US index futures are slightly higher in Tuesday’s pre-market, a

day before Federal Reserve’s decision on monetary policy, with

interest rates forecast to remain between 5.25% and

5.50%. Meanwhile, in the euro zone, the latest reading showed

more moderate inflation.

At 7:04 AM, Dow Jones futures (DOWI:DJI) rose 30 points, or

0.09%. S&P 500 futures rose 0.11% and Nasdaq-100 futures

rose 0.09%. The yield on the 10-year Treasury note was at

4.319%.

In the commodities market, West Texas Intermediate crude oil for

October rose 1.14% to $92.52 per barrel. Brent oil for

November rose 0.59% to US$94.99 per barrel. Iron ore with a

concentration of 62% fell 0.69%, quoted at US$118.12 per ton.

On Tuesday’s United States economic agenda, investors await, at

8:30 AM, data on the construction of new homes for August, while at

1 PM the government holds an auction of 20-year Treasuries. At

4:30 PM, API releases oil stocks for the week ending September

15th.

In August, the euro zone consumer price index rose 0.50%, below

expectations of 0.60%. Excluding food and energy, inflation

was 5.30%, as expected. Current inflation does not change the

outlook that the European Central Bank (ECB) is ending monetary

tightening. However, Christine Lagarde, president of the ECB,

signaled possible interest rate increases.

In Asia, markets closed with mixed results, awaiting monetary

decisions from the US and China. The Chinese five-year

benchmark rate is set at 4.20% per year.

The Chinese real estate sector breathed a sigh of relief as

Country Garden and Sunac renegotiated debts. Country obtained

an extension of a US$500 million onshore bond with interest of

6.15%. In response to its challenges, the Chinese government

took supportive measures, giving the company a 30-day grace period

to pay off. Sunac, on the other hand, had its US$9 billion

debt restructuring plan approved. However, its shares fell 7%

after seeking protection from creditors in the US.

At Monday’s close, Dow Jones rose 6.06 points or 0.02% to

34,624.30 points. S&P 500 rose 3.21 points or 0.07% to

4,453.53. Nasdaq Composite rose 1.90 or 0.01% to 13,710.24

points. US stock markets had slight variations, while the

price of oil approached US$95 per barrel, intensifying inflationary

fears and raising Treasury yields.

This week, global central banks have important meetings, with a

highlight on the Federal Reserve on Wednesday. It is expected to

maintain the interest rate but indicate potential future increases.

Decisions from ECB and BOJ are also expected. Fed will also present

the “Dot Plot,” a chart with projections from the FOMC, further

emphasizing the significance of Wednesday.

On Tuesday’s corporate earnings front, investors will be

watching reports from AutoZone (NYSE:AZO), Endava (NYSE:DAVA),

Apogee Enterprises (NASDAQ:APOG) and Steelcase (NYSE:SCS).

Wall Street Corporate Highlights for Today

Alphabet (NASDAQ:GOOGL) – Google’s chatbot

Bard has expanded to other services like Gmail, Google Docs, and

YouTube, making it more versatile. A new feature, “Bard

Extensions”, allows users to access information across various

Google tools. Enhancements also include accuracy checks and

conversation sharing. In other news, the U.S. Department of Justice

challenged the proposal to exclude the public from discussions

about Google’s ad pricing during the antitrust trial. In the

federal antitrust trial, Jerry Dischler, Google’s VP of advertising

products, testified that the company adjusted ad auctions to meet

revenue targets, sometimes raising prices by up to 5% without

notifying advertisers. The government aims to prove that Google

violated antitrust law to dominate online searches, boosting its

advertising revenues.

Microsoft (NASDAQ:MSFT) – Yusuf Mehdi

takes over leadership of Microsoft’s Surface and Windows businesses

following the departure of Panos Panay, who may

join Amazon (NASDAQ:AMZN) to manage

Alexa and Echo. Panay oversaw Surface and the launch of

Windows 11 during his 20 years at Microsoft.

Amazon (NASDAQ:AMZN) – Amazon announced

“Prime Big Deals Day” for October 10 and 11, following a summer

sale in July. Similar to 2022, the event will include partners

of the “Buy with Prime” feature. Amazon’s online sales grew,

with an estimate of US$56.7 billion for September. Responding,

WalMart (NYSE:WMT) plans its own event from October 9th to

12th. Amazon shares are up 0.11% in premarket trading

Tuesday.

International Business Machines (NYSE:IBM)

– IBM has committed to training 2 million people in artificial

intelligence over three years, with a focus on underrepresented

communities. They will offer accreditation and partnerships

with universities. The initiative comes with the expectation

that advances in AI will require significant requalification in the

job market.

Taiwan Semiconductor

Manufacturing (NYSE:TSM) – Saxony and Taiwan

Semiconductor Manufacturing Co (TSMC) are launching an exchange

program for Dresden students, aiming to boost semiconductor

talent. From 2024, TU Dresden will send students to study and

intern in Taiwan. TSMC also plans a €10 billion factory in

Germany, increasing its European presence. In other news,

Arizona Governor Katie Hobbs and TSMC are discussing expanding chip

packaging capacity in Arizona. Hobbs’ visit to Taiwan focuses

on the country’s importance in the semiconductor chain. TSMC

plans to increase investment and production in Arizona as it faces

growing demands and challenges in producing advanced chips.

Micron Technology (NASDAQ:MU) – Micron

shares outperformed after Deutsche Bank’s Sidney Ho raised his

recommendation due to growing demand, particularly from AI

servers. He raised the price target to $85 from $65. Micron, a

specialist in DRAM and NAND chips, could benefit from increased

demand for AI. The company will report earnings on September

27. So far, Micron shares are up 41% this year.

Arm Holdings (NASDAQ:ARM) – Shares of Arm

Holdings closed down 4.5% on Monday at $58.00 following its recent

listing. On the first day of its options trading, about 74,000

contracts were traded, mostly puts expiring in

October. Bernstein rated the stock “underperform.” Arm

shares are down 1.9% in premarket trading Tuesday.

DoorDash (NYSE:DASH) – DoorDash has

expanded its deliveries to include more grocery stores, adding

100,000 non-restaurant locations to its platform in North

America. While DoorDash shares rose 2.7% on Monday, rival

Instacart is preparing for its public offering. Experts warn

of increased competition in the sector.

Instacart (CART) – Instacart priced its

IPO at $30 per share, hitting the upper end of the forecast range,

indicating strong investor interest. With the sale of 22

million shares, the market valuation is US$9.9 billion. Nasdaq

debut will take place under the symbol CART.

Toyota (NYSE:TM) – Toyota is intensifying

its competition with Tesla (NASDAQ:TSLA)

in the EV market, combining technological innovations such as

self-propelled assembly lines and gigacasting foundries with its

time-honored lean production efficiency. This approach aims to

optimize productivity and reduce costs.

Ford Motor (NYSE:F), General

Motors (NYSE:GM), Stellantis (NYSE:STLA)

– The UAW union has threatened to expand strikes at US factories if

there is no progress in negotiations with the three big Detroit

automakers. Meanwhile, a Canadian union postponed a strike at

Ford after receiving a “substantive offer.” UAW President

Shawn Fain expressed frustration with the slow pace of

negotiations. Unifor in Canada is seeking better terms and

investment commitments from Ford, with the focus shifting to GM and

Stellantis following a deal. In the US, around 12,700 workers

are on strike, disputing wages and benefits.

Tesla (NASDAQ:TSLA) – Saudi Arabia is in

talks with Tesla to establish a factory in the country, while

Turkey has also made a similar request. Elon Musk, CEO of

Tesla, had meetings with global leaders but denied the

reports. Saudi Arabia seeks to diversify its economy and is

considering supporting a cobalt and copper project in Congo, aiming

to supply Tesla. Musk plans to decide on a new factory

location by the end of 2023.

Nio (NYSE:NIO) – Chinese EV maker NIO

announced a $1 billion convertible bond offering, similar

to Nikola (NASDAQ:NKLA)

and Fisker (NYSE:FSR). These bonds

can be converted into shares, diluting existing shareholders but

offering financing at lower rates.

Nikola (NASDAQ:NKLA) – On Monday, Nikola

shares rose following the appointment of Mary Chan as chief

operating officer. Chan, with experience

at VectoIQ, GM (NYSE:GM)

and Dell (NYSE:DELL), will start on

October 9. Shares rose 34% after the

announcement. However, shares are down 26% year to date.

Lyft (NASDAQ:LYFT) – Lyft will pay $10

million to resolve SEC charges over failure to disclose a

director’s financial interest in a transaction. The sale

involved US$424 million in shares ahead of the company’s public

listing in 2019.

United Airlines (NASDAQ:UAL) – United

Airlines has identified suspicious parts in two engines from

supplier AOG Technics Ltd., as have other global carriers. The

parts were in a two aircraft engine. The Chicago-based company

is replacing the engines and conducting additional

investigations. Other companies, such as Southwest Airlines

(NYSE:LUV) and Virgin Australia, have also found questionable

components of AOG.

Okta (NASDAQ:OKTA), MGM

Resorts (NYSE:MGM), Caesars

Entertainment (NASDAQ:CZR) – Hackers who compromised

MGM Resorts and Caesars Entertainment casino systems also attacked

three other companies in the manufacturing, retail and technology

sectors. Okta’s David Bradbury confirmed that five of his

clients, including casinos, were targeted by the ALPHV and

Scattered Spider groups.

UBS (NYSE:UBS) – UBS CEO Sergio Ermotti

expressed optimism about the Swiss bank following its merger with

Credit Suisse, bringing its assets under management to $5.5

trillion. He emphasized the advantages of economies of scale

at Bank of America’s Annual Financial CEO Conference. Ermotti

plans to lead the bank until 2026 and identified four countries –

South Korea, India, Ireland and Saudi Arabia – as slow to obtain

regulatory approval for the Credit Suisse acquisition. Delays

range from 18-22 months in South Korea, up to two years in Ireland

and six months in India.

Citigroup (NYSE:C) – Investors anticipate

further declines in the Nasdaq 100 technology index, according to

Citigroup analysis. Despite the bearish trend, Chris Montagu

indicates that the pessimistic momentum has slowed down. The

Nasdaq 100 has retreated since July on concerns about higher

interest rates.

Block (NYSE:SQ) – Alyssa Henry, leader of

Square’s commerce business, is leaving the company, with Jack

Dorsey assuming her responsibilities. While Block is down 18%

this year, other tech stocks have performed better.

BP Plc (NYSE:BP) – Former BP CEO John

Browne believes the company will quickly overcome its recent

governance scandal while maintaining its current

strategy. Bernard Looney resigned as CEO of BP after failing

to disclose employment relationships, leading to a global search

for a replacement. Browne highlighted the strength and

resilience of large companies in the midst of crises.

Rio Tinto (NYSE:RIO) – Rio Tinto alone

financed the work at Simandou, a large unexplored iron ore deposit,

as its Chinese partners did not release funds. The mining

company invested more than US$500 million, expecting joint

financing with China’s Chalco Iron Ore Holdings. Approval of

Chinese financing was delayed, raising concerns about the project’s

continuity.

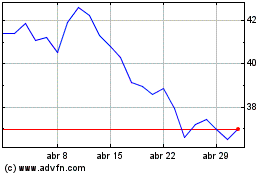

US Steel (NYSE:X) – US Steel released

financial projections for the third quarter that exceeded

expectations. However, the company’s shares are flat in

pre-market trading on Tuesday. The company expects adjusted

earnings of between $1.10 and $1.15 per share, surpassing analysts’

forecast of $1.01. The steel company mentioned that these

projections take into account the expected effects of the United

Auto Workers strike.

Newmont

Corp (NYSE:NEM), Newcrest (USOTC:NCMGY)

– Newmont Corp received authorization from Australia to acquire the

mining company Newcrest for US$16.86 billion. The deal, backed

by Newcrest, awaits a shareholder vote in October and approval from

additional regulators, and expects closing in the fourth

quarter.

Norfolk Southern Corp (NYSE:NSC) – Norfolk

Southern has proposed a plan to compensate residents of East

Palestine, Ohio, whose homes depreciated in value after a toxic

chemical train derailment in February. Those affected will be

able to receive the difference between the market value and the

sales price.

Rackspace Technology (NASDAQ:RXT) –

Rackspace Technology rose 8.8% to $1.61 after Raymond James

upgraded the cloud computing company’s stock rating from “Market

Perform” to “Outperform,” setting a price target of $3.50.

Novo Nordisk (NYSE:NVO) – MarketWire

reported quality control failures at a Novo Nordisk

plant in Clayton. Novo Nordisk did

not comment on the report but said the factory operates normally,

while MarketWire did not specify when the FDA inspection

occurred.

GE HealthCare Technologies (NASDAQ:GEHC) –

GE HealthCare received $44 million from the Bill & Melinda

Gates Foundation to develop AI-powered ultrasound to target

maternal, fetal health and respiratory diseases. The

technology, designed by Caption Health, will focus on globally

accessible devices.

Moderna (NASDAQ:MRNA) – Moderna was up

0.57% in Tuesday’s premarket, recovering from a drop of more than

9% the day before. This drop occurred after the CFO

of Pfizer (NYSE:PFE) anticipated a

decrease in demand for Covid vaccines this year. On Monday,

Moderna recorded the worst performance in the S&P 500.

Target (NYSE:TGT) – Target shares fell 3%

on Monday, down more than 20% this year, close to their 52-week

low. Other retail stocks also fell, although for no apparent

reason. While inflation has affected discretionary spending,

Target has been hit by concerns such as shoplifting, controversies

related to Pride Month and pressures in the food market. The

company faces challenges from delivery competitors and an uncertain

post-pandemic landscape.

Macy’s (NYSE:M) – Macy’s plans to hire

more than 38,000 workers for the holiday season, fewer than in

previous years. A report indicates that year-end hiring in the

US is at its lowest level since 2008 due to economic concerns.

Stitch Fix (NASDAQ:SFIX) – Stitch Fix

reported a 22% drop in its fiscal fourth quarter revenue, with its

active customer base decreasing to 3.3 million, compared to 3.4

million in the previous quarter and 3.8 million in the same period

last year. The company forecasts revenue of between US$355

million and US$365 million for the next quarter, representing a

reduction of 18% to 20% compared to the previous year and below

analysts’ projection, which was approximately US$402

million. The company also announced the closure of operations

in the United Kingdom. CEO Matt Baer expressed commitment to

the company’s growth. Shares are flat in Tuesday’s

premarket.

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024