US index futures are declining in pre-market trading this

Thursday, primarily due to investors’ negative reaction to

companies reporting results below expectations. Meta (NASDAQ:META)

saw a 2.8% drop in pre-market trading, citing an uncertain economic

environment as the reason, while Alphabet (NASDAQ:GOOGL) lost 1.7%

due to disappointing cloud-related numbers. Amazon (NASDAQ:AMZN),

which will release results later, fell by 1.5%.

At 06:40 AM, Dow Jones futures (DOWI:DJI) dropped 107 points, or

0.32%. S&P 500 futures fell 0.61%, and Nasdaq-100 futures fell

0.90%. The yield on 10-year Treasury bonds stood at 4.953%.

In the commodities market, West Texas Intermediate crude oil for

December fell 1.23% to $84.34 per barrel. Brent crude oil for

December dropped 1.10% to around $89.14 per barrel. Iron ore with a

62% concentration traded on the Dalian exchange rose 0.69% to

$119.73, marking its third consecutive session of gains after three

declining sessions.

The downward trend has extended to other markets, including

stocks in Europe and Asia, which also recorded significant losses.

The dollar strengthened, and the price of gold rose by 0.5%. The

Japanese yen weakened against the dollar, raising speculation about

possible government intervention in the foreign exchange

market.

In Europe, the European Central Bank is expected to make a

policy decision to keep interest rates unchanged for the first time

in over a year.

US stock markets experienced a sharp decline in Wednesday’s

session, with corporate earnings weighing on stock indices’

performance. The Dow Jones fell 105.45 points or 0.32% to 33,035.93

points. The S&P 500 dropped 60.91 points or 1.43% to 4,186.77

points, its lowest closing level in almost five months. The Nasdaq

fell 318.65 points or 2.43% to 12,821.22 points, marking its worst

day since February.

Alphabet (NASDAQ:GOOGL) reported below-expected results, while

Meta’s (NASDAQ:META) results were expected after the market close.

U.S. home sales exceeded expectations, while a Treasury auction had

lower demand, influencing interest rates. Globally, tension in Gaza

escalated with Israel preparing for a ground attack, raising oil

prices. In Canada, the interest rate remained at 5%.

Regarding corporate earnings on Thursday, investors will be

watching for reports from United Parcel Service (NYSE:UPS), Royal

Caribbean Group (NYSE:RCL), Hershey (NYSE:HSY), Altria (NYSE:MO),

Southwest Airlines (NYSE:LUV), Valero (NYSE:VLO), Northrop Grumman

(NYSE:NOC), Newmont (NYSE:NEM), Merck (NYSE:MRK), before the market

opens. After the close, results from Amazon (NASDAQ:AMZN), Intel

(NASDAQ:INTC), Enphase Energy (NASDAQ:ENPH), Ford Motor (NYSE:F),

Chipotle Mexican Grill (NYSE:CMG), United States Steel (NYSE:X),

Vale (NYSE:VALE), Capital One (NYSE:COF), and others will be

anticipated.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple plans a complete overhaul of its

AirPods lineup, with an updated version of the standard AirPods in

2024 and a new Pro model in 2025. The changes will include improved

design, cases, and audio quality. Additionally, a new version of

AirPods Max is expected in 2024. The company also plans to

discontinue the second and third-generation AirPods in favor of two

fourth-generation models with similar prices but different

features, including noise cancellation in the top-end version.

Meta Platforms (NASDAQ:META) – Mark Zuckerberg, CEO of Meta

Platforms, has highlighted 2023 as a “year of efficiency,” earning

praise from the market. The cost-cutting effort appears to be

nearing completion, and analysts are confident despite the planned

increase in payroll in 2024 to invest in artificial intelligence.

Spending on AI is now more accepted by investors, boosting Meta. In

other news, Malaysia’s communications regulator will warn TikTok

and Meta for allegedly blocking pro-Palestinian content on their

platforms. The Communications Minister threatens to take a firm

stance if the issue persists, emphasizing the right to freedom of

expression regarding the Palestinian cause.

Alphabet (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META), Snap

(NYSE:SNAP) – Google, Meta, and Snap exceeded quarterly revenue

expectations, indicating that artificial intelligence is attracting

marketers to digital platforms. Google reported a 9.5% increase in

advertising revenue, while Meta plans to invest in AI next year.

Snap saw its average revenue per user increase in the third

quarter. The advertising market is rebounding, led by retail

company spending, with Google and Meta standing out as potential

beneficiaries. However, Meta noted softness in advertising spending

related to the Israel-Gaza conflict.

Arista Networks (NYSE:ANET), Nvidia (NASDAQ:NVDA) – Shares of

Arista Networks and Nvidia fell after Meta Platforms provided a

lower-than-expected capital spending outlook for 2024. Meta plans

to invest in servers, AI, and data centers, affecting related

stocks.

ON Semiconductor (NASDAQ:ON) – ON Semiconductor’s shares fell

about 25% from their record high. With earnings expected on Monday,

the company has a history of surpassing estimates. Its focus on

automotive and consumer chips protects it from trade restrictions

with China. Analysts predict solid growth through 2026, which could

boost the stock price, currently with an attractive valuation

multiple.

Ford Motor (NYSE:F) – The UAW union and Ford reached a tentative

agreement after a strike involving 45,000 workers. The agreement

includes a 25% pay increase over four and a half years, strike

rights, reversing past concessions, and pressuring other

automakers. President Biden praised the agreement.

Stellantis (NYSE:STLA) – Stellantis announced the acquisition of

a 21% stake in electric vehicle manufacturer Leapmotor in a $1.6

billion deal. This gives Stellantis access to Leapmotor’s advanced

technology but faces increasing competition from Chinese electric

vehicle manufacturers in Europe. Stellantis seeks to revitalize its

presence in China, where it faces sales challenges. The deal also

aims to help Stellantis expand its electric vehicle lineup to meet

2030 goals.

Southwest Airlines (NYSE:LUV) – Southwest Airlines reached a

tentative agreement with the Transport Workers Union Local 556,

which represents flight attendants. The union will communicate

details and a voting schedule to members. Flight attendants were

seeking pay increases and better working conditions.

Shell (NYSE:SHEL) – Shell plans to cut 15% of its workforce in

its low-carbon solutions division and scale back its hydrogen

business to boost profits under CEO Wael Sawan. About 200 jobs will

be cut in 2024 as the company seeks to focus on more profitable

low-carbon areas.

Berkshire Hathaway (NYSE:BRK.B), Occidental Petroleum (NYSE:OXY)

– Berkshire Hathaway increased its stake in Occidental Petroleum,

acquiring 3.9 million shares, raising its stake to 228 million

shares worth $14.5 billion. Berkshire holds $8.5 billion in

preferred Occidental shares. The company now owns 25.8% of

Occidental Petroleum and paid about $63 per share in its latest

purchase.

General Electric (NYSE:GE) – The offshore wind industry faced

challenges in 2023, with project cancellations due to rising costs.

General Electric (GE) incurred losses in its offshore wind turbine

business but plans improvements. New York State will invest $300

million in wind equipment production as part of a plan to add 6.4

GW of renewable energy capacity. While projects on the East Coast

have been delayed, new contracts offer lucrative opportunities for

companies like RWE (USOTC:RWEOY), TotalEnergies (NYSE:TTE), and

National Grid (NYSE:NGG), despite higher tariffs for consumers.

Endeavor Group Holdings (NYSE:EDR) – In Thursday’s pre-market,

the value of talent agency and sports company Endeavor increased by

21.4%. Endeavor CEO Ari Emanuel announced in a press release that

the company was exploring potential strategic options. The

statement also emphasized that Endeavor is not considering selling

its stake in TKO Group Holdings, which is the resulting company

from the merger including WWE and UFC.

Morgan Stanley (NYSE:MS) – Ted Pick has been chosen as the next

CEO of Morgan Stanley, succeeding James Gorman on January 1st.

Pick, a former co-president of the company, led crucial divisions,

including institutional securities and fixed income. He excelled in

restructuring the fixed income division and has been with the

company since 1990, serving on the management and operating

committee.

Barclays (NYSE:BCS) – Barclays is laying off dozens of employees

in its U.S. consumer banking division as part of a global

cost-cutting effort. The layoffs represent about 3% of the

division’s U.S. employees. The bank also announced a new round of

restructuring to increase efficiency. Its shares fell 2.3% in

Thursday’s pre-market in response to the bleak outlook for the

domestic market.

Nomura Holdings (NYSE:NMR) – Nomura Holdings is reevaluating its

business in China due to mounting losses in its Shanghai joint

venture. The joint venture has faced challenges since 2019 and

incurred CNY 225 million in losses in 2022. The review comes as

Nomura cuts bankers in Hong Kong, and other global financial

institutions conduct layoffs in Asia.

FedEx (NYSE:FDX) – FedEx warned that its Express deliveries in

the U.S. could experience delays due to an overnight disruption in

the FAA’s IT system. The company stated that affected shipments are

not eligible for refunds or credits.

Unilever (NYSE:UL) – New Unilever CEO Hein Schumacher revealed

plans to simplify the business by focusing on 30 key brands

representing 70% of sales. Shares fell 3.2% in Thursday’s

pre-market due to the lack of surprises in the strategy. Schumacher

took over after several years of underperformance. The company met

sales growth expectations in the third quarter but did not regain

some customers due to cheaper products. The focus now is on

improving gross margin without significant acquisitions.

Additionally, CFO Fernando Fernandez was appointed.

Hershey (NYSE:HSY) – Consumer Reports found lead and cadmium in

one-third of the chocolate products tested and urged Hershey to

reduce these metals. Sixteen of the 48 products contained harmful

levels. Hershey has expressed interest in reducing these metals in

its chocolate. Consumer Reports is once again calling for action

from the company.

Choice Hotels (NYSE:CHH), Wyndham Hotels and Resorts (NYSE:WH) –

Choice Hotels has requested that the board of Wyndham Hotels and

Resorts, a U.S. economy hotel operator, engage in merger

negotiations. Wyndham had previously rejected a $7.8 billion

acquisition offer from Choice.

Biogen (NASDAQ:BIIB), Eisai (USOTC:ESAIY) – Biogen and Eisai

released promising data on the Alzheimer’s treatment Leqembi. The

weekly subcutaneous version showed a 14% greater removal of amyloid

plaques compared to the intravenous version after six months,

potentially boosting the acceptance of the medication.

Sunnova Energy International (NYSE:NOVA) – Sunnova Energy

International’s shares surged 9.9% in Thursday’s pre-market after

the residential and commercial solar energy company announced

measures that improved its corporate liquidity, completely

eliminating the need for $500 million in planned capital for

2024.

Earnings

Meta Platforms (NASDAQ:META) – The parent company of Facebook,

Meta, saw its stock fall by -2.7% after announcing third-quarter

results that, while showing a reduction in profit and revenue

estimates, exceeded expectations. Meta reported revenue of $34.15

billion and earnings of $4.39 per share, surpassing analysts’

projections of $33.56 billion in revenue and earnings per share of

$3.63, according to LSEG.

IBM (NYSE:IBM) – The corporate services and cloud computing

company reported adjusted earnings of $2.20 per share in its

third-quarter earnings report, beating analysts’ estimates by 7

cents, according to LSEG. Additionally, the quarter’s revenue

reached $14.75 billion, slightly above analysts’ forecast of $14.73

billion.

ServiceNow (NYSE:NOW) – In Thursday’s pre-market trading, the

process automation company saw a 4.7% increase in its stock value

due to third-quarter results that exceeded expectations. ServiceNow

announced earnings of $2.92 per share, excluding extraordinary

items, surpassing analysts’ expectations of earnings per share of

$2.56, according to LSEG. Additionally, ServiceNow’s revenue

reached $2.29 billion, also exceeding analysts’ forecasts.

Whirlpool (NYSE:WHR) – The appliance company lowered its

full-year profit forecast. The company now estimates earnings per

share of $16, in contrast to its previous forecast ranging from $16

to $18 per share. Nevertheless, Whirlpool exceeded earnings and

revenue expectations in the third quarter.

Align Technology (NASDAQ:ALGN) – In Thursday’s pre-market

trading, shares of the medical devices company fell more than 25%.

This happened because Align issued a weak revenue forecast for the

fourth quarter, and CEO Joe Hogan explained in a statement that the

third-quarter results reflect lower-than-expected demand, along

with a more challenging macroeconomic environment compared to the

first half of the year. The company reported adjusted earnings per

share of $2.14 and revenue of $960 million, which fell short of

analysts’ expectations surveyed by LSEG.

Mattel (NASDAQ:MAT) – The toy manufacturer surprised analysts by

reporting earnings and profits above expectations and even raised

its full-year profit outlook. However, despite this positive

performance, its stock price fell by -10.4% in Thursday’s

pre-market trading. Mattel reported adjusted earnings of $1.08 per

share, surpassing analysts’ expectations of earnings of 86 cents

per share. Revenue reached $1.92 billion, while analysts had

expected $1.84 billion.

WPP (NYSE:WPP) – The WPP Group revised its growth outlook for

2023, now predicting 0.5-1.0% growth due to reduced spending by

technology clients and a slowdown in China. Third-quarter

performance fell below expectations, with shares dropping 3% in

Thursday’s pre-market trading. CEO Mark Read noted that technology

companies are cutting marketing expenses. Growth at GroupM slowed

to 1.6% due to client losses in the U.S. and technological

deceleration. WPP plans to merge Wunderman Thompson and VMLY&R

to create the industry’s largest creative agency.

Amazon (NASDAQ:AMZN) – Amazon seeks to increase its profit

margin in the third quarter by boosting same-day delivery services.

Investors expect a 2.67% increase in gross profit margins compared

to the previous year.

Intel (NASDAQ:INTC) – Intel will release its third-quarter

results, causing some concerns on Wall Street about its profit

margins for the coming year. Revenue of $13.6 billion and earnings

of 22 cents per share are estimated for the quarter, with analysts

predicting $14.4 billion and 33 cents per share for the next

quarter. Weak demand for data center server chips is a concern,

with forecasts below consensus for 2024.

Honeywell (NASDAQ:HON) – Industrial giant Honeywell

International is about to report its third-quarter earnings,

offering investors an opportunity to assess its progress toward

long-term goals. Wall Street expects earnings of $2.23 per share

and sales of $9.2 billion. Its shares have fallen about 6% in the

last 12 months but have exceeded estimates in previous

quarters.

Merck (NYSE:MRK) – Merck will announce its quarterly results

following a stock decline due to regulatory concerns and interest

rates. Investors expect cancer treatments to boost results.

Analysts project earnings of $1.95 per share and sales of $15.3

billion. The company also announced a collaboration with Daiichi

Sankyo worth up to $22 billion.

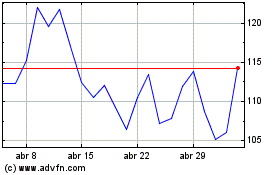

Enphase Energy (NASDAQ:ENPH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Enphase Energy (NASDAQ:ENPH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024