Plug Launches Industry's First Spot Pricing for Green Hydrogen

05 Fevereiro 2025 - 9:00AM

In a significant move towards a more flexible and dynamic green

hydrogen market, Plug Power Inc. (NASDAQ: PLUG), a global leader in

comprehensive hydrogen solutions for the green hydrogen economy,

has introduced the first-ever spot pricing program for liquid green

hydrogen, marking a major step forward in the industry.

Hydrogen buyers now have the freedom to purchase liquid green

hydrogen from Plug’s production plants on-demand and without the

limitations of long-term take-or-pay agreements. The flexibility

provided by this new spot market allows customers like retailers,

industrial manufacturers, and power plant operators to optimize

their hydrogen sources efficiently, reacting swiftly to fluctuating

energy demands without being tied down by long-term contracts.

In an early sign of success, Plug has entered into spot pricing

agreements with several key industry players. Among these, a spot

agreement with one of the largest industrial gas companies

underscores widespread industry endorsement. Looking forward, the

ripple effects of this innovative pricing model could redefine

supply dynamics and cost structures across the entire green

hydrogen ecosystem.

“Our pioneering spot pricing program is a testament to Plug’s

commitment to customer-centric innovation,” said Andy Marsh, CEO of

Plug Power. “By adapting to market demands in real-time, we are not

only enhancing the accessibility and affordability of green

hydrogen but also accelerating its adoption across various

sectors.”

Each Thursday, S&P Global Platts will publish a price for

the following week based on Plug’s supply and demand at the current

time. Customers must have a spot agreement in place with Plug. If

customers want to purchase hydrogen at the published price, Plug

will execute a transaction agreement to accept a customer tanker at

one of its plants for a fill.

All Plug operating plants in Woodbine, Ga., Charleston, Tenn.,

and St. Gabriel, La., with a combined liquid hydrogen production

capacity of approximately 45 tons per day, participates in the spot

pricing program. Plug, the third-largest producer of liquid

hydrogen in North America, is the only producer of liquid green

hydrogen on a commercial scale.

“As our hydrogen demand experiences peaks and valleys, our

unique spot pricing initiative will allow us to run our plants more

efficiently, maintaining economies of scale and scope, and

ultimately, maximizing return on capital investment,” added Plug

President Sanjay Shrestha.

By spearheading this transformative change, Plug solidifies its

leadership in the green hydrogen ecosystem while contributing

significantly to the global market for sustainable and renewable

energy solutions.

“We believe this initiative will increase trust and transparency

in the industrial hydrogen market,” explained Marsh. “In five

years, we anticipate most buyers will tap into the spot market to

benefit from the flexibility it offers them.”

About Plug

Plug is building an end-to-end green hydrogen ecosystem, from

production, storage, and delivery to energy generation, to help its

customers meet their business goals and decarbonize the economy. In

creating the first commercially viable market for hydrogen fuel

cell technology, the company has deployed more than 69,000 fuel

cell systems and over 250 fueling stations, more than anyone else

in the world, and is the largest buyer of liquid hydrogen.

With plans to operate a green hydrogen highway across North

America and Europe, Plug built a state-of-the-art Gigafactory to

produce electrolyzers and fuel cells and is developing multiple

green hydrogen production plants targeting commercial operation by

year-end 2028. Plug delivers its green hydrogen solutions directly

to its customers and through joint venture partners into multiple

environments, including material handling, e-mobility, power

generation, and industrial applications.

For more information, visit www.plugpower.com.

Plug Power Safe Harbor Statement

This communication contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 that involve significant risks and uncertainties about Plug

Power Inc. (“Plug”), including but not limited to statements about

Plug’s spot pricing program for liquid green hydrogen. Such

statements are subject to risks and uncertainties that could cause

actual performance or results to differ materially from those

expressed in these statements. For a further description of the

risks and uncertainties that could cause actual results to differ

from those expressed in these forward-looking statements, as well

as risks relating to the business of Plug in general, see Plug’s

public filings with the Securities and Exchange Commission (the

“SEC”), including the “Risk Factors” section of Plug’s Annual

Report on Form 10-K for the year ended December 31, 2023, Plug’s

Quarterly Reports on Form 10-Q for the quarters ended March 31,

2024, June 30, 2024 and September 30, 2024 and any subsequent

filings with the SEC. Readers are cautioned not to place undue

reliance on these forward-looking statements. The forward-looking

statements are made as of the date hereof, and Plug undertakes no

obligation to update such statements as a result of new

information.

MEDIA CONTACT

Fatimah Nouilati AllisonplugPR@allisonpr.com

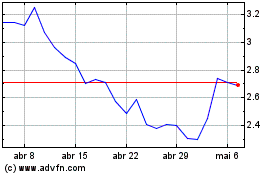

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025