Pre-Market U.S. Stock Movers

Netflix Inc (NASDAQ:NFLX) surged about +13% in pre-market

trading after the company reported stronger-than-expected Q3 EPS,

posted its best subscriber growth in years, and confirmed it would

start raising prices.

Tesla Inc (NASDAQ:TSLA) slid over -5% in pre-market trading

after the Austin-based company reported weaker-than-expected Q3

results.

Las Vegas Sands Corp (NYSE:LVS) climbed more than +5% in

pre-market trading after the company reported

stronger-than-expected Q3 revenue and announced a $2 billion stock

buyback reauthorization.

Lam Research Corp (NASDAQ:LRCX) fell over -2% in pre-market

trading after the semiconductor equipment firm reported

better-than-expected Q1 results but provided mixed Q2 guidance.

Zscaler (NASDAQ:ZS) rose more than +2% in pre-market trading

after Jefferies upgraded the stock to Buy from Hold.

Fortinet (NASDAQ:FTNT) dropped over -1% in pre-market trading

after Jefferies downgraded the stock to Hold from Buy.

Don’t Trade Without Seeing

The Orderbook

Today’s U.S. Earnings Spotlight: Thursday – October

19th

Philip Morris (PM), Union Pacific (UNP), Blackstone (BX),

AT&T (T), Intuitive Surgical (ISRG), Marsh McLennan (MMC), CSX

(CSX), Freeport-McMoran (FCX), Truist Financial Corp (TFC), Genuine

Parts (GPC), Fifth Third (FITB), Watsco (WSO), Snap-On (SNA), Pool

(POOL), KeyCorp (KEY), Knight-Swift Trans (KNX), American Airlines

(AAL), East West Bancorp (EWBC), Webster Financial (WBS), Iridium

(IRDM), Western Alliance (WAL), Home BancShares (HOMB), Alaska Air

(ALK), Bank Ozk (OZK), Badger Meter (BMI), ManpowerGroup (MAN),

Glacier (GBCI), WNS Holdings (WNS), Texas Capital (TCBI), WD-40

(WDFC), Associated Banc-Corp (ASB), Atlantic Union (AUB),

Independent Bank (INDB), BankUnited (BKU), Triumph Bancorp (TFIN),

Lindsay (LNN), 1st Source (SRCE), S&T Bancorp (STBA),

OceanFirst (OCFC), Dime Community (DCOM), Amerant Bancorp A (AMTB),

Insteel Industries (IIIN), Heritage Financial Co (HFWA), Five Point

(FPH), Metropolitan Bank (MCB).

US Options Trader

Live Realtime Streaming: US

Options (OPRA), NYSE, NASDAQ, AMEX prices + Dow Jones and S&P

indices – and our innovative Options Tools, featuring Live Options

Flow.

Abbott Laboratories (NYSE:ABT): Morningstar

upgrades to buy from hold with a target price of $104.

Amgen (NASDAQ:AMGN): BMO Capital Markets

maintains its market perform recommendation with a price target

raised from $260 to $286.

Best Buy (NYSE:BBY): Goldman Sachs upgrades to

buy from neutral. PT up 21% to $85.

Biogen (NASDAQ:BIIB): BMO Capital Markets

maintains its outperform rating and reduces the target price from

$336 to $314

Bristol-Myer (NYSE:BMY): BMO Capital Markets

maintains its outperform rating and reduces the target price from

$79 to $70.

Crowdstrike (NASDAQ:CRWD): Jefferies upgrades

to buy from hold with a price target raised from $170 to $225.

Eli Lilly (NYSE:LLY): BMO Capital Markets

maintains its outperform recommendation and raises the target price

from $633 to $710.

Fidelity National (NYSE:FIS): Barclays upgrades

to overweight from equalweight with a price target raised from $62

to $69.

First Solar (NASDAQ:FSLR): JP Morgan upgrades

to overweight from neutral with a price target reduced from $239 to

$220.

Fortinet (FTNT): Jefferies downgrades to hold

from buy with a price target reduced from $85 to $65.

Foot Locker (NYSE:FL): Goldman Sachs downgrades

to sell from neutral. PT down 18% to $18.

Incyte (NASDAQ:INCY): BMO Capital Markets

maintains its market perform recommendation with a price target

reduced from $68 to $58.

Johnson & Johnson (NYSE:JNJ): DZ Bank AG

Research maintains its buy recommendation and reduces the target

price from $186 to $182.

Lam Research (NASDAQ:LRCX): Goldman Sachs

maintains its buy recommendation and raises the target price from

$684 to $700.

Lockheed Martin (NYSE:LMT): DZ Bank AG Research

maintains its buy recommendation and reduces the target price from

$570 to $550.

McDonald’s (NYSE:MCD): RBC Capital maintains

its outperform rating and reduces the target price from $340 to

$315.

Microsoft (NASDAQ:MSFT): Citi maintains its buy

recommendation with a price target raised from $420 to $430.

Nasdaq (NASDAQ:NDAQ): Morningstar upgrades to

buy from hold with a target price of $55.

Netflix (NASDAQ:NFLX): KeyBanc Capital Markets

upgrades to overweight from sector weight with a target price of

$510.

Targa Resources (NYSE:TRGP): Haitong

International Research Ltd initiates its outperform recommendation

with a target price of $116.95.

Tesla (NASDAQ:TSLA): Fubon Securities

downgrades to neutral from buy with a price target reduced from

$330 to $275.

Unity Software (NYSE:U): Jefferies downgrades

to hold from underperform with a price target reduced from $29 to

$27.

Visa (NYSE:V): Mizuho Securities maintains its

neutral recommendation with a price target reduced from $255 to

$240.

Xylem (NYSE:XYL): Oppenheimer upgrades to

outperform from market perform with a target price of $118.

Zscaler (NASDAQ:ZS): Jefferies upgrades to buy

from hold with a price target raised from $170 to $225.

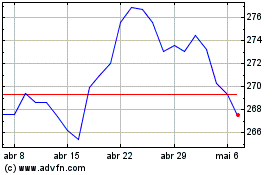

McDonalds (NYSE:MCD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

McDonalds (NYSE:MCD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024