US index futures are down premarket on Friday, continuing to

reflect the impacts of US inflation figures, UK activity and

uncertainty surrounding global interest rate trends.

By 7:00 AM, Dow Jones Futures (DOWI:DJI) were down 3 points, or

0.01%. S&P 500 futures were down 0.10% and Nasdaq-100

futures were down 0.23%. The 10-year Treasury yield was at

4.096%.

On Friday’s American economic agenda, investors will follow the

producer price index at 8:30 am. On a monthly basis, the

analysts’ expectation is for an increase of 0.20% in June, while in

the annual comparison the indicator should present an increase of

0.70%. At 10 am, the University of Michigan confidence index

will be released, which is forecast at 71 in August, down from

July, when it reached 71.6. At 1 pm, Baker Hughes will release

the number of oil rigs for the week.

In the United Kingdom, the Gross Domestic Product (GDP) grew by

0.2% in the second quarter compared to the previous year,

surprising expectations that indicated stability. Industrial

production also increased by 1.8% in June, beating the 0.10%

forecast. This data could strengthen the prospect that the

Bank of England will need to adopt a more rigorous stance to

control inflation, which could have a negative impact on

markets.

In Asia, on a public holiday in Japan, markets closed lower,

reflecting data on controlled inflation in the United States in

July. In China, social funding figures reached 528.2 billion

yuan in July, nearly half of expectations. In addition,

Chinese banks extended 345.9 billion yuan in new loans in July,

missing the forecast of 848 billion yuan.

In commodities markets, West Texas Intermediate crude for

September was up 0.36% to trade at $83.12 a barrel. Brent

crude for October was up 0.42% to close at $86.76 a

barrel. Iron ore futures traded in Dalian, China, rose 2.27%

to $101.17 a tonne, recovering part of back-to-back declines.

By Thursday’s close, the Dow Jones was up 0.15%. The

S&P 500 was broadly flat at 0.03%, while the Nasdaq Composite

was up 0.12%. While stocks started the day positive, they

closed almost flat. The July inflation index (CPI) was in line

with market expectations, registering an increase of 0.2% both in

the general index and in the core.

Although the composition of the index did not bring significant

surprises, there was an acceleration in the services core, also

known as “super-core”. This acceleration, however, does not

seem to be sustainable, given that the trend of this component

continues to decline.

Overall, the CPI numbers confirm the inflation scenario

projected by the Fed, characterized by a gradual deceleration of

the cores towards the target. This makes the Fed more likely

to stop interest rate hikes, although it continues to emphasize a

“high rates longer” policy, indicating that lowering rates may take

time. As a result, this data provoked a mixed reaction in the

market.

Ahead of Friday’s corporate results, investors are awaiting

reports from Air Canada (TSX:AC), AirSculpt (NASDAQ:AIRS), Silver

Spike (NASDAQ:SPKBW), ReWalk (NASDAQ:RWLK), among others.

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT) – A US

cybersecurity advisory panel will review the risks of cloud

computing, investigating Microsoft’s role in the breach of

government email systems by Chinese hackers. The Cybersecurity

Review Board will examine cloud infrastructure and identity

management, covering relevant providers. Microsoft faces

scrutiny over the hack that enabled spying, prompting calls for

action. The House Oversight Committee is also investigating

China’s role in the breaches.

Amazon (NASDAQ:AMZN) – Amazon.com is

eliminating several of its own clothing brands, reducing its

previous range of 30 brands to three. This action is intended

to save costs and respond to antitrust concerns. The FTC is

investigating Amazon for alleged anti-competitive practices, with a

meeting scheduled to avoid prosecution. Amazon denies

wrongdoing.

Alphabet (NASDAQ:GOOGL), General

Motors (NYSE:GM) – Self-driving car companies have

been granted expanded permits to operate in San Francisco despite

local concerns. General Motors’ Cruise and Alphabet’s Waymo

were authorized to offer paid trips in autonomous vehicles around

the city at any time, with unlimited vehicles. GM forecasts

$80 billion in annual sales by 2030 from autonomous

software. Tesla (NASDAQ:TSLA)

and Amazon (NASDAQ:AMZN) are also

looking to expand in the sector.

Alphabet (NASDAQ:GOOGL) – Alphabet faces

the challenge of directing its growing cash pile. Generating

about $29 billion in cash in Q2, the company has about $118 billion

in cash and securities. Unlike Apple

(NASDAQ:AAPL), Alphabet does not have a clear return on capital

strategy. Share buybacks are an option, but strategic

investments such as Microsoft (NASDAQ:MSFT) with

OpenAI are also considered. The focus on share buybacks aims

to avoid the perception of a lack of growth opportunities.

Tesla (NASDAQ:TSLA) – Tesla CEO Elon

Musk’s leadership style has raised concerns among

investors. Recently, however, Linda Yaccarino, CEO of X

(formerly Twitter), stated that she has the autonomy to run Company

X, showing that Musk is willing to delegate to strong

managers. Although tangentially, that could allay fears and

indicate that Musk is more focused on Tesla after having strayed

into other endeavors.

Zoom Video Communications (NASDAQ:ZM) –

Zoom Video has lifted its policy of not having internal meetings on

Wednesdays, citing difficulties in collaboration. CEO Eric

Yuan announced the move, also requiring employees within 50 miles

of an office to show up twice a week.

Alibaba Group (NYSE:BABA) – Due to global

supply constraints, Alibaba Group Holding Ltd. has not been able to

fully meet customers’ demand for AI training, as stated by CEO

Daniel Zhang. Shortages of critical components such as AI

chips are hurting Chinese technology efforts, further hampered by

new US rules on investment in AI and quantum computing sectors in

China.

KKR & Co (NYSE:KKR) – The Italian

government may divest up to 20% of Telecom Italia following

preliminary agreement with US fund KKR to acquire NetCo, comprised

of TIM’s fixed network and submarine cable. The Italian

Treasury will have 20% of the binding offer, with a strategic role,

while the Italian fund F2I can raise the combined stake to

30%. TIM seeks to sell to cut debts. KKR has until

September to submit a mandatory

offer. Vivendi (EU:VIV)

is a drag because of its 24% stake. KKR offered

around €23 billion on a debt basis.

Moody’s (NYSE:MCO) – Moody’s downgraded

Chinese developer Country Garden’s corporate family rating to Caa1

from B1 due to liquidity issues and refinancing risk following bond

defaults. The outlook is negative due to uncertainty about the

company’s ability to honor its obligations. Moody’s also

lowered its contracted sales forecast for 2023, highlighting market

concerns about the company’s liquidity and finances, which is

facing pressure from China’s volatile real estate sector.

UBS (NYSE:UBS) – UBS will no longer need

the Swiss government guarantee, which had been provided to bail out

rival Credit Suisse. The Swiss government had guaranteed CHF9

billion to UBS as part of the Credit Suisse bailout. UBS will

also not need public liquidity support. The news boosted UBS

shares by as much as 5% in premarket trading on Friday.

Goldman Sachs (NYSE:GS) – Goldman Sachs

welcomed changes in monetary policy by the Reserve Bank of Kenya,

praising exchange rate flexibility and inflation

targeting. The bank foresees a strengthening of Kenya’s

external balances and foreign reserve, as well as the possibility

of attracting foreign investment in local debt. The reforms,

including an interest rate corridor, are associated with new

Central Bank leadership.

Citigroup (NYSE:C) – Citigroup is lowering

its bullish outlook on Egyptian bonds due to concerns over slow

progress on the sale of state assets. Bank strategists have

reduced their view on Egypt’s debt, citing lack of progress in the

privatization plan and heightened idiosyncratic risks. Egypt’s

dollar debt has been underperforming in emerging markets. The

agreement with the IMF is essential for its economic recovery.

Bank of America (NYSE:BAC) – Recently,

investors have been pouring money into money market funds and

bonds, pulling money out of the US stock market, according to

strategists at Bank of America Corp. In the week to Aug. 9,

cash funds received $20.5 billion, while $6.9 billion was withdrawn

from bonds. US stocks had their first outflow in three weeks,

totaling $1.6 billion.

Grupo Aval (NYSE:AVAL) – Colombia’s Grupo

Aval and its banking unit will pay more than $80 million to settle

charges of violating US anti-corruption laws. The

Corficolombiana unit will face a $40.6 million criminal fine and

$40 million in repayment and pretrial interest as part of the

resolution of the SEC investigation.

Virgin Galactic (NYSE:SPCE) – Virgin

Galactic completed its second commercial space tourism mission,

launching the VSS Unity spacecraft from New Mexico with three

female guests and a company instructor. Jon Goodwin, a former

Olympic kayaker, Keisha Schahaff, an entrepreneur from the

Caribbean, and Anastatia Mayers, an 18-year-old student, were taken

into space. The altitude reached was 88 km, surpassing the 80

km defined by the USA as the beginning of space. Virgin

Galactic plans to fly monthly, after the previous mission was

carried out with members of the Italian Air Force and the National

Research Council of Italy.

Wisk Aero , Archer

Aviation (NYSE:ACHR), Boeing (NYSE:BA)

– Archer Aviation has reached an agreement with Boeing and its Wisk

unit to resolve disputes and collaborate on autonomous

technology. Archer will make Wisk its exclusive provider of

autonomous technology for its aircraft. Boeing will invest in

Archer to integrate Wisk’s autonomous technology. Archer

shares were up 23.2% in premarket trading on Friday.

Lyft (NASDAQ:LYFT) – Lyft plans to run ads

on its ridesharing app to boost its revenue. Following the

example of its rival Uber (NYSE:UBER),

the company partnered with Rokt to sell ads for companies such as

Amazon (NASDAQ:AMZN) and Universal

Pictures. Drivers will also be able to choose to have a Lyft

Media tablet in their car.

Occidental Petroleum (NYSE:OXY) – The US

Department of Energy is investing up to $1.2 billion in direct air

capture (DAC) technology to reduce global warming. Occidental

Petroleum and its subsidiary 1PointFive in Texas are leading one of

the projects, aimed at removing up to 30 million metric tons of CO2

per year, while Climeworks and Heirloom manage the Louisiana

hub. These pioneering projects will contribute to local jobs

and clean energy, with additional funding expected. However,

billions of tons of CO2 still need to be removed annually to reach

the Paris Agreement targets.

Kroger (NYSE:KR), Albertsons (NYSE:ACI)

– The FTC is investigating Kroger’s acquisition deal over

Albertsons to determine whether suppliers will be harmed, impacting

small supermarket chains. Kroger and the FTC plan divestments

to address antitrust concerns. The FTC surveyed experts and

industry associations to understand the settlement’s dynamics and

potential impacts.

Cano Health (NYSE:CANO) – Shares fell

44.1% in premarket trading due to “substantial doubts” about its

one-year operational viability. The company plans to reduce

its workforce by 17% and is exploring the possibility of a

sale.

DigitalOcean (NYSE:DOCN) – Shares were up

2.2% to hit $35.77 after a rating upgrade from “Underweight” to

“Equal Weight” with an increase in price target to $36 from $30.

The company recently revised its annual outlook and is correcting

accounting errors in past earnings.

Earnings

Alibaba (NYSE:BABA) – Alibaba reported its

strongest quarterly revenue growth in nearly two years, focusing on

low-cost products to attract consumers amid a difficult economic

environment. First-quarter revenue was $32.3 billion, up 14%

year-over-year. Net profit grew 51%. The revenue increase

comes as the Chinese economy grapples with

uncertainty. Alibaba seeks to compete with rivals with

low-cost products, planning to invest more in this

strategy. The company is also preparing for the departure of

CEO Daniel Zhang.

Pagaya Technologies (NASDAQ:PGY) – Shares

are up 16.0% premarket after Pagaya reported a second-quarter loss

of $31.3 million, adjusted for earnings of $886,000, beating

forecasts. Total revenue increased by 7.8%. Pagaya

projected adjusted EBITDA of $10 million to $20 million on total

revenue of $190 million to $200 million for the third quarter.

Arlo Technologies (NYSE:ARLO) – Arlo

Technologies shares fell 2.6% after the maker of security cameras,

video doorbells and other home security devices reported a narrower

quarterly loss and revenue that, while , exceeded Wall Street

expectations. Arlo Technologies reported Q2 EPS of $0.060,

$0.02 better than the analyst estimate of $0.040. Revenue for

the quarter came in at $115.1 million, versus the consensus

estimate of $110.18 million.

IONQ (NYSE:IONQ) – Quantum computing

hardware and software company IONQ posted a 5.6% premarket increase

after revising its annual booking outlook to a range between $49

million and $56 million . IONQ reported a second-quarter loss

per share of $0.22, worse than analysts’ estimate of a loss of

$0.13. Revenue for the quarter came in at $5.5 million, versus

the consensus estimate of $4.35 million.

Maxeon Solar (NASDAQ:MAXN) –

Singapore-based solar technology company Maxeon Solar was down

25.6% in premarket after it revised downwards its full-year outlook

due to softened residential demand and forecast challenging market

conditions. to persist into the fourth trimester. The new

annual forecast is for revenue between $1.25 billion and $1.35

billion, and adjusted earnings before taxes, interest, depreciation

and amortization between $80 million and $100 million.

Flowers Foods (NYSE:FLO) – Flowers Foods

reported second-quarter adjusted earnings of 33 cents per share,

beating analyst forecasts, with revenue up 8.8% to $1.23

billion.

Ralph Lauren (NYSE:RL) – Ralph Lauren CEO

Patrice Louvet expressed optimism about the future, despite not

raising annual guidance after reporting fiscal first quarter

earnings. Revenue of $1.5 billion beat estimates. Louvet

highlights the resilience of the brand’s core consumer and notes

the shift to a “casual upscale” style, emphasizing the brand’s

visibility with celebrities.

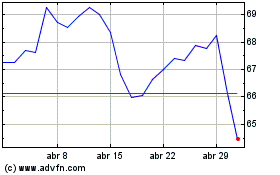

Occidental Petroleum (NYSE:OXY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

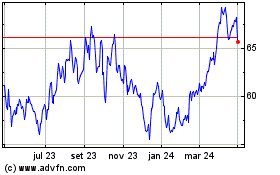

Occidental Petroleum (NYSE:OXY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024