US Index Futures are down in premarket trading on Tuesday,

reflecting data on German inflation, the Chinese trade balance and

awaiting corporate earnings.

By 07:22 AM, Dow Jones futures (DOWI:DJI) were down 234 points,

or 0.66%. S&P 500 futures were down 0.71%, while

Nasdaq-100 futures were down 0.77%. The 10-year Treasury yield

was at 3.99%.

In Germany, inflation, measured by the consumer price index,

increased by 6.2% on a monthly basis, in line with the

consensus. A survey by the European Central Bank (ECB) shows

that consumer expectations for inflation in the euro zone dropped

in June, both for the next 12 months and for the next three years,

changing from 3.9% to 3.4%, and from 2.5% to 2.3%,

respectively.

In Asia, markets closed without a single direction,

reverberating weaker data from the Chinese trade balance. In

July, exports fell 14.5% in the annual comparison, worse than the

projection, which expected a drop of 12.8%, while imports had a

reduction of 12.4% in the period, far surpassing the low consensus

of 5.1%.

The weak numbers confirm the difficulty that the world’s second

largest economy has had to expand business, amid difficulties

around the globe, which suffers from inflation and high interest

rates.

In addition, the PBoC, the Chinese central bank, injected 6

billion yuan into the economy, and even increased the dollar parity

rate by 15 points, to 7.1365%. All efforts aimed at heating up

economic activity. With that, the “onshore yuan” dropped 160

basis points against the dollar, registering the biggest

devaluation since the 20th of July, according to local

agencies.

On Tuesday’s economic agenda, investors will follow, at 8:30 am,

the release of the trade balance for June, in which the consensus

expects a deficit of US$ 65 billion, while at 10:00 am it will be

the turn of wholesale stocks for June, which is forecast for a drop

of 0.30%.

Investors will follow speeches by two members of the Federal

Reserve: Patrick Harker of the Philadelphia Borough at 8:15 am and

Thomas Barkin of Richmond at 8:30 am.

At 1 pm, the government holds the three-year Treasury

auction. At 4:30 pm, last week’s API oil inventories will be

released.

In commodities markets, West Texas Intermediate crude for

September was down 1.61% to settle at $80.61 a barrel. Brent

crude for October was down 1.63% near $83.95 a barrel. Iron

ore futures traded in Dalian, China fell 0.28%, at US$ 99.10 per

tonne, continuing the movement of recent days.

On Monday, US stock markets rallied on expectations that

Friday’s jobs report will lead to an end to US rate

hikes. During yesterday, there were not many factors

influencing the direction of the market. Despite that, the

S&P 500 rose 0.90% and managed to break a four-day losing

streak, but the Nasdaq 100 fared weaker, up 0.61%. The Dow

gained 407.51 points or 1.16%, the best return in about seven

weeks.

Michelle Bowman, Governor of the Federal Reserve, hinted

yesterday at the possibility of further hikes in interest

rates. Meanwhile, John Williams, president of the Federal

Reserve Bank of New York, stressed the importance of keeping

monetary policy tight for some time to come, although he

acknowledged the chance of rate cuts next year if inflation

eases.

Ahead of Tuesday’s corporate results, traders are awaiting

reports from United Parcel Services (NYSE:UPS), Eli Lilly

(NYSE:LLY), DataDog (NASDAQ:DDOG), Capri Holdings (NYSE:CPRI), AMC

Entertainment (NYSE:AMC), ahead of market opening. Following

the market’s closure, reports are expected from Rivian

(NASDAQ:RIVN), Upstart (NASDAQ:UPST), Twilio (NYSE:TWLO), among

others.

Wall Street Corporate Highlights for Today

Amazon (NASDAQ:AMZN) – Amazon is scheduled

to launch the first internet satellites under the Kuiper program

later next month, using the United Launch Alliance (ULA) joint

venture Atlas V rocket, after changing plans to avoid

delays. The launch is scheduled for September

26th. Initially planned for ULA’s Vulcan rocket, delays led

Amazon to opt for the Atlas V. The company invested $10 billion in

the satellite internet project, aimed at competing with SpaceX and

its Starlink program.

Meta Platforms (NASDAQ:META) – Meta is

seeking to lift a fine imposed by Norway’s data regulator due to

privacy violations committed by the owner of Facebook and

Instagram. The $97,700 daily fine effective Aug. 14 has

broader European implications. Meta is seeking an injunction

against the fine, with a hearing scheduled for August 22. The

Norwegian data regulator claims that Meta cannot collect user data

in Norway for targeted advertising. The fine can be made

permanent and extended to the whole of Europe.

Tesla (NASDAQ:TSLA) – Tesla Chief

Financial Officer Zachary Kirkhorn has resigned, surprising

analysts who considered him a possible successor to CEO Elon

Musk. The company did not give reasons for the

departure. Vaibhav Taneja, 45, took office. Kirkhorn, a

13-year Tesla veteran, was known for his communication skills and

balance between Musk and was visible on calls with analysts.

Lucid (NASDAQ:LCID) – Luxury electric

vehicle maker Lucid has maintained its annual production target,

confirming SUV production for next year. While it reported

second-quarter earnings and earnings below estimates, strong

liquidity from a $3 billion equity offering put it ahead of

supply-challenged rivals. The company lowered prices to

increase demand and face competition from Tesla.

Moody’s (NYSE:MCO) – Moody’s cut U.S. bank

ratings, warning of weak funding risks. Ten banks had ratings

downgraded, six big ones under review for downgrade. Profit

pressures have increased, especially on home loans. Agency

changed perspective of eleven creditors to negative.

UBS (NYSE:UBS) – UBS unveiled a revamp of

its investment banking division, selecting heads of mergers and

acquisitions and restructuring the unit to compete with Wall

Street. The company seeks to hire and promote talent, but it

also plans hundreds of exits. The transformation includes the

appointment of leaders such as global co-heads of coverage, chiefs

of staff and global co-heads of mergers and acquisitions, notably

members of Credit Suisse.

Goldman Sachs (NYSE:GS) – Jeff Currie,

Global Head of Commodity Research at Goldman Sachs and a renowned

analyst who accurately predicted the rise in commodity prices in

the 2000s, is retiring after 27 years with the firm. His

influence was significant, coining terms such as “Revenge of the

Old Economy” to describe the commodity

supercycle. Responsibilities will be taken over by Daan

Struyven, Sam Dart and Nick Snowdon. Currie’s departure is the

latest in a string of notable departures from Goldman Sachs in

recent months.

Wells Fargo (NYSE:WFC) – Wells Fargo

announced that Malcolm Price has joined its corporate and

investment bank (CIB) as head of financial sponsors, following 35

years at Credit Suisse. Price played a significant role in

developing the financial sponsor hedging business at Credit Suisse

and has led other sectors.

LPL Financial Holdings (NASDAQ:LPLA) – LPL

will add direct indexing capabilities, allowing financial advisors

to customize stock indexes for clients. This approach seeks to

optimize tax and ESG issues, benefiting investors with large

positions. LPL is the largest independent brokerage in the US,

with 22,000 advisors and $1.24 trillion in assets.

PayPal (NASDAQ:PYPL) – PayPal launched a

dollar stablecoin, becoming a pioneer among financial technology

companies in adopting digital currencies for payments and

transfers. The announcement reflects confidence in the

cryptocurrency industry despite recent regulatory challenges and

meltdowns. The stablecoin PYUSD is backed by dollars and US

Treasuries, issued by Paxos Trust Co., and will be gradually

available in the US. Visa also plans to utilize

cryptocurrencies for settlements.

Proterra (NASDAQ:PTRA) – Electric vehicle

parts supplier Proterra has filed for Chapter 11 bankruptcy

protection due to supply chain constraints, reduced demand and

funding shortages. The company intends to operate normally and

file bankruptcy motions to fund its operations.

Yellow Corp (NASDAQ:YELL) – Trucking

company Yellow Corp declared Chapter 11 bankruptcy, sending nearly

30,000 workers seeking employment. The company blames the

International Brotherhood of Teamsters union for the situation,

while analysts point to debt and low shipping rates as

factors. The US government could face losses after bailing out

the company in 2020.

Snap Inc (NYSE:SNAP) – The UK data

regulator is investigating Snapchat to assess whether the platform

is removing underage users. Snap was reported to have removed

few children under the age of 13 from the platform in the UK,

despite Ofcom’s estimates of thousands of underage users. The

ICO collects information prior to an official

investigation. Snap is under pressure after reports of

indecent distribution of children’s images. The decision to

formally investigate will be taken in the coming months.

Adobe (NASDAQ:ADBE) – Adobe’s $20 billion

bid for cloud design platform Figma has raised antitrust concerns

in the EU. The European Commission is investigating the deal

due to concerns about reduced competition in interactive design

markets. The acquisition could allow Adobe to restrict

competition and affect Figma’s growth. The decision will be

taken by December 14th.

Black

Knight (NYSE:BKI), Intercontinental

Exchange (NYSE:ICE) – The United States Federal Trade

Commission (FTC) has expressed its desire to drop the lawsuit

against the $11.7 billion acquisition of data provider Black Knight

by the Intercontinental Exchange (ICE ), which owns the

NYSE. The companies are seeking an agreement to finalize the

deal, and the case was scheduled for trial. The FTC originally

expressed concerns about the concentration of market

power. Black Knight has already agreed to sell its Optimal

Blue business to address the concerns. The parties involved

are seeking an agreement by August 25.

Sage Therapeutics (NASDAQ:SAGE) – Shares

in Sage Therapeutics hit an all-time low on Monday after the US FDA

approved the company’s Biogen-partnered pill (NASDAQ:BIIB) for

postpartum depression, but the rejection as treatment for major

depressive disorder raises uncertainties about business

growth. Analysts point out that the market for major

depressive disorder is considerably larger than that for postpartum

depression. Biogen may terminate the development agreement

with Sage to minimize losses. Sage is also considering job

cuts following the FDA decision.

Novo Nordisk (NYSE:NVO) – Shares in Novo

Nordisk rose in premarket trading on Tuesday after the company

announced that its semaglutide obesity treatment, marketed as

Wegovy, had achieved its primary goal in a study measuring the

reduction of cardiovascular events. The 2.4 mg dose of

semaglutide reduced the risk of adverse cardiovascular events by

20% in overweight or obese adults in the study called

Select. Novo Nordisk will seek regulatory approval for label

indication expansion in the US and EU in 2023.

Eli Lilly (NYSE:LLY) – Drugmaker Eli Lilly

is about to report its second-quarter results, boosting its stock

which is up about 50% in 12 months and 24% this

year. Expectations are focused on the type 2 diabetes

treatment, Mounjaro, which may receive approval to treat

obesity. Other obesity drugs under development also draw

optimism from analysts. Donanemab, a therapy for Alzheimer’s

disease, is another point of interest following the approval of

Biogen’s Leqembi.

Petrobras (NYSE:PBR) – Petrobras is

considering an increase of up to 10% in investments for its next

five-year business plan over the previous one, bringing capital

expenditure to around US$86 billion, said the chief financial

officer Sergio Caetano Leite in an interview on Monday. The

2024-2028 plan under discussion would include inflation adjustments

of around US$4 billion and up to US$4 billion for new projects,

with a focus on low-carbon initiatives. The company is

pursuing a green transition under the leadership of President Luiz

Inacio Lula da Silva.

Embraer (NYSE:ERJ) – Embraer maintained a

two-year backlog for executive jets, driven by the continued

increase in demand during the pandemic. The aircraft

manufacturer expects to deliver up to 130 private jets in 2023. The

company is meeting growing demand, particularly from customers

looking to purchase their own aircraft. Executive aviation

accounted for 28.5% of Embraer’s revenue in 2020, around 27%

currently, while commercial aviation is also recovering.

Alibaba (NYSE:BABA) – Shares of Alibaba

fell in premarket trade on unfavorable trade data from China,

signaling a broader economic slowdown. The worse-than-expected

drop in exports and imports reflects low demand for Chinese

products and worries investors about government stimulus.

MercadoLibre (NASDAQ:MELI) – MercadoLibre

reached five million customers in its insurance segment in less

than four years, driven by investments in technology and a focus on

low- and middle-income users. The offer of insurance through

the marketplace and Mercado Pago allows for greater access, filling

a gap in the region where Latin Americans have limited access to

insurance products. With investment plans in logistics,

technology and fintech, the company is expanding its financial and

e-commerce ecosystem. In the second quarter, it recorded a

113% increase in net income.

Dish

Network (NASDAQ:DISH), EchoStar

Corp (NASDAQ:SATS) – Billionaire Charlie Ergen is

considering a possible merger between his telecommunications

companies, according to the Wall Street Journal. A deal could

be announced soon. Dish is valued at around $4 billion, while

EchoStar has a market cap of approximately $1.6 billion. The

combination of companies would give Ergen the financial flexibility

to compete in the national wireless networking

market. EchoStar was spun off from Dish in 2008. Dish stock

hit its lowest since 1999, while EchoStar rose 41% for the

year.

Earnings

UPS (NYSE:UPS) – Shares in United Parcel

Service fell to a six-week low after the announcement of

lower-than-expected second-quarter revenue, leading to a cut in the

full-year outlook. Net income fell to $2.08 billion, while

revenue declined 10.9%, hit by labor negotiations. The company

has adjusted its revenue outlook to around $93 billion for 2023,

citing the impact of labor negotiations and costs associated with

an interim deal. UPS confirmed its plans for capital

expenditures, dividend payments and share repurchases.

Li Auto (NASDAQ:LI) – Li Auto beat

profit expectations on Tuesday, but its shares, owned by the

Chinese electric vehicle company, fell about 2% in premarket

trading. The company posted net income of $318.6

million. Revenue also beat estimates. The company

delivered 86,533 vehicles in the quarter, an increase of more than

200% over the previous year.

AMC Entertainment (NYSE:AMC) – Shares of

AMC rose in premarket trade on Tuesday after the theater operator

reported second-quarter results that beat expectations. With a

12% increase in attendance and higher spend per guest, the company

posted a net profit of $8.6 million, compared to a loss of $121.6

million a year earlier. Revenue grew 15.6% to $1.35 billion,

driven by increases in attendance, average ticket and food and

beverage revenue per customer.

Paramount Global (NASDAQ:PARA) – Despite

lower subscriber growth, Paramount Global has seen its post-earning

reaction in equities take a positive turn. The addition of

just 700,000 subscribers in the second quarter, compared with 4.1

million previously, did not prevent a 3.2% increase in premarket

shares. The boost came from a deal to sell its publishing

business and 47% growth in streaming subscription revenue, putting

pressure on Disney to deliver similar results in its streaming

strategy.

RingCentral (NYSE:RNG) – Shares of

RingCentral were down 12.4% in premarket Tuesday after the

announcement that founder Vlad Shmunis will step down as CEO and

become executive chairman. Tarek Robbiati, former CFO of

Hewlett Packard Enterprise, has been named as the new CEO. The

company also released its quarterly results, with revenue and

earnings above expectations, reiterating the full-year revenue

outlook but adjusting the earnings forecast due to interest

expense.

Chegg (NYSE:CHGG) – Shares in Chegg were

up 21.2% in premarket Tuesday as the online learning software

provider reported better-than-expected second-quarter financial

results and delivered a new AI-based strategy. For the

quarter, revenue reached $182.9 million, beating

forecasts. The company is focused on its generative AI

experience, seeking improvements in personalized learning for

students. CEO Dan Rosensweig highlighted the positive

reception of the beta version of the AI experience and the launch

of the full version is planned for the fall.

BioNTech (NASDAQ:BNTX) – Like its

competitors, BioNTech is also facing the “Covid vaccine curse”,

with revenue falling to €168m, far below estimates of

€692m. The company reported a loss of €0.79 per share, blaming

Pfizer’s reduced profit-sharing. Shares fell 1.2% premarket,

exemplifying challenges for vaccine companies. The analysis

suggests that uncertainty will persist until these companies

diversify beyond vaccines.

International Flavors &

Fragrances (NYSE:IFF) – International Flavors &

Fragrances fell about 22% in premarket Tuesday, due to nearly

doubled high inventory costs and a reduction in forecast sales for

the year. The company reported net income of US$ 27 million in

the second quarter, against US$ 107 million in the same period of

the previous year. Sales of food products and health and life

sciences also fell.

Tyson Foods (NYSE:TSN) – Tyson Foods

missed Wall Street’s Q3 expectations due to lower chicken and pork

prices and slowing demand for beef. The company also announced

the closure of four more chicken plants in the US to reduce

costs. Tyson faces market and macroeconomic challenges across

different protein segments. Quarterly revenue fell 3% to

$13.14 billion, below analyst expectations.

Palantir Technologies (NYSE:PLTR) –

Palantir Technologies slightly raised its full-year revenue

forecast, planning to buy back up to $1 billion in shares, driven

by growing demand for its artificial intelligence

platform. CEO Alexander Karp highlighted the acceptance of the

platform in more than 100 organizations, including healthcare and

automotive, with ongoing negotiations with more than 300

companies. Second-quarter revenue reached $533.3 million, with

government and commercial revenue growing 15% and 10%,

respectively.

InterContinental Hotels

Group (NYSE:IHG) – IHG, owner of Holiday Inn,

anticipates positive room revenue growth across regions in the

second half of 2023 despite macroeconomic pressures. Global

revenue per available room increased 17% in Q2, driven by higher

rates and recovery in China. The group also increased

dividends by 10% following a 27% increase in operating profit.

Beyond Meat (NASDAQ:BYND) – Beyond

Meat revised down its full-year revenue forecast and missed

second-quarter net sales estimates due to slowing demand for meat

products. Concerns about inflation and ambiguity about the

health benefits of plant-based meats weigh on growth. The

company has been implementing price cuts and now forecast revenue

of between $360 million and $380 million for 2023. Quarterly net

income was down nearly 31%, but cutting costs helped minimize

losses.

KKR & Co (NYSE:KKR) – KKR &

Co reported a 23% decline in its second-quarter after-tax

distributable earnings compared to a year earlier, attributed to a

slowdown in asset sales, although after-tax distributable earnings

per share have beaten analysts’ estimates. Its net income from

asset disposals fell nearly 80%, reflecting restrictions on merger

and acquisition activity due to higher interest rates, inflation

and volatility. Fees generated from management and

transactions increased by 31%, while KKR recorded a 5% increase in

its private equity portfolio. Its assets under management

increased to $519 billion.

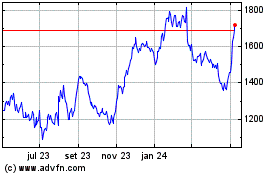

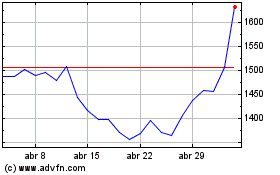

MercadoLibre (NASDAQ:MELI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

MercadoLibre (NASDAQ:MELI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024