AGF Management Limited - Normal Course Issuer Bid

06 Fevereiro 2025 - 9:25AM

AGF Management Limited (“AGF”) announced today that the Toronto

Stock Exchange (“TSX”) has approved AGF’s notice of intention to

renew its normal course issuer bid in respect of its Class B

Non-Voting Shares (AGF.B).

As at January 27, 2025, there were 65,291,5571 Class B

Non-Voting Shares issued and outstanding and the public float

consisted of 47,507,917 Class B Non-Voting Shares.

Under the announced normal course issuer bid, AGF is permitted

to purchase up to 4,750,792 Class B Non-Voting Shares, representing

approximately 10% of the public float for such shares as of January

27, 2025. Purchases under the normal course issuer bid may commence

on February 10, 2025 and continue until February 9, 2026, when the

bid expires. Pursuant to the Articles of AGF, the Class B

Non-Voting Shares may not be purchased by AGF at a price which

exceeds more than 15% of the weighted average price at which the

Class B Shares traded on the TSX during the ten trading days

immediately preceding the date of any such purchase.

AGF announced that it will be entering into an automatic

purchase plan (the “Plan”) with a broker during the normal course

issuer bid. The Plan is effective as of February 10, 2025 and

should terminate together with the normal course issuer bid. The

Plan allows for purchases by AGF of its Class B Non-Voting Shares,

subject to certain parameters.

Under the announced normal course issuer bid, purchases may be

made through the facilities of TSX, alternative Canadian trading

systems /other designated exchanges, or as otherwise permitted by

the Canadian Securities Administrators or Ontario Securities

Commission. The average daily trading volume (“ADTV”) of the Class

B Non-Voting Shares (for the six-month period ended January 31,

2025) on the TSX was 93,109. Under the rules of the TSX, AGF is

entitled to repurchase during the same trading day on the TSX up to

25% of the ADTV of its Class B Non-Voting Shares, being 23,277

except where reliance is placed on the TSX’s block purchase

exemption.

Class B Non-Voting Shares purchased under the NCIB will be

canceled or purchased and held by the AGF Employee Benefit Trust

for the settlement of equity settled incentive plans by AGF. The

directors believe that the purchase for cancellation of Class B

Non-Voting Shares represents a desirable use of capital when, if in

the opinion of management, the value of the Class B Non-Voting

shares is attractive relative to the trading price of said shares.

Purchase for cancellation by AGF of outstanding Class B Non-Voting

Shares may also be used to offset the dilutive effect of treasury

stock released for the employee benefit trust and of shares issued

through AGF’s stock option plans and dividend reinvestment

plan.

Under its existing normal course issuer bid, which expires on

February 8, 2025, AGF sought and received approval from the TSX to

purchase 4,735,269 Class B Non-Voting Shares. During the period

from February 8, 2024 to February 5, 2025, AGF acquired 871,800

Class B Non-Voting Shares at a weighted average price of $8.12.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent

and globally diverse asset management firm. Our companies deliver

excellence in investing in the public and private markets through

three business lines: AGF Investments, AGF Capital Partners and AGF

Private Wealth.

AGF brings a disciplined approach, focused on incorporating

sound, responsible and sustainable corporate practices. The firm’s

collective investment expertise, driven by its fundamental,

quantitative and private investing capabilities, extends globally

to a wide range of clients, from financial advisors and their

clients to high-net worth and institutional investors including

pension plans, corporate plans, sovereign wealth funds, endowments

and foundations.

Headquartered in Toronto, Canada, AGF has investment operations

and client servicing teams on the ground in North America and

Europe. With over $54 billion in total assets under management

and fee-earning assets, AGF serves more than 815,000 investors. AGF

trades on the Toronto Stock Exchange under the symbol AGF.B.

Media Contact

Amanda MarchmentDirector, Corporate

Communications416-865-4160amanda.marchment@agf.com

1 Includes treasury stock in the amount of 96,458

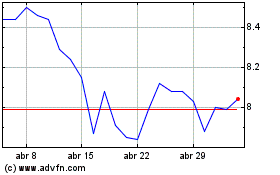

AGF Management (TSX:AGF.B)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

AGF Management (TSX:AGF.B)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025