Plug Power Inc. (NASDAQ: PLUG), a global leader in the hydrogen

economy, today provided an update on its strategic and operational

progress and path to profitability. This past year of 2024 marked a

pivotal commercial inflection point for Plug as the Company

advanced its hydrogen generation platform and scaled new product

offerings, such as its electrolyzer solutions.

Commensurate with these strategic initiatives

driving the commercial inflection point, and in response to

evolving market conditions, Plug took decisive steps in 2024 to

improve margins and cash flows by optimizing operations,

streamlining its workforce, consolidating facilities, increasing

pricing on certain offerings, reducing working capital, and

reprioritizing certain hydrogen and new product investments. These

collective strategic actions drove a substantial reduction in cash

burn throughout 2024, with notably strong improvements in the

fourth quarter of 2024.

Despite the significant improvement in cash

burn, the Company determined that the strategic actions to temper

the investment pace on certain platforms, coupled with the fact

that certain markets are developing slower than anticipated,

collectively resulted in accounting conclusions to record varied

non-cash impairments of certain long-lived and intangible

assets.

In addition, given ongoing market conditions and

the Company’s decision to focus more on certain markets and temper

the pace of investments on medium-term opportunities, the Company

has determined it was prudent to take additional measures to

optimize its operational footprint, resources, and ongoing

expenses. The Company is calling these collective measures “Project

Quantum Leap”. These measures are expected to include additional

reductions in the workforce over the coming weeks, furthering its

rooftop facility consolidations, additional reductions in

discretionary spending, additional reduction and leveraging of

inventory, and limiting capital expenditures to near-term critical

requirements. Project Quantum Leap is targeted to reduce annual

expenses in the range of $150 million to $200 million.

We expect that taking these actions will further

improve margins and cash flows, and accelerate the path to

profitability. As Plug continues to drive innovation and expansion

in the hydrogen economy, the Company remains focused on

strengthening its financial foundation and executing its growth

strategy with discipline and efficiency.

Financial Highlights

-

Revenues: In the fourth quarter of 2024, Plug

reported revenue of $191.5 million, reflecting a key commercial

inflection point in electrolyzer deployments, continued expansion

of its hydrogen network, and increased utilization of its

manufacturing footprint. Customer warrant charges for the fourth

quarter of 2024 totaled $22.7 million, an elevated amount driven by

updated forecasts and the timing of customer programs.

-

Liquidity Management: In the fourth quarter of

2024, operating cash flow improved by 25% quarter-over-quarter

(QoQ) and 46% year-over-year (YoY), driven by margin expansion and

increased working capital efficiency. For the full year of 2024,

operating cash flow burn also improved by 34% compared to 2023,

reflecting the Company’s ongoing focus on financial discipline and

operational optimization. In terms of capital expenditures, outlays

were down by 56% quarter-over-quarter (QoQ) and 52% for the full

year of 2024 compared to 2023. This stems from Plug driving key

strategic projects to conclusion and limiting incremental

investments, as the Company focuses on leveraging recently

established platforms to drive cash leverage.

-

Gross Margin Loss: In the fourth quarter of 2024,

Plug reported a gross margin loss of 122%, which included the

impact of non-cash adjustments of approximately $22.7 million in

customer warrant charges and $104.2 million in inventory valuation

adjustments. The inventory valuation adjustments were deemed

necessary given the strategic slowdown of certain market

investments in mobility, high-power stationary applications, and

the development of other products. For the full year of 2024, the

results included an estimated reduced amount of labor, overhead,

and outside services of approximately $42 million (excluding

absorption variation for inventory build/reductions). This stems in

part from targeted cost reduction including labor optimization and

rooftop consolidation. For the full year of 2024, the results also

reflect improvements in contribution margin for service and fuel

given the Company’s focus on price increases, cost downs, and the

leverage of its hydrogen platform buildout. These cost downs were

complemented by additional reductions in operational expenses for

SG&A and R&D driving enhanced overall operational

leverage.

-

Asset Impairment and Bad Debt Charges: Plug

recorded $971.3 million in non-cash charges for varied asset

impairments and bad debt provision in operating expenses in the

fourth quarter of 2024 due to strategic shifts in its business

operations stemming from pushouts of market demand and overall

market dynamics. The impairment charges recorded will reduce the

associated future depreciation and amortization, including an

estimated $55 million to $60 million for 2025. The types of assets

related to the impairment charges recorded in the fourth quarter of

2024 include property plant and equipment, right-of-use assets,

intangible assets, non-marketable equity investments, contract

assets, and assets associated with power purchase agreements and

fuel.

Operational and Strategic

Highlights

-

2024 Electrolyzer Milestone and Strong Basic Engineering

and Design Package (BEDP) Pipeline Supporting Future

Growth: Plug reported another quarter of growth as its

electrolyzer business continues to scale. In the fourth quarter of

2024, electrolyzer revenue increased 583% YoY, driven by the

recognition of revenue from 5-megawatt (MW) system sales and a

large-scale order deployment. During the fourth quarter of 2024,

Plug announced a significant purchase agreement with Allied Green

Ammonia (AGA), under which the Company will supply three gigawatts

(GW) of electrolyzer capacity for AGA’s cutting-edge green

hydrogen-to-ammonia plant in Australia. This agreement further

strengthens Plug’s position for continued growth in 2025 and

beyond. To date, Plug has secured more than 8 GW in global BEDP

contracts, with ongoing progress across its customer base.

-

Hydrogen Production Network and Louisiana Plant

Update: Plug continues to strengthen its hydrogen business

by effectively leveraging its internal network of hydrogen plants.

The Company’s joint venture hydrogen plant with Olin Corporation in

Louisiana is on track for full operation, with final commissioning

nearly complete. This expansion is expected to increase Plug’s

hydrogen nameplate network capacity to over 39 tons per day (TPD),

supporting continued growth in hydrogen sales and margin expansion

through 2025. We believe this expansion will further enhance Plug’s

ability to meet growing customer demand, providing key partners

like Amazon and Walmart with reliable, vertically integrated

hydrogen solutions.

-

Continued Momentum in Material Handling, with Safe Harbor

from Key Customer Demonstrating Ongoing Interest: Plug

anticipates its material handling business to grow approximately

10-20% YoY, driven by increased customer diversification and

ongoing deployments with key pedestal customers. In the fourth

quarter of 2024, a major customer placed an approximate $10 million

order, positioning over $200 million in equipment opportunities by

using this $10 million order to facilitate a safe harbor investment

structure. We believe this development underscores the strong

growth trajectory and expanding market opportunities within the

material handling segment.

-

Liquidity Planning:

- Cash

Management: Plug closed 2024 with over $200 million in unrestricted

cash on its balance sheet as we enter 2025. The improvement in cash

burn in the fourth quarter makes it clear the initiatives in 2024

are significantly reducing cash burn for the Company. Given that

2025 will include a full year of benefits from activities

undertaken in 2024, coupled with incremental benefits from Project

Quantum Leap as outlined above, the cash burn in 2025 is expected

to continue to significantly improve.

-

Investment Tax Credit (ITC) Transfers: Plug is pleased to have

completed the transfer of approximately $30 million in energy

storage ITC related to the hydrogen liquefier at its hydrogen

generation plant in Woodbine, GA. This transaction demonstrates

Plug’s ability to leverage its assets to provide non-dilutive

financing options. The Company plans to leverage a similar strategy

for its Louisiana and Texas hydrogen plants and pursue sales of

various other asset ITC opportunities.

-

Department of Energy (DOE) Loan Update: Plug recently closed the

$1.66 billion DOE Loan Guarantee program. Plug has invested over

$250 million in the project to date. To complete the project, Plug

estimates an additional required investment of approximately $600

million. Of this additional investment, the DOE loan is targeted to

cover approximately $400M. To cover the investment amount outside

the DOE loan, Plug has targeted a process of working with project

finance and potential equity investors. The Company has made

progress aligning with interested parties and anticipates

culminating that process commensurate with kicking off the project

in the coming months. Construction is expected to take

approximately 18 months once its engineering, procurement, and

construction (EPC) contractor is mobilized. This remains an

important project for the future and is expected to benefit the

Company and the U.S. market once completed, but the Company will be

prudent about the timing of mobilizing the project to ensure

third-party funding given this project is not correlated to

near-term sales and margin goals.

CEO Statement

Plug CEO Andy Marsh stated: “2024 was a year of

strong execution and meaningful strategic progress for Plug as we

advanced our initiatives and made strides in driving the hydrogen

economy forward. While we made great strides in improving cash

flows in 2024, it is clear based on market dynamics that we have to

make additional strides, therefore we are initiating Project

Quantum Leap to further position Plug for success in the near and

long term by continuing to leverage the platforms we have built

while further optimizing the Company. Hydrogen plays a crucial role

in energy diversification and contributes to both economic growth

and job creation. Plug has the solutions in place today, and we are

committed to scaling further, ready to support the world’s energy

goals and the increasing demand for reliable and resilient energy

systems."

Conference Call

Plug has scheduled a conference call on March 4,

at 8:30 AM ET to review the Company’s results for the fourth

quarter and full year of 2024. Interested parties are invited to

listen to the conference call by calling 877-407-9221 / +1

201-689-8597.

The webcast can be accessed at:

https://event.webcasts.com/starthere.jsp?ei=1709272&tp_key=dd1df42c9a

A playback of the call will be available online

for a period following the event.

About Plug Power

Plug is building an end-to-end green hydrogen

ecosystem, from production, storage, and delivery to energy

generation, to help its customers meet their business goals and

decarbonize the economy. In creating the first commercially viable

market for hydrogen fuel cell technology, the Company has deployed

more than 72,000 fuel cell systems and over 275 fueling stations,

more than anyone else in the world, and is the largest buyer of

liquid hydrogen.

With plans to operate a green hydrogen highway

across North America and Europe, Plug built a state-of-the-art

Gigafactory to produce electrolyzers and fuel cells and is

developing multiple green hydrogen production plants for commercial

operation. Plug delivers its green hydrogen solutions directly to

its customers and through joint venture partners into multiple

environments, including material handling, e-mobility, power

generation, and industrial applications.

For more information, visit

www.plugpower.com.

Safe Harbor

This communication contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve significant risks and uncertainties

about Plug, including but not limited to statements about Project

Quantum Leap and the anticipated benefits from the implementation

of such initiative, including the anticipated reductions in annual

expenses; Plug’s ability to deliver on its business and strategic

objectives; Plug’s expectations regarding its financial profile and

market outlook, including anticipated improvements to Plug’s path

to profitability, cash generation, estimated reductions in future

depreciation and amortization, and anticipated improvements in

Plug’s cash burn; Plug’s expectations regarding its projects and

products, including its hydrogen production network, Louisiana

hydrogen plant, material handling products, electrolyzer projects

and new products in its energy business, and Plug’s plans regarding

its production plants and the timing of the development and

commercial operation of such plants; and Plug’s expectations

regarding the DOE Loan, including anticipated funding timeline,

anticipated construction timeline and expectations that the DOE

Loan will benefit Plug and the U.S. market in the future.

You are cautioned that such statements should

not be read as a guarantee of future performance or results as such

statements are subject to risks and uncertainties. Actual

performance or results may differ materially from those expressed

in these statements as a result of various factors, including, but

not limited to, the following: the anticipated benefits and actual

savings and costs resulting from the implementation of

cost-reduction measures, including workforce reductions and limits

on discretionary spending, inventory and capital expenditures; the

risk that Plug’s ability to achieve its business objectives and to

continue to meet its obligations is dependent upon its ability to

maintain a certain level of liquidity, which will depend in part on

its ability to manage its cash flows; the risk that the funding of

the DOE Loan may be delayed and the risk that Plug may not be able

to satisfy all of the technical, legal, environmental or financial

conditions acceptable to the Department of Energy to receive the

full DOE Loan; the risk that Plug may continue to incur losses and

might never achieve or maintain profitability; the risk that Plug

may not be able to raise additional capital to continue its

operations and such capital may not be available to Plug on

favorable terms or at all; the risk that Plug may not be able to

expand its business or manage its future growth effectively; the

risk that global economic uncertainty, including inflationary

pressures, fluctuating interest rates, currency fluctuations,

increase in tariffs, and supply chain disruptions, may adversely

affect Plug’s operating results; the risk that Plug may not be able

to obtain from its hydrogen suppliers a sufficient supply of

hydrogen at competitive prices or the risk that Plug may not be

able to produce hydrogen internally at competitive prices; the risk

that delays in or not completing its product and project

development goals may adversely affect its revenue and

profitability; the risk that its estimated future revenue may not

be indicative of actual future revenue or profitability; the risk

of elimination, nonrenewal, reduction of, or changes in qualifying

criteria for government subsidies and economic incentives for

alternative energy products, including the Inflation Reduction Act

and its qualification to utilize the ITC; the risk that volatility

in commodity prices and product shortages may adversely affect

Plug’s gross margins and financial results; and the risk that Plug

may not be able to manufacture and market products on a profitable

and large-scale commercial basis. For a further description of the

risks and uncertainties that could cause actual results to differ

from those expressed in these forward-looking statements, as well

as risks relating to the business of Plug in general, see Plug’s

public filings with the Securities and Exchange Commission,

including the “Risk Factors” section of Plug’s Annual Report on

Form 10-K for the year ended December 31, 2024 as well as

any subsequent filings. Readers are cautioned not to place undue

reliance on these forward-looking statements. The forward-looking

statements are made as of the date hereof and are based on current

expectations, estimates, forecasts and projections as well as the

beliefs and assumptions of management. Plug disclaims any

obligation to update forward-looking statements except as may be

required by law.

Media Contact: Fatimah Nouilati

Plug Power Inc. Email: PlugPR@plugpower.com

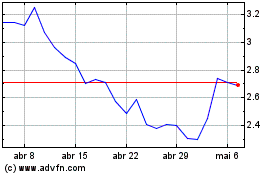

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025