Keep An Eye Out: Pre-Market Movers And Analyst Recommendations

20 Outubro 2023 - 9:29AM

IH Market News

Pre-Market U.S. Stock Movers

SolarEdge Technologies (NASDAQ:SEDG) plunged

about -23% in pre-market trading after cutting its Q3 revenue

outlook, citing “substantial unexpected cancellations and pushouts

of existing backlog from our European distributors.”

Knight-Swift Transportation (NYSE:KNX) soared

over +16% in pre-market trading after the company reported upbeat

Q3 results.

Intuitive Surgical (NASDAQ:ISRG) slid more than

-8% in pre-market trading after the maker of robotic-assisted

surgical systems posted weaker-than-anticipated Q3

revenue.

Hewlett Packard Enterprise (NYSE:HPE) fell over

-3% in pre-market trading after the company provided a

disappointing FY24 outlook.

Union Pacific Corporation (NYSE:UNP) rose about

+1% in pre-market trading after Deutsche Bank upgraded the stock to

Buy from Hold.

Don’t Trade Without Seeing

The Orderbook

Today’s U.S. Earnings Spotlight: Friday – October

20th

American Express (AXP), Schlumberger (SLB), Regions Financial

(RF), Huntington Bancshares (HBAN), IPG (IPG), Autoliv (ALV),

Comerica (CMA), Euronet (EEFT), First Bancorp (FBP), Sensient

Technologies (SXT), Hilltop (HTH), OFG Bancorp (OFG), Berkshire

Hills Bancorp (BHLB), World Acceptance (WRLD), Sify (SIFY).

US Options Trader

Live Realtime Streaming: US

Options (OPRA), NYSE, NASDAQ, AMEX prices + Dow Jones and S&P

indices – and our innovative Options Tools, featuring Live Options

Flow.

Analyst Recommendations:

Blackstone: JP Morgan maintains its neutral

recommendation with a price target reduced from $108 to $94.

Cognizant: Citi upgrades to buy from neutral

with a price target raised from $72 to $80.

Crown Castle: Goldman Sachs maintains its

neutral recommendation with a price target reduced from $94 to

$90.

Discover Financial: Goldman Sachs maintains its

buy recommendation with a price target reduced from $103 to

$102.

Enphase Energy: BNP Paribas Exane maintains its

neutral recommendation with a target price of $131.

Epam Systems: JP Morgan maintains its

overweight recommendation and reduces the target price from $319 to

$301.

First Solar: BNP Paribas Exane maintains its

outperform recommendation with a target price of $237.

Genuine Parts: Evercore ISI maintains its

in-line recommendation with a price target reduced from $155 to

$145.

Halliburton: Baptista Research maintains its

hold recommendation with a target price of $49.

HCA healthcare: Baptista Research maintains its

outperform rating with a target price of $281.20.

Humana: Morningstar downgrades to hold from buy

with a target price of $550.

Intuitive Surgical: Raymond James maintains its

outperform rating and reduces the target price from $368 to

$310.

Marsh & Mclennan: Goldman Sachs maintains

its buy recommendation with a price target reduced from $218 to

$215.

Morgan Stanley: Wolfe Research upgrades to

peerperform from underperform.

Netflix: Phillip Securities upgrades to

accumulate from neutral with a price target raised from $446 to

$455.

Oneok: Morningstar downgrades to sell from hold

with a target price of $62.

Salesforce: Fubon Securities initiates a buy

recommendation with a target price of $251.

Sherwin-Williams: Evercore ISI maintains its

outperform rating and reduces the target price from $290 to

$275.

Solaredge Technologies: Goldman Sachs

downgrades to neutral from buy with a price target reduced from

$254 to $131.

Tesla: Daiwa Securities maintains its

outperform rating and reduces the target price from $290 to

$250.

Tractor Supply: Telsey Advisory Group maintains

its outperform rating and reduces the target price from $65 to

$245.

Truist Financial: Goldman Sachs maintains its

buy recommendation with a price target raised from $34 to $35.

Union pacific: Deutsche Bank upgrades to buy

from hold with a price target raised from $223 to $235.

Waste Connections: BMO Capital Markets

maintains its outperform rating with a price target reduced from

$162 to $158.

Waste Management: BMO Capital Markets maintains

its market perform recommendation with a price target reduced from

$166 to $160.

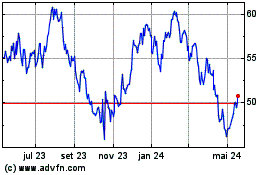

Knight Swift Transportat... (NYSE:KNX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Knight Swift Transportat... (NYSE:KNX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024