US index futures are higher in premarket trading on Monday, amid

the start of the last trading week in August with a quieter global

schedule.

By 6:50 AM, Dow Jones (DOWI:DJI) futures were up 77 points,

or 0.22%. S&P 500 futures were up 0.15% and Nasdaq-100

futures were up 0.25%. The 10-year Treasury yield was at

4.233%.

On Monday’s US economic agenda, investors await, at 10:30 am,

the Dallas Fed’s industrial activity index for August, in which the

consensus expects a retraction of 21.6 points. At 1 pm, the

government will announce two Treasury auctions, one with a two-year

maturity and another with a five-year maturity.

In Europe, activity should be subdued due to a UK holiday, with

the London Stock Exchange closed.

Asian markets ended higher, following China’s decision to launch

stimulus to strengthen the economy. On Sunday, the country

said it would cut the tax on stock market transactions in half,

seeking to bolster investor confidence in the Shanghai exchange,

the world’s second-largest. Reports indicate that this tax

break, which also applies to stocks in Shenzhen, is the first since

2008 and is already in effect.

In other Asian news, shares in Evergrande, a major Chinese

homebuilder, resumed trading after a 17-month lull, falling

87%. The company recently requested court protection in the US

to guard against potential lawsuits from international creditors

seeking to collect on its debts.

In commodities markets, West Texas Intermediate crude for

October was up 0.06% at $79.88 a barrel. Brent crude for

October fell 0.17% near $84.33 a barrel. Iron ore futures

traded in Dalian, China, rose 0.55% to trade at $112.84, with an

eye on further stimulus in China.

At the close of Friday, US markets experienced a favorable day as

investors interpreted Jerome Powell’s words in Jackson

Hole. The Dow closed with a gain of 247.48 points or 0.73% at

34,346.90 points. The S&P 500 rose 29.40 points or 0.67%

to 4,405.71 points, while the Nasdaq Composite closed up 126.67

points or 0.94% to 13,590.65 points.

The Federal Reserve Chairman emphasized that the fight against

inflation is not yet resolved and is open to raising interest rates

if indicators show an increase in inflation. However, Powell

indicated that the Fed may keep rates as they are at the next

September meeting, in line with market expectations. Despite

this, volatile assets rose as Powell’s tone remained consistent

with his previous statements.

Ahead of Monday’s corporate results, traders are watching

reports from Nordic American Tankers (NYSE:NAT), BaoZun

(NASDAQ:BZUN), among others. After the close, reports will be

expected from Heico (NYSE:HEI), Afya (NASDAQ:AFYA), LifeVantage

(NASDAQ:LFVN), Noah Holdings (NYSE:NOAH), and more.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple plans to

revitalize the tablet market with a redesigned iPad Pro for next

year amid declining tablet sales. The iPhone 15 and Apple

Watch event is scheduled for September 12th. The company is

also gearing up for the release of iOS 17. Last quarter, iPad sales

slumped, facing competition from improved Macs and phones with

bigger screens. A new Magic Keyboard for the iPad Pro is also

in development.

Nvidia (NASDAQ:NVDA) – Nvidia’s profits

may boost the Korean won, which recently declined due to economic

challenges. With the growing demand for AI chips, suppliers like SK

Hynix might benefit. Nvidia’s shares saw a 1% increase in

pre-market trading on Monday. Despite a remarkable 215% growth in

shares this year, the recent earnings report from the AI chip

pioneer made the shares seem cheap. The forward price/earnings

metric, which compares the current value of a stock to its expected

earnings, typically over the next year, suggests that Nvidia’s

shares are more attractively priced now than they were on January

5, even with the significant rise since then.

Jabil (NYSE:JBL) – Chinese

automaker BYD (USOTC:BYDDY) has

purchased Jabil Inc’s mobile electronics business in China for $2.2

billion, expanding its portfolio and customer base. BYD,

initially focused on electronic components, has become a leader in

electric vehicles and a supplier to Apple

(NASDAQ:AAPL). The deal will potentially increase BYD

Electronic’s share of supply to Apple. The form of financing

for the acquisition was not disclosed.

Xpeng (NYSE:XPEV) – Chinese electric car

maker Xpeng will acquire Didi’s EV unit for up to $744 million,

forming a strategic partnership. Xpeng shares are up 4.5%

premarket. Xpeng will launch a new model under the MONA brand,

targeting the mass market. The cooperation will include

marketing, insurance and robotaxis. Didi will acquire 3.25% of

Xpeng.

Boeing (NYSE:BA) – Boeing is preparing to

resume deliveries of the 737 MAX to China after a 4-year

interruption. The first deliveries are expected in

weeks. China had suspended the 737 MAX after accidents, but

90% have been operating commercially since June.

UBS (NYSE:UBS) – Credit Suisse, a

subsidiary of UBS, reported a loss of US$4.0 billion in the second

quarter of 2023, according to the Sonntagszeitung. The bank

had already anticipated losses due to the restructuring and exit of

non-core businesses.

JPMorgan Chase (NYSE:JPM) –

Singapore-based Whampoa Group has hired Ali Moosa, formerly of

JPMorgan, to lead a crypto-focused digital bank in

Bahrain. The bank, Singapore Gulf Bank, aims to integrate

conventional and digital financial services across Asia and the

Middle East.

Citigroup (NYSE:C) – Jon Gidney, Vice

President of Citigroup Australia, plans to retire after nearly 30

years in finance. Previously, he led mergers and acquisitions

at JPMorgan Australia. He announced his retirement on

LinkedIn.

McDonald’s (NYSE:MCD) – Chinese private

equity firm Trustar Capital plans to create a continuation fund to

sell its stake in McDonald’s China at a target valuation of $10

billion. This movement would provide liquidity to current

investors. Trustar trades with sovereign wealth funds

including GIC and Mubadala. In 2017, McDonald’s sold 80% of

its Chinese operations, including to CITIC and Carlyle. Both

analyze options for their holdings.

Hostess Brands (NASDAQ:TWNK) – Snack maker

Hostess Brands is considering a sale after showing interest from

major players such as General

Mills (NYSE:GIS), Mondelez (NASDAQ:MDLZ), PepsiCo (NASDAQ:PEP)

and Hershey (NYSE:HSY). With a

market cap of approximately $4 billion, Hostess has consulted

with Morgan Stanley (NYSE:MS) about

potential deals.

Horizon

Therapeutics (NASDAQ:HZNP), Amgen (NASDAQ:AMGN)

– The US FTC has paused its challenge to Amgen’s purchase of

Horizon Therapeutics for $27.8 billion through September

18. Amgen expects to finalize the acquisition in

December. The FTC had initially sought to block the deal over

competitive concerns related to two Horizon drugs.

SentinelOne (NYSE:S) – Cybersecurity

startup Wiz is considering acquiring SentinelOne, valued at $4.9

billion. SentinelOne, which faces financial challenges, is

exploring options to sell. Both companies have been partnering

on cloud security since March.

BlackBerry (NYSE:BB) – Veritas Capital has

offered to buy BlackBerry Ltd, which is valued at US$3.1

billion. BlackBerry, famous for its smartphones, now focuses

on software for automobiles and cybersecurity. Offer details

remain unknown.

3M (NYSE:MMM) – 3M moves closer to a $5.5

billion settlement over defective earplugs, affecting thousands of

military veterans. The company was expected to pay around $10

billion. Aearo, a subsidiary of 3M, declared bankruptcy in

2022. Shares of 3M, which have fallen 17% this year, are up 5.1% in

premarket trading on Monday.

Alibaba (NYSE:BABA), JD.com (NASDAQ:JD), Baidu (NASDAQ:BIDU)

– Chinese companies’ US depositary receipts are up about 1%

premarket after the Chinese government’s announcement about the

reduction of a transaction tax and other initiatives to boost its

financial markets.

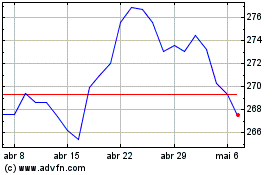

McDonalds (NYSE:MCD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

McDonalds (NYSE:MCD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024