US Bitcoin ETFs attracted $4.6 billion in trades

On the first day of trading, US-listed Bitcoin ETFs reached an

impressive volume of $4.6 billion, attracting both bullish and

bearish investors who placed $80 million in long and short bets.

Investors rushed to purchase these new SEC-approved products,

marking a significant milestone for the cryptocurrency industry.

However, after the launch, the price of Bitcoin (COIN:BTCUSD)

surged to over $49,000, generating bullish sentiment, but it later

retreated, falling to $45,700. Bitget analyst Fernando Pereira

commented, “After aggressively rejecting $49,000.00, BTC once

again showed that supply exceeded demand, even as the price rose. I

believe it’s unlikely that the month’s peak will exceed

$50,000.00.” This volatility led to the liquidation of $83

million in Bitcoin futures and losses of over $230 million in other

futures products, underscoring market instability following the ETF

debut.

Today, around 36,000 Bitcoin options contracts are set to

expire, with a notional value of approximately $1.68 billion.

Ethereum options (COIN:ETHUSD) are also expiring. At the time of

writing, Bitcoin and Ethereum are down 6.1% and 1.2%, respectively,

at $43,570 and $2,588.

Franklin Templeton offers cheapest Bitcoin ETF

Franklin Templeton (AMEX:EZBC) reduced the fee on its Bitcoin

ETF to 0.19%, making it the lowest among the new US ETFs. This 10

basis point reduction surpasses Bitwise, which charges 0.2%. The

fund will waive additional fees until it reaches $10 billion in

assets under management. Following its launch, Bitcoin ETFs were

valued at $4.6 billion, with Franklin Templeton contributing $65

million.

Grayscale Bitcoin moves and ETF market implications

Grayscale began transferring 4,000 BTC ($200 million) to

Coinbase Prime (NASDAQ:COIN) on January 12. This move, likely a

result of recent ETF sales, indicates significant withdrawals from

Grayscale. Unlike traditional ETFs, spot Bitcoin ETFs do not

require instant buying and selling of Bitcoin (COIN:BTCUSD).

Crucial transactions occur before 2 pm New York time, and the

actual transfer of Bitcoin takes place on T+1 or T+2. These

activities can impact Bitcoin’s price. Grayscale (AMEX:GBTC), known

for its high fees, faces competition from new ETFs with lower

costs. The SEC has directed new Bitcoin ETFs to use cash

redemptions, diverging from stock and commodity funds that

typically employ in-kind redemptions. This decision mainly affects

institutional transactions and can influence market efficiency.

While it does not alter tax treatment for investors, it raises

questions about trading costs and market liquidity. SEC rules

mandate that the creation and redemption of shares should not be

done in Bitcoin, potentially affecting Bitcoin’s liquidity and

price during weekends and holidays.

BlackRock CEO endorses Ethereum ETF after Bitcoin success

Larry Fink, CEO of BlackRock (NYSE:BLK), endorsed the idea of an

Ethereum ETF following the launch of the Bitcoin ETF, highlighting

tokenization as the future of the sector. In an interview with

CNBC, Fink emphasized the potential value of an Ethereum ETF,

seeing it as a step towards tokenization, which he believes is the

future of the financial industry. BlackRock’s iShares Bitcoin Trust

(NASDAQ:IBIT) contributed approximately $1 billion to the ETFs’

total $4.6 billion volume. Fink views cryptocurrencies not as

currencies but as valuable asset classes, comparing Bitcoin to gold

and highlighting its role as a hedge against geopolitical risks. He

also mentioned the benefits of tokenization in mitigating money

laundering and corruption and considers Bitcoin’s limited supply a

unique aspect compared to gold.

Cathie Wood’s Ark Invest sells Coinbase and Robinhood shares

Cathie Wood’s Ark Invest liquidated $4.4 million worth of

Coinbase shares and $4.3 million worth of Robinhood shares as both

companies’ shares fell at market close. The ARK Innovation ETF

(AMEX:ARKK) sold 26,301 Coinbase shares and 341,592 Robinhood

shares, while the ARK Next Generation Internet (AMEX:ARKW) sold

4,980 and 23,838 shares, respectively. The sale occurred amid the

launch of spot Bitcoin ETFs in the US, with Coinbase and Robinhood

offering related services. Coinbase (NASDAQ:COIN) and Robinhood

(NASDAQ:HOOD) shares closed Thursday’s trading session with

declines of 6.7% and 3.5%, respectively, with continued declines in

today’s negotiations.

CoinShares acquires Valkyrie’s cryptocurrency ETF business

European asset manager CoinShares has acquired the

cryptocurrency ETF division of Valkyrie (NASDAQ:BRRR), expanding

its presence in the US. CoinShares aims to strengthen its global

position with the addition of Valkyrie ETFs to its portfolio,

adding around $110 million to its $4.5 billion in assets under

management. The transaction is pending legal agreements and board

approval.

UBS allows Bitcoin ETF trading with specific conditions

Swiss bank UBS (NYSE:UBS) will allow some clients to trade

Bitcoin ETFs, but under restricted conditions. The rules include

bans on bank solicitation and restrictions for accounts with low

risk tolerance. Meanwhile, Citigroup (NYSE:C) offers access to

Bitcoin ETFs to institutional clients and evaluates options for

individual clients. The debut of Bitcoin ETFs generated significant

interest, with substantial trading on the first day, despite some

banks, such as Vanguard, refusing to offer them.

Vanguard stays away from Bitcoin ETFs

Vanguard, a giant in the asset management market, reaffirmed

that it will not offer Bitcoin ETFs on its platform. The company

stated that cryptocurrency products do not align with Vanguard’s

focus on traditional asset classes like stocks and bonds. Vanguard

maintains its conservative, low-cost approach inherited from its

founder Jack Bogle.

Ripple Labs repurchases shares and faces SEC pressure for financial

transparency

Ripple Labs (COIN:XRPUSD) is repurchasing $285 million worth of

company stock from early investors and employees. The buyback,

valuing the company at $11.3 billion, limits share sales to 6% per

investor. Confirmed by Ripple on Wednesday, the move is part of a

larger $500 million buyback plan to cover share conversion costs

and taxes, according to Reuters. CEO Brad Garlinghouse revealed

that Ripple holds more than $1 billion in cash and $25 billion in

cryptocurrencies, and the company does not plan to go public soon

due to regulatory uncertainty.

Additionally, the US Securities and Exchange Commission (SEC) is

pressuring Ripple Labs to provide 2022 and 2023 financial

statements, as well as institutional sales contracts for XRP, in

the context of an ongoing legal case. The SEC seeks to clarify the

proceeds Ripple made from these sales following the initial

complaint. This request aims to assist Judge Torres in deciding on

precautionary measures and possible civil sanctions. The legal

dispute between the SEC and Ripple, which began in December 2020,

was largely resolved by October 2023.

BSV Blockchain ready to challenge Visa and Mastercard with Teranode

The BSV Blockchain is ready to compete with payment giants like

Visa (NYSE:V) and Mastercard (NYSE:MA), with the Teranode

development team announcing significant improvements in network

efficiency and speed. The updates will allow BSV to process one

million transactions per second, thanks to new features such as

modularized functions and transaction segmentation into subtrees.

This evolution of BSV, designed to follow the original principles

of Bitcoin (COIN:BTCUSD), puts the network in a unique position to

transform the digital economy.

Telcoin restores user balances after $1.2 million exploit

Telcoin quickly restored user balances following an exploit that

resulted in the loss of $1.2 million. CEO Paul Neuner is proud of

the team’s efficiency in recovering funds from the company’s

treasury by fixing the flaw in the interaction between the Telcoin

digital wallet and a proxy contract on Polygon. After the

restoration, Telcoin saw a significant increase in deposits,

demonstrating users’ renewed confidence in the platform.

Genesis Global Trading to pay $8 million in settlement with New

York regulator

Genesis Global Trading, a subsidiary of Digital Currency Group,

agreed to pay $8 million to the state of New York following

violations of financial regulations. The agreement with the New

York Department of Financial Services includes the suspension of

operations in the state and the waiver of the BitLicense. The

company has been criticized for failures to maintain effective

compliance programs, exposing it to money laundering risks and

cyber vulnerabilities.

Do Kwon Seeks to Postpone Trial Due to Extradition Delay

Terraform Labs co-founder Do Kwon has requested a postponement

of his trial by the SEC until mid-March, pending his extradition

from Montenegro. Kwon’s legal team informed Judge Rakoff of the

delay caused by the pending extradition, seeking to allow Kwon to

be present at the trial. He faces multiple charges, including fraud

and securities law violations, with uncertainty over his final

extradition destination between the US and South Korea.

Study reveals that more than 30% of blockchain games have been

abandoned

Data from BlockchainGamer.biz shows that of the 1,318 blockchain

games released since 2021, more than 30% have been abandoned or

discontinued. Of the remaining 911 games, 334 are active, and 577

are in development. Top reasons for abandonment include funding

challenges, volatile market conditions, and inexperienced teams.

Many projects have ceased operations without warning, with Binance

BNB Chain leading in abandoned projects, followed by Polygon.

2023 saw significant increase in activity and interest in NFTs

DappRadar revealed significant growth in the NFTs market in

2023, driven by positive variations in the cryptocurrency market.

The report highlighted a 166% increase in the number of new wallets

trading NFTs. Despite a 49% reduction in trading volume to $12.6

billion, the number of NFTs sold soared by 445%. The entry of major

brands into the NFT space, such as Samsung and Nike (NYSE:NKE), and

Blur’s leadership in trading volume are indicative of the growing

mainstream adoption of NFTs. DappRadar also approved 2,985 new

dApps in 2023, with a focus on NFTs and games, signaling a

continued growth trend in the sector.

Sotheby’s launches art auction focused on Bitcoin Ordinals

Sotheby’s has opened an auction specializing in Bitcoin

Ordinals, called “Natively Digital: An Ordinals Curated Sale.” The

event includes 19 exclusive pieces, such as rare Satoshis and works

by artist Shroomtoshi, a pioneer in Bitcoin Ordinals. Following the

success of the first Bitcoin Ordinals auction in December, which

raised $450,850, Sotheby’s continues to explore this new arena for

artists and collectors, highlighting the fusion of digital art and

cryptoculture. The auction closes on January 22nd.

Hut 8 expands credit with Coinbase and advances in energy projects

Hut 8 Mining (NASDAQ:HUT), a Bitcoin mining company, increased

its line of credit to $65 million through an agreement with

Coinbase (NASDAQ:COIN), its US partner. This new $15 million loan,

added to the pre-existing $50 million credit, will be used for

general corporate purposes. The loan is secured by Bitcoin

(COIN:BTCUSD) and has the same interest rate as the previous

agreement. Additionally, Hut 8 received authorization to acquire

four natural gas plants in Ontario, Canada. This acquisition, which

includes a Bitcoin mining operation, is part of a new financing

agreement with Macquarie, where Hut 8 retains an 80% equity stake.

This transaction is expected to close on February 15th.

Bitcoin miners transfer record BTC to exchanges

The outflow of Bitcoin miners (COIN:BTCUSD) reached record

levels, with the transfer of more than $1 billion in BTC to

exchanges, according to CryptoQuant. The majority came from F2Pool,

with rising costs and the need to update equipment as the main

reasons. This move, which could historically impact the price of

Bitcoin, comes during the introduction of the first Bitcoin ETFs in

the US, but analysts do not see it as a negative sign.

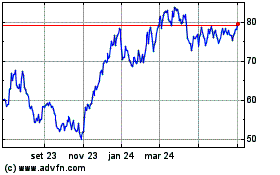

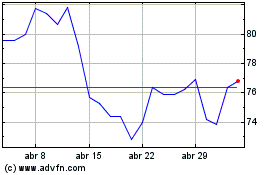

ARK Next Generation Inte... (AMEX:ARKW)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ARK Next Generation Inte... (AMEX:ARKW)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025