Dollar General Lowers Annual Sales Forecast as Inflation Pressures Weigh on Customers

31 Agosto 2023 - 9:11AM

IH Market News

On Thursday, Dollar General (NYSE:DG) reduced its annual

forecast for same-store sales as it anticipates customers will

continue feeling the strain from persistently high inflation and

pull back on discretionary spending.

The company, headquartered in Goodlettsville, Tennessee, has

seen its shares fall about 36% this year, dropping by 14% in

pre-market trading.

According to Refinitiv IBES data, analysts had, on average,

expected a growth of 1.45%.

U.S. consumers, particularly those in lower and middle-income

groups, have been feeling the squeeze as cuts in government aid and

lower tax refunds compound inflationary pressures.

The company noted that gross profit as a percentage of net sales

dropped 126 basis points in the second quarter compared to the

previous year. This was driven by lower inventories, increased

markdowns, and inventory damages.

The discount retailer now foresees same-store sales for the

fiscal year 2023 to be in the range of a decline of 1% to growth of

1%, compared to its previous outlook of an increase of 1% to 2%.

Analysts had, on average, anticipated a growth of 1.45% according

to Refinitiv IBES data.

For the year, adjusted earnings per share are forecasted in the

range of $7.10 to $8.30, marking a decline of 34% to 22% from the

previously stable 8% decline.

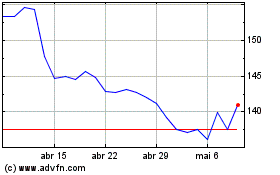

Dollar General (NYSE:DG)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

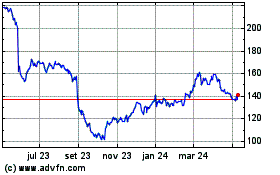

Dollar General (NYSE:DG)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024