

forward-looking statements are based on management’s current

beliefs, based on currently available information, as to the

outcome and timing of future events, including specifically the

statements regarding the pending acquisitions discussed in this

news release and any potential capital markets transactions and

other funding sources for the pending acquisitions, as well as

statements regarding the pro forma results for the pending

acquisitions and Viper’s operating and financial expectations

following those acquisitions, including existing and future

production on the mineral and royalty acreage subject to the

pending acquisitions and Diamondback’s plans with respect to such

Diamondback-operated acreage.

Factors that could cause the outcomes to differ materially

include (but are not limited to) the following: the completion of

the pending acquisitions on anticipated terms and timing or at all,

including obtaining the requisite regulatory and stockholder

approvals for the Pending Drop Down, the satisfaction of other

conditions to the pending acquisitions, uncertainties as to whether

the pending acquisitions, if consummated, will achieve their

anticipated benefits within the expected time periods or at all,

and those risks described in Item 1A of Viper’s Annual Report on

Form 10-K, filed with the SEC on February 22, 2024, subsequent

Forms 10-Q and 8-K and other filings Viper makes with the SEC,

which can be obtained free of charge on the SEC’s website at

http://www.sec.gov and Viper’s website at

www.viperenergy.com/investor-overview, as well as those risks that

will be more fully described in the definitive proxy statement on

Schedule 14A that is intended to be filed with the SEC in

connection with the Pending Drop Down.

In light of these factors, the events anticipated by Viper’s

forward-looking statements may not occur at the time anticipated or

at all. Moreover, Viper conducts its business in a very competitive

and rapidly changing environment and new risks emerge from time to

time. Viper cannot predict all risks, nor can it assess the impact

of all factors on its business or the extent to which any factor,

or combination of factors, may cause actual results to differ

materially from those anticipated by any forward-looking statements

it may make. Accordingly, you should not place undue reliance on

any forward-looking statements. All forward-looking statements

speak only as of the date of this news release or, if earlier, as

of the date they were made. Viper does not intend to, and disclaims

any obligation to, update or revise any forward-looking statements

unless required by applicable law.

Additional Information about the Pending Drop Down and Where to

Find It

In connection with the Pending Drop Down, Viper expects to file

relevant materials with the SEC including a proxy statement on

Schedule 14A. Promptly after filing its definitive proxy statement

with the SEC, Viper will mail the definitive proxy statement to

each stockholder entitled to vote at the special meeting relating

to the Pending Drop Down. This news release is not a substitute for

the proxy statement or for any other document that Viper may file

with the SEC and send to its stockholders in connection with the

Pending Drop Down. INVESTORS AND STOCKHOLDERS ARE URGED TO

CAREFULLY READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE

THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE

PENDING DROP DOWN THAT VIPER WILL FILE WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The

definitive proxy statement, the preliminary proxy statement, and

other relevant materials in connection with the Pending Drop Down

(when they become available) and any other documents filed by Viper

with the SEC, may be obtained free of charge at the SEC’s website

www.sec.gov. Copies of the documents filed with the SEC by Viper

will be available free of charge on Viper’s website at

www.viperenergy.com/investor-overview.

Participants in the Solicitation

Viper and its directors and executive officers, and Diamondback

as its parent and major stockholder, may be deemed, under SEC

rules, to be participants in the solicitation of proxies from

Viper’s stockholders in connection with the Pending Drop Down.

Information about the directors and executive officers of Viper

and, as applicable, about Diamondback, is set forth in (i) in

Viper’s proxy statement for its 2024 annual meeting, including

under the headings “Proposal 1—Election of Directors”, “Executive

Officers”, “Compensation Discussion and Analysis”, “Compensation

Tables”, “Stock Ownership” and “Certain Relationships and Related

Transactions,” which was filed with the SEC on April 25, 2024 and

is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1602065/000119312524113976/d796418ddef14a.htm,

(ii) Viper’s Annual Report on Form 10-K for the year ended December

31, 2023, including under the headings “Item 10. Directors,

Executive Officers and Corporate Governance”, “Item 11. Executive

Compensation”, “Item 12. Security Ownership of Certain Beneficial

Owners and Management and Related Stockholder Matters” and “Item

13. Certain Relationships and Related Transactions, and Director

Independence”, which was filed with the SEC on February 22, 2024

and is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1602065/000160206524000010/vnom-20231231.htm

and (iii) subsequent statements of changes in beneficial ownership

on file with the SEC.

Additional information about Diamondback may be found in

Diamondback’s Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC on February 22, 2024, and

subsequent quarterly reports on Form 10-Q and current reports on

Form 8-K filed by Diamondback with the SEC. These documents may be

obtained free of charge from the SEC’s website at www.sec.gov and

Diamondback’s website at www.diamondbackenergy.com/investors.

Additional information regarding the participants in the proxy

solicitation and a description of their direct or indirect

interests, by security holdings or otherwise, will be contained in

the proxy statement and other relevant materials filed with the SEC

when they become available. These documents may be obtained free of

charge from the SEC’s website at www.sec.gov and Viper’s website at

www.viperenergy.com/investor-overview.

No Offer or Solicitation

This news release does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Investor Contact:

Austen Gilfillian+1

432.221.7420agilfillian@diamondbackenergy.com

Source: Viper Energy, Inc.; Diamondback Energy, Inc.

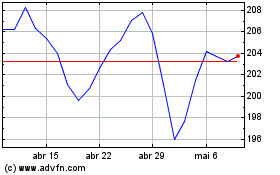

Diamondback Energy (NASDAQ:FANG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

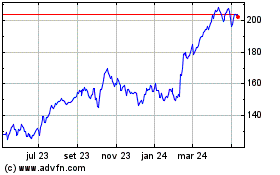

Diamondback Energy (NASDAQ:FANG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025