Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the “Company”)

today announced financial results for the fiscal 2025 third quarter

period ended December 31, 2024. All amounts are expressed in

Canadian dollars unless otherwise noted.

Financial statements are available online at

Sedar+ www.sedarplus.ca.

Financial Highlights

- Group Tangible

Capital of $138.8 million, an increase of 2.6% QoQ

- Group Tangible

Capital per Share of $10.40, an increase of 1.4% QoQ

- Group Tangible

Capital per Share excluding MENE of $9.45 per share, an increase of

1.6% QoQ

- Adjusted Net Income

of $3.9 million, a decrease of 11.2% QoQ

Quarterly Performance Metrics Table

|

|

Q3 |

Q2 |

|

Q1 |

|

Q4 |

|

Q3 |

|

Q2 |

Q1 |

|

Q4 |

|

|

Key Performance Metrics (Balance Sheet) |

|

|

|

|

Shares outstanding |

13,348 |

13,182 |

|

13,060 |

|

13,137 |

|

13,449 |

|

13,777 |

13,926 |

|

13,996 |

|

|

Shareholder equity |

152,487 |

149,026 |

|

147,984 |

|

141,178 |

|

173,761 |

|

172,602 |

173,224 |

|

172,123 |

|

|

Tangible equity inclusive of MENE |

138,832 |

135,299 |

|

133,780 |

|

126,100 |

|

147,078 |

|

143,019 |

143,475 |

|

142,203 |

|

|

Tangible equity exclusive of MENE |

126,164 |

122,631 |

|

113,217 |

|

105,457 |

|

113,059 |

|

108,396 |

108,756 |

|

107,599 |

|

|

Tangible equity per share ($CAD) |

10.40 |

10.26 |

|

10.24 |

|

9.60 |

|

10.94 |

|

10.38 |

10.30 |

|

10.16 |

|

|

Tangible equity per share exclusive of MENE |

9.45 |

9.30 |

|

8.67 |

|

8.03 |

|

8.41 |

|

7.87 |

7.81 |

|

7.69 |

|

|

Key Performance Metrics (Operational) |

|

|

|

|

Net income (loss) |

2,891 |

(3,896 |

) |

5,132 |

|

(32,095 |

) |

6,005 |

|

2,009 |

1,995 |

|

(4,050 |

) |

|

Total comprehensive income (loss) |

2,628 |

792 |

|

6,077 |

|

(30,640 |

) |

7,391 |

|

627 |

1,651 |

|

(4,053 |

) |

|

Adjustments for revaluations, FX, stockcompensation, and non-cash

items |

1,246 |

3,569 |

|

550 |

|

34,857 |

|

(1,350 |

) |

2,310 |

1,903 |

|

7,020 |

|

|

Non-IFRS adjusted net income |

3,874 |

4,361 |

|

6,627 |

|

4,217 |

|

6,040 |

|

2,937 |

3,554 |

|

2,966 |

|

|

Key Performance Metrics (Earnings per Share) |

|

|

|

|

Basic earnings (loss) per share |

0.22 |

(0.29 |

) |

0.39 |

|

(2.42 |

) |

0.44 |

|

0.15 |

0.14 |

|

(0.27 |

) |

|

Diluted earnings (loss) per share |

0.22 |

(0.29 |

) |

0.38 |

|

(2.42 |

) |

0.44 |

|

0.14 |

0.14 |

|

(0.27 |

) |

|

Non-IFRS adjusted net income per share |

0.29 |

0.33 |

|

0.51 |

|

0.32 |

|

0.45 |

|

0.21 |

0.26 |

|

0.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Statement Restatement

Goldmoney also announces the restatement of

previously issued financial statements for the years ended March

31, 2024 and 2023 (the “Restatement”).

Since the Company’s wholly owned subsidiary

Goldmoney.com was founded, client cash and client precious metals

had been treated as an off-balance sheet item and clearly disclosed

as such in the Notes to the Company’s audited annual financial

statements. The Restatement recognizes and presents client cash

within Goldmoney.com on the Company’s consolidated balance sheet

with a corresponding liability. This has been presented in prior

years as a line item separate from the Company’s cash and cash

equivalents. Consequently, the March 31, 2024, audited consolidated

financial statements have been restated to capture this change in

presentation, along with the related management’s discussion and

analysis, and the 2024 Annual Information Form (collectively, the

“Restatement Package”). This restated accounting presentation for

client cash has also been reflected in the Company’s December 31,

2024, unaudited interim financial statements. There has been no

impact to the Company’s financial statement presentation of

historic equity or earnings as a result of this restatement.

The Restatement has been approved by the Board

of Directors on the recommendation of the Audit Committee and

management in connection with a review of its historic accounting

treatment of client cash as off-balance sheet assets. Management

considers these restatements to result from a material weakness in

internal controls over financial reporting, and accordingly has

implemented measures to address this weakness. As described in the

restated annual information form and other public disclosure,

Goldmoney Inc.’s wholly owned subsidiary Goldmoney.com operates an

online platform which provides clients with access to purchase and

sell precious metals, and to arrange for custody and storage in

accordance with the terms of a standard-form client agreement

available on the Goldmoney website (the “Client

Agreement”). Cash balances used to settle purchases and

sales are held in Company bank accounts.

Shareholders and users of Goldmoney’s financial

statements should note that the Restatement is not a result of any

change to its operations, business or financial operating

performance for the restated periods. The Company continues to hold

customer cash on behalf of its clients in accordance with and in

full compliance with all of the terms of the Client Agreement.

The Restatement Documents have been filed at

Sedar+ www.sedarplus.ca with the unaudited interim financial

statements for the three- and nine-month period ended December 31,

2024, with restated unaudited comparative interim financial

statements the three- and nine-month period ended December 31,

2023.

The effect of the restatement on the condensed

consolidated interim statement of financial position and condensed

consolidated interim statements of cash flows for the periods ended

June 30, 2024 and September 30, 2024 are as follows:

| |

|

|

|

|

|

|

|

Effect on Condensed Consolidated Interim Statements of

Financial Position |

|

|

|

|

| |

|

|

|

|

|

|

|

As at June 30, 2024 |

|

Previously Reported ($) |

|

Adjustment ($) |

|

Restated ($) |

|

|

|

|

|

|

|

|

|

Client cash |

|

- |

|

|

61,472,682 |

|

61,472,682 |

|

|

Total assets |

|

193,484,934 |

|

|

61,472,682 |

|

254,957,616 |

|

|

|

|

|

|

|

|

|

|

Client liabilities |

|

- |

|

|

61,472,682 |

|

61,472,682 |

|

|

Total liabilities |

|

45,500,586 |

|

|

61,472,682 |

|

106,973,268 |

|

|

Total liabilities and shareholders' equity |

|

193,484,934 |

|

|

61,472,682 |

|

254,957,616 |

|

|

|

|

|

|

|

|

|

|

As at September 30, 2024 |

|

Previously Reported ($) |

|

Adjustment ($) |

|

Restated ($) |

|

|

|

|

|

|

|

|

|

Client cash |

|

- |

|

|

67,446,073 |

|

67,446,073 |

|

|

Total assets |

|

195,538,391 |

|

|

67,446,073 |

|

262,984,464 |

|

|

|

|

|

|

|

|

|

|

Client liabilities |

|

- |

|

|

67,446,073 |

|

67,446,073 |

|

|

Total liabilities |

|

46,512,066 |

|

|

67,446,073 |

|

113,958,139 |

|

|

Total liabilities and shareholders' equity |

|

195,538,391 |

|

|

67,446,073 |

|

262,984,464 |

|

|

|

|

|

|

|

|

|

|

Effect on Condensed Consolidated Interim Statements of Cash

Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three month period ended June 30, 2024 |

|

Previously Reported ($) |

|

Adjustment ($) |

|

Restated ($) |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

7,683,278 |

|

|

2,859,508 |

|

10,542,786 |

|

|

Net cash used in investing activities |

|

(6,963,178 |

) |

|

- |

|

(6,963,178 |

) |

|

Net cash used in financing activities |

|

(1,328,262 |

) |

|

- |

|

(1,328,262 |

) |

|

Decrease in cash and cash equivalents and client cash |

|

(608,162 |

) |

|

2,859,508 |

|

2,251,346 |

|

|

|

|

|

|

|

|

|

|

For the three month period ended September 30, 2024 |

|

Previously Reported ($) |

|

Adjustment ($) |

|

Restated ($) |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

4,726,457 |

|

|

5,973,391 |

|

10,699,848 |

|

|

Net cash used in investing activities |

|

(6,793,363 |

) |

|

- |

|

(6,793,363 |

) |

|

Net cash used in financing activities |

|

(1,640,059 |

) |

|

- |

|

(1,640,059 |

) |

|

Decrease in cash and cash equivalents and client cash |

|

(3,706,965 |

) |

|

5,973,391 |

|

2,266,426 |

|

|

|

|

|

|

|

|

|

|

|

|

For the six month period ended September 30, 2024 |

|

Previously Reported ($) |

|

Adjustment ($) |

|

Restated ($) |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

12,409,735 |

|

|

8,832,899 |

|

21,242,634 |

|

|

Net cash used in investing activities |

|

(13,756,541 |

) |

|

- |

|

(13,756,541 |

) |

|

Net cash used in financing activities |

|

(2,968,321 |

) |

|

- |

|

(2,968,321 |

) |

|

Decrease in cash and cash equivalents and client cash |

|

(4,315,127 |

) |

|

8,832,899 |

|

4,517,772 |

|

|

|

|

|

|

|

|

|

About Goldmoney Inc.

Founded in 2001, Goldmoney (TSX:XAU) is a TSX

listed company invested in the real economy. The leading custodians

and traders of precious metals, Goldmoney Inc. also owns and

operates businesses in jewelry manufacturing and property

investment. For more information about Goldmoney,

visit goldmoney.com.

Financial Information and IFRS

Standards

The selected financial information included in

this release is qualified in its entirety by, and should be read

together with, the Company's amended and restated consolidated

financial statements for the fiscal year ended March 31, 2024 and

prepared in accordance with IFRS Accounting Standards ("IFRS") and

the corresponding restated management's discussion and analysis

(“MD&A”), which are available under the Company's profile on

SEDAR+ at www.sedarplus.ca.

Non-IFRS Measures

This news release contains non-IFRS financial

measures; the Company believes that these measures provide

investors with useful supplemental information about the financial

performance of its business, enable comparison of financial results

between periods where certain items may vary independent of

business performance, and allow for greater transparency with

respect to key metrics used by management in operating its

business. Although management believes these financial measures are

important in evaluating the Company's performance, they are not

intended to be considered in isolation or as a substitute for, or

superior to, financial information prepared and presented in

accordance with IFRS. These non-IFRS financial measures do not have

any standardized meaning and may not be comparable with similar

measures used by other companies. For certain non-IFRS financial

measures, there are no directly comparable amounts under IFRS.

These non-IFRS financial measures should not be viewed as

alternatives to measures of financial performance determined in

accordance with IFRS. Moreover, presentation of certain of these

measures is provided for year-over-year comparison purposes, and

investors should be cautioned that the effect of the adjustments

thereto provided herein have an actual effect on the Company's

operating results.

Tangible Capital is a non-IFRS measure. This

figure excludes from total shareholder equity (i) intangibles, and

(ii) goodwill, and is useful to demonstrate the tangible capital

employed by the business.

Non-IFRS Adjusted Net Income is a non-IFRS

measure, defined as total comprehensive income (loss) adjusted for

non-cash and non-core items which include, but is not limited to,

revaluation of precious metal inventories, fair value movements,

stock-based compensation, depreciation and amortization, foreign

exchange fluctuations and gains and losses on investments.

For a full reconciliation of non-IFRS financial

measures used herein to their nearest IFRS equivalents, please see

the section entitled "Reconciliation of Non-IFRS Financial

Measures" in the Company's MD&A for the year ended March 31,

2024.

Media and Investor Relations

inquiries:

Sean TyChief Financial

OfficerGoldmoney Inc.+1 647 250 7098

Forward-Looking Statements

This news release contains or refers to certain

forward-looking information. Forward-looking information can often

be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “plan”, “intend”, “estimate”, “may”,

“potential” and “will” or similar words suggesting future outcomes,

or other expectations, beliefs, plans, objectives, assumptions,

intentions or statements about future events or performance. All

information other than information regarding historical fact, which

addresses activities, events or developments that the Goldmoney

Inc. believes, expects or anticipates will or may occur in the

future, is forward-looking information. Forward-looking information

does not constitute historical fact but reflects the current

expectations the Company regarding future results or events based

on information that is currently available. By their nature,

forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that

contribute to the possibility that the predictions, forecasts,

projections and other forward-looking information will not occur.

Such forward-looking information in this release speak only as of

the date hereof.

Forward-looking information in this release

includes, but is not limited to, statements with respect to:

financial performance and growth of the Company’s business;

expected results of operations, the market for the Company’s

products and services and competitive conditions; the establishment

of a real estate investment strategy and the success of the

Company’s real estate portfolio; the expected value and return on

investment in the Company’s real estate acquisitions, and the

properties described herein (the “Properties”) in particular, the

ability of the current tenants on the Properties to meet their

rental obligations, the future state of the Properties and the

environment surrounding it, the ability of the Company to maintain

and service the indebtedness incurred to acquire the properties,

including any future refinancings, the ability of the Company to

redevelop the properties as anticipated and, in general, return

value from the Properties to shareholders; and the basis for the

Restatement. This forward-looking information is based on

reasonable assumptions and estimates of management of the Company

at the time it was made, and involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking information. Such

factors include, among others: the Company’s operating history;

future capital needs and uncertainty of additional financing;

fluctuations in the market price of the Company’s common shares;

the effect of government regulation and compliance on the Company

and the industry; legal and regulatory change and uncertainty;

jurisdictional factors associated with international operations;

foreign restrictions on the Company’s operations; product

development and rapid technological change; dependence on technical

infrastructure; protection of intellectual property; use and

storage of personal information and compliance with privacy laws;

network security risks; risk of system failure or inadequacy; the

Company’s ability to manage rapid growth; competition; the ability

to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; the ability to identify and complete the

acquisition of suitable real estate investment opportunities on

terms which are economic or at all; the global inflationary

environment and its effect on real estate prices, interest rates,

and the Properties in particular; the ability of the Company to

integrate the Properties into its current operations; the

anticipated value and income growth in connection with the

Properties; the ability to maintain current and procure future

commercial tenants for the Properties; the surrounding environment

and infrastructure of the Properties remaining suitable; the

ability to redevelop the Properties on terms which are economic or

at all; the anticipated variable interest rate for the loan used to

finance the acquisition of the Properties, and the effect on this

interest rate from the SONIA as set by the Bank of England; the

ability to successfully develop and manage the Company’s real

estate portfolio; the risks of concentration of the Company’s real

estate portfolio in the United Kingdom; effectiveness of the

Company’s risk management and internal controls; use of the

Company’s services for improper or illegal purposes; uninsured and

underinsured losses; theft & risk of physical harm to

personnel; precious metal trading risks; and volatility of precious

metals prices & public interest in precious metals investment;

the potential that additional restatements of the financial

statements will be required; the impact on the Company’s reputation

and customer relation in respect of the Restatement; risks

associated with regulatory reviews and investigations; risks that

the Restatement or any future required restatement may negatively

affect the Company’s financial condition or result in additional

liabilities; the potential impact on investor confidence, market

perception, and the Company’s reputation in respect of the

Restatement; risks related to maintaining adequate liquidity and

access to capital while resolving restatement matters; and those

risks set out in the Company’s most recently filed annual

information form, available on SEDAR. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

undertakes no obligation to update or revise any forward-looking

information, except as required by law.

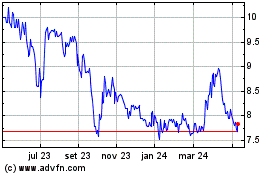

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

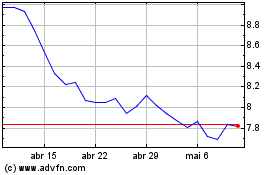

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025