Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) (“Liberty Gold” or the

“Company”) is pleased to report assay results from the 2024 reverse

circulation (“RC”) exploration drill program at its Black Pine

Oxide Gold Project (“Black Pine”) in southeastern Idaho. These

results are from step-out and infill drilling at Rangefront, M Zone

and CD Pit as well as exploration drilling in the lower Burnt Basin

target area.

HIGHLIGHTS

- Successfully

expanded deposit footprints at Rangefront, M Zone and CD Pit, with

mineralization remaining open to extension in all three areas.

Further evaluation is planned for the 2025 feasibility resource

drilling program.

-

Areas of inferred mineralization, based on shallow historic or

widely-spaced drilling at Rangefront and CD Pit show the potential

for conversion of the extensive inferred resource into indicated

for inclusion in a resource update, expected in the second half of

2025.

-

It is anticipated that there could be a significant increase in the

indicated ounces in the updated resource estimate, and this could

lead to an increased production rate or extend the mine life as

compared to that published in the Preliminary Feasibility Study1

(“PFS”).

- The near-surface

high-grade oxide gold discovery previously reported at Rangefront

west (see press release dated December 4, 2024) has been expanded

and is still open to the west, north and downdip to the east. This

has the potential to improve on the early PFS production schedule

and thus could improve the project economics in the early

years.

- A zone of oxide

gold mineralization in the typically barren lower plate shale unit

was intersected in a hydrological hole drilled in the A pit. This

opens an entirely new oxide gold target at Black Pine.

Pete Shabestari, VP

Exploration, "Ending the drill season on a high note was a

perfect way to wrap up a transformational year for the Company in

2024. Drill results continue to point towards strong resource

growth potential in all major areas. The gold system at Black Pine

continues to impress with its size, structure, lateral extent,

pervasive oxidation, highly beneficial metallurgy and now,

intriguingly, the potential for a new oxide mineralization target

in an underexplored rock unit at depth. We look forward to getting

drills back into the field in Q2 this year to complete the

feasibility resource drill out, targeting up to a half-million

ounce conversion increase in indicated resources for the

feasibility study.”

FIGURE 1: RANGEFRONT ZONE CROSS

SECTION

RANGEFRONT ZONE

Drilling along the western margin of the

Rangefront deposit continues to expand the oxide gold mineralized

envelope, which now extends 230 meters (“m”) west from the current

block model and 300 m west of the currently modeled resource

constraining pit.

The previously announced discovery of a shallow

mineralized zone in the western margin of Rangefront (see press

release dated December 4, 2024) has been expanded with drill hole

LBP1061 returning 21.3 m of 0.54 grams per

tonne (“g/t”) gold (“Au”) starting at 61 m

downhole. Future drilling will be targeting this zone down

dip to the east, extending back into the current resource pit, as

well as to the west where it appears to come closer to surface.

Addition of mineralization in this area, currently modeled as waste

in the mine plan, would have a positive impact on strip ratios at

Rangefront.

The near-surface oxide material on the western

margin of Rangefront will be drilled out for the feasibility

resource model and has the potential to feed the leach pad with

early, higher-grade material. This potential early strip at

Rangefront could change the economics of the deeper, high-grade

zones at Rangefront and bring that mineralization forward in the

production schedule. This will be evaluated in detail during the

feasibility mine planning scheduled to commence in Q4 2025.

Drilling along the eastern margin of Rangefront,

near the modeled pit in a large area of inferred blocks currently

defined only by historic drilling, has returned a better than

expected result in hole LBP1078 with a shallow

oxide intercept of 24.4 m of 0.96 g/t Au including 6.1 m of

1.94 g/t Au starting at 76.2 m downhole. This result

confirms the presence of higher-grade lenses of mineralization

within the lower-grade inferred ounces. Such lenses can have a

material impact on strip ratio which can lead to significant

expansion of resource pit shells. Further drilling in the area is

being planned for the 2025 resource evaluation drill program.

Five holes drilled along the north-eastern

margin of Rangefront have expanded the defined inferred resource,

which is still open for expansion in this direction. Highlight

intercepts from this area are from hole LBP1075 with 24.4 m

of 0.50 g/t Au starting at 109 m downhole. It is

anticipated that this drilling will push out the resource pit slope

back to the northeast opening up additional mineralization for

feasibility evaluation.

FIGURE 2: M ZONE CROSS

SECTION

M Zone

A total of eight holes were drilled in the M

Zone with the goal of expanding the mineralized zone to the west

and north. All drill holes successfully hit gold mineralization

including a highlight intercept in hole LBP1048 of 15.2 m

of 5.51 g/t Au including 9.1 m of 7.88 g/t Au. Some of the

gold intercepts hit in M Zone exhibit reduced cyanide solubility.

Additional drilling and modeling are required in M Zone to fully

define the potential of the resource area that currently remains

open.

FIGURE 3: DRILL RESULTS MAP

CD Pit Area

Three holes were drilled in the CD pit area,

including one hole drilled in the pit bottom for hydrologic

testing. The two other holes were drilled along the southeastern

margin of the resource, and both successfully expanded and should

upgrade the defined resource. Additional drilling is needed in this

area to expand the large area of inferred resource currently

defined only by historic drilling. The best intercept was from hole

LBP1076 which returned 19.8 m of 0.62 g/t Au.

Burnt Basin Area

Six, widely spaced exploration holes were

drilled into the lower Burnt Basin target area with one hole

hitting an intercept of 6.1 m of 0.28 g/t Au starting from

surface. Mineralization was associated with low angle

faulting and multiple intrusive dykes and sills. This indicates

that the gold mineralizing system is active out to and potentially

beyond the lower Burnt Basin area, located some 3.5 kilometres

(“km”) from the center of the Discovery Pit. This intercept

confirms the footprint of the gold system at 6.5 km x 5 km for an

area exceeding 32.5 square kilometers (“km2”). The system remains

open for future discovery to the north and south.

The 1 km2 upper Burnt Basin target area was not

drilled in 2024 and remains as a priority target area for testing

in 2025.

A Pit Drilling

A single hole was drilled in the A Pit as part

of the hydrology program. This hole was notable for a gold

intercept that was entirely within the lower plate and was

partially oxide as defined by cyanide soluble assay ratios. The

intercept in this hole (LBP1051 with 6.1 m of 0.18 g/t Au

and 9.1 m of 0.24 g/t Au) was near an intercept in a

historic hole (96BX-14) that had 9.1 m of 0.62 g/t Au and historic

hole MGR11-007 which had an intercept of 9.1 m of 1.19 g/t Au.

Hitting mineralization deep in the lower plate

is significant in that it may indicate that deep feeder zone(s) to

the main mineralized area are present on the Black Pine

property.

For a table showing complete drill results for the current

release, see this link:

https://libertygold.ca/images/news/2025/February/BP_Intercepts02062025.pdf

QUALIFIED PERSON

Peter Shabestari, P.Geo., Vice-President

Exploration, Liberty Gold, is the Company's designated Qualified

Person for this news release within the meaning of National

Instrument 43-101 Standards of Disclosure for Mineral Projects and

has reviewed and validated that the information contained in the

release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. We know the Great Basin and are driven to

discover and advance big gold deposits that can be mined profitably

in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations Phone:

604-632-4677 or Toll Free 1-877-632-4677 info@libertygold.ca

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off

of 0.15 g/t Au. Drill intersections are reported as drilled

thicknesses. True widths of the mineralized intervals vary between

30% and 100% of the reported lengths due to varying drill hole

orientations but are typically in the range of 50% to 90% of true

width. Drill samples were assayed by ALS Limited in Reno, Nevada

for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA

finish, or if over 5.0 g/t Au were re-assayed and completed with a

gravimetric finish. For these samples, the gravimetric data were

utilized in calculating gold intersections. For any samples

assaying over 0.10 parts per million an additional cyanide leach

analysis is done where the sample is treated with a 0.25% NaCN

solution and rolled for an hour. An aliquot of the final leach

solution is then centrifuged and analyzed by Atomic Absorption

Spectroscopy. QA/QC for all drill samples consists of the insertion

and continual monitoring of numerous standards and blanks into the

sample stream, and the collection of duplicate samples at random

intervals within each batch. All holes are also analyzed for a 51

multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is

ISO 17025:2005 Accredited, with the Elko and Twin Falls prep lab

listed on the scope of accreditation.

All statements in this press release, other

than statements of historical fact, are "forward-looking

information" with respect to Liberty Gold within the meaning of

applicable securities laws, including statements that address

potential quantity and/or grade of minerals, potential size and

expansion of a mineralized zone, proposed timing of exploration and

development plans, potential timing of a resource update, expected

capital costs at Black Pine, expected gold and silver recoveries

from the Black Pine mineralized material, potential additions to

the resource through additional drill testing, potential upgrade of

inferred mineral resources to measured and indicated mineral

resources, potential impacts to mine life, potential impacts to

production rates and economics of the PFS, and beliefs regarding

gold resources being contained within a larger property area.

Forward-looking information is often, but not always, identified by

the use of words such as "seek", "anticipate", "plan", "continue",

"planned", "expect", "project", "predict", "potential",

"targeting", "intends", "believe", "potential", and similar

expressions, or describes a "goal", or variation of such words and

phrases or state that certain actions, events or results "may",

"should", "could", "would", "might" or "will" be taken, occur or be

achieved. Forward-looking information is not a guarantee of future

performance and is based upon a number of estimates and assumptions

of management at the date the statements are made including, among

others, assumptions about future prices of gold, and other metal

prices, currency exchange rates and interest rates, favourable

operating conditions, political stability, obtaining governmental

approvals and financing on time, obtaining renewals for existing

licenses and permits and obtaining required licenses and permits,

labour stability, stability in market conditions, availability of

equipment, accuracy of any mineral resources and mineral reserves,

the availability of drill rigs, the accuracy of the PFS, successful

resolution of disputes and anticipated costs and expenditures. Many

assumptions are based on factors and events that are not

within the control of Liberty Gold and there is no assurance they

will prove to be correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the interpretation of results and/or the reliance on technical

information provided by third parties as related to the Company’s

mineral property interests; changes in project parameters as plans

continue to be refined; current economic conditions; future prices

of commodities; possible variations in grade or recovery rates; the

costs and timing of the development of new deposits; failure of

equipment or processes to operate as anticipated; the failure of

contracted parties to perform; the timing and success of

exploration activities generally; delays in permitting; possible

claims against the Company; labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals,

financing or in the completion of exploration as well as those

factors discussed in the Annual Information Form of the Company

dated March 28, 2024 in the section entitled "Risk Factors", under

Liberty Gold’s SEDAR+ profile at www.sedarplus.ca .

The Mineral Resource estimates referenced in

this press release use the terms "Indicated Mineral Resources" and

"Inferred Mineral Resources." While these terms are defined in and

required by Canadian regulations (under NI 43-101), these terms are

not recognized by the U.S. Securities and Exchange Commission

("SEC"). "Inferred Mineral Resources" have a great amount of

uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. The SEC normally only permits

issuers to report mineralization that does not constitute SEC

Industry Guide 7 compliant "reserves" as in-place tonnage and grade

without reference to unit measures. U.S. investors are cautioned

not to assume that any part or all of mineral deposits in these

categories will ever be converted into reserves. Liberty Gold is

not an SEC registered company.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results, and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

1 See technical report “Black Pine Project NI 43-101 Technical

Report, Oneida County, Idaho, USA”, effective June 1, 2024, and

dated November 21, 2024, prepared by Valerie Wilson, P.Geo. SLR

Consulting Ltd.; Todd Carstensen, RM-SME AGP Mining Consultants

Inc.; Gary Simmons, MMSA GL Simmons Consulting, LLC; Nicholas T.

Rocco, Ph.D., P.E. NewFields Companies LLC; Benjamin Bermudez, P.E.

M3 Engineering & Technology Corp.; Matthew Sletten, P.E. M3

Engineering & Technology Corp.; John Rupp, P.E. Piteau

Associates Ltd. ; Daniel Yang, P.Eng., P.E. Knight Piésold Ltd.;

Richard DeLong, M.Sc. Westland Engineering & Environmental

Services Inc. on the Company’s profile on SEDAR+ at

www.sedarplus.ca and press release dated October 10, 2024.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c68a94d8-e0a3-4ab9-aca3-af88f17ee38a

https://www.globenewswire.com/NewsRoom/AttachmentNg/4b674129-2c85-4008-b5d1-85ac47d8e2cd

https://www.globenewswire.com/NewsRoom/AttachmentNg/2910296b-be53-4f35-b74c-3f2e235950d3

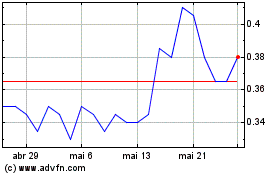

Liberty Gold (TSX:LGD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Liberty Gold (TSX:LGD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025