US index futures are up in Monday’s pre-market, staging a

recovery and digesting data from Europe and China, following a week

in which U.S. interest rate concerns left investors apprehensive

and fueled a global risk-averse sentiment.

By 6:48 AM, Dow Jones (DOWI:DJI) futures were up 105

points, or 0.30%. S&P 500 futures were up 0.43% and

Nasdaq-100 futures were up 0.55%. The 10-year Treasury yield

was at 4,298%.

In Germany, the producer price index recorded a monthly drop of

1.10% in July, beating expectations of -0.20%. In annual

terms, there was a decrease of 6.0%, indicating a positive scenario

amid the restricted conditions of the largest European economy.

In Asian markets, lack of direction prevailed due to growing

concerns about China. Evergrande, the real estate giant, has

filed for creditor protection in the US. The People’s Bank of

China (PBoC) cut the one-year lending rate to 3.45%, down from

3.55% previously, while the five-year rate remained at

4.20%. Despite expectations of a bigger cut to boost sectors,

the PBoC implemented measures to mitigate financial risks in the

face of concerns about contagion in the real estate sector.

In commodities markets, West Texas Intermediate crude for

September was up 1.05% to trade at $82.10 a barrel. Brent

crude for October was up 0.88% near $85.55 a barrel. Iron ore

futures traded in Dalian, China, were up 0.91% to $106.18 a

tonne.

At Friday’s close, the Dow Jones rose 25.83 points, or 0.07%, to

34,500.66 points. The S&P 500 was broadly flat, or -0.01%,

at 4,369.71 points, while the Nasdaq ended up losing 26.16 points,

or 0.20%, at 13,290.78 points. Anxieties related to rising

interest rates worldwide continue to influence risk aversion

sentiment, and increases in yields hit technology and finance

companies hardest.

The increase in long-term interest rates in the United States,

in part, seems to be linked to the idea that the probability of an

imminent recession is now less likely, and a mild slowdown scenario

seems to be taking shape. In any case, the fall in asset

values over the last few days found a point of stability on

Friday, as US stocks, except for the technology sector, showed a

day of appreciation.

Ahead of Monday’s corporate results, traders are watching

reports from Zoom Video (NASDAQ:ZM) and Nordson (NASDAQ:NDSN).

Wall Street Corporate Highlights for Today

Walmart (NYSE:WMT) – Walmart and Centric

Brands are investigating their supply chains in Cambodia following

allegations that female inmates at the country’s largest women’s

prison illegally produced clothing for export. AAFA has

expressed concerns about forced labor.

Starbucks (NASDAQ:SBUX) – A judge ordered

Starbucks to pay an additional $2.7 million in lost wages and tax

damages to Shannon Phillips, a former regional manager who alleged

racial discrimination. In June, she was already awarded $25

million for wrongful termination following the 2018 black male

arrest incident. The company is seeking a new trial, while

Phillips’ lawyers want $1.4 million in fees. The case

addresses allegations of unfair punishment of white employees after

the incident, which sparked protests and settlements with the men

involved.

Domino’s (NYSE:DPZ) – Russian franchise

Domino’s Pizza faces a challenging backdrop with the news of its

bankruptcy and subsequent exit from Russia. DP Eurasia, the

main franchisee of the Domino’s brand in Russia and listed in

London, announced that it is filing for bankruptcy after facing

financial difficulties. This situation marks the end of an

attempt to sell the Russian unit.

Citigroup (NYSE:C) – Citigroup CEO Jane

Fraser is evaluating a plan to spin off the bank’s main division,

the Institutional Clients Group (ICG), into three key segments:

investment and corporate banking, global markets and transaction

services, according to the Financial Times. The move comes as

divisional CEO Paco Ybarra is expected to leave in the first half

of 2024.

Adobe (NASDAQ:ADBE) – John Warnock,

co-founder of Adobe, has passed away at age 82. The cause of

death was not disclosed. He founded Adobe in 1982 with Charles

Geschke, serving in leadership roles until 2017.

Nvidia (NASDAQ:NVDA) – Next Wednesday,

quarterly results from Nvidia Corp. will test its position as

a leader in the AI boom and its ability to meet high expectations

after forecasting record revenue. Despite the supply

bottlenecks, analysts see potential for growth due to rising demand

for technology, especially AI.

Meta Platforms (NASDAQ:META) – Meta

Platforms has plans to introduce a web edition of its Threads

microblogging app soon, as reported by the Wall Street Journal on

Sunday.

Palo Alto Networks (NASDAQ:PANW) – After a

brief moment of panic over its unusual earnings report, Palo Alto

Networks brought analysts some relief. Its long-term growth

boosted cybersecurity stocks, with Palo Alto, Zscaler and

CrowdStrike rising in premarket trading. The report beat

expectations, highlighting a compound annual growth rate of 17% to

19% over the next three years, allaying concerns against a backdrop

of macroeconomic uncertainty. The momentum in big business was

also highlighted, raising valuations and positive prospects for the

sector.

Baidu (NASDAQ:BIDU) – Baidu is scheduled

to release its second-quarter results on Tuesday. Forecasts

suggest that its net income will increase by 44% year-over-year to

reach $719.6 million for the quarter ended June 30. In

addition, second-quarter revenue is estimated to grow 14%

year-over-year.

Napco Security Technologies (NASDAQ:NSSC)

– Napco Security Technologies shares fell 34.7% in premarket after

the company disclosed errors in previous financial

statements. The inflated numbers for the first three quarters

of fiscal 2023 were identified by the wireless communications and

security equipment maker.

DuPont De Nemours (NYSE:DD) – DuPont De

Nemours is in advanced talks to sell its Delrin resins business to

The Jordan Company for approximately $1.8 billion, according to

Bloomberg News. The sale may be announced soon, although

uncertainties remain.

General Motors (NYSE:GM) – The California

Motor Vehicle Regulatory Authority is investigating recent

incidents involving autonomous vehicles operated by General Motors’

Cruise business in San Francisco. The regulator has asked the

company to pull half of its robotaxis off the road and immediately

reduce its active fleet by 50% pending the completion of the

investigation. Cruise agreed to the reduction. The

investigation was triggered after an accident involving an

emergency vehicle and a Cruise robotaxi.

Xpeng (NYSE:XPEV) – Shares in XPeng rose

6.1% in premarket trading on Monday after analysts at BofA raised

the Chinese electric vehicle maker’s recommendation from “Neutral”

to “Buy”, raising the price target from $16.30 to $22. The shares

had fallen 4.3% on Friday after the company forecast revenue below

estimates, reflecting weak demand and intense competition after

price cuts. In the second quarter, Xpeng’s revenue fell 32%,

with negative gross margins due to inventories of the G3i crossover

SUV.

Tesla (NASDAQ:TSLA) – In May, Tesla’s data

breach affected more than 75,000 individuals, including employee

records, resulting from “internal errors,” Maine’s attorney general

disclosed on Friday. About 9 Maine residents were affected,

all of whom are current or former employees of the Austin,

Texas-based automaker. The investigation identified that

former employees misappropriated information, resulting in lawsuits

and device seizures. Tesla is taking steps to prevent the

continued use, access and disclosure of data.

Stellantis (NYSE:STLA) – Stellantis is

considering moving production of the Ram 1500 pickup from suburban

Detroit to Mexico, according to United Auto Workers vice president

Rich Boyer. The company discussed this change in contract

negotiations with the union.

Hawaiian Electric Industries (NYSE:HE) –

Hawaiian Electric said it is not planning a restructuring but is

seeking expert advice amid concerns about its role in the Maui

wildfires. The company did not detail the purpose of the

counseling. Rating agencies downgraded its credit rating, and

analysts compare its situation to that of PG&E Corp in

California.

Estee Lauder (NYSE:EL) – Estée Lauder projected

lower-than-expected full-year sales and earnings on Friday,

indicating a slower-than-expected recovery in its travel retail

business, particularly in Asia, and weakened demand in the United

States. The company expects the Asia-Pacific region, in

particular Hainan and mainland China, to remain

challenging. Annual sales are forecast to increase between 5%

and 7%, while adjusted annual earnings are expected to be between

$3.50 and $3.75 per share.

WeWork (NYSE:WE) – WeWork on Friday confirmed

its intention to undertake a 1-for-40 reverse stock split to regain

compliance with listing requirements, after raising doubts about

its viability. The company’s shares, previously valued at $47

billion, are now worth around $336 million. The company has

faced challenges since the collapse of its IPO plans in 2019 and

has pursued savings and restructuring measures. The stock

split is expected to take effect on September 1.

Deere & Co (NYSE:DE) – Deere & Co beat

estimates for third-quarter earnings, up 60%, but its shares fell

last Friday on concerns about future sales. Net income rose to

$2.98 billion for the quarter ended July 31. Earnings per

share came in at $10.20, beating analysts’ forecast of $8.20,

according to Refinitiv data. Although it raised the annual

projection, the market reacted lukewarm due to the possible

slowdown in demand in 2024.

Jet.AI (NASDAQ:JTAI) – Jet.AI shares fell 16.3%

in premarket Monday after the launch of its AI-powered booking app

on Apple’s App Store, after closing up 64% on Friday -fair.

Pfizer (NYSE:PFE), Moderna

(NASDAQ:MRNA) – Amid an increase in COVID-19 hospitalizations,

vaccine manufacturers report efficacy of updated vaccines for

circulating variants. Pfizer reported positive results, while

Moderna said its vaccine also responds to emerging variants,

alleviating concerns. As hospitalizations grow, variants such

as EG.5 raise global concerns. Approval and recommendation of

new vaccines are expected.

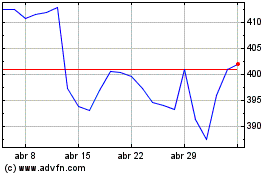

Deere (NYSE:DE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

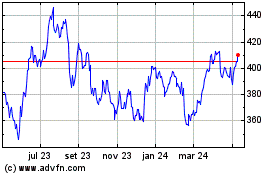

Deere (NYSE:DE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024