Today, all eyes are focused on the U.S. Philadelphia Fed

manufacturing index in a couple of hours. Economists, on average,

forecast that the November Philadelphia Fed manufacturing index

will come in at -9.0, compared to the previous value of -9.0.

U.S. Export and Import Price Indexes for October will also be in

focus today. Economists anticipate the export price index to be at

-0.5% m/m and the import price index to stand at -0.3% m/m.

U.S. Industrial Production data will be reported today.

Economists foresee this figure to stand at -0.3% m/m in October,

compared to the previous number of +0.3% m/m.

U.S. Manufacturing Production data will come in today.

Economists expect October’s figure to be -0.3% m/m, compared to the

previous value of +0.4% m/m.

On the earnings front, notable companies like Walmart

(NYSE:WMT), Applied Materials (NASDAQ:AMAT), Copart (NASDAQ:CPRT),

and Ross Stores (NASDAQ:ROST) are set to report their quarterly

earnings today.

December S&P 500 futures are down

-0.15%, and December Nasdaq 100 E-Mini futures are down -0.30% this

morning as weak forecasts from Cisco and Palo Alto Networks weighed

on sentiment, while investors looked ahead to a new round of U.S.

economic data and speeches from Fed officials.

Cisco Systems Inc (NASDAQ:CSCO) plunged over -10% in pre-market

trading after the networking giant cut its full-year revenue

guidance. Also, Palo Alto Networks Inc (NASDQ:PANW) slid more than

-5% in pre-market trading after the company cut its FY24 billings

forecast.

Pre-Market U.S. Stock Movers

Cisco Systems (CSCO) plunged over -10% in

pre-market trading after the networking giant cut its full-year

revenue guidance.

Palo Alto Networks (PANW) slid more than -5% in

pre-market trading after the company cut its FY24 billings

forecast.

Advance Auto Parts (AAP) fell over -2% in

pre-market trading after BofA downgraded the stock to Underperform

from Neutral.

Maxeon Solar Technologies (MAXN) tumbled more

than -5% in pre-market trading after the company reported a

larger-than-expected Q3 loss and lowered its FY23 revenue

guidance.

Plug Power (PLUG) dropped over -3% in

pre-market trading after Citi downgraded the stock to Neutral from

Buy.

StoneCo (STNE) gained more than +1% in

pre-market trading after BofA upgraded the stock to Buy from

Neutral.

ANALYST RECOMMENDATIONS

Abbvie: Baptista Research upgrades to

outperform from hold with a price target raised from USD 162.40 to

USD 164.30.

Charter Communications: Baptista Research

maintains its hold recommendation with a price target reduced from

USD 469 to USD 445.50.

Chevron Corporation: Baptista Research upgrades

to buy from hold with a price target raised from USD 178.20 to USD

188.60.

Cisco Systems: Barclays maintains its

equalweight recommendation and reduces the target price from USD 53

to USD 46.

Costar Group: Baird maintains its outperform

rating and raises the target price from USD 87 to USD 94.

Diamondback Energy: Piper Sandler & Co

maintains its overweight recommendation and raises the target price

from USD 189 to USD 206.

Exxon Mobil Corporation: Baptista Research

upgrades to outperform from hold with a price target raised from

USD 120 to USD 122.80.

Fiserv: Cowen maintains its outperform rating

and raises the target price from USD 137 to USD 147.

Target Corporation: Goldman Sachs maintains its

buy recommendation and raises the target price from USD 168 to USD

176.

The Tjx Companies: Citigroup maintains its buy

recommendation with a price target raised from USD 103 to USD

110.

Tractor Supply Company: Baptista Research

upgrades to buy from hold with a price target reduced from USD

252.10 to USD 247.50.

Uber Technologies: Canaccord Genuity maintains

its buy recommendation and raises the target price from USD 60 to

USD 65.

Verisign: Baptista Research upgrades to

outperform from hold with a price target raised from USD 235 to USD

240.60.

West Pharmaceutical Services: Baptista Research

downgrades to underperform from hold with a price target reduced

from USD 424 to USD 326.70.

Western Digital: BNP Paribas Exane maintains

its outperform recommendation and raises the target price from USD

58 to USD 68.

Workday: JMP Securities maintains its market

outperform recommendation and raises the target price from USD 260

to USD 270.

Zscaler: Barclays maintains its overweight

recommendation and raises the target price from USD 190 to USD

210.

Today’s U.S. Earnings Spotlight: Thursday – November

16th

Walmart (WMT), Applied Materials (AMAT), Copart (CPRT), Ross

Stores (ROST), ZTO Express Cayman (ZTO), Warner Music (WMG),

Williams-Sonoma (WSM), Dolby Labs (DLB), Woodward (WWD), Globant SA

(GLOB), Bath & Body Works (BBWI), Berry Global (BERY), Post

(POST), Gap (GPS), UGI (UGI), Macy’s Inc (M), Spire (SR), PagSeguro

Digital (PAGS), ESCO Technologies (ESE), Brady (BRC), Arcos Dorados

(ARCO), Borr Drilling (BORR), Matthews (MATW), Dole (DOLE), Beazer

Homes USA (BZH), Stratasys Ltd (SSYS), BrightView Holdings (BV),

Shoe Carnival (SCVL), Gogoro (GGR), Haynes (HAYN).

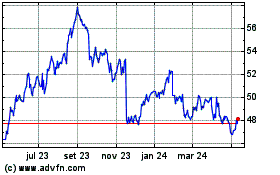

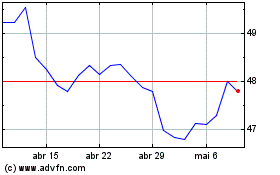

Cisco Systems (NASDAQ:CSCO)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Cisco Systems (NASDAQ:CSCO)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024