US index futures are trading higher in pre-market on Friday,

striving to stay positive on the final trading day of September,

awaiting American inflation data. Recent days have been turbulent

due to heightened investor concerns about interest rates.

At 6:59 AM, Dow Jones futures (DOWI:DJI) rose 154 points, or

0.45%. S&P 500 futures rose 0.46% and Nasdaq-100 futures rose

0.60%. The yield on the 10-year Treasury note was at 4.553%.

In the commodities market, November West Texas Intermediate

crude oil rose 0.93%, to $92.56 per barrel. November Brent crude

oil rose 0.81% near $96.15 per barrel. 62% concentration iron ore

was not traded on the Dalian Commodity Exchange (DCE) in China due

to a holiday. The previous day, the commodity price rose 0.89%,

reaching $116.51 per ton.

On Friday’s U.S. economic agenda, investors are awaiting, at

8:30 AM, the Personal Consumption Expenditure (PCE) index,

predicted to rise by 0.50% monthly in August, with a yearly

forecast of 3.50%. Personal spending and income, both with a

consensus of 0.40%, will also be released at the same time.

At 9:45 AM, investors are waiting for Chicago’s Purchasing

Managers’ Index (PMI), one of the major U.S. production hubs. At

10:00 AM, Michigan’s consumer confidence will be released, expected

to be 67.70 points in September. To conclude the agenda, New York

Fed President John Williams will speak at 12:45 PM, and Baker

Hughes will release the weekly rig count at 1:00 PM.

The possibility of a U.S. government shutdown on October 1

remains a global concern, as the House and Senate have not yet

agreed on next year’s budget. If the deadlock continues,

non-essential federal agencies might halt services due to lack of

employee payment. An agreement is expected by Sunday.

In the Eurozone, September inflation dropped to 4.30% YoY,

compared to 5.20% in August, suggesting that European Central Bank

(ECB) measures might be taking effect. In Germany, retail sales

unexpectedly fell in August, while the unemployment rate met

projections in September. In the UK, the Q2 GDP met expectations,

standing out among European economies since the pandemic’s

start.

In Asia, markets closed with no clear direction, reflecting Wall

Street and Japanese economic data. Japanese retail sales and

industrial production showed stability, while inflation slowed in

September. In China’s real estate scene, Evergrande stated its

founder is under police custody for suspected “illegal crimes” and

is seeking creditor approval to restructure a $31.7 billion

offshore debt.

At Thursday’s close, the Dow Jones rose 116.07 points or 0.35%

to 33,666.34 points. The S&P 500 rose 25.19 points or

0.59% to 4,299.70. The Nasdaq rose 108.42 points or 0.83% to

13,201.28 points. The market had a day of relief with modest

gains after recent declines. Shares of big technology

companies boosted gains due to the pause in interest rate

hikes. Drops in oil prices, weaker US 2Q23 GDP consumption

data and “dovish” comments from Chicago Fed President Alan Goolsbee

also had a positive influence. Goolsbee suggested the rate

increase could be hasty. Declines in oil eased inflation concerns,

while weak economic data eased pressure on interest rates.

Ahead of Friday’s corporate earnings, investors will be watching

the report from Carnival Corporation (NYSE:CCL).

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL)

– Microsoft’s Jonathan Tinter testified in the US Department of

Justice’s antitrust case against Google, alleging monopoly abuse in

search. Apple (NASDAQ:AAPL) and other

manufacturers have preferred Google as their default search engine,

rejecting proposals from Microsoft’s

Bing. According to Bloomberg, Microsoft

reportedly discussed selling Bing to Apple in 2020, which could

have replaced Google as the default search engine on

iPhones. The talks, however, never advanced to significant

stages, and the relationship between Apple and Google remained

intact, with Google continuing to dominate the search industry and

Apple benefiting financially from the existing partnership.

Meta Platforms (NASDAQ:META) – Norway will

forward the fine imposed on Meta Platforms to the European data

authority, potentially making the penalty permanent in the European

Union. Meta, owner of Facebook and Instagram, is being fined

for violating users’ privacy and misusing their data for

advertising. Additionally, to train its new virtual assistant,

Meta AI, Meta used public posts from Facebook and Instagram,

keeping private posts and chats out of the dataset to respect

consumer privacy, as reported by Nick Clegg, president of Meta’s

global affairs.

Nvidia (NASDAQ:NVDA) – France’s

competition authority raided Nvidia’s offices over suspected

anti-competitive practices, part of a wider investigation into the

cloud computing sector. The focus is on whether large

companies are using their access to computing power to exclude

smaller competitors. Demand for Nvidia chips increased

considerably, reaching around 80% of the market, especially after

the launch of ChatGPT. The authority has adopted a strict

stance, recently confronting Apple

(NASDAQ:AAPL) regarding radiation concerns. Nvidia faced a

turbulent September. The shares reached their peak at the end

of August, worth US$493.55, an increase of 238% since the beginning

of the year. Values subsequently declined to US$410, but

recovered, closing Thursday at US$430.89.

Amazon (NASDAQ:AMZN) – Amazon shares

are down about 13% from their recent closing price peak, creating

an “attractive” entry point, according to Evercore analyst Mark

Mahaney. He considers the competitive risk of Chinese

marketplaces such as Shein and Temu to be “greatly exaggerated,”

highlighting Amazon’s user loyalty and competitive

advantages. Mahaney believes in the company’s resilience, even

with changing competitive dynamics, due to its strong user base and

constant innovations.

General Motors (NYSE:GM) – Canadian union

Unifor has set an October 9 deadline for negotiations with General

Motors. Discussions aim to reach an agreement similar to that

of Ford of Canada. GM Canada and Unifor resumed negotiations

on September 26.

Stellantis (NYSE:STLA) – On Thursday, the

United Auto Workers (UAW) made a new counterproposal to Stellantis

as tensions in labor negotiations with the Detroit Three

intensify. Disputes remain, particularly over wages and

benefits. Automakers propose smaller raises and less generous

benefits than the UAW demands.

Tesla (NASDAQ:TSLA) – The lawyer for victims of

a Tesla Model 3 accident blamed the company’s Autopilot system in

court, claiming that “an automobile company should never sell

experimental products to consumers.” Tesla defends the safety

of the system and attributed the accident to “classic human

error”. The case takes place in California and involves

allegations that the system caused the car to swerve and

crash. Tesla denies the allegations. Additionally, Tesla

faces a lawsuit from the U.S. Equal Employment Opportunity

Commission, accused of tolerating racial harassment at its Fremont,

California, factory. It is alleged that black employees

suffered abuse, stereotyping and retaliation. The EEOC seeks

damages, back pay and changes to the company’s employment

practices. In 2021, an employee received $137 million in a

similar case, later reduced to $15 million.

Nio (NYSE:NIO) – Nio

and Mercedes-Benz (USOTC:MBGYY) held

exploratory talks for a potential partnership and

investment. However, details about technology and investment

were not discussed and Mercedes demonstrated internal resistance,

probably not going ahead with the union. Both companies denied

plans to collaborate.

CarMax (NYSE:KMX) – CarMax reported

lower-than-expected quarterly earnings due to decreased demand for

used vehicles. Despite robust demand during the pandemic,

consumers are opting for newer models with better financing

conditions. However, labor strikes at large automakers could

impact the availability of new cars, possibly raising used car

prices. With adjustments, the company earned 75 cents per

share, 3 cents below analysts’ expectations, according to LSEG

data. Total revenue decreased by approximately 13%, reaching

US$7.07 billion, exceeding projections of US$7.03 billion.

Boeing (NYSE:BA) – Boeing agreed to pay

US$8.1 million to resolve accusations of violating US laws by

failing to fulfill contractual obligations in the production of the

V-22 Osprey, as declared by the US Department of Justice. The

settlement concerns violations of the False Claims Act between 2007

and 2018 relating to the manufacturing of components for the

aircraft. Boeing denies the allegations and has not admitted

liability.

United Airlines (NASDAQ:UAL) – United

Airlines will offer conditional positions to active U.S. military

pilots to join as first officers upon completion of

service. This move comes as airlines seek qualified pilots to

meet increased demand for post-pandemic travel. United, which

already employs more than 16,000 pilots, plans to add more than

10,000 this decade.

Delta Air Lines (NYSE:DAL) – Delta Air

Lines CEO Ed Bastian admitted that the company has possibly

over-restricted its SkyMiles program and access to Sky Clubs,

hinting at future modifications to the restrictions. This

statement comes after criticism for limiting access to lounges and

changes to the terms of the rewards program. Bastian did not

detail the possible changes, but promised updates in the coming

weeks.

Chevron (NYSE:CVX) – This year, oil

tankers, including one from Chevron, have faced threats in the Gulf

of Oman. Chevron, managing geopolitical risks and global

operational issues, stands out in performance and

diversification. The company faces environmental and social

challenges in places like Venezuela and Myanmar, while pursuing

clean energy innovation and sustainable strategies, continuing to

deliver strong results for shareholders against a backdrop of

rising oil prices.

AGCO

Corp (NYSE:AGCO), Trimble (NASDAQ:TRMB)

– AGCO Corp will acquire 85% of Trimble’s agricultural division for

US$2 billion, expanding its portfolio in precision

agriculture. This agreement accelerates the race to automate

agriculture amid food crises and enables advances in autonomous

equipment and disruptive technologies.

Berkshire Hathaway (NYSE:BRK.B) – Analyst

James Shanahan downgraded his rating on Berkshire Hathaway to

“Hold” from “Buy,” citing its superior performance in the financial

sector. Berkshire shares are up 15.5% this year, outperforming

financial indexes, implying a lower likelihood of

outperformance. Shanahan attributes the stock’s performance to

the prospect of robust profits and accelerated investment, while

also benefiting from the company’s solid cash flow and confidence

in Warren Buffett’s leadership.

BlackRock (NYSE:BLK) – Larry Fink, CEO of

BlackRock, expressed openness to more acquisitions, aiming to

solidify the company as a reference for investors. Fink sees

significant opportunities in inorganic growth and is focused on

diversifying offerings by integrating private asset strategies and

advanced technologies. He highlighted, at the Berlin Global

Dialogue forum, the importance of private capital and anticipated

that the search for productivity could accelerate the adoption of

technology, while warning of possible modest recessions and the

urgency of promoting hope and stability.

Citigroup (NYSE:C) – Citigroup and its

former unit, Citi International Financial Services, were fined

$1.975 million by the SEC for failing to meet disclosure

obligations when recommending securities to retail

clients. Both entities agreed to the settlement without

admitting wrongdoing.

JPMorgan

Chase (NYSE:JPM), Taiwan Semiconductor

Manufacturing (NYSE:TSM) – JPMorgan anticipates an

uncertain future for TSMC, predicting a mixed outlook on upcoming

earnings. Analyst Gokul Hariharan expects conservatism in

TSMC’s investments and a muted recovery in 2024, with possible

disappointments next year due to excess inventories and weak demand

in several chip segments. However, he remains optimistic for

2025.

Vail Resorts (NYSE:MTN) – In the fourth

fiscal quarter, Vail Resorts presented a loss greater than that of

the previous year, attributed to “considerable weather problems

last season”. However, the ski resort company anticipates

growth for fiscal 2024 compared to 2023.

Nike (NYSE:NKE) – Nike beat first-quarter

profit forecasts as high prices offset low demand and cost

pressures, sending its shares up 8.2% in Friday pre-market

trading. The company expects an increase in gross margins in

the second quarter and maintains its annual forecasts, focusing on

running shoes. Nike’s report boosted shares of other athletic

footwear and accessories companies.

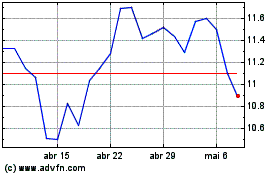

Coty (NYSE:COTY) – Coty will price its

global offering of 33 million shares at $10.80 each, beginning

trading in Paris. The company, which owns CoverGirl, has seen

a 7% drop in its shares since the launch of the offer. Coty

plans to use the funds to reduce debt after rising annual sales

forecasts due to strong demand for its premium beauty products even

as inflation continues.

GameStop (NYSE:GME) – On Thursday,

GameStop named billionaire Ryan Cohen as CEO, tightening its grip

on the struggling video game retailer. Cohen, already

prominent for turning Chewy (NYSE:CHWY)

into an online powerhouse, has been steering GameStop toward a more

e-commerce-oriented model amid resistance from the company’s

brick-and-mortar model, and has faced concerns about the pace of

changes and his history as an activist investor.

BlackBerry (NYSE:BB) – BlackBerry

presented quarterly results in line with forecasts, but with

revenue below expectations. Shares gained 0.2% in pre-market

trading on Friday, following a 2.7% drop in regular trading on

Thursday. The company reported a loss of US$42 million in the

second quarter, a decrease compared to the previous

year. Revenue was $132 million, down from $168 million a year

ago, and also below analysts’ forecast of $134.3 million. CEO

John Chen sees a better than 50% chance of completing a strategic

review of the company before his contract ends in

November. Veritas Capital has expressed interest in

BlackBerry. The delay in the review has intensified concerns

about the company’s financial performance, which has already seen

its shares fall, and uncertainty persists.

Goodyear Tire & Rubber (NASDAQ:GT) –

Goodyear said a fire at its factory in Poland will impact sales,

estimating a drop of $20-25 million in the third quarter and $10-15

million in the fourth quarter. The incident, which occurred on

August 20, significantly damaged the Debica unit, reducing

production to 70% of capacity. Full recovery is expected by

the end of 2024. The company is implementing strategies to mitigate

the impact on customers.

Philip Morris International (NYSE:PM) –

Philip Morris announced a slower U.S. launch for its IQOS heated

tobacco device, favoring competitors in the near term. The

company, producer of Marlboro, aims for the majority of its revenue

to come from “smoke-free” products by 2030, and will reduce its

focus on nicotine-free products, focusing more on IQOS and ZYN,

aiming to transform its image as a product supplier traditional

tobacco products.

DXC

Technology (NYSE:DXC), Kohl’s

Corp (NYSE:KSS) – Veralto Corp., a spinoff of Danaher

Corp., will join the S&P 500 on Monday, replacing DXC

Technology Co., which will migrate to the S&P SmallCap 600 on

Tuesday , where it will replace Ebix Inc. Separately, Vestis

Corp. will be added to the S&P MidCap 400 on Monday,

replacing Kohl’s Corp., which will join the S&P SmallCap 600 on

Tuesday.

Johnson & Johnson (NYSE:JNJ) – Unitaid

called for immediate action from the CEO of Johnson & Johnson

to expand access to the tuberculosis drug bedaquiline. The

global agency claims the company impedes access by limiting

competition and maintaining secondary patents in countries with a

high incidence of drug-resistant tuberculosis.

Bionomics (NASDAQ:BNOX) – Bionomics saw

its shares rise 242% on Thursday after releasing promising results

from a mid-stage trial for a treatment for post-traumatic stress

disorder. In pre-market trading on Friday, shares are down

13.4%.

Novo Integrated Sciences (NASDAQ:NVOS) –

Shares of Novo Integrated Sciences soared after the company

announced a $1 billion financing deal with Blacksheep Trust over

the next 15 years. After the close, shares rose as much as

155%, recovering from a previous drop of 15.37%. Shares are up

83.6% in Friday premarket trading. The company, with a market

capitalization of US$31.8 million, expects to complete the

transactions this fiscal quarter, following due diligence

procedures.

PTC Therapeutics (NASDAQ:PTCT) –

Biopharmaceutical company PTC Therapeutics made a 25% cut in its

workforce, declaring that such a measure would enable a 20%

decrease in its annual operating expenses.

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024