US index futures are down in Friday’s pre-market, with investors

gearing up to assess the earnings of major banks.

At 7:01 AM, Dow Jones futures (DOWI:DJI) fell 11 points, or

0.03%. S&P 500 futures dropped 0.20%, and Nasdaq-100 futures

declined 0.44%. The yield on 10-year Treasury bonds stood at

4.602%.

In the commodities market, November West Texas Intermediate

crude oil rose 3.88% to $86.11 per barrel. December Brent crude oil

also increased by 3.56%, nearing $89.05 per barrel.

On the economic agenda for Friday, investors await import and

export price data at 8:30 AM, while Philadelphia Fed President

Patrick Harker is scheduled to speak at 09 AM. At 10 AM, the

University of Michigan Consumer Sentiment Survey is due, with a

forecast of 67.2 points in October, down from the previous

month.

In Asia, markets closed lower, keeping an eye on U.S. and

Chinese inflation, as well as data from China’s trade balance,

which showed a surplus above expectations. The possibility of

additional stimulus from Beijing is still seen as essential.

In the European market, which is currently trading lower,

industrial production in the Eurozone increased by 0.60% in August

on a monthly basis, surpassing expectations. On an annual basis,

there was a 5.10% decline, exceeding projections.

At 8 AM, a speech by the President of the European Central Bank

(ECB), Christine Lagarde, is scheduled, where she is expected to

discuss monetary policy at an International Monetary Fund (IMF)

event.

At Thursday’s close, US stocks fell interrupting the recent

upward trend. The Dow Jones fell 173.73 points or 0.51% to

33,631.14 points. The S&P 500 fell 27.34 points or 0.62%

to 4,349.61. The Nasdaq fell 85.46 points or 0.63% to

13,574.22. Rising Treasury yields and better-than-expected

consumer price data impacted the market. Real estate and

airline sectors also saw notable declines.

On the corporate earnings front Wednesday, investors will be

watching reports from JPMorgan Chase (NYSE:JPM), UnitedHeath

(NYSE:UNH), BlackRock (NYSE:BLK), Citigroup (NYSE:C), Wells Fargo

(NYSE:WFC), Progressive (NYSE:PGR) and PNC Financial

(NYSE:PNC).

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT), Activision

Blizzard (NASDAQ:ATVI) – The British antitrust body

approved Microsoft’s acquisition of Activision after concerns were

addressed. The deal could now be completed by October 18, with

the regulator saying Microsoft’s concession was crucial to avoiding

monopoly in the UK cloud gaming market.

Fortinet (NASDAQ:FTNT) – Barclays

downgraded Fortinet’s rating from “overweight” to “equal weight”

and revised the price target from $71 to $63. The cybersecurity

company is scheduled to report its third-quarter results on

November 2. As a result, the shares fell 2.6%, reaching $56.50 in

pre-market trading.

Amazon (NASDAQ:AMZN) – Amazon is expanding

its logistics services initiative, potentially targeting more than

$100 billion in revenue, according to Truist Securities analyst

Youssef Squali. The company aims to transform its logistics

network into a service offering for merchants beyond Amazon,

converting a cost center into a profit center. Despite the

high valuation, analyst confidence in Amazon remains high, with

most recommending buying shares and an average price target that

implies a 31% gain over the next year.

TSMC (NYSE:TSM) – TSMC hopes to

obtain U.S. permission to supply U.S. chip equipment to its factory

in China on an indefinite basis, seeking permanent authorization

through the “validated end user” (VEU) process. This follows

similar authorization given to Samsung Electronics and SK Hynix by

the South Korean government. Last year, TSMC received a

one-year authorization from the US for its factory in Nanjing,

China, which produces 28-nanometer chips.

Qualcomm (NASDAQ:QCOM) – Qualcomm plans to

cut about 2.5% of its workforce, eliminating 1,064 positions in San

Diego and 194 in Santa Clara, California, in mid-December,

according to documents filed with the Department of Development

California Employment. The company had 51,000 employees

globally.

Smart Global Holdings (NASDAQ:SGH) – Smart

Global Holdings announced that its fiscal fourth quarter sales

decreased 12.6% to $316.7 million, below analyst estimates of $375

million. The company projected sales from continuing

operations for its fiscal first quarter of around $275 million,

with a margin of error of approximately $25 million. This

resulted in a 25.4% drop in Smart Global shares in pre-market

trading.

Tesla (NASDAQ:TSLA) – Electric vehicle

sales in the US exceeded 300,000 in the 3rd quarter, but Tesla’s

market share fell to 50%, after having 62% in the 1st

quarter. Other manufacturers have reduced prices due to

inflation. Tesla’s price war dropped the average price to

$50,683 in September. Electric vehicle sales represented 7.9%

of total industry sales,

with Rivian (NASDAQ:RIVN) exceeding

delivery expectations. Tesla missed estimates due to factory

upgrades as demand grows for a wider range of electric vehicles in

the US. Additionally, Tesla plans to increase wages for

workers at its factory in Germany, following criticism from unions

over wages below the industry average. Details of the increase

will be released in November, following a 6% increase last

year.

Ford Motor (NYSE:F) – A senior Ford

executive has warned of strikes at its most profitable plants due

to wage pressure from the United Auto Workers (UAW). Ford

seeks to reallocate resources within its bid to secure a deal,

while the UAW directs negotiations

to Stellantis (NYSE:STLA). The

United Auto Workers closed Ford’s largest factory in the world, the

Kentucky Truck Plant, following Ford’s refusal to move forward in

contract negotiations. The decision could affect Ford’s annual

profits, as the plant generates about a sixth of its global

revenue.

General Motors (NYSE:GM) – GM

and LG Energy Solution (KOSPI:373220)

face $270,000 fines due to health and safety violations at the

Ultium Cells battery plant in Ohio following an explosion in

March. OSHA issued 19 violations, including lack of safety

training and exposure to metal dust. Ultium Cells seeks a

hearing with OSHA.

Toyota Motor (NYSE:TM) – Toyota and oil

refiner Idemitsu Kosan announced an agreement to develop

all-solid-state batteries and plan to commercialize them in 2027-28

as part of its electric vehicle strategy. Companies are

seeking solutions to durability problems and planning mass

production. Solid-state technology promises greater autonomy

and faster charging times.

Honda Motor (NYSE:HMC) – Honda and

Mitsubishi have agreed to explore business opportunities related to

electric vehicle batteries. The partnership aims to utilize EV

batteries for energy storage and promote smart charging and

vehicle-to-grid (V2G) technologies.

Chevron (NYSE:CVX) – Negotiations between

Chevron and unions at LNG facilities in Australia have progressed

but have not resulted in an agreement. A union leader

mentioned “some” points of contention, without details, and new

negotiations are scheduled. Chevron expressed commitment to

reaching an agreement. Negotiations are mediated by the Fair

Work Commission. After suspending strikes in September, unions

threatened to resume strikes in October. The benchmark Dutch

gas contract rose on uncertainty.

Pioneer Natural

Resources (NYSE:PXD), Exxon

Mobil (NYSE:XOM) – Pioneer Natural Resources

leadership will face unemployment after sale to Exxon

Mobil. The top five executives will receive a total of $71

million in compensation, with CEO Scott Sheffield receiving about

$29 million, representing three times his base salary, plus

outstanding awards. These packages, known as “golden

parachutes,” are common but often generate controversy due to their

size compared to regular employee benefits.

Boeing (NYSE:BA), Spirit

AeroSystems (NYSE:SPR) – Boeing and Spirit

AeroSystems have expanded inspections for a production defect on

737 Max 8 aircraft. The issue involves holes in the rear pressure

bulkhead and now encompasses hand-drilled holes. Boeing did

not provide additional details about the scope or its impact on

delivery goals. The FAA said there are no immediate safety

concerns.

Delta Air Lines (NYSE:DAL) – Delta Air

Lines reinforced its confidence in continued demand for travel

despite concerns about slowing domestic demand. The company

noted strong global bookings and an increase in business travel,

maintaining an optimistic view of the situation.

Citigroup (NYSE:C) – Citigroup announced

that its board of directors will meet in Singapore for the first

time since 2011 as a sign of commitment to the city-state. The

meeting comes at a time when Singapore is attracting wealth flows

from China and other countries due to its political stability and

fund-friendly policies.

Wells Fargo (NYSE:WFC) – Wells Fargo will

roll out its financial planning tool, Life Sync, to all of its

nearly 70 million customers, after initially offering it to wealth

customers. The tool lets you set financial goals, check credit

scores and connect with financial advisors, as well as invest and

move money between accounts through the mobile app. This is

part of the bank’s efforts to enhance its digital offerings and cut

costs.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase

CEO Jamie Dimon warned that the conflict in the Middle East will

have ripple effects beyond the region, predicting a rise in

anti-Semitism and global Islamophobia. The bank is taking

steps to ensure the safety of its employees and will contribute $1

million to relief

efforts. American Express (NYSE:AXP)

also pledged significant donations. In terms of quarterly results,

JPMorgan Chase exceeded analysts’ expectations in the third

quarter, reporting an earnings per share of $4.33 and revenue of

$40.69 billion. The bank attributed its success to interest income

exceeding estimates and credit costs lower than expected. However,

CEO Jamie Dimon cautioned that these exceptional results may not be

sustainable, as credit costs and interest rates are expected to

normalize in the future.

Goldman Sachs (NYSE:GS) – Goldman Sachs

has sued the Malaysian government at the London Court of

International Arbitration over alleged breaches of the settlement

and asset recovery agreement related to the 1MDB scandal. This

follows disagreements over compliance with the 2020 agreement,

which involved a $3.9 billion payment. Goldman Sachs is

forecast to report weak quarterly earnings, with an average

estimate of $5.31 per share, representing a 36% drop from the

previous year. The results reflect pressure on investment

banking and writedowns on commercial real estate assets. The

company also sold GreenSky as part of its strategy to exit the

consumer business.

Bank of America (NYSE:BAC) – Michael

Hartnett, Bank of America strategist, believes the US stock market

can avoid a bleak scenario as long as bond yields remain below 5%.

He predicts the S&P 500 could stay above 4,200 points in the

short term, but a break below that level could be triggered by a

stronger dollar, higher yields, oil above $100 per barrel, and a

small business credit crisis. Hartnett remains pessimistic for 2023

despite the recent S&P 500 uptick. He believes a recession and

rate cuts by the Federal Reserve could generate gains in bonds and

gold, along with a broader stock market recovery in 2024. To turn

optimistic, he expects to see an economic contraction and rate cuts

to attract new investors.

UBS (NYSE:UBS) – UBS Group AG has

expressed concerns about the rapid growth of unsecured personal

loans in India, warning that the increased risk of default could

lead to higher credit costs for Indian lenders. State banks

are considered more vulnerable to this trend than those in the

private sector. The country’s banking regulator, the Reserve

Bank of India, has also highlighted the need to assess risk-taking

strategies in personal loans. UBS warned of the risk of

regulatory tightening as the RBI is alert to possible crises.

Deutsche Bank (NYSE:DB) – Deutsche Bank

CEO Christian Sewing predicts challenges in the commercial real

estate sector due to rising interest rates. While the bank’s

exposure is limited, high borrowing costs and post-pandemic remote

working will weigh on the asset class. Sewing emphasizes the

importance of underwriting principles to mitigate risk.

KKR and Company (NYSE:KKR) – US fund KKR

is planning to submit a multibillion-euro bid

for Telecom Italia’s (BIT:TITR) fixed

network as part of an Italian government-backed plan to reshape the

debt-burdened telecoms group. The offer will include Netco,

with plans to absorb half of TIM’s domestic employees. The

Italian Treasury plans to acquire a 15-20% stake in NetCo’s

business as part of the deal.

LendingClub (NYSE:LC) – LendingClub plans

to reduce its staff by around 14%, equivalent to 172

employees. This decision is a response to persistent

macroeconomic challenges and market pressure, especially due to

higher interest rates.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens Boots Alliance plans to reduce at least $1 billion in

costs by 2024, including closing unprofitable stores, as it seeks

to improve efficiency. The company is also cutting capital

expenditures by about $600 million and looking to optimize its

supply chain with artificial intelligence. These measures were

announced after the company forecast financial results below Wall

Street expectations due to falling sales of Covid-19 products and

other pressures.

Illumina (NASDAQ:ILMN) – US genetic

testing company Illumina has been ordered by the EU to sell cancer

testing maker Grail after completing the deal without

approval. The EU imposed a $457 million antitrust fine and

blocked the deal due to monopoly concerns. Illumina must

ensure Grail’s independence and competitiveness prior to the

sale.

Cassava Sciences (NASDAQ:SAVA) – Cassava

Sciences experienced a 27.9% drop in pre-market trading after a

Science report alleged scientific misconduct by neuroscientist

Hoau-Yan Wang, a longtime Cassava collaborator and member of

faculty of the City University of New York. The investigation

questioned the validity of 20 research articles, many of which

supported the experimental Alzheimer’s drug simufilam. Cassava

reaffirmed its confidence in the science behind simufilam and will

proceed with its Phase 3 clinical program.

Kroger (NYSE:KR), Albertsons (NYSE:ACI)

– California Attorney General Rob Bonta has expressed concerns

about Kroger’s proposed deal to acquire Albertsons for $24.5

billion and is mulling action to block it, citing concerns about

higher prices, lower payments to farmers and food

deserts. Kroger argues that the merger would result in lower

prices, secure jobs and more food for families in need. The

FTC is reviewing the deal to ensure compliance with antitrust

laws.

Domino’s Pizza (NYSE:DPZ) – Domino’s Pizza

is counting on revitalizing demand in the U.S., leveraging its

improved loyalty program and promotional offers to offset the

reduced benefits of higher prices. The company is focused on

providing value to customers in addition to competitive prices.

Dollar General (NYSE:DG) – Shares of

Dollar General Corp. rose 7.2% in Friday pre-market trading on

the announcement that Todd Vasos would return as CEO

immediately. Vasos, who was CEO from 2015 to 2022, succeeds

Jeff Owen, and the change aims to restore stability and confidence

in the company. Dollar General kept its sales forecast in line

with analyst expectations, but lowered its sales growth forecast to

1.5% to 2.5% and expected earnings of between $7.10 and $7.60 per

action.

JD.com (NASDAQ:JD) – JD.com is down -4.5%

in Friday pre-market trading and hit a record low in Hong Kong,

with several brokerages including Morgan Stanley and Citigroup

downgrading your ratings and target prices. Rumors about the

arrest of a businessman surnamed Liu, unrelated to the company’s

president, also affected the shares. The retailer faces

challenges due to slow consumption in China and competition from

low pricing strategies, making its position in the Chinese

e-commerce market less favorable.

AMC Entertainment (NYSE:AMC) – AMC’s

shares rose by 5.6% on Thursday, extending their five-session

rally, as Taylor Swift’s concert film generated significant

anticipation and broke records ahead of its scheduled release on

Friday. The film is expected to have a global opening of up to $200

million, a record for a concert film. In other news, AMC CEO Adam

Aron faced extortion in a criminal scheme related to false claims

about his personal life, which he reported to the authorities,

resulting in the capture and conviction of the extortionist. He had

maintained confidentiality until recently.

Viasat (NASDAQ:VSAT) – Viasat expects to

recover less than 10% of the planned capacity of ViaSat-3 F1, its

failed satellite, but believes it can meet customer needs without

replacing it. The company also forecasts sustainable positive

cash flow in the first half of 2025.

Newcrest

Mining (TSX:NCM), Newmont

Corporation (NYSE:NEM) – Newcrest Mining shareholders

voted overwhelmingly in favor of the $16.81 billion acquisition of

Newmont Corporation. Around 92.63% of votes were in favor,

exceeding the 75% support requirement. The final hearing is

scheduled for Tuesday.

Paramount (NASDAQ:PARA), Warner

Bros. Discovery (NASDAQ:WBD), Walt

Disney (NYSE:DIS), Netflix (NASDAQ:NFLX)

and Comcast (NASDAQ:CMCSA) –

Entertainment industry stocks fell after negotiations between the

film and television actors union collapsed and the

studios. The Alliance of Motion Picture and Television

Producers (AMPTP) suspended negotiations with SAG-AFTRA following

the union’s proposal. AMPTP alleges that SAG-AFTRA’s offer

includes an unsustainable ratings bonus, while the union accuses

AMPTP of intimidation tactics. Wall Street realized that the

Hollywood actors’ strike could last longer, impacting the shares of

entertainment companies such as Paramount, Warner

Bros. Discovery, Walt Disney, Netflix and Comcast.

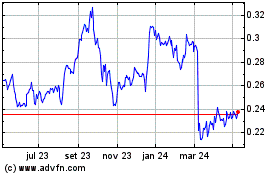

Telecom Italia (BIT:TITR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

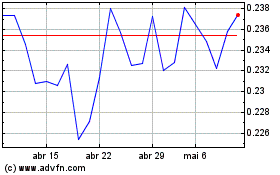

Telecom Italia (BIT:TITR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024