Eldorado Gold Corporation (“Eldorado” or “the Company”) today

provides an update on the construction progress at its copper-gold

Skouries Project (“Skouries” or the “Project”), detailed 2025

production and cost guidance, and three-year production outlook.

As previously disclosed, labour market tightness

in Greece, particularly pronounced in construction, has continued

to limit the availability of key construction personnel at

Skouries, resulting in a slower ramp-up of the workforce and

delayed progress in certain areas of the Project. To address these

constraints, Eldorado recently undertook, and has now completed, a

comprehensive bottom-up analysis to evaluate, and where possible,

mitigate their impact on the Project schedule and costs. This

analysis included an optimization of the production plan, which is

now expected to provide earlier access to higher grade ore through

early start-up of mining operations and to facilitate efficient

process plant commissioning.

First production at Skouries is now expected in

the first quarter of 2026, followed by commercial production

expected in mid-2026. The revised Project capital cost estimate

incorporates an increase of approximately $143 million or 15.5%

over prior capital cost estimates, to a total of approximately

$1.06 billion. In addition, the Company expects to complete

additional pre-commercial production mining and has accelerated the

purchase of higher capacity mobile mining equipment (originally

expected to be purchased post commercial production), resulting in

$154 million of accelerated operational capital prior to commercial

production.

The revised schedule and cost estimates remain

sensitive to a successful workforce ramp up, with a target of

maintaining approximately 1,300 workers on site through the peak of

construction activities. The Company continues to make progress,

achieving a daily on-site total of approximately 1,150 workers at

the end of January. The workforce risk will remain after ramping up

to the required personnel, as the Company continues integrating and

managing diverse skill sets (concrete, mechanical, electrical and

control systems) needed to support the unfolding work fronts.

As of December 31, 2024, the Company has

incurred approximately $512 million of capital expenditures at

Skouries, with approximately $705 million of remaining expenditures

expected to achieve commercial production, including accelerated

operational capital.

The Company maintains a strong financial

position, with approximately $857 million of cash and cash

equivalents(1) and total liquidity(2) of approximately $1.1 billion

as of December 31, 2024. The project remains fully funded through a

combination of our balance sheet and remaining undrawn amounts

under the Company’s Skouries Project finance facility. Year-end

liquidity has been further augmented by the divestment of our G

Mining Ventures holding in January 2025 for proceeds of $155

million.

(1) Cash position reflects the Company’s cash

balance and cash equivalents. Amounts are unaudited.(2) Total

liquidity includes the cash balance and availability on the senior

secured facility. Amounts are unaudited.

“While we have revised the start-up and cost

estimates, we remain confident in Skouries’ long-term value,

highlighted by an initial 20-year mine life that is expected to

have a transformational impact on our production and costs,” said

George Burns, President and CEO. “Skouries will increase our

operational scale and strengthen our foundation for sustainable

growth and long-term value. We continue to operate responsibly and

sustainably and the Skouries Project will continue to be a

significant contributor to the Greek economy and local communities,

with hundreds of jobs and significant social investments for the

people of the Aristotle Municipality.

“Our updated 2025 gold production guidance is

expected to be between 460,000 and 500,000 ounces. This has been

lowered from our prior outlook provided in 2024 to reflect the

change in initial production at Skouries from the third quarter of

2025 to the first quarter of 2026. In addition, guidance at both

Kisladag and Olympias has been lowered compared to our prior 2025

guidance provided in 2024. At Kisladag, expected production has

been impacted by longer than planned leach cycles and lower grade

stacked. At Olympias, production guidance has been impacted by a

delay in mill expansion commissioning to 650 ktpa and unscheduled

maintenance of the gold concentrate filters.

“Our costs have increased due to wage pressures

in Turkiye and Quebec and increased royalties across the global

portfolio due to the anticipated continuation of higher gold

prices. In Turkiye, the increase is primarily the result of

inflation not currently being fully offset by the depreciation of

the Lira against the US dollar. At the Lamaque Complex the increase

is primarily the result of wage pressure from a competitive labour

market in Quebec and deepening of the mine and lower grade in the

top of Lower Triangle.”

Skouries Cost Variance

The revised cost estimates reflect a mid-2026

commercial production date with variances allocated to either

Project Capital or Accelerated Operational Capital.

Table 1. Skouries Project –Cost Estimates

($Millions)

|

Category |

Previous |

Revised |

Incurred |

Remaining |

|

Estimate |

Estimate |

(Dec-31-24) |

(Dec-31-24) |

|

Project Capital |

920 |

1,063 |

505 |

558 |

|

Accelerated Operational Capital |

0 |

154 |

7 |

147 |

|

Total Capital and Cost |

920 |

1,217 |

512 |

705 |

|

|

|

|

|

|

Project Capital

The Project Capital cost variance relates

primarily to:

- Indirect Costs:

Certain fixed monthly costs, such as those associated with the

owner's team, EPCM, insurance, and general administration, will be

incurred over an extended construction period.

- Quantity of

Materials: Higher expected quantities of materials such as

concrete, steel, and piping, identified during completion of

detailed engineering in compliance with Greek engineering

standards.

- Other: Escalation

in the unit rates from the construction contractors and other

items.

Table 2. Project Capital – Variance from

Previous Estimate ($Millions)

|

Category |

Variance |

|

Indirect Costs |

86 |

|

Materials |

36 |

|

Other |

21 |

|

Total Variance |

143 |

Accelerated Operational

Capital

The Company has reviewed and optimized the open

pit and underground mine start-up and production plans. With

commercial production now expected in mid-2026, the Company expects

to incur additional mining costs through to commercial production

of approximately $154 million. These accelerated operational

capital costs reflect the following:

- Pre-Commercial

Mining: The Company continues to progress the

operationalization of mining activities and expects to complete

additional pre-commercial production mining in both the open pit

and underground mines ahead of commercial production. This will

provide better continuity of our mining teams and faster access to

higher-grade ore, enabling the mill to process higher-quality

material during 2026. This plan is expected to deliver gold and

copper production volumes in 2026 in line with prior guidance.

- Open Pit:

Trade-off studies for the open pit mine support a faster transition

from contract mining to an owner-operated model. This has

accelerated the purchase of higher capacity mobile mining

equipment, including five Cat 777 haul trucks and three additional

loading units. The combination of these larger 100-tonne haul

trucks versus the 20-tonne haul truck fleet being required for

construction of civil works and switching to an owner-operated

model is expected to increase overall efficiency and lower life of

mine unit costs. The studies also support transitioning from a

two-phase to a four-phase open pit, accelerating access to higher

grade ore while optimizing waste stripping.

- Underground:

Underground development is progressing well with a leading European

contractor, which is also deploying a multi-year training program

to develop the local workforce and enhance large-stope mining

capability. The longer period of underground mining prior to

commercial production provides additional time to complete the

required development metres, which, combined with the completion of

test stoping, derisks overall production plans. As previously

guided, test stoping is expected to be completed within 2025.

Table 3. Accelerated Operational Capital

($Millions)

|

Category |

Estimate |

|

Mining Equipment |

47 |

|

Mining & Mobile Maintenance |

67 |

|

Other |

40 |

|

Total Variance |

154 |

Project Status

As of December 31, 2024, phase 2 of the Project

was 60% complete. Detailed engineering and procurement were

substantially complete.

2025 Production and Cost

Guidance

|

2025 Guidance |

|

|

Lamaque Complex |

Kisladag |

Efemcukuru(3) |

Olympias(3,4) |

Skouries Project |

Total |

|

Gold Production (000’ oz) |

170 – 180 |

160 – 170 |

70 – 80 |

60 – 70 |

|

460 – 500 |

|

Silver Production (000’ oz) |

|

|

|

1,300 – 1,500 |

|

1,300 – 1,500 |

|

Lead Production (000’ t) |

|

|

|

12 – 15 |

|

12 – 15 |

|

Zinc Production (000’ t) |

|

|

|

12 – 15 |

|

12 – 15 |

|

Tonnes Processed (millions) |

0.95 – 1.00 |

13.20 – 13.60 |

0.53 – 0.55 |

0.50 – 0.52 |

|

|

|

Gold Grade (g/t) |

5.50 – 6.20 |

0.65 – 0.75 |

4.80 – 5.30 |

7.50 – 8.50 |

|

|

|

Total Cash Costs(1) ($/oz sold) |

790 – 890 |

1,020 – 1,120 |

1,300 – 1,400 |

1,020 – 1,120 |

|

980 – 1,080(5) |

|

All-in Sustaining Costs(1) ($/oz sold) |

1,290 – 1,390 |

1,200 – 1,300 |

1,560 – 1,660 |

1,280 – 1,380 |

|

1,370 – 1,470(5) |

|

Capital Expenditures ($ millions) |

|

|

|

|

|

|

|

Sustaining Capital(1) |

85 – 95 |

25 – 30 |

15 – 20 |

20 – 25 |

|

145 – 170 |

|

Operations - Growth Capital(1,2) |

70 – 75 |

115 – 125 |

15 – 20 |

45 – 50 |

|

245 – 270 |

|

Operations - Sustaining and Growth

Capital(1,2) |

155 – 170 |

140 – 155 |

30 – 40 |

65 – 75 |

|

390 – 440 |

|

Skouries - Construction Project

Capital(1) |

|

|

|

|

400 – 450 |

400 - 450 |

|

Skouries - Accelerated Operational

Capital(1) |

|

|

|

|

80 – 100 |

80 - 100 |

|

(1) |

These financial measures are non-IFRS financial measures. Certain

additional disclosures for non-IFRS financial measures and ratios

have been incorporated by reference and additional detail can be

found at the end of this press release in the section titled

‘Non-IFRS and Other Financial Measures and Ratios.’ |

|

(2) |

Includes capitalized exploration at the Lamaque Complex and

Efemcukuru. |

|

(3) |

Payable metal produced. |

|

(4) |

Olympias by-product grades: Silver: 90 – 120 g/t; Zinc: 4.0 – 4.5%;

Lead: 3.5 – 4.0%. |

|

(5) |

Totals may not add based on the averaging of costs. |

|

|

|

Gold production in 2025 is expected to be

between 460,000 and 500,000 ounces which reflects the

following:

- First production from Skouries in

2026 rather than 2025.

- At Kisladag, expected production

has been impacted by longer than planned leach cycles and lower

grade stacked.

- At Olympias, expected production

has been impacted by a delay in mill expansion commissioning to

650ktpa, and unscheduled maintenance of the gold concentrate

filters.

Similar to prior years, quarter-to-quarter gold

production in 2025 is expected to fluctuate with higher production

expected in the second half as a result of ore grade variability

across the portfolio and the impact of winter conditions at

Kisladag.

Total cash costs(1) in 2025 are expected to be

between $980 and $1,080 per ounce sold and an average AISC(1) of

$1,370 to $1,470 per ounce sold. The expected increase in 2025

costs is driven by forecasted higher labour costs as a result of

inflation particularly in Turkiye, as well as lower production,

increased sustaining capital and higher royalty expense, partially

offset by higher by-product credits.

(1) Total cash cost per ounce sold and AISC per

ounce sold are non-IFRS financial measures. Certain additional

disclosures for non-IFRS financial measures and ratios have been

incorporated by reference, and additional detail can be found at

the end of this press release and in the section ‘Non-IFRS and

Other Financial Measures and Ratios.’

Exploration and evaluation expenditures are

expected to be between $29 and $32 million in 2025, with 88%

expensed, and 12% capitalized. General and administrative expenses

are expected to be between $35 and $38 million in 2025, and

depreciation expense is expected to be between $250 and $270

million.

OPERATING MINES:

CANADA

Lamaque Complex

In 2025, production guidance of 170,000 to

180,000 ounces at the Lamaque Complex is unchanged from the

previously guided range. In 2025, the focus remains on further

resource conversion drilling at Triangle and Ormaque and the

completion of a second bulk sample.

Total cash costs and all-in sustaining costs per

ounce sold are expected to increase as a result of the deepening of

the mine and lower grade in the top of Lower Triangle, in addition

to increased labour costs as a result of wage pressures due to the

tight labour market in Quebec and increased royalties due to the

anticipated continuation of higher gold prices.

Sustaining capital expenditures of between $85

and $95 million for 2025 are expected to include significant

underground mine development and resource conversion drilling at

the Triangle deposit, as we target the C8 zone. Expected growth

capital of between $70 and $75 million for 2025 primarily includes

development and infrastructure to access the Ormaque deposit,

construction of the North Basin, a new water basin that is expected

to extend the life of the Sigma tailings storage facility and

construction of the paste plant.

TURKIYE

KisladagIn 2025, production

guidance of 160,000 to 170,000 ounces at Kisladag is slightly lower

than the previously guided range of 175,000 to 185,000 ounces,

primarily due to lower grade as a result of recent mine plan

optimization adjusting to avoid an area of local cultural

significance. Also, as previously disclosed in the third quarter of

2024, the Company has incorporated the longer leach cycle and

coarse ore particle performance in its guidance. The Company

continues to focus on irrigation optimization efforts, which have

demonstrated positive results on gold inventory reduction,

partially offsetting the longer leach cycle. In addition, an

engineering study is underway to confirm optimal recovery, leach

kinetics and process throughput and is expected to be completed in

mid-2025.

Total cash costs and all-in sustaining costs per

ounce sold are expected to be impacted by inflation not currently

being fully offset by the depreciation of the Lira against the US

dollar, and increased royalties due to the anticipated continuation

of high gold prices.

Planned 2025 sustaining capital of between $25

and $30 million includes the increased total material that is

expected to be moved (+2.6Mt) as the Company transitions from Phase

4 to Phase 5 and begin pre-stripping of Phase 6, resulting in

higher demand from the mobile fleet and related equipment

overhauls. Planned 2025 growth capital of between $115 and $125

million includes the continuation of the capitalized waste

stripping campaign and the phased expansion of the North Heap Leach

Pad, in addition to capital for the engineering study and long lead

items.

EfemcukuruIn 2025, production

guidance of 70,000 to 80,000 ounces is unchanged from the

previously guided range. Total cash costs and all-in sustaining

costs per ounce sold are expected to be negatively impacted by

increased labour costs and electricity costs. Higher labour costs

are expected as a result of inflation not currently being fully

offset by the depreciation of the Lira against the US dollar, and

increased royalties due to the anticipated continuation of high

gold prices.

Planned sustaining capital expenditures of

between $15 and $20 million for 2025 includes underground

development and equipment purchases. The planned growth capital of

between $15 and $20 million for 2025 is expected to be primarily

focused on development and infrastructure for expansion of the

Kokarpinar vein system including portal construction and

development of the Bati vein systems, following the additional

two-year mine life extension announced in December 2024.

GREECE

Olympias In 2025, production

guidance of 60,000 to 70,000 ounces at Olympias is expected to be

lower than the prior guidance due a delay in mill expansion

commissioning to 650ktpa and unscheduled maintenance of the gold

concentrate filters.

Total cash costs and all-in sustaining costs per

ounce sold are expected to be positively impacted by increased

by-product metal sales partially offset by increased royalties due

to the anticipated continuation of high gold prices. Continued

quarter to quarter variability in AISC and total cash costs is

expected due to by-product credits from timing of by-product

concentrate shipments.

Planned 2025 sustaining capital expenditures of

between $20 and $25 million include underground mine development

and management of the Kokkinolakas tailings management facility.

Planned 2025 growth capital of $45 to $50 million is primarily

focused around the mill expansion to support the ramp-up to 650

ktpa, capitalized development and a resource conversion drilling

program.

Three-Year Outlook

Overview:

- Gold production of between 660,000

and 720,000 ounces by 2027, resulting in growth of 33% over the

three-year period compared to 2024 production.

- Delivering consistent safe

production from robust long-life assets.

- Unlocking mineral value across the

portfolio through expansion and development.

- Skouries commercial production in

mid-2026.

- Addition of copper, a critical

mineral to the portfolio.

- Continued focus on exploration to

unlock the outstanding potential of the Company’s brownfield

property portfolio and to the identification and development of new

opportunities in Eldorado’s focus jurisdictions.

|

|

2025 |

2026 (2) |

2027 |

2024 Actual |

|

Gold Production (000’ oz) |

|

Lamaque Complex |

170 – 180(1) |

180 – 190 |

175 – 185 |

197 |

|

Kisladag |

160 – 170 |

135 – 145 |

165 – 175 |

174 |

|

Efemcukuru |

70 – 80 |

75 – 85 |

70 – 80 |

80 |

|

Olympias |

60 – 70 |

80 – 90 |

80 – 90 |

70 |

|

Skouries |

|

135 – 155(2) |

170 – 190 |

|

|

Total Gold Production |

460 – 500 |

605 – 665 |

660 – 720 |

520 |

|

Copper Production (Mlbs) |

|

Total Copper Production Skouries |

|

45 – 60 |

60 – 80 |

|

|

Silver Production (000’ oz) |

|

Total Silver Production Olympias |

1,300 – 1,500 |

1,550 – 1,750 |

1,750 – 1,950 |

|

|

Lead Production (t) |

|

Total Lead Production Olympias |

12,000 – 15,000 |

15,000 – 18,000 |

17,000 – 20,000 |

|

|

Zinc Production (t) |

|

|

|

|

|

Total Zinc Production Olympias |

12,000 – 15,000 |

18,000 – 21,000 |

19,000 – 22,000 |

|

|

(1) |

Includes expected production ounces from the second bulk sample

process at Ormaque. |

|

(2) |

Includes expected pre-commercial production from Skouries.

Skouries’ commercial production is expected in mid-2026. |

| |

|

2025 Assumptions and

Sensitivities

|

Commodity and Currency Price Assumptions |

|

Gold ($/oz) |

2,300 |

|

Silver ($/oz) |

28.00 |

|

Lead ($/mt) |

2,050 |

|

Zinc ($/mt) |

2,700 |

|

USD : CDN |

1 : 1.33 |

|

EUR : USD |

1 : 1.05 |

|

USD : TRY (Q1) |

1 : 35.00 |

|

USD : TRY (Q2) |

1 : 37.00 |

|

USD : TRY (Q3) |

1 : 39.00 |

|

USD : TRY (Q4) |

1 : 41.00 |

|

Sensitivities |

2025 |

Change |

Operating Sites Local Currency Exposure |

AISC ($/oz sold) |

|

Gold Price |

$2,300 |

$100 |

|

~8 |

|

USD : CDN |

1 : 1.33 |

$0.05 |

90% |

~20 |

|

EUR : USD |

1 : 1.05 |

$0.05 |

95% |

~15 |

Qualified Person

Except as otherwise noted, Simon Hille, FAusIMM,

Executive Vice President, Technical Services and Operations, is the

Qualified Person under National Instrument 43-101 responsible for

preparing and supervising the preparation of the scientific or

technical information contained in this news release and for

verifying the technical data disclosed in this document relating to

our operating mines and development projects.

Jessy Thelland, géo (OGQ No. 758), a member in

good standing of the Ordre des Géologues du Québec, is the

Qualified Person as defined in National Instrument 43-101

responsible for, and has verified and approved, the scientific and

technical data contained in this news release for the Quebec

projects.

Data is verified through the internal reviews of

life of mine plans on a site-by-site basis which confirms the

expected production outputs along with the expected revenue and

cost distribution.

Conference Call

Senior management will host a conference call to

discuss the details of the Company’s Skouries Project Update and

Guidance on Thursday, February 6, 2025 at 11:30 AM ET (8:30 AM PT).

The call will be webcast and can be accessed at Eldorado’s website:

www.eldoradogold.com or via this

link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=hXu5PtUk

Participants may elect to pre-register for the

conference call via this link:

https://dpregister.com/sreg/10196352/fe619f1800. Upon registration,

participants will receive a calendar invitation by email with dial

in details and a unique PIN. This will allow participants to bypass

the operator queue and connect directly to the conference.

Registration will remain open until the end of the conference

call.

| Conference

Call Details |

Replay

(available until March 20, 2025) |

|

Date: |

Thursday, February 6, 2025 |

Vancouver: |

+1 412 317 0088 |

| Time: |

11:30 AM ET (8:30 AM PT) |

Toll Free: |

1 855 669 9658 |

| Dial in: |

+1 647 484 8814 |

Access code: |

1502892 |

| Toll free: |

1 844 763 8274 |

|

|

| |

|

|

|

About Eldorado

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkiye, Canada

and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lynette Gould, VP, Investor Relations,

Communications & External Affairs647 271 2827 or 1 888 353 8166

lynette.gould@eldoradogold.com

Media

Chad Pederson, Director, Communications and

Public Affairs236 885 6251 or 1 888 353 8166

chad.pederson@eldoradogold.com

Non-IFRS and Other Financial Measures

and Ratios

Certain non-IFRS financial measures and ratios

are included in this news release, including total cash costs,

all-in sustaining cost ("AISC"), growth capital costs, and

sustaining capital costs. The Company believes that these

measures and ratios, in addition to conventional measures and

ratios prepared in accordance with International Financial

Reporting Standards (“IFRS”), provide investors an improved ability

to evaluate the underlying performance of the Company. The non-IFRS

and other financial measures and ratios are intended to provide

additional information and should not be considered in isolation or

as a substitute for measures or ratios of performance prepared in

accordance with IFRS. These measures and ratios do not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to other issuers.

With respect to the non-IFRS measures disclosed

in this news release, the Company defines them as

follows:

Total Cash Costs

We define total cash costs following the

recommendations of the Gold Institute Production Cost Standard. The

production cost standard developed by the Gold Institute remains

the generally accepted standard of reporting total cash costs of

production by gold mining companies. Total cash costs include

direct operating costs (including mining, processing and

administration), refining and selling costs (including treatment,

refining and transportation charges and other concentrate

deductions), and royalty payments, but exclude depreciation and

amortization, share based payments expenses and reclamation costs.

Revenue from sales of by-products including silver, lead and zinc

reduce total cash costs.

All-In Sustaining Costs (AISC)

We define AISC based on the definition set out

by the World Gold Council, including the updated guidance note

dated November 14, 2018. We define AISC as the sum of total cash

costs (as defined above), sustaining capital expenditure relating

to current operations (including capitalized stripping and

underground mine development), sustaining leases (cash basis),

sustaining exploration and evaluation cost related to current

operations (including sustaining capitalized evaluation costs),

reclamation cost accretion and amortization related to current gold

operations and corporate and allocated general and administrative

expenses. Corporate and allocated general and administrative

expenses include general and administrative expenses, share-based

payments and defined benefit pension plan expense. Corporate and

allocated general and administrative expenses do not include

non-cash depreciation. As this measure seeks to reflect the full

cost of gold production from current operations, growth capital and

reclamation cost accretion not related to operating gold mines are

excluded. Certain other cash expenditures, including tax payments,

financing charges (including capitalized interest), except for

financing charges related to leasing arrangements, and costs

related to business combinations, asset acquisitions and asset

disposals are also excluded.

Sustaining Capital

Sustaining capital is capital required to

maintain current operations at existing levels, including

capitalized stripping and underground mine development. Sustaining

capital excludes non-cash sustaining lease additions, unless

otherwise noted, and does not include capitalized interest,

expenditure related to development projects, or other growth or

sustaining capital not related to operating gold mines.

Growth Capital

Growth capital is capital investment for new

operations, major growth projects or enhancement capital for

significant infrastructure improvements at existing

operations.

Our September 30, 2024 Management’s Discussion

& Analysis (“MD&A”), available on SEDAR+ at

www.sedarplus.com and on the Company's website under the

'Investors' section, contains explanations and discussions of

historic total cash costs., AISC, sustaining capital and growth

capital for the operating mines for the three and nine months ended

September 30, 2024, as well as the comparable measures as at

September 30, 2023. For a discussion of the composition and

usefulness of certain of these non-IFRS measures and a

reconciliation of these historical measures to production costs,

see specifically "Non-IFRS and Other Financial Measures and Ratios"

in the Company’s Management Discussion & Analysis for the

periods ended December 31, 2023 and September 30,

2024.

Forward-looking Statements and

Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

forward-looking information within the meaning of the United States

Private Securities Litigation Reform Act of 1995 and applicable

Canadian securities laws. Often, these forward-looking statements

and forward-looking information can be identified by the use of

words such as “anticipates”, “believes”, “budgets”, "committed",

“continue”, “estimates”, “expects”, "focus", “forecasts”,

"foresee", "forward", "future", "goal", “guidance”, “intends”,

"opportunity", "outlook", “plans”, “potential”, "schedule",

"strategy", "target", “underway”, "working" or the negatives

thereof or variations of such words and phrases or statements that

certain actions, events or results “can”, “could”, "likely", "may",

“might”, “will” or "would" be taken, occur or be achieved.

Forward-looking statements and forward-looking

information contained in this press release includes, but is not

limited to, statements or information with respect to: our updated

2025 production and cost guidance for the Company and by each

material property with detail on plans for each property in 2025;

three year production outlook for each of the Company, material

property and metal mined; construction costs and site expenditures

for the Skouries Project generally; the project schedule and

remaining costs to complete for the Skouries Project, including key

inputs such as, key personnel, staffing and contractors; guidance

regarding the progress, anticipated production, schedule and costs

required to complete construction of the Skouries Project including

our expectations on timing in relation to first production and

commercial production, as well as expected increases in project

capital and accelerated operational capital; the completion and

expected results from the Company’s risk analysis with respect to

the cost, schedule, mitigation and optimization required to

complete construction at the Skouries Project; expected benefits

from the operational improvements and de-risking strategies enacted

by the Company; estimated mine life and benefits of the

Skouries Project for the Company, the Greek economy and local

communities; expected impact of increased costs, continued high

gold prices and inflationary pressures; expectations to develop a

second underground mine within the Lamaque Complex; expectations to

complete the engineering study at Kisladag; expected development

and portal construction at Efemcukuru; underground mine

development, management of the Kokkinolakas tailings management

facility, mill expansion and resource conversion drilling at

Olympias; the addition of copper to the Company’s portfolio of

metals mined; and generally our strategy, plans and goals,

including our proposed exploration, development, construction,

permitting, financing and operating potential, plans and priorities

and related timelines and schedules.

Forward-looking statements and forward-looking

information are by their nature based on a number of assumptions,

that management considers reasonable. However, such assumptions

involve both known and unknown risks, uncertainties, and other

factors which, if proven to be inaccurate, may cause actual

results, activities, performance or achievements may be materially

different from those described in the forward-looking statements or

information. These include assumptions concerning: timing, cost and

results of our construction and development activities,

improvements and exploration; the future price of gold and other

commodities; exchange rates; anticipated values, costs, expenses

and working capital requirements; production and metallurgical

recoveries; mineral reserves and resources; our ability to unlock

the potential of our brownfield property portfolio; our ability to

address the negative impacts of climate change and adverse weather;

consistency of agglomeration and our ability to optimize it in the

future; the cost of, and extent to which we use, essential

consumables (including fuel, explosives, cement, and cyanide); the

impact and effectiveness of productivity initiatives; the time and

cost necessary for anticipated overhauls of equipment; expected

by-product grades; the use, and impact or effectiveness, of growth

capital; the impact of acquisitions, dispositions, suspensions or

delays on our business; the sustaining capital required for various

projects; and the geopolitical, economic, permitting and legal

climate that we operate in (including recent disruptions to

shipping operations in the Red Sea and any related shipping delays,

shipping price increases, or impacts on the global energy

market).

More specifically with respect to the Skouries

Project and updates, we have made assumptions regarding inflation

rates; labour productivity, rates and expected hours; the scope and

timing related to the awarding of key contract packages and

approval thereon; expected scope of project management frameworks;

our ability to continue to execute our plans relating to Skouries

on the estimated existing project timeline and consistent with the

current planned project scope; the timeliness of shipping for

important or critical items; our ability to continue to access our

project funding and remain in compliance with all covenants and

contractual commitments in relation thereto; our ability to obtain

and maintain all required approvals and permits, both overall and

in a timely manner; no further archaeological investigations being

required, the future price of gold, copper and other commodities;

and the broader community engagement and social climate in respect

of the Skouries Project.

In addition, except where otherwise stated,

Eldorado has assumed a continuation of existing business operations

on substantially the same basis as exists at the time of this press

release. Even though we believe that the assumptions and

expectations represented by such statements or information are

reasonable, there can be no assurance that the forward-looking

statement or information will prove to be accurate. Many

assumptions may be difficult to predict and are beyond our

control.

Forward-looking statements and forward-looking

information are subject to known and unknown risks, uncertainties

and other important factors that may cause actual results,

activities, performance or achievements to be materially different

from those described in the forward-looking statements or

information. Generally, these risks, uncertainties and other

factors include, among others: risks relating to our operations in

foreign jurisdictions; community relations and social license;

liquidity and financing risks; climate change; inflation risk;

environmental matters including existing or potential environmental

hazards; production and processing, including throughput, recovery

and product quality; geometallurgical variability; waste disposal

including a spill, failure or material flow from a tailings

facility causing damage to the environment or surrounding

communities; geotechnical and hydrogeological conditions or

failures; the global economic environment; risks relating to any

pandemic, epidemic, endemic or similar public health threats;

reliance on a limited number of smelters and off-takers; labour

(including in relation to employee/union relations, the Greek

transformation, employee misconduct, and the availability of key

personnel, skilled workforce, expatriates, and contractors);

indebtedness (including current and future operating restrictions,

implications of a change of control, ability to meet debt service

obligations, the implications of defaulting on obligations and

change in credit ratings); the Company's ability to satisfy

covenants under its agreements, including its project funding

agreements; government regulation; the Sarbanes-Oxley Act;

commodity price risk; mineral tenure; ability to secure the

required permits, licenses and authorizations in a timely manner;

risks relating to environmental sustainability and governance

practices and performance; financial reporting (including relating

to the carrying value of our assets and changes in reporting

standards); non-governmental organizations; corruption, bribery and

sanctions; information and operational technology systems;

litigation and contracts; estimation of mineral reserves and

mineral resources; different standards used to prepare and report

mineral reserves and mineral resources; credit risk; price

volatility, volume fluctuations and dilution risk in respect of our

shares; actions of activist shareholders; reliance on

infrastructure, commodities and consumables (including power and

water); currency risk; interest rate risk; tax matters; dividends;

reclamation and long-term obligations; the ongoing potential for

material impairment and/or write-downs of assets; acquisitions,

including integration risks, and dispositions; regulated

substances; necessary equipment; co-ownership of our properties;

the unavailability of insurance; conflicts of interest; compliance

with privacy legislation; reputational issues; competition, and

those risk factors discussed in our most recent Annual Information

Form & Form 40-F.

With respect to the Skouries Project, these

risks, uncertainties and other factors may cause further delays in

the completion of the construction and commissioning at the

Skouries Project which in turn may cause delays in the commencement

of production, and further increase to the costs of the Skouries

Project. The specific risks, certainties and other factors

include, among others: our ability to recruit the required number

of personnel within the required timelines, and to manage changes

to workforce numbers through the construction of the Skouries

Project; our ability to recruit personnel having the requisite

skills, experience and ability to work on site; our ability to

increase productivity by adding or modifying labour shifts; rising

labour costs or costs of key inputs such as materials, power and

fuel; risks related to third-party contractors, including reduced

control over aspects of the Company's operations and/or the ability

of contractors to perform; the ability of key suppliers to meet key

contractual commitments in terms of schedules, amount of product

delivered, cost or quality; our ability to construct key

infrastructure within the required timelines including the process

plant, filter plant, waste management facilities and embankments;

differences between projected and actual degree of pre-strip

required in the open pit; variability in metallurgical

recoveries and concentrate quality due to factors such as extent

and intensity of oxidation or presence of transition minerals;

presence of additional structural features impacting hydrological

and geotechnical considerations; variability in minerals or

presence of substances that may have an impact on filtered tails

performance and resulting bulk density of stockpiles or filtered

tails; distribution of sulfides that may dilute concentrate and

change the characteristics of tailings; unexpected disruptions to

operations due to protests, non-routine regulatory inspections,

road conditions or labour unrest; unexpected inclement weather and

climate events including short and long duration rainfall and

floods; our ability to meet pre-commercial producing mining or

underground development targets; unexpected results from

underground stopes; new archaeological finds on site requiring the

completion of a regulatory process; changes in support from local

communities, and our ability to meet the expectations of

communities, governments and stakeholders related to the Skouries

Project; and timely receipt of necessary permits and

authorizations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes. There can be no assurance that

forward-looking statements or information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

you should not place undue reliance on the forward-looking

statements or information contained herein. Except as required by

law, we do not expect to update forward-looking statements and

information continually as conditions change and you are referred

to the full discussion of the Company’s business contained in the

Company’s reports filed with the securities regulatory authorities

in Canada and the United States.

This press release contains information that may

constitute future-orientated financial information or financial

outlook information (collectively, “FOFI”) about Eldorado’s

prospective financial performance, financial position or cash

flows, all of which is subject to the same assumptions, risk

factors, limitations and qualifications as set forth above. Readers

are cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise or inaccurate and, as such,

undue reliance should not be placed on FOFI. Eldorado’s actual

results, performance and achievements could differ materially from

those expressed in, or implied by, FOFI. Eldorado has included FOFI

in order to provide readers with a more complete perspective on

Eldorado’s future operations and management’s current expectations

relating to Eldorado’s future performance. Readers are cautioned

that such information may not be appropriate for other purposes.

FOFI contained herein was made as of the date of this press

release. Unless required by applicable laws, Eldorado does not

undertake any obligation to publicly update or revise any FOFI

statements, whether as a result of new information, future events

or otherwise.

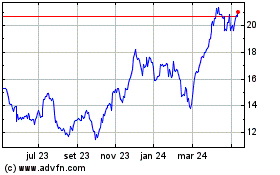

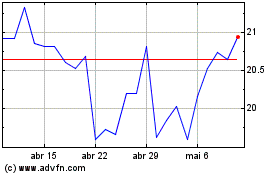

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025