US Index Futures rose in premarket trading on Friday after last

night’s earnings and on the lookout for indicators. European

markets operate without a defined direction reflecting the most

recent releases of GDPs in the region, and with an eye on the

economic policy of the Bank of Japan.

By 7:08 AM, Dow Jones (DOWI:DJI) futures were up 74 points,

or 0.21%. S&P 500 futures were up 0.42%, while Nasdaq-100

futures were up 0.82%. The 10-year Treasury yield was at

3.961%.

Germany’s second-quarter GDP was stable, frustrating the

consensus that expected growth of 0.10%. In Spain and France,

however, activity advanced, but brought mixed feelings. In the

first, the high was 0.40%, but the expectation was higher,

0.60%. In the second, the expectation of 0.10% was surpassed,

with an increase of 0.40% of GDP. Finally, consumer confidence

in the euro zone remains negative at -15.10, in line with market

expectations.

Over there, investors are still waiting for the release, at 8:00

am, of the German consumer price index. The market consensus

projects a variation of 0.30% in the monthly data for July.

In Asia, the markets closed the trading session this Friday in a

fall, reverberating from the decision of the Bank of Japan to

maintain the economy’s basic interest at -0.10%. On the other

hand, the BOJ made adjustments in the way it controls its forward

yield curve, the so-called Yield Curve Control.

On Friday’s American economic agenda, investors will follow at

8:30 am the release of data on personal income and personal

expenses for June, which have a consensus of 0.50% and 0.40%, in

that order. In addition, investors will get to know the June

inflation data, as well as the cost of labor. At 10:00 am, the

Michigan consumer confidence for July will be released, which has a

consensus of 72.6 points.

In commodities markets, West Texas Intermediate crude for

September is down 0.32% at $79.83 a barrel. Brent crude for

September is down -0.42% near $83.89 a barrel. Iron ore

futures traded in Dalian, China, fell 2.68%, at US$ 116.52 per

tonne, on doubts about new Chinese stimuli in the economy.

At Thursday’s close, the Dow Jones was down 237.40 points, or

0.67%, to 35,282.72 points, ending a 13-day winning

streak. The S&P 500 fell 29.34 points, or 0.64%, to

4,537.41 points. The Nasdaq Composite dropped 77.17 points or

0.55% to 14,050.11 points. The American market had a day of

losses after the Fed announced financial stabilization measures

that generate greater restrictions on large banks. Earlier,

the GDP data for the second quarter showed annual growth of 2.4%,

above estimates of 1.8% growth. Virtually all components came

in with stronger numbers than expected. However, it was

private sector investment that led the rise. The stronger data

revealed a greater chance that the Fed will have to raise interest

rates again, if inflation does not help.

Treasury yields rose yesterday. Regarding the Fed’s

decision, the measure brings greater capital requirements on the

part of banks, especially among the large ones. This generated

some criticism among Wall Street bankers, since, according to them,

there was no need for such a restrictive capital

requirement. Finally, in Europe, the ECB raised interest rates

by 0.25 pp, in line with forecasts, but signaled that it might rise

again in the next meetings. Meanwhile, the Nasdaq 100 index

performed slightly better, following a positive result released by

Meta.

Ahead of Friday’s corporate results, traders await reports from

Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX), AstraZeneca

(NASDAQ:AZN), Procter & Gamble (NYSE:PG), Colgate-Palmolive

(NYSE:CL), Charter Communications (NASDAQ:CHTR), Centene

(NYSE:CNC), Newell Brands (NASDAQ:NWL), among others.

Wall Street Corporate Highlights for Today

Meta Platforms (NASDAQ:META) – Meta

Platforms executives focus on Threads retention after losing more

than half of users. Zuckerberg highlights growing retention,

seeks to add features and invest in the metaverse to compete with

Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL) and Microsoft

(NASDAQ:MSFT). The artificial intelligence model called Llama

2 has received more than 150,000 download requests in the week

since its launch. The Reels Meta app has been growing rapidly

in both users and advertisers, catching up with TikTok in daily

video views. The annual revenue rate reached US$10

billion. While Reels attracts advertisers with ease of use,

TikTok leads in time spent per user.

Microsoft (NASDAQ:MSFT) – The European

Union has launched an antitrust investigation against Microsoft

over its bundling of Teams with Office, risking a hefty

fine. The company has accumulated 2.2 billion euros in

antitrust fines previously. The European Commission accuses

Microsoft of abusing and restricting competition in the market for

communication and collaboration products. Microsoft must

cooperate to find solutions to the Commission’s concerns.

Advanced Micro Devices (NASDAQ:AMD) –

Advanced Micro Devices has announced an investment of around US$400

million in India over the next five years to build its largest

design center in Bengaluru. The new 500,000 square foot campus

will create 3,000 new engineering roles, bolstering the Indian chip

industry.

American Airlines (NASDAQ:AAL) – The

American Airlines pilots union has reached an agreement in

principle with the airline on improvements to a new employment

contract, aligning with earnings for United Airlines pilots

(NASDAQ:UAL). The deal needs board approval and will be voted

on in August.

Toyota Motor (NYSE:TM) – Toyota has

announced that it will sell about $1.80 billion of its stake in

KDDI Corp to accelerate vehicle electrification. The automaker

is seeking funds for its plans to develop future electric vehicles

with greater autonomy and cost reduction. The sale will reduce

Toyota’s stake in KDDI from 14.68% to 11.71%, ending a longstanding

partnership.

General Motors (NYSE:GM) – GM has warned

that changes to vehicle emissions rules proposed by the Biden

administration could lead to hundreds of billions of dollars in

fines for the auto industry by 2031. The Biden administration

disputed that estimate, stating that it is pure speculation and

inaccurate. The National Highway Traffic Safety Administration

will release its proposal to increase Corporate Average Fuel

Economy (CAFE) requirements on Friday. GM said it intends to

increase technical dialogue with the EPA and the White House to

resolve compliance issues.

TotalEnergies (NYSE:TTE) – TotalEnergies

does not believe it overpaid for seabed leasing in Germany, despite

criticism from the industry. CEO Patrick Pouyanne said they

are in line with their goals and confident in electricity prices in

Germany by 2030. The company won the bid along with

BP (NYSE:BP), while Orsted withdrew due to price

concerns. The initial amount paid was 582 million euros.

First Solar (NASDAQ:FSLR) – First Solar

plans to invest up to $1.1 billion in a new U.S. factory, driven by

the Biden Inflation Reduction Act. The plant will produce 3.5

gigawatts of solar power per year starting in 2026. With tax

breaks, the company has committed $2.8 billion to expand production

in the country, reaching 14 gigawatts annually in the US and 25

gigawatts globally. President Biden hailed the investment as a

boost to domestic manufacturing and building domestic supply

chains.

Tupperware (NYSE:TUP) – Shares in

Tupperware, a maker of home and kitchen products, have seen

surprising and unexplained gains, rising more than 50% and nearly

350% in the past five days. This comes despite recent concerns

about its business, including poor sales and misstatements in past

financial reports. The stock is still down about 28%

year-to-date.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens Chief Financial Officer James Kehoe will step down in

mid-August to pursue opportunities in the technology

sector. The company has named Manmohan Mahajan as interim head

of global finance as it seeks to fill the role. Walgreens has

been looking to expand beyond its core business with acquisitions

of health services companies. To regain market share lost

during the pandemic, the company plans to close the wage gap and

increase automation in call centers by the end of fiscal 2023.

GameStop (NYSE:GME) – GameStop CFO Diana

Saadeh-Jajeh will resign on Aug. 11, resulting in the second major

departure in two months. Shares are down -0.5%

premarket. The company has struggled to implement Chief

Executive Ryan Cohen’s vision of becoming a leader in e-commerce

for video games and related products. Since the peak of meme

stocks in 2021, the company’s stock has dropped about 82%.

AMC Entertainment (NYSE:AMC) – A federal

lawsuit accuses AMC of illegally sharing customer information

with Facebook (NASDAQ:META) whenever

customers purchase tickets on the AMC website. The lawsuit

alleges violation of the Video Privacy Protection Act.

Overstock (NASDAQ:OSTK) – Shares in

Overstock.com rose 1.9% in premarket trading on Friday after

reporting a smaller-than-expected loss and positive indications on

the move to the Bed Bath & Beyond brand. CEO Jonathan

Johnson expects long-term growth with the acquisition and

rebranding of the company, already successful in Canada.

UBS Group (NYSE:UBS) – UBS

reorganized its equity leadership in Singapore following the

acquisition of Credit Suisse. Senior banker Jacky Ang will

leave to pursue other interests, and Alain Bernasconi will take

over as manager of the Singapore branch, subject to regulatory

approvals. The restructuring accompanies the administrative

changes resulting from the mega merger in Asia. Dominique Boer

will now oversee Credit Suisse’s wealth management business in the

city-state. David Leung will take over as Senior Corporate

Director at another entity in Singapore.

Bank of America (NYSE:BAC) – Brian

Moynihan, CEO of Bank of America, warned of careful implementation

of new Basel III capital requirements to prevent US banks from

losing global competitiveness. He stressed the importance of

leveling the playing field for smaller banks. Bank of America

expects a “mild” recession next year and predicts the first

interest rate cut will come in mid-2024. In other news, Bank of

America warns of frenzy in artificial intelligence (AI) stocks,

calling it a “baby bubble”. Strategists recommend assets such

as emerging markets and commodities for summer bets, while they

point to technology and credit as “fall negative games”.

Citigroup (NYSE:C) – Citigroup has

informed UK employees that it will monitor office attendance to

assess the effectiveness of the hybrid working policy. Data

will be used for disciplinary actions against consistent absences,

from bonus adjustments to terminations. Most of the bank’s

approximately 240,000 employees are considered hybrids, but Wall

Street has taken a stricter approach to remote

work. Monitoring will begin in August.

Dime Community Bancshares (NASDAQ:DCOM) –

Stuart Lubow has been named to succeed Kevin O’Connor at the helm

of Dime Community Bancshares, a banking company in Hauppauge, New

York. O’Connor, CEO since the 2021 merger with Bridge Bancorp,

will step down on August 31. Lubow, current president and COO,

will take over as CEO on the same date, and will also join the

board. O’Connor will remain as director until the end of the

year.

Unilever (NYSE:UL) – Unilever has

announced the appointment of Ian Meakins as its designated

President, succeeding Nils Andersen. Meakins will take up the

role on December 1, bringing successful experience in a variety of

executive and non-executive roles at a variety of companies,

including Diageo (NYSE:DEO), Bain & Company and Procter &

Gamble (NYSE:PG). Andersen will leave the board in May

2024.

McDonald’s (NYSE:MCD), Domino’s (NYSE:DPZ), Chipotle (NYSE:CMG)

– Major U.S. restaurant chains saw profit margins driven by lower

costs for ingredients like chicken, cheese and

avocado. Wholesale prices have dropped in recent months,

allowing fast-food chains to consider lowering menu prices later

this year.

Earnings

AstraZeneca (NASDAQ:AZN) – AstraZeneca

posted better-than-expected Q2 earnings and sales, driven by

performance in cancer drugs, despite declining sales of Covid-19

vaccines. The drugmaker reported adjusted earnings of $2.15

per share, up 25%, on revenue of $11.4 billion, up

6%. Analysts had expected EPS of $1.98 on revenue of $10.97

billion. Shares were up 4.5% in premarket trading on

Friday. The company anticipates growth in China and plans to

file data with the US regulator for its experimental drug. The

Alexion unit has acquired a Pfizer (NYSE:PFE) gene

therapy portfolio for up to $1 billion, plus royalties.

Sanofi (NASDAQ:SNY) – French drugmaker

Sanofi has raised its full-year profit forecast, boosted by sales

of Dupixent treatment and new drug launches. The outlook

includes expected one-time revenues from Covid-19 vaccines in the

second half. Dupixent drug revenue increased by

34%. Sanofi posted second-quarter earnings of $1.56 billion,

or 63 cents a share. Revenue of $10.85 billion missed

forecasts of $11.47 billion.

Intel (NASDAQ:INTC) – Shares of Intel are

up 6.9% in premarket trading on Friday, boosted by investor

celebrations at the return to profitability and bullish

outlook. Intel forecast third-quarter adjusted earnings of 20

cents a share, beating Refinitiv’s estimates of 16 cents a

share. Intel posted EPS of 13 cents on revenue of 12.9 billion

in the second quarter. Analysts had expected a loss of 3 cents

on revenue of 12.13 billion.

Harley-Davidson (NYSE:HOG) –

Harley-Davidson saw an 18% drop in second-quarter profit, below

Wall Street expectations, due to slowing demand in North

America. The company revised its annual revenue target and

forecast steady sales growth. Stocks are stable in premarket

trading. Production was temporarily halted due to a lack of

parts. Chief Executive Jochen Zeitz cited tighter consumer

credit and price increases as factors impacting demand. Net

income fell to $178 million, or $1.22 a share, missing analysts’

forecasts of $1.25 a share. Motorcycle and related product

revenue reached $1.2 billion, down 4% year-over-year.

Ford Motor (NYSE:F) – Ford posted a

premarket decline of 2% although it raised its full-year forecast

and beat second-quarter expectations. The company reported

adjusted earnings of 72 cents per share on $42.43 billion in

revenue, beating Refinitiv analysts’ estimates of 55 cents per

share and $40.38 billion in revenue. Ford Chief Executive Jim

Farley outlined a significant shift in the automaker’s product

strategy, focusing on gas-electric hybrids and high-margin Ford Pro

commercial vehicles.

Enphase Energy (NASDAQ:ENPH) – Enphase

shares were down 14.3% in premarket Friday after the mixed

financial report. The company reported adjusted earnings of

$1.47 per share, beating Refinitiv analysts’ estimates of $1.25 per

share. However, revenue of $711 million was short of the

consensus estimate by $11 million.

First Solar (NASDAQ:FSLR) – Shares in the

solar energy company rose 9.0% in premarket trading on Friday after

beating Wall Street expectations for the second quarter. First

Solar reported earnings of $1.59 per share and revenue of $811

million, beating forecasts by Refinitiv analysts, who had expected

a gain of 96 cents per share on revenue of $721 million.

T-Mobile (NASDAQ:TMUS) – Shares were down

0.5% premarket due to a mixed second-quarter earnings

report. T-Mobile posted earnings of $1.86 per share, beating

the analysts’ consensus estimate of $1.69, according to

Refinitiv. However, revenue was below expectations, with

T-Mobile reporting $19.2 billion while Wall Street forecast $19.31

billion.

Roku (NASDAQ:ROKU) – Shares of the

streamer were up 9.2% premarket after surprising quarterly

report. The company lost 76 cents a share for the second

quarter, less than the consensus estimate of $1.26 by

Refinitiv. Roku’s revenue also beat expectations, totaling

$847 million against the forecast of $775 million.

Dexcom (NASDAQ:DXCM) – Shares in the

medical device company rose 3.3% in premarket trading on Friday

after delivering better-than-expected quarterly earnings and future

prospects on Wall Street. The company reported earnings of 34

cents per share, excluding items, on revenue of $871.3

million. Analysts polled by FactSet were expecting 23 cents a

share and revenue of $841.2 million. Dexcom raised its

full-year revenue forecast to a range of $3.5 billion to $3.55

billion, while the average analyst estimate was $3.5 billion.

Boston Beer (NYSE:SAM) – Stocks were flat

premarket after the spirits company reaffirmed its full-year

outlook and delivered a robust quarterly report. Boston Beer

posted earnings of $4.72 per share and revenue of $603 million,

beating analysts polled by Refinitiv who were expecting $3.43 per

share and $593 million in revenue.

Mastercard (NYSE:MA) – Mastercard posted

better-than-expected second-quarter earnings, buoyed by robust

spending that brought the payments company back to growth after a

lukewarm start to the year. Customers returned to spending on

travel and entertainment, even as interest rates

rose. Adjusted profit was $2.7 billion, up 10%

year-over-year. Earnings per share of $2.89 also beat

estimates. Gross dollar volumes increased 12% to $2.3

trillion, while international volumes increased 24%. Net

revenue grew 14% to $6.3 billion.

Mondelez International (NASDAQ:MDLZ)

– Mondelez International has raised its full-year growth forecasts

after strong demand for its snacks and chocolates despite price

increases. The company reported revenue growth in all regions,

highlighting its strong performance in China. However, it

faced volume declines in Europe as it closed price talks with

retailers. Mondelez now expects adjusted earnings per share

growth of more than 12% for the full year. It also sold its

stake in Keurig Dr Pepper (NASDAQ:KDP) for $704 million. In

the second quarter EPS was $0.76, $0.07 better than the analyst

estimate of $0.69. Revenue for the quarter came in at $8.5

billion, versus the consensus estimate of $8.22 billion.

Southwest Airlines (NYSE:LUV) – The

outlook for the current quarter and full year disappointed

investors, raising concerns about domestic travel

demand. Revenue per available seat mile (RASM) is expected to

decline as much as 7% in the September quarter. The company is

facing ever-changing travel patterns and plans to adjust flight

frequency to adapt to the changes. Second-quarter adjusted

earnings were $1.09 per share, below analysts’ estimates of

$1.10.

Sweetgreen (NYSE:SG) – The salad

restaurant chain was down 10.7% in premarket trading on Friday

after missing second-quarter revenue expectations. The company

reported revenue of $153 million, while analysts polled by

Refinitiv had forecast $157 million.

S&P Global (NYSE:SPGI) – S&P

Global missed second-quarter earnings estimates due to weakness in

its index and commodity insights units, despite gains in its market

intelligence business. Market intelligence segment revenues

increased 5%, driving total revenue to $3.1 billion. The

company recently completed the divestment of its Engineering

Solutions business

to KKR (NYSE:KKR).

Teck Resources (NYSE:TECK) – Teck

Resources is considering several proposals, including the partial

sale of its coal business, after Glencore offered up to US$8.2

billion for the unit. The company is betting on its limited

coking coal mines to ensure a better valuation. The company

missed second-quarter profit estimates and lowered its full-year

copper production outlook. Glencore’s offer initially to

acquire all of Teck Resources was rejected, but they came back with

an offer to buy just Teck’s coal business.

Live Nation (NYSE:LYV) – Shares in Live

Nation were flat in premarket trading on Friday after beating

estimates on net income of $331.3 million, or $1.02 per share, and

revenue of US$ 5.63 billion. The company predicts “record”

results for 2023, driven by more than 117 million tickets sold this

year. Chief Executive Michael Rapino highlighted the strong

growth of live music worldwide. Live Nation has also faced

regulatory scrutiny, but analysts believe the risks have eased

following efforts to increase transparency.

Centene (NYSE:CNC) – Centene posted profit

in the last quarter, driven by significant growth in

membership. Net income was $1.06 billion, or $1.92 per share,

compared with a loss in the prior-year period. Revenue of

$37.61 billion beat analysts’ expectations. Premiums and

services revenue increased 3% to $34.84 billion. The

proportion of health benefits increased to 87% due to strong growth

in market membership.

Juniper Networks (NYSE:JNPR) – Shares of

Juniper Networks were flat premarket after the company forecast

revenue of approximately $1.385 million for the third quarter, with

a possibility of variation of $50 million. The expectation is

based on continued weakness in bookings, especially in the cloud

segment and, to a lesser extent, service provider

customers. Analysts expect revenue of around $1.48

billion.

Evotec (NASDAQ:EVO) – Evotec cut its

annual forecast due to a cyberattack in the second

quarter. Estimated revenue for 2023 has been reduced to €750m

to €790m, and adjusted earnings before interest, tax, depreciation

and amortization has been downgraded to €60m to €80m. The

attack impacted productivity in the second quarter, but the company

maintains its 2025 Action Plan with expected revenue above €1

billion and adjusted Ebitda of over €300 million. The costs

related to the cyberattack were around €25 million.

NatWest Group (NYSE:NWG) – NatWest Group

reported better-than-expectations pre-tax earnings for the second

quarter of 2023 and lowered its net interest margin guidance for

the full year. The bank also released an independent review of

the closure of Nigel Farage’s account at Coutts, its private

bank. The review will be conducted by the law firm of Travers

Smith and will examine the circumstances of the account closures in

question. NatWest shares were up 2.9% in premarket trading on

Friday.

Sleep Number (NASDAQ:SNBR) – Shares in

SNBR plunged 26.9% in premarket trading on Friday after

second-quarter sales fell 16% to hit $459 million, below the

consensus forecast of $471 million. The bedding and mattress

company forecast earnings of $1.25 to $1.75 per share in 2023,

assuming a single-digit sales drop from the prior year.

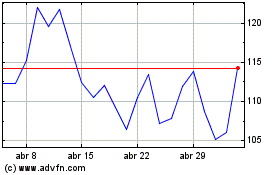

Enphase Energy (NASDAQ:ENPH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Enphase Energy (NASDAQ:ENPH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024