AirSculpt Technologies, Inc. (NASDAQ:AIRS)(“AirSculpt” or the

“Company”), a national provider of premium body contouring

procedures, today announced results for the fourth quarter and

twelve months ended December 31, 2024.

“Following a challenging 2024, I am eager to

help write the next chapter for AirSculpt and focus on setting a

strategy, implementing business processes and developing a culture

that delivers meaningful value for our shareholders,” stated Yogi

Jashnani, Chief Executive Officer. “AirSculpt possesses many

strengths given its proprietary method, its successful track record

of providing more than 70,000 minimally invasive body contouring

procedures and its international footprint with 32 centers in

operation.”

“While we anticipate facing a tough

year-over-year comparison in the first quarter in terms of same

center revenue, I am confident we are developing the right

operating plan and implementing the right actions to improve our

platform and progress toward positive revenue and profit

growth.”

“My number one priority in the year ahead is to

stabilize our same center sales performance, which we aim to

accomplish by: utilizing data to optimize our marketing investment;

improving our go-to-market strategy, implementing more robust

training modules for our sales team; expanding our financing

options for consumers and working on product and sales innovation,”

continued Mr. Jashnani. “We also recognize that transformations

take time, and as such we are taking measures to increase our

liquidity and focus on the areas of our business that offer us the

highest opportunity. In this regard, we have implemented a cost

reduction program that is expected to deliver approximately $3

million in annualized savings, we have paused de novo and new

procedure room openings.”

“While we have experienced an improvement in our

lead generation as we begin 2025, we expect the reduction in our

marketing activity at the end of 2024 to pressure our first quarter

performance. That said, we expect to deliver improving trends

sequentially each quarter as our strategic priorities gain

traction. I believe that AirSculpt is an attractive business with a

competitive moat that is ripe for disruption and that the best

years lie ahead for AirSculpt and its shareholders,” concluded Mr.

Jashnani.

Fourth Quarter 2024 Results

- Case volume

was 3,064 for the fourth quarter of 2024, representing a 16.7%

decline from the fiscal year 2023 fourth quarter case volume of

3,680;

- Revenue

declined 17.7% to $39.2 million from $47.6 million in the fiscal

year 2023 fourth quarter;

- Net loss for

the quarter was $5.0 million compared to net loss of $4.6 million

in the fiscal year 2023 fourth quarter; and

- Adjusted EBITDA

was $1.9 million compared to $10.1 million for the fiscal year 2023

fourth quarter.

Full Year 2024 Results

- Case volume was 14,036, a decline

of 6.0% from the full fiscal year 2023 case volume of 14,932;

- Revenue declined 7.9% to $180.4

million from $195.9 million in the full fiscal year 2023;

- Net loss was $8.3 million compared

to net loss of $4.5 million in the full fiscal year 2023; and

- Adjusted EBITDA was $20.7 million

compared to $43.2 million for the full fiscal year 2023.

Liquidity

As of December 31, 2024, the Company had

$8.2 million in cash and cash equivalents, with no availability on

its revolving credit facility. The Company generated $11.4 million

in operating cash flow for the twelve months ended

December 31, 2024, compared to $24.0 million for the same

period of 2023. The Company was compliant with its bank covenants

at year end and has received additional relief from its lenders

regarding future covenant compliance to enable increased investment

in support of its transformation.

Conference Call Information

AirSculpt will hold a conference call today,

March 14, 2025 at 8:30 am (Eastern Time). The conference call

can be accessed by dialing 1-877-407-9716 (toll-free domestic) or

1-201-493-6779 (international) using the conference ID 13751643 or

by visiting the link below to request a return call for instant

telephone access to the event.

https://callme.viavid.com/viavid/?callme=true&passcode=13725116&h=true&info=company&r=true&B=6

The live webcast may be accessed via the

investor relations section of the AirSculpt Technologies website at

https://investors.airsculpt.com. A replay of the webcast will be

available for approximately 90 days following the call.

To learn more about AirSculpt, please visit the

Company's website at https://investors.airsculpt.com. AirSculpt

uses its website as a channel of distribution for material Company

information. Financial and other material information regarding

AirSculpt is routinely posted on the Company's website and is

readily accessible.

About AirSculpt

AirSculpt is a next-generation body contouring

treatment designed to optimize both comfort and precision,

available exclusively at AirSculpt offices. The minimally invasive

procedure removes fat and tightens skin, while sculpting targeted

areas of the body, allowing for quick healing with minimal

bruising, tighter skin, and precise results.

Forward-Looking Statements

This press release contains forward-looking

statements. In some cases, you can identify these statements by

forward-looking words such as “may,” “might,” “will,” “should,”

“expects,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential” or “continue,” the negative of these terms

and other comparable terminology, but the absence of these words

does not mean that a statement is not forward-looking. These

forward-looking statements, which are subject to risks,

uncertainties, and assumptions about us, may include projections of

our future financial performance, our anticipated growth

strategies, and anticipated trends in our business. These

statements are only predictions based on our current expectations

and projections about future events. You are cautioned that there

are important risks and uncertainties, many of which are beyond our

control, that could cause our actual results, level of activity,

performance, or achievements to differ materially from the

projected results, level of activity, performance or achievements

that are expressed or implied by such forward-looking statements.

We qualify all of our forward-looking statements by these

cautionary statements, including those factors discussed in the

section titled “Risk Factors” in our Annual Report on Form

10-K.

Our future results could be affected by a

variety of other factors, including, but not limited to, failure to

stabilize same-store performance; not being able to optimize our

marketing investment, go-to market strategy and sales process; not

having the ability to expand our financing options for consumers;

being unsuccessful in further product innovations; failure to

operate centers in a cost-effective manner; increased competition

in the weight loss and obesity solutions market, including as a

result of the recent regulatory approval, increased market

acceptance, availability and customer awareness of weight-loss

drugs; shortages or quality control issues with third-party

manufacturers or suppliers; competition for surgeons; litigation or

medical malpractice claims; inability to protect the

confidentiality of our proprietary information; changes in the laws

governing the corporate practice of medicine or fee-splitting;

changes in the regulatory, macroeconomic conditions, including

inflation and the threat of recession, economic and other

conditions of the states and jurisdictions where our facilities are

located; and business disruption or other losses from natural

disasters, war, pandemic, terrorist acts or political unrest.

The risk factors discussed in “Item 1A. Risk

Factors” in our Annual Report on Form 10-K and in other filings we

make from time to time with the SEC could cause our results to

differ materially from those expressed in the forward-looking

statements made in this press release.

There also may be other risks and uncertainties

that are currently unknown to us or that we are unable to predict

at this time.

Although we believe the expectations reflected

in the forward-looking statements are reasonable, we cannot

guarantee future results, level of activity, performance, or

achievements. Moreover, neither we nor any other person assumes

responsibility for the accuracy and completeness of any of these

forward-looking statements. Forward-looking statements represent

our estimates and assumptions only as of the date they were made,

which are inherently subject to change, and we are under no duty

and we assume no obligation to update any of these forward-looking

statements, or to update the reasons actual results could differ

materially from those anticipated after the date of this press

release to conform our prior statements to actual results or

revised expectations, except as required by law. Given these

uncertainties, investors should not place undue reliance on these

forward-looking statements.

Use of Non-GAAP Financial Measures

The Company reports financial results in

accordance with generally accepted accounting principles in the

United States (“GAAP”), however, the Company believes the

evaluation of ongoing operating results may be enhanced by a

presentation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Net Income and Adjusted Net Income per Share, which are non-GAAP

financial measures. Although the Company provides guidance for

Adjusted EBITDA, it is not able to provide guidance for net income,

the most directly comparable GAAP measure. Certain elements of the

composition of net income, including equity-based compensation, are

not predictable, making it impractical for us to provide guidance

on net income or to reconcile our Adjusted EBITDA guidance to net

income without unreasonable efforts. For the same reasons, the

Company is unable to address the probable significance of the

unavailable information regarding net income, which could be

material to future results.

These non-GAAP financial measures are not

intended to replace financial performance measures determined in

accordance with GAAP. Rather, they are presented as supplemental

measures of the Company's performance that management believes may

enhance the evaluation of the Company's ongoing operating results.

These non-GAAP financial measures are not presented in accordance

with GAAP, and the Company’s computation of these non-GAAP

financial measures may vary from similar measures used by other

companies. These measures have limitations as an analytical tool

and should not be considered in isolation or as a substitute or

alternative to revenue, net income, operating income, cash flows

from operating activities, total indebtedness or any other measures

of operating performance, liquidity or indebtedness derived in

accordance with GAAP.

|

AirSculpt Technologies, Inc. and

SubsidiariesSelected Consolidated Financial

Data (Dollars in thousands, except shares and per

share amounts) |

|

|

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

39,178 |

|

|

$ |

47,608 |

|

|

$ |

180,350 |

|

|

$ |

195,917 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of service |

|

16,747 |

|

|

|

17,868 |

|

|

|

71,382 |

|

|

|

74,012 |

|

|

Selling, general and administrative(1) |

|

23,355 |

|

|

|

25,576 |

|

|

|

98,880 |

|

|

|

102,381 |

|

|

Depreciation and amortization |

|

3,195 |

|

|

|

2,774 |

|

|

|

11,888 |

|

|

|

10,253 |

|

|

Loss/(gain) on disposal of long-lived assets |

|

12 |

|

|

|

(14 |

) |

|

|

16 |

|

|

|

(212 |

) |

|

Total operating expenses |

|

43,309 |

|

|

|

46,204 |

|

|

|

182,166 |

|

|

|

186,434 |

|

|

(Loss)/income from operations |

|

(4,131 |

) |

|

|

1,404 |

|

|

|

(1,816 |

) |

|

|

9,483 |

|

| Interest expense, net |

|

1,609 |

|

|

|

1,023 |

|

|

|

6,247 |

|

|

|

6,485 |

|

|

Pre-tax net (loss)/income |

|

(5,740 |

) |

|

|

381 |

|

|

|

(8,063 |

) |

|

|

2,998 |

|

| Income tax

(benefit)/expense |

|

(706 |

) |

|

|

4,955 |

|

|

|

188 |

|

|

|

7,477 |

|

|

Net loss |

$ |

(5,034 |

) |

|

$ |

(4,574 |

) |

|

$ |

(8,251 |

) |

|

$ |

(4,479 |

) |

| |

|

|

|

|

|

|

|

| Loss per share of common

stock |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.09 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.08 |

) |

|

Diluted |

$ |

(0.09 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.08 |

) |

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

|

58,121,431 |

|

|

|

57,132,355 |

|

|

|

57,688,906 |

|

|

|

56,778,793 |

|

|

Diluted |

|

58,121,431 |

|

|

|

57,132,355 |

|

|

|

57,688,906 |

|

|

|

56,778,793 |

|

|

(1) |

During the first quarter of fiscal year 2024, the Company recorded

a cumulative reversal of stock compensation expense of $10.4

million related to reassessing the probability of achieving the

performance target on certain of the Company's performance-based

stock units. For further discussion, see Note 6 to the consolidated

financial statements included in the Company's Annual Report on

Form 10-K for the year ended December 31, 2024. |

| |

|

|

AirSculpt Technologies, Inc. and

SubsidiariesSelected Financial and Operating

Data(Dollars in thousands, except per case

amounts) |

|

|

| |

December 31,2024 |

|

December 31, 2023 |

| Balance Sheet Data (at

period end): |

|

|

|

|

Cash and cash equivalents |

$ |

8,235 |

|

$ |

10,262 |

| Total current assets |

|

17,117 |

|

|

15,961 |

| Total assets |

$ |

209,996 |

|

$ |

204,019 |

| |

|

|

|

| Current portion of long-term

debt |

$ |

4,250 |

|

$ |

2,125 |

| Deferred revenue and patient

deposits |

|

1,169 |

|

|

1,463 |

| Total current liabilities |

|

28,609 |

|

|

20,315 |

| Long-term debt, net |

|

65,456 |

|

|

69,503 |

| Revolving credit funds

payable |

|

5,000 |

|

|

— |

| Total liabilities |

$ |

130,706 |

|

$ |

120,027 |

| |

|

|

|

| Total stockholders’

equity |

$ |

79,290 |

|

$ |

83,992 |

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash Flow

Data: |

|

|

|

|

|

|

|

| Net cash provided by (used

in): |

|

|

|

|

|

|

|

| Operating activities |

$ |

2,713 |

|

|

$ |

4,866 |

|

|

$ |

11,350 |

|

|

$ |

23,956 |

|

| Investing activities |

|

(3,528 |

) |

|

|

(1,827 |

) |

|

|

(14,007 |

) |

|

|

(9,919 |

) |

| Financing activities |

|

3,078 |

|

|

|

(1,437 |

) |

|

|

630 |

|

|

|

(13,391 |

) |

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Other

Data: |

|

|

|

|

|

|

|

| Number of facilities |

|

32 |

|

|

|

27 |

|

|

|

32 |

|

|

|

27 |

|

| Number of total procedure

rooms |

|

67 |

|

|

|

57 |

|

|

|

67 |

|

|

|

57 |

|

| |

|

|

|

|

|

|

|

| Cases |

|

3,064 |

|

|

|

3,680 |

|

|

|

14,036 |

|

|

|

14,932 |

|

| Revenue per case |

$ |

12,787 |

|

|

$ |

12,937 |

|

|

$ |

12,849 |

|

|

$ |

13,121 |

|

| Adjusted EBITDA (1) (3) |

$ |

1,855 |

|

|

$ |

10,093 |

|

|

$ |

20,726 |

|

|

$ |

43,236 |

|

| Adjusted EBITDA margin

(2) |

|

4.7 |

% |

|

|

21.2 |

% |

|

|

11.5 |

% |

|

|

22.1 |

% |

|

(1) A reconciliation of this non-GAAP financial measure appears

below. |

|

(2) Defined as Adjusted EBITDA as a percentage of revenue. |

|

(3) For the three months ended December 31, 2024 and

2023, pre-opening de novo and relocation costs were $0.1 million

and $0.1 million, respectively. For the twelve months ended

December 31, 2024 and 2023, pre-opening de novo and relocation

costs were $1.0 million and $3.3 million, respectively. |

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| Same-center

Information (1): |

|

|

|

|

|

|

|

| Cases |

|

2,879 |

|

|

3,680 |

|

|

12,892 |

|

|

14,932 |

| Case growth |

(21.8)% |

|

N/A |

|

(13.7)% |

|

N/A |

| Revenue per case |

$ |

12,797 |

|

$ |

12,937 |

|

$ |

12,801 |

|

$ |

13,121 |

| Revenue per case growth |

(1.1)% |

|

N/A |

|

(2.4)% |

|

N/A |

| Number of facilities |

|

27 |

|

|

27 |

|

|

27 |

|

|

27 |

| Number of total procedure

rooms |

|

57 |

|

|

57 |

|

|

57 |

|

|

57 |

|

(1) |

For the three months ended December 31, 2024 and 2023, we

define same-center case and revenue growth as the growth in each of

our cases and revenue at facilities that were owned and operated

during the three months ended December 31, 2024 and 2023,

respectively. At facilities that were not owned or operated for the

entirety of the prior year period, the current year period has been

pro-rated to reflect only growth experienced during the portion of

the three months ended December 31, 2024 in which such

facilities were owned and operated during the three months ended

December 31, 2023. We define same-center facilities and

procedure rooms based on if a facility was owned or operated as of

December 31, 2023. |

|

|

For the twelve months ended December 31, 2024 and 2023,

we define same-center case and revenue growth as the growth in each

of our cases and revenue at facilities that were owned and operated

during the twelve months ended December 31, 2024 and 2023,

respectively. At facilities that were not owned or operated for the

entirety of the prior year period, the current year period has been

pro-rated to reflect only growth experienced during the portion of

the twelve months ended December 31, 2024 in which such

facilities were owned and operated during the twelve months ended

December 31, 2023. We define same-center facilities and

procedure rooms based on if a facility was owned or operated as of

December 31, 2023. |

|

|

|

AirSculpt Technologies, Inc. and

SubsidiariesReconciliation of Non-GAAP Financial

Measures(Dollars in thousands)

We report our financial results in accordance

with GAAP, however, management believes the evaluation of our

ongoing operating results may be enhanced by a presentation of

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and

Adjusted Net Income per Share, which are non-GAAP financial

measures.

We define Adjusted EBITDA as net loss excluding

depreciation and amortization, net interest expense, income tax

(benefit)/expense, restructuring and related severance costs,

loss/(gain) on disposal of long-lived assets, settlement costs for

non-recurring litigation, and equity-based compensation.

We define Adjusted Net Income as net loss

excluding restructuring and related severance costs, loss/(gain) on

disposal of long-lived assets, settlement costs for non-recurring

litigation, equity-based compensation and the tax effect of these

adjustments.

We include Adjusted EBITDA and Adjusted Net

Income because they are important measures on which our management

assesses and believes investors should assess our operating

performance. We consider Adjusted EBITDA and Adjusted Net Income

each to be an important measure because they help illustrate

underlying trends in our business and our historical operating

performance on a more consistent basis. Adjusted EBITDA has

limitations as an analytical tool including: (i) Adjusted

EBITDA does not include results from equity-based compensation and

(ii) Adjusted EBITDA does not reflect interest expense on our

debt or the cash requirements necessary to service interest or

principal payments. Adjusted Net Income has limitations as an

analytical tool because it does not include results from

equity-based compensation.

We define Adjusted EBITDA Margin as Adjusted

EBITDA as a percentage of revenue. We define Adjusted Net Income

per Share as Adjusted Net Income divided by weighted average basic

and diluted shares. We included Adjusted EBITDA Margin and Adjusted

Net Income per Share because they are important measures on which

our management assesses and believes investors should assess our

operating performance. We consider Adjusted EBITDA Margin and

Adjusted Net Income per Share to be important measures because they

help illustrate underlying trends in our business and our

historical operating performance on a more consistent basis.

The following table reconciles Adjusted EBITDA

and Adjusted EBITDA Margin to net (loss)/income, the most directly

comparable GAAP financial measure:

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

$ |

(5,034 |

) |

|

$ |

(4,574 |

) |

|

$ |

(8,251 |

) |

|

$ |

(4,479 |

) |

|

Plus |

|

|

|

|

|

|

|

|

Equity-based compensation(1) |

|

2,240 |

|

|

|

4,741 |

|

|

|

3,762 |

|

|

|

18,224 |

|

|

Restructuring and related severance costs |

|

539 |

|

|

|

1,188 |

|

|

|

6,026 |

|

|

|

5,488 |

|

|

Depreciation and amortization |

|

3,195 |

|

|

|

2,774 |

|

|

|

11,888 |

|

|

|

10,253 |

|

|

Loss/(gain) on disposal of long-lived assets |

|

12 |

|

|

|

(14 |

) |

|

|

16 |

|

|

|

(212 |

) |

|

Litigation settlements(2) |

|

— |

|

|

|

— |

|

|

|

850 |

|

|

|

— |

|

|

Interest expense, net |

|

1,609 |

|

|

|

1,023 |

|

|

|

6,247 |

|

|

|

6,485 |

|

|

Income tax (benefit)/expense |

|

(706 |

) |

|

|

4,955 |

|

|

|

188 |

|

|

|

7,477 |

|

| Adjusted

EBITDA |

$ |

1,855 |

|

|

$ |

10,093 |

|

|

$ |

20,726 |

|

|

$ |

43,236 |

|

| Adjusted EBITDA

Margin |

|

4.7 |

% |

|

|

21.2 |

% |

|

|

11.5 |

% |

|

|

22.1 |

% |

|

(1) |

As of the twelve months ended December 31, 2024, this amount

contains a cumulative reversal of stock compensation expense of

$10.4 million related to reassessing the probability of achieving

the performance target on certain of the Company's

performance-based stock units. For further discussion, see Note 6

to the consolidated financial statements included in the Company's

Annual Report on Form 10-K for the year ended December 31,

2024. |

| (2) |

This amount relates to settlement costs for non-recurring

litigation of $0.9 million for the twelve months ended December 31,

2024. |

| |

|

For the three months ended

December 31, 2024 and 2023, pre-opening de novo and relocation

costs were $0.1 million and $0.1 million, respectively. For the

twelve months ended December 31, 2024 and 2023, pre-opening de

novo and relocation costs were $1.0 million and $3.3 million,

respectively.

The following table reconciles Adjusted Net

Income and Adjusted Net Income per Share to net income/(loss), the

most directly comparable GAAP financial measure:

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss |

$ |

(5,034 |

) |

|

$ |

(4,574 |

) |

|

$ |

(8,251 |

) |

|

$ |

(4,479 |

) |

| Plus |

|

|

|

|

|

|

|

|

Equity-based compensation(1) |

|

2,240 |

|

|

|

4,741 |

|

|

|

3,762 |

|

|

|

18,224 |

|

|

Restructuring and related severance costs |

|

539 |

|

|

|

1,188 |

|

|

|

6,026 |

|

|

|

5,488 |

|

|

Loss/(gain) on disposal of long-lived assets |

|

12 |

|

|

|

(14 |

) |

|

|

16 |

|

|

|

(212 |

) |

|

Litigation settlements |

|

— |

|

|

|

— |

|

|

|

850 |

|

|

|

— |

|

|

Tax effect of adjustments |

|

(2,267 |

) |

|

|

(653 |

) |

|

|

(1,271 |

) |

|

|

(2,732 |

) |

| Adjusted net

(loss)/income |

$ |

(4,510 |

) |

|

$ |

688 |

|

|

$ |

1,132 |

|

|

$ |

16,289 |

|

| |

|

|

|

|

|

|

|

| Adjusted net (loss)/income per

share of common stock (2) |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.08 |

) |

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.29 |

|

|

Diluted |

$ |

(0.08 |

) |

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.28 |

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

|

58,121,431 |

|

|

|

57,132,355 |

|

|

|

57,688,906 |

|

|

|

56,778,793 |

|

|

Diluted |

|

58,121,431 |

|

|

|

58,134,210 |

|

|

|

58,281,133 |

|

|

|

57,611,469 |

|

|

(1) |

During the first quarter of fiscal year 2024, the Company recorded

a cumulative reversal of stock compensation expense of $10.4

million related to reassessing the probability of achieving the

performance target on certain of the Company's performance-based

stock units. For further discussion, see Note 6 to the consolidated

financial statements included in the Company's Annual Report on

Form 10-K for the year ended December 31, 2024. |

| (2) |

Diluted Adjusted Net Income Per Share is computed by dividing

adjusted net income by the weighted-average number of shares of

common stock outstanding adjusted for the dilutive effect of all

potential shares of common stock. |

| |

|

Investor ContactAllison

MalkinICR, Inc.airsculpt@icrinc.com

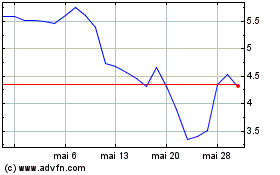

AirSculpt Technologies (NASDAQ:AIRS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

AirSculpt Technologies (NASDAQ:AIRS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025