US index futures were broadly flat in premarket trading on

Wednesday as traders await indicators such as Federal Reserve

minutes and industrial production.

By 6:53 AM, Dow Jones futures (DOWI:DJI) were up 3 points, or

0.01%. S&P 500 futures were up 0.01% and Nasdaq-100

futures were up 0.06%. The 10-year Treasury yield was at

4.186%.

On Wednesday’s US economic agenda, investors will follow at 8:30

am the preliminary building permit for July, which is projected to

have 1.46 million new orders. At 9:15 am, the industrial

production data for July will be released, with the consensus

predicting an increase of 0.30% on a monthly basis. At 10:30

am, the EIA releases last week’s oil inventories, which are

projected to drop by 2.5 million barrels.

The great expectation of the day is for the minutes of the last

meeting of the Open Market Committee (FOMC), which will be released

at 2 pm. At its July meeting, the Fed raised interest rates to

a range between 5.25% and 5.50%. The expectation on the part

of investors is that the document will bring clues about the

trajectory of interest rates, after the publication of recent data

that are used as benchmarks for monetary policy.

Mortgage rates in the US hit a 22-year high, resulting in a 29%

year-on-year drop in application volume. The 30-year average

interest rate rose to 7.16%. Demand for new homes has

increased, particularly among first-time buyers, driven by low-down

payment options. Refinances have dropped due to rising

rates.

In the UK, July inflation fell by 0.4% monthly, less than the

forecast 0.5%. However, core inflation increased by 0.3%,

beating the estimate of 0.2%. These figures raise concerns

that the Bank of England could raise interest rates.

In the euro zone, GDP grew by 0.3% in the second quarter

compared to the previous quarter, in line with

expectations. Annual growth was 0.6%. Contrary to

forecasts of a 0.10% decline, industrial production in June

increased by 0.5% month-on-month.

In Asian markets, the declines reflect concerns about China’s

economy, given recent disappointing numbers. In addition, JP

Morgan (NYSE:JPM) raised its forecast for corporate defaults in

emerging markets due to fears related to the Chinese real estate

sector, compounded by the financial difficulties of Garden

Country.

In the commodities market, West Texas Intermediate crude for

September fell -0.01% at $80.98 a barrel. Brent crude for

October fell 0.07% near $84.83 a barrel. Iron ore futures

traded in Dalian, China, were up 0.52% at $100.95 a tonne.

At the close of Tuesday, global financial markets started the

day on a downward trend, a trend that persisted until the end of

the session. European stock markets reacted negatively to

local economic indicators and tensions with China. The British

job market showed robust figures, raising concerns about possible

increases or maintenance of high interest rates. In China,

retail sales and industrial production disappointed, prompting the

PBoC to cut interest rates.

In the US, indexes took big losses for similar

reasons. Retail sales beat expectations, while the NY Fed’s

Empire Manufacturing Index signaled a sharp decline in

August. The Dow closed with a loss of 361.24 points or 1.02%

at 34,946.39 points. The S&P 500 closed down 51.86 points,

or 1.16%, at 4,437.86 points, and the Nasdaq Composite lost 157.28

points, or 1.14%, at 13,631.05.

Ahead of Wednesday’s corporate results, traders are watching

reports from Target (NYSE:TGT), Zim (NYSE:ZIM), JD.com (NASDAQ:JD),

TJX (NYSE:TJX). After the close, results will be announced for

Cisco Systems (NASDAQ:CSCO), Synopsys (NASDAQ:SNPS), Wolfspeed

(NYSE:WOLF), Stone (NASDAQ:STNE), Paycor (NASDAQ:PYCR), among

others.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple will start

production of the iPhone 15 in Tamil Nadu, diversifying its

manufacturing outside of China. Seeking to speed up

deliveries, the company reduced the difference between Indian and

Chinese operations. In addition to Foxconn, Pegatron and

Wistron will also assemble the iPhone 15 in India. Apple

expands its presence in India, benefiting from government

incentives and sees a growing market.

Amazon (NASDAQ:AMZN) – Amazon Pharmacy

will automatically apply discounts on over 15 insulin and diabetes

medications. Patients will no longer need to manually enter

manufacturer coupons. The aim is to facilitate access to

insulin at reduced prices.

Intel (NASDAQ:INTC), Tower

Semiconductor (NASDAQ:TSEM) – Intel and Tower

Semiconductor ended a proposed $5.4 billion deal due to lack of

regulatory approvals. Tower shares were down more than 10% in

premarket trading on Wednesday. Intel will pay Tower a $353

million termination fee. US-China tensions impact tech

deals. Pat Gelsinger, CEO of Intel, sought approval for the

deal in China and said Intel will continue to invest in its foundry

business. Intel’s foundry sales have grown, but demand for the

chips has declined.

Nvidia (NASDAQ:NVDA) – Shares of Nvidia

rose on Tuesday after two brokerages raised their price

targets. The high reflects optimism with artificial

intelligence and the demand for its components. Analysts

raised price estimates ahead of Nvidia’s quarterly

results. The company predicts higher revenue due to demand for

its AI chips, like those used in ChatGPT.

ASML (NASDAQ:ASML) – Samsung halved its

stake in ASML Holding NV in Q2, selling 3.55 million shares,

raising $2.2 billion. Samsung plans to strengthen its chip

manufacturing, rivaling Taiwan Semiconductor Manufacturing Co

(TSM).

VinFast (NASDAQ:VFS) – Vietnamese electric

vehicle maker VinFast soared on the Nasdaq, doubling its valuation

to $85 billion, outpacing Ford and GM. The debut followed a

merger with SPAC Black Spade. Despite initial slow sales, the

company plans to expand and revise its distribution

strategy. VinFast is developing a $4 billion factory in North

Carolina and faces competition from Tesla and Chinese

companies.

Thomson

Reuters (NYSE:TRI), The New York

Times (NYSE:NYT) – Company X, formerly Twitter, has

temporarily delayed access to links from sites such as Reuters and

The New York Times. The delay was noted and then

removed. The action comes after Elon Musk, new owner,

criticized certain news organizations. The cause of the delay

remains unclear.

Occidental Petroleum (NYSE:OXY) –

Occidental Petroleum has acquired technology provider Carbon

Engineering for $1.1 billion to develop carbon capture

sites. Direct air capture technology aims to remove CO2 from

the atmosphere for various uses, such as in the manufacture of

concrete and fuel.

Woodside Energy (NYSE:WDS) – Woodside

Energy reports “positive progress” in wage disputes at its LNG

facility in Australia, while unions indicate significant

differences. Around 99% of offshore workers voted for union

actions, which could affect LNG shipments and prices.

Chevron (NYSE:CVX) – Negotiations between

Chevron, Woodside Energy (NYSE:WDS) and Australian

unions on wages and conditions at LNG facilities may take time due

to the need for unions to consult their members. Workers at several

facilities consider the possibility of industrial actions,

including strikes. Experts see low risk of prolonged outages.

US Steel (NYSE:X) – Esmark Inc CEO James

Bouchard said he had the funds for US Steel Corp’s $7.8 billion bid

after Cleveland-Cliffs’ (NYSE:CLF) $7.3 billion

bid was rejected. Bouchard was revealed to have $10 billion in

cash, with no debt at Esmark. He receives advice from an

undisclosed international bank. US Steel invited Esmark to join the

negotiation process.

TPG Inc (NASDAQ:TPG) – The TPG Capital

group has expressed interest in buying a stake in Ernst & Young

(EY) consultancy, according to the Financial Times. After

regulatory concerns, EY considered splitting its audit and

consulting units, but later abandoned the idea.

BlackRock (NYSE:BLK) – Investors such as

BlackRock and Allianz own significant holdings in Country Garden,

the Chinese real estate company facing default risk. Although

records show large exhibitions, holdings may have changed. The

company’s potential default could impact Chinese debt markets.

UBS (NYSE:UBS) – A court in Moscow has

banned UBS and Credit Suisse from selling shares in their Russian

branches following a request from Zenit Bank, which fears losses if

they exit Russia over a 2021 loan related to Intergrain and

subsequent sanctions.

Goldman Sachs (NYSE:GS) – Senior managers

at Goldman Sachs openly criticized CEO David Solomon. John

Waldron, chairman of Goldman, became the focus of attention,

pressured to decide whether to support Solomon or differentiate

himself. As dissatisfaction mounts over Solomon’s forceful

leadership and unpopular decisions, Waldron struggles to find his

place, constantly being watched for signs of falling out, according

to Bloomberg.

Bank of America (NYSE:BAC) – The Argentine

peso will face further devaluations, according to strategists at

Bank of America. It is forecast to weaken to 545/dollar in

2021 and 1,193 in 2024. The recent 18% devaluation has caused

increased demand for dollars in the parallel market. The

situation intensifies political and economic uncertainty.

HSBC (NYSE:HSBC) – Bangladesh’s equity

market, buoyed by rising consumption and foreign investment, could

offer big returns, according to analysis by HSBC. Compared to

India and Vietnam in past decades, profits are expected to increase

by 20% over the next three years.

Boeing (NYSE:BA) – Boeing has appointed

Alvin Liu, a former auto industry executive, as head of its China

unit, aiming to improve relations amid geopolitical

tensions. China is a vital aviation market. Liu replaces

Sherry Carbary and has experience with Ford and Chrysler in

China.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines has reached a tentative agreement with the union of 17,120

transportation workers, setting an hourly wage of $36.72. The

contract also provides better retirement medical coverage, 401(k)

benefits, and vacations at premium rates.

Fisker (NYSE:FSR) – Startup Fisker has

reached an agreement

with Tesla (NASDAQ:TSLA) to adopt its

charging standard, allowing access to the Supercharger network by

2025. Many automakers are adopting Tesla’s design, predicted to

lead the market, replacing the CCS standard.

Tesla (NASDAQ:TSLA) – Tesla has cut prices

for its Model S and Model X in China for the second time this week,

intensifying concerns about a price war in the auto

sector. These cuts put pressure on other automakers, such as

BMW and Mercedes-Benz, to adopt similar measures.

Avis Budget Group (NASDAQ:CAR) – Avis

Budget was fined $275,000 by New York for failing to rent vehicles

to customers without a credit card, in violation of state law.

Lordstown Motors (NASDAQ:RIDE) – Lordstown

Motors has agreed to pay $40 million to Karma Automotive after

being accused of stealing proprietary technology. The deal

includes $5 million in royalties from Karma’s intellectual

property. Lordstown faces bankruptcy and the case will go to

trial in September.

Apollo Global

Management (NYSE:APO), Yellow

Corp (NASDAQ:YELL) – Apollo Global Management is

selling a $500 million loan to Yellow Corp, waiving the financing

extension. The loan was acquired by Citadel. Yellow

reviews alternative loan offers and faces debt payments through

2024.

Alibaba (NYSE:BABA) – DingTalk, Alibaba’s

platform, will separate from its cloud division, operating as a

wholly owned subsidiary. Although rumors suggest a possible

IPO, the date has not been confirmed. The separation will not

affect DingTalk’s services or its technology collaboration with the

cloud division.

Bain Capital (NYSE:BCSF) – Bain Capital has

acquired Brazilian steakhouse Fogo de Chão for around $1.1

billion. The sale provided Rhone Capital with a triple return

on its $560 million investment in 2018. Fogo, founded in 1979,

operates in 76 locations globally.

Ralph Lauren (NYSE:RL) – Canadian regulator

CORE is investigating Ralph Lauren’s Canadian unit and GobiMin for

possible links to Uyghur forced labor in China, following

complaints from 28 organizations. Similar investigations

involve Nike Canada and Dynasty Gold.

Roku (NASDAQ:ROKU) – Roku and NBCUniversal have

agreed to launch ad-supported channels for reruns of popular

shows. This deal expands Roku’s free TV streaming and benefits

NBCUniversal. Shares in both companies surged, outperforming

the S&P 500. FAST channels, which offer ad-supported content,

are a growing trend.

FedEx (NYSE:FDX) – FedEx is pushing its

delivery service providers to beef up safety after a surge in

accidents nearly tripled insurance costs over the past

decade. The company requires the installation of cameras and

sensors in vehicles and improvement in training. Providers

with low safety scores may face competition on routes. This

move aligns with CEO Raj Subramaniam’s plan to integrate company

units. But contractors say FedEx doesn’t address high driver

turnover, which can lead to more accidents. Safety has become

a central issue for the company’s bottom line.

Earnings

Target (NYSE:TGT) – Target lowered its

full-year forecast after quarterly sales below expectations. A

drop in comparable sales and earnings per share between $7 and $8

are expected. While in-store sales improved in July, concerns about

inflation and future trends persist. Second-quarter earnings

beat expectations, hitting $1.80 a share.

Tencent Music Entertainment

Group (NYSE:TME) – Tencent Music Entertainment,

compared to Spotify, saw its quarterly revenue grow by 5.5% due to

more subscriptions. However, it projects a drop in future

revenue from tighter controls on live streaming, following China’s

anti-gambling measures. The company reached 100 million paying

users. Shares are up 1.78% in premarket trading on

Wednesday.

Coherent (NYSE:COHR) – Coherent was down

21.8% in premarket trading on Wednesday after delivering

lower-than-expected first-quarter and full-year forecasts. The

company anticipates adjusted earnings of between 5 and 20 cents per

share and revenue of between $1 billion and $1.1 billion,

contrasting with analysts’ expectations of 47 cents per share and

$1.17 billion in revenue. Coherent indicated that his estimate

does not consider a significant improvement in the macroeconomic

scenario, including in China.

DLocal (NASDAQ:DLO), MercadoLibre (NASDAQ:MELI)

– DLocal reported a 24.77% increase in pre-market transactions

after delivering better-than-expected quarterly results and

confirming forecast annual revenue of between $620 million and $640

million. In addition, Pedro Arnt was appointed co-CEO of the

company, having previously served as CFO of MercadoLibre, a major

Latin American e-commerce player.

H&R Block (NYSE:HRB) – After reporting

quarterly earnings of $2.05 a share, beating Wall Street’s forecast

of $1.88 per share according to Refinitiv, tax preparers are

holding steady premarket. H&R Block had revenue of $1.03

billion, above analysts’ estimate of $1.01 billion. In

addition, the company raised its quarterly dividend by 10.3%, from

US$ 0.29 to US$ 0.32, and also revised upward its forecasts for the

full year.

Cava (NYSE:CAVA) – After releasing a

second-quarter report with earnings that beat forecasts, shares in

the Mediterranean restaurant chain rose 11.88% in premarket trading

on Wednesday. The fast-casual company reported revenue of

$172.9 million, above analysts’ forecast of $163.2 million, as per

FactSet data. In relation to earnings per share, US$ 0.21 was

recorded, contrary to the expectation of FactSet analysts who

predicted a loss of US$ 0.02 per share.

Stride (NYSE:LRN) – Stocks were flat in

premarket trading Wednesday after the education technology company

reported better-than-expected results for the fiscal fourth

quarter. GAAP earnings of $1.01 per share exceeded FactSet

analyst expectations by 14 cents. Likewise, revenue of $483.5

million beat the estimate of $460.7 million.

AgEagle Aerial Systems (AMEX:UAVS) – The

company reported in the second quarter a loss per share lower than

that recorded in the same period of 2022. AgEagle had a loss of 5

cents per share, which is 2 cents lower than the previous

year. However, the company’s quarterly revenue of $3.3 million

was lower than last year. Stocks are stable in premarket

trading.

Nu Holdings (NYSE:NU) – Nubank announced

record revenue in the second quarter, adding 4.6 million

customers. Revenue grew 60% to $1.9 billion. The CEO,

David Vélez, pointed out that half of Brazilian adults are

customers. The bank’s shares have rallied, rising 95% this

year, and are up 3.92% in premarket trading on Wednesday.

Mercury Systems (NASDAQ:MRCY) – Defense

stocks were down 12.83% in premarket trading on Wednesday after

fiscal fourth-quarter results missed Wall Street’s

forecasts. Mercury reported earnings of 11 cents a share,

excluding certain items, and revenue of $263.2 million. By

comparison, FactSet had analysts forecast earnings of 52 cents per

share and revenue of $278.8 million for the

quarter. Additionally, Mercury’s full-year estimates were

below FactSet consensus expectations.

Palo Alto Networks (NASDAQ:PANW) – Palo

Alto Networks surprised Wall Street by announcing quarterly results

on a Friday after markets closed. Analysts are divided on what

this indicates. The company, recently added to the S&P 500

index, may have a big DoD contract in the pipeline.

Beam Global (NASDAQ:BEEM) – Sales reached

$17.8 million, up about 380% year-over-year and above the $13.5

million analysts projected. Beam is still unprofitable, but

the company posted a loss per share of 32 cents, slightly better

than the 34 cent loss Wall Street expected. Profitability is

expected around 2026.

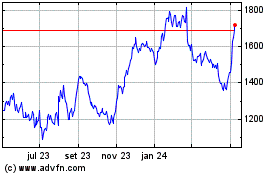

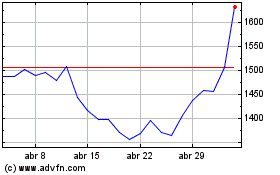

MercadoLibre (NASDAQ:MELI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

MercadoLibre (NASDAQ:MELI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024