US index futures are mixed in Friday’s pre-market trading, a day

after the interest rate hike in Europe and following oil hitting a

10-month high, surpassing the $94 mark, along with improved data

from China indicating recent stimulus measures have taken effect.

Investors are also monitoring a workers’ union strike at 3

automakers and Arm shares, which continue to surge a day after an

exciting debut.

At 7:25 AM, Dow Jones futures (DOWI:DJI) rose 76 points, or

0.22%. S&P 500 futures were up 0.08% and Nasdaq-100

futures were down 0.10%. The yield on the 10-year Treasury

note was at 4.324%.

On Thursday’s United States economic agenda, investors await, at

8:30 AM, the prices of exported goods, which have a consensus of an

increase of 0.40% in August; The Empire State manufacturing

index for September will be released at the same time. At 9:15

AM, it will be the turn of industrial production for August, which

is expected to rise modestly by 0.10% on a monthly basis,

confirming the difficulty of production in the country. At 10

AM, the Michigan consumer confidence index will be released, which

is projected at 69.10 points for September. Later at 1 PM,

Baker Hughes releases the oil rig count for the week ending

September 15th.

Stock markets in Europe and Asia rose, driven by positive

economic indicators from China, signaling that stimulus initiatives

may be having an effect. Investors are also anticipating this

Friday’s triple options event, which could result in trading

flare-ups and instability. Everyone is paying attention to the

next Fed meeting, hoping that the US will continue with economic

stability and maintain interest rates.

On the other hand, the suspicion that the European Central Bank

has stopped raising rates has affected the euro, which is heading

for its ninth consecutive week of decline, an unprecedented

sequence since its creation, more than 20 years ago. Christine

Lagarde, President of the ECB, recently emphasized that the bank

does not plan to reduce interest rates. She highlighted, after

a Eurogroup meeting, the relevance of the current level of rates

and their duration, but did not go into details.

In other regions, Asian markets grew, benefiting from

higher-than-expected industrial production and retail sales figures

in China. These indicators revealed that, in August, the

Chinese economy got a boost, thanks to the increase in travel

during the summer and more robust stimulus policies, which

increased both consumption and industrial production.

In the commodities market, iron ore with a concentration of 62%

rose 2.33%, quoted at US$120.77. West Texas Intermediate crude

oil for October rose 0.50% to $90.61 per barrel. Brent oil for

November rose 0.41% to US$94.09 per barrel.

At Thursday’s close, Dow Jones jumped 331.58 points or 0.96% to

34,907.11 points. S&P 500 advanced 37.66 points or 0.84% to

4,505.10 points. Nasdaq rose 112.47 points or 0.81% to 13,926.05

points. In August, retail sales grew 0.6%, exceeding analysts’

estimates of a 0.1% increase. The Producer Price Index (PPI)

increased by 0.7%, above the expected 0.4%. However, this

increase was mainly driven by energy costs, reflecting the

appreciation of oil and other energy sources. Thus, the

favorable results reinforce the prospect of a smooth landing for

the economy.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple will release

an update to the iPhone 12 in France due to regulatory concerns

about radiation limits. The measure aims to comply with

European standards, after suspending sales. Belgium is also

investigating health risks from the iPhone 12.

Alphabet (NASDAQ:GOOGL) – Google has

released an early version of Gemini, its conversational artificial

intelligence software, aiming to compete with OpenAI’s

GPT-4. Gemini ranges from chatbots to text and image

generation, and will be powered by Google Cloud Vertex AI.

Arm Holdings (NASDAQ:ARM) – Shares of

SoftBank’s Arm Holdings are up 9.6% in Friday’s premarket after

jumping nearly 25% yesterday in its Nasdaq debut, renewing optimism

in IPOs. The stock closed at $63.59, valuing the company at

$65 billion. Experts see this as a positive sign for future

market launches.

Taiwan Semiconductor Manufacturing (NYSE:TSM) –

TSMC has asked major suppliers to delay deliveries of cutting-edge

equipment due to demand concerns. Suppliers, including

Netherlands-based ASML (NASDAQ:ASML), saw their

stocks drop after the announcement. TSMC is also facing delays in

its Arizona factory. Suppliers believe the postponement is

temporary.

Salesforce (NYSE:CRM) – After cutting 10%

of its jobs in January, Salesforce plans to hire 3,300 employees,

divided between sales, engineering and its data cloud platform, as

reported by Bloomberg. The decision aims to sustain the

company’s growth and margins.

Adobe (NASDAQ:ADBE) – Adobe shares are

down 2.4% in pre-market trading on Friday, despite beating

expectations with the launch of artificial intelligence tools and

rising subscription prices. While DA Davidson analyst sees

little room for growth, RBC Capital Markets and Evercore ISI are

bullish.

Amazon (NASDAQ:AMZN) – Amazon opened its

largest delivery center in Latin America in Mexico City,

strengthening its presence since 2015 and investing US$3 billion to

compete with Mercado Libre

(NASDAQ:MELI) and Walmart (NYSE:WMT). The

structure houses “last mile” deliveries and employs thousands.

Microsoft (NASDAQ:MSFT), Oracle (NYSE:ORCL)

– Microsoft and Oracle have expanded their cloud partnership,

facilitating the integration of Microsoft’s Azure AI with the

Oracle database. The service, called Oracle Database@Azure,

will be available in 2024 in some regions. This move

represents a strategic shift in the cloud market, as companies

previously tried to confine users to a single platform. The

cooperation aims to optimize database and network performance for

customers using both solutions.

Tesla (NASDAQ:TSLA) – Tesla is innovating

in vehicle production, adopting a technique called “gigacasting”,

which could significantly reduce production costs. By

employing massive presses, the company can mold larger Model Y

structures, challenging the industry’s traditional

approach. To improve this advancement, Tesla intends to create

almost the entire base of the vehicle as a single piece, instead of

the conventional 400 pieces. Additionally, the company is

exploring 3D printing and sand molding techniques to improve design

and efficiency.

Ford Motor (NYSE:F) – Workers at the Ford

plant in Wayne, Michigan, supported by the UAW union, began a

historic strike, along with simultaneous strikes at other

automakers. The strike followed contractual disagreements,

including demands for pay increases and better benefits. Ford

CEO Jim Farley warned that the UAW union’s proposal could bankrupt

the company. If adopted since 2019, the changes would have

turned profits of US$30 billion into losses of US$15

billion. Shares

of Carvana (NYSE:CVNA) and

CarMax (NYSE:KMX) rose 13% and 4% on Thursday,

preceding an auto worker walkout.

Chevron (NYSE:CVX) – Despite intensified

strikes and an issue at the Wheatstone plant, Chevron’s Australian

plants have maintained LNG exports. Workers intensified

previously limited protests, but supplies to Japan and China

continued. Chevron seeks to minimize disruptions.

Uber Technologies (NYSE:UBER) – Uber has

entered into a partnership with Deliverect, a Belgian restaurant

software company. Uber and Deliverect will integrate systems

and Deliverect will prioritize deliveries via Uber Direct. The

partnership benefits restaurants that want to highlight their brand

and carry out external deliveries, and will be available in nine

countries. In other news, Uber rejected a Brazilian court

ruling that fined it $205 million for irregular employment

relationships. The court also asked for recognition of the

employment relationship with drivers. Uber will appeal, citing

“legal uncertainty”.

DoorDash (NYSE:DASH) – Doordash announced

the transfer of its listing from the NYSE to Nasdaq, beginning

September 27th under the ticker symbol “DASH.” The move is

seen as a setback for the NYSE as it seeks more listings of

technology companies.

Visa (NYSE:V) – Visa shares were the

worst-performing in the Dow Jones on Thursday after announcing

discussions with shareholders about allowing banks to exchange

Class B shares for Class B-2 and C shares. The latter could be

converted into Class A shares and sold. Analysts have mixed views

on the proposal.

Citigroup (NYSE:C) – In its

reorganization, Citigroup may lay off compliance and risk

management support staff and technology staff with duplicate

roles. CEO Jane Fraser aims to reduce bureaucracy and focus on

profitability. In other news, Citigroup in India will allow

female employees to work remotely for up to a year after their

26-week maternity leave as it seeks to expand benefits and retain

female talent. This policy can result in up to 21 months

without going to the office.

Deutsche Bank (NYSE:DB) – Deutsche Bank

has teamed up with Swiss crypto firm Taurus to custodian

cryptocurrencies and tokenized client assets. Although

cryptocurrency trading is not immediately planned, the bank

recognizes the potential of the digital asset market, acting with

regulatory caution.

UBS (NYSE:UBS) – UBS CEO Sergio Ermotti

has committed to leading the company until 2026 to complete the

integration of Credit Suisse, avoiding its collapse. He sees

the US and Asia as key growth areas as UBS plans to reduce

costs.

Goldman Sachs (NYSE:GS) – Goldman Sachs

fired executives from its transaction banking unit for violating

communications policies, according to a memo. Philip Berlinski

takes over day-to-day management. Hari Moorthy, one of those

fired, is no longer registered with FINRA. The company

emphasizes the importance of communication

policy. Additionally, Goldman Sachs is withdrawing from the

business of advising massively wealthy investors, choosing to focus

on the advisor custody business. Recognizing limitations, the

company will sell its PFM to Creative Planning. CEO David

Solomon highlights a return to a focus on ultra-high net worth,

aligning with the company’s roots. This strategy connects to

the custody business the company has been building, aiming to serve

and not compete with RIAs.

Charles Schwab (NYSE:SCHW) – Charles

Schwab will update data on its clients’ assets and new net inflows

on Friday. After the acquisition of TD Ameritrade in 2020,

there was a decrease in net new assets, attributed to the departure

of TD clients.

Barclays (NYSE:BCS) – Barclays is

exploring the opportunity to enter the ESG debt market segment

previously dominated by Credit Suisse. Furthermore, economists

at Barclays Plc expect a more gradual rise in Turkey’s interest

rates despite President Erdogan’s support for conventional monetary

policies. They predict an increase of 250 basis points,

pointing to “gradual” adjustments.

Virtu Financial (NASDAQ:VIRT) – Following

accusations from the Securities and Exchange Commission over data

protection, Virtu Financial shares fell on Thursday. However,

CEO Douglas A. Cifu and co-president Joe Molluso purchased shares

in the company. Virtu disagrees with the accusations and will

defend itself.

Disney (NYSE:DIS) – Byron Allen offered

$10 billion to buy ABC and Disney assets including FX and National

Geographic. As Disney mulls selling traditional TV assets due

to the growth of streaming, it has also had discussions

with Nexstar Media (NASDAQ:NXST).

Northrop Grumman

Corp (NYSE:NOC), Lockheed

Martin (NYSE:LMT) – China sanctioned Northrop Grumman

and Lockheed Martin for supplying weapons to Taiwan. Beijing

warned the US to stop military support for Taiwan, threatening

“resolute retaliation”, as stated by spokesman Mao Ning.

MGM Resorts

International (NYSE:MGM), Caesars

Entertainment (NASDAQ:CZR) – Scattered Spider hackers

claimed to have removed six terabytes of data from the MGM Resorts

and Caesars Entertainment casino systems. MGM and Caesars have

not confirmed the amount of data compromised. The group,

linked to several invasions, does not intend to disclose the

data.

Lennar Corp (NYSE:LEN) – Construction

company Lennar Corp released quarterly results that exceeded

expectations, despite the drop in the annual

comparison. Lennar reported third-quarter net income of $1.11

billion, or $3.87 per share, compared with $1.47 billion, or $5.03

per share, in the same quarter last year. Revenue of $8.73

billion was down from $8.93 billion. The market remains

favorable for construction companies, the CEO said, citing pent-up

demand and supply shortages. The company used incentives to

offset economic challenges.

Nucor (NYSE:NUE) – Steel company Nucor

projected a profit for the third quarter that was below

expectations. Nucor expects earnings from its steel division

in the third quarter to be lower than in the second quarter due to

reduced prices and, to a lesser extent, lower volumes.

Abbott (NYSE:ABT) – Goa, India, threatens

to suspend the license of the local Abbott unit following hygiene

and contamination issues at its factory. The pharmaceutical

company, which had recalled batches of Digene syrup due to taste

and odor complaints, claims there is no impact on health. The

plant, which accounts for 7% of the Indian antiflatulent market,

faces regulatory questions following inspections. Abbott plans

to officially respond to the notice.

Novartis (NYSE:NVS) – Novartis’ generics

unit Sandoz plans to launch five additional biologics. Its

CEO, Richard Saynor, highlights the growth of biosimilars in the

pipeline, aiming to

overtake Pfizer (NYSE:PFE) as the leader

in the sector. The spin-off of Sandoz will be decided at a

Novartis meeting. The company intends to improve profitability

by expanding its presence in biosimilars, and will face competition

from other large pharmaceutical companies.

Bristol Myers Squibb (NYSE:BMY) – Bristol

Myers Squibb plans to double its clinical trials, focusing on

cellular therapies, due to generic competition for its leading

drugs. The company, which is facing declining demand for

Revlimid and Eliquis, will expand its production capacity in

Devens.

Canopy Growth (NASDAQ:CGC) – Canopy Growth

seeks bankruptcy protection for BioSteel, its sports nutrition

segment, as it seeks to control costs. The move sent Canopy

shares up 9.6% on Thursday, hoping to reduce debt. The company

faces financial challenges and will lay off 181 BioSteel

employees.

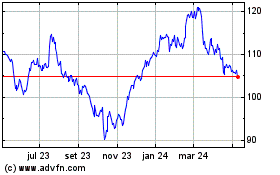

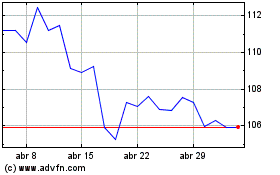

Abbott Laboratories (NYSE:ABT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Abbott Laboratories (NYSE:ABT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024