US Index Futures are lower in premarket trading on Friday,

weighed down by economic uncertainty, particularly in China, after

major developer Evergrande filed for creditor protection in the

U.S.

By 6:45, Dow Jones futures (DOWI:DJI) were down 53 points, or

0.15%. S&P 500 futures were down 0.23% and Nasdaq-100

futures were down 0.43%. The 10-year Treasury yield was at

4.221%.

In the American economic agenda for Friday, investors will

follow, at 1 pm, the number of oil probes for the week by Baker

Hughes.

In the UK, July retail sales declined by 1.20% from the previous

month, beating expectations for a 0.50% decline. More notable

was the 1.40% decline in monthly core data, beating the forecast

for a 0.7% retraction.

In the euro zone, July inflation retreated 0.10% monthly, in

line with expectations. Annually, inflation in the region is

at 5.30%. These figures reinforce inflationary pressure and

the possible need for measures by the European Central Bank

(ECB). The ECB’s chief economist, Philip Lane, mentioned that

although inflation is high, reduced energy prices could balance the

situation in the future.

In Asia, concerns over Japanese inflation and Evergrande’s

filing for bankruptcy protection in the US led markets to close

lower. In Japan, monthly inflation for July increased by

0.40%. Annually, it is at 3.30%, beating expectations of

2.5%. The annual core inflation, often considered in

forecasts, was 3.1% in July, in line with projections.

Evergrande recently sought protection from creditors in the US,

using Chapter 15 of the Bankruptcy Code, seeking to safeguard its

assets. Previously, it had already postponed debt meetings to

give holders more time to evaluate a restructuring plan.

Additionally, the PBoC, China’s central bank, pegged the onshore

yuan at 7.2006 against the dollar today. This rate serves as a

daily reference, with fluctuations limited to 2% in both

directions.

In commodities markets, West Texas Intermediate crude for

September fell 0.04% to trade at $80.36 a barrel. Brent crude

for October fell 0.17% near $83.98 a barrel. Iron ore futures

traded in Dalian, China, rose 2.94% to $105.45 a tonne.

At the close of Thursday, US market had another bearish day,

influenced by the growth of Treasury yields. The S&P 500

and Nasdaq 100 ended near their lowest points, mainly affected by

the performance of large technology companies. The Dow closed

down 290.91 points or 0.84% to 34,474.83 points. The S&P

500 dropped 33.97 points or 0.77% to settle at 4,370.36 points,

while the Nasdaq Composite fell 157.70 points or 1.17% to 13,316.93

points.

Most traders expect rates to hold at the next FOMC meeting, but

after the minutes released yesterday, expectations of a hike gained

steam. Yields on US bonds reached the highest level since 2007

on concerns about inflation and US government debt.

Ahead of Friday’s corporate results, traders are watching

reports from Deere (NYSE:DE), Xpeng (NYSE:XPEV), Estée Lauder

(NYSE:EL), Madison Square Garden Sports Corp (NYSE:MSGS), Palo Alto

Networks (NASDAQ:PANW) and more.

Wall Street Corporate Highlights for Today

Streaming – The Writers Guild of America

(WGA) alleges

that Disney (NYSE:DIS), Amazon (NASDAQ:AMZN)

and Netflix (NASDAQ:NFLX) wield

excessive power in streaming and calls for more

regulation. They argue that these companies hurt competitors,

raise prices and lower wages. The Federal Trade Commission has

expressed similar concerns. The WGA is on strike calling for

better compensation and protections.

Microsoft (NASDAQ:MSFT) – Microsoft will

close the Xbox 360 online store and marketplace on July 29, 2024,

focusing on newer consoles and Game Pass. Users can still play

titles already purchased for the Xbox 360.

Amazon (NASDAQ:AMZN) – Amazon, trying to

leverage its TikTok-like feed, offered $25 per video to

influencers. The offer was ridiculed on social media. The

initiative aims to leverage “Inspire”, a feed that presents

products. As TikTok expands e-commerce, Amazon faces

challenges in competing with TikTok content. Influencers like

Jazmine Flores highlight the effort it takes to create quality

content.

Berkshire Hathaway (NYSE:BRK.A) – Warren

Buffett donated $27 million worth of Berkshire Hathaway stock to an

unnamed charity. This gesture is part of the billionaire’s

pledge to give away his fortune. His shares in Berkshire

represent about 15% of the company.

Goldman Sachs (NYSE:GS) – Goldman Sachs is

hiring hundreds of employees due to increased regulatory scrutiny

in the US, according to Bloomberg. The bank has not officially

commented on the situation.

Citigroup (NYSE:C) – Citibank was

subpoenaed by the US House Judiciary Committee, chaired by Jim

Jordan, regarding alleged sharing of financial data with the

FBI. The investigation focuses on the sharing of information

related to the events of January 6, 2021 in the Capitol.

Nomura Holdings (NYSE:NMR) – Nomura

lowered its China growth estimate to 4.6% due to disappointing July

data and a slumping economy. The previous forecast was

5.1%.

Barclays (NYSE:BCS) – Barclays has

revamped its leadership in India, appointing Pramod Kumar as CEO,

replacing the retired Ram Gopal. India is a key market for

Barclays, with its business in the country growing considerably

over the last 10 years, outpacing other Asian markets. The

team will face increased competition and challenges associated with

significant clients such as the Adani Group.

Ralph Lauren (NYSE:RL) – Patrice Louvet,

CEO of Ralph Lauren, is navigating modern fashion shifts, including

accepting hoodies at the office and embodying the

metaverse. It emphasizes the importance of sustainability in

attracting young consumers and talent, and values leaders with

authenticity and consumer understanding.

Hershey (NYSE:HSY), Mondelez

International (NASDAQ:MDLZ) – Chocolate companies

such as Hershey and Mondelez are facing challenges with rising

cocoa costs as consumers reduce consumption due to rising

prices. Inflation in the sector worries, while more affordable

brands gain space.

Bloomin’ Brands (NASDAQ:BLMN) – Shares in

Bloomin’ Brands are up more than 6% in premarket trading on Friday

after the Wall Street Journal reported that activist investor

Starboard Value acquired more than 5% of the company, which owns

from Outback Steakhouse. It’s unclear what Starboard’s

intentions are.

Chegg (NYSE:CHGG) – Education software

company Chegg announced on Thursday a $200 million increase in its

share repurchase program, bringing the total to $289

million. Despite facing competition from AI chatbots, Chegg is

adapting its software tools to technology.

Yellow Corp (NASDAQ:YELL) – Estes Express

offered $1.3 billion for the shipping hubs of bankrupt Yellow

Corp. Despite the offer including a bankruptcy loan, Yellow

opted for a $142.5 million financing from Citadel and MFN

Partners. Yellow’s debt includes a 2020 pandemic loan to the

US Treasury.

Tesla (NASDAQ:TSLA) – Australian

company Core Lithium (ASX:CXO) has not

finalized a planned supply agreement with Tesla by the October 26,

2022 deadline. In response, Tesla threatens to use “all available

legal remedies” . The agreement under discussion related to

the supply of spodumene, an essential mineral for electric vehicle

batteries.

Ford Motor (NYSE:F) – A consortium, led by

Ford and South Korean companies, will invest $887 million in a

plant in Becancour, Quebec, to produce materials for electric

vehicle batteries. With financial support from the Canadian

and Quebec governments, the plant will produce 45,000 tons of

cathode materials annually. The facility, to be completed in

2026, will strengthen Becancour as a hub in the North American EV

supply chain.

Stellantis (NYSE:STLA) – Stellantis will

invest more than $100 million in Controlled Thermal Resources to

extract lithium amid growing demand for electric vehicle

batteries. DLE technology allows for sustainable extraction

without extensive mining. The deal will also increase

Stellantis’ lithium purchases to 65,000 tonnes annually from

2027.

US Steel (NYSE:X) – US Steel has stated

that the United Steel Workers (USW) union has no right to veto a

sale of the company. This statement came after the USW

endorsed Cleveland-Cliffs Inc as a potential buyer. US Steel

is evaluating several bids, including one from Esmark Inc and

ArcelorMittal SA (MTCN).

CVS Health (NYSE:CVS) – Blue Shield of

California announced Thursday that it will discontinue most of its

services with CVS Health, aiming to work with Amazon (AMZN)

and drugmaker Mark Cuban to cut drug costs . This move

estimates savings of $500 million annually starting in 2025.

Dolby Laboratories (NYSE:DLB) – Dolby

Laboratories will replace Staar Surgical in the S&P MidCap 400.

Staar, in turn, will replace Urstadt Biddle in the S&P SmallCap

600 on Aug. 22, due to the acquisition of the latter by Regency

Centers Corp.

Earnings

Applied Materials (NASDAQ:AMAT) –

Applied Materials forecast fourth-quarter profit above expectations

due to increased demand for chips and government

subsidies. The company reported earnings of $1.90 a share on

revenue of $6.43 billion that beat estimates in the third

quarter. Governments globally have earmarked billions for

domestic semiconductor production, benefiting the company.

Walmart (NYSE:WMT) – Walmart raised

its full-year guidance after outperforming second-quarter sales and

earnings on Thursday, buoyed by demand for groceries and health

products. US sales grew 6.4%, and the company highlighted

strong consumption at seasonal events. Walmart expects fiscal

2024 earnings to be in the range of $6.36 to $6.46 per share, up

from its previous forecast of $6.10 to $6.20.

Keysight Technologies (NYSE:KEYS) – Test

equipment maker Keysight Technologies projected fourth-quarter

earnings below expectations, leading to a drop of about 11.2% in

its premarket stock. The company anticipates earnings of

between $1.83 and $1.89 per share on revenue of between $1.29

billion and $1.31 billion, while analysts were projecting $2 per

share and $1.39 billion in revenue.

Farfetch (NYSE:FTCH) – Shares in Farfetch

fell about 37.4% premarket after reporting lower-than-expected

quarterly sales and a loss of $281 million, or $0.68 per

share. Revenue was US$ 572 million, against US$ 650 million

forecast. José Neves, CEO, highlighted the company’s

adaptation to the recent macroeconomic environment.

Bill Holdings (NYSE:BILL) – Bill Holdings,

maker of software to help small businesses with payments, forecast

revenue of $1.29 billion for 2024, below analyst expectations of

$1.31 billion.

Ross Stores (NASDAQ:ROST) – Ross Stores

stock rose more than 5% premarket after beating Q2 expectations and

updated forecast, attributing this to budget-conscious

customers. Ross reported earnings of $446 million and sales of

$4.9 billion. The company updated its annual forecast despite

ongoing concerns about inflation.

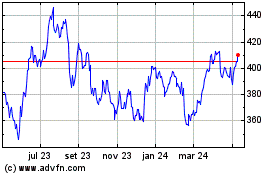

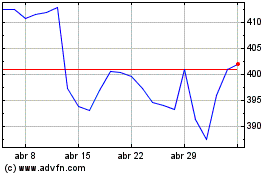

Deere (NYSE:DE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Deere (NYSE:DE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024