Bitcoin recovers $40,000 mark on Wednesday

Bitcoin (COIN:BTCUSD) reclaimed the $40,000 level after a brief

dip below that value, registering a modest 0.5% increase in 24

hours, trading at $40,040. “After more than a 20% drop, BTC

found the 100-period moving average. A very strong support with

many robots programmed to buy in this region. This could cause a

short-term rise in the asset before it falls again,” said

Fernando Pereira, an analyst at Bitget. Meanwhile, Arthur Hayes,

founder of BitMEX, argues that the recent Bitcoin volatility is not

due to factors related to the Grayscale Bitcoin Trust (AMEX:GBTC),

but rather to macroeconomic and monetary policy changes. Hayes

suggests that fluctuations in US Treasury bond yields are more

closely related to Bitcoin movements, anticipating changes in

dollar liquidity ahead of conventional markets, and predicts a

cryptocurrency recovery based on potential interest rate cuts and a

resumption of quantitative easing.

Solana enhances programmability with innovative token extensions

The Solana Foundation is launching token extensions for its

blockchain, increasing the programmability of SPL tokens. These

extensions, developed for over a year, allow creators to implement

specific rules such as whitelists, automatic transfer fees, and

transaction privacy. The innovation particularly benefits

stablecoin issuers like Paxos and GMO Trust, enabling adaptation to

varying regulations. The extensions include transfer hooks,

automatic fees, confidential transfers, delegated authority, and

token transfer restrictions, enhancing control and security in the

Solana ecosystem.

Nexo demands $3 billion from Bulgaria in international arbitration

Cryptocurrency lending company Nexo has filed an arbitration

claim against Bulgaria, seeking $3 billion in damages. Alleging

that the country engaged in “illegal and politically motivated

actions,” including oppressive and unfounded criminal

investigations, Nexo (COIN:NEXOUSD) is seeking compensation for the

harm it has suffered. The investigations, which Nexo claims damaged

its reputation and cost it business opportunities, including a

potential IPO in the United States, were closed by the Bulgarian

Prosecutor’s Office due to lack of evidence. The complaint was

filed with the International Centre for Settlement of Investment

Disputes (ICSID) in Washington, DC.

SEC defends requirement for Ripple’s financial documents in lawsuit

In a recent legal battle, the US Securities and Exchange

Commission (SEC) defended its request for Ripple’s (COIN:XRPUSD)

audited financial statements for the past two years, stating that

they were procedurally valid and relevant. Ripple had opposed these

demands, arguing that they were inappropriate and unnecessary,

considering that both parties had previously agreed that additional

discovery was not needed. However, the SEC argued that recent

developments in the case justified new discovery, emphasizing the

importance of this information in determining potential penalties.

The legal dispute between Ripple and the SEC has been ongoing for

four years, with significant decisions regarding the classification

of XRP sales at stake.

Maxine Waters investigating Meta’s involvement in digital assets

US Representative Maxine Waters, a senior member of the House

Financial Services Committee, has initiated an investigation into

Meta Platforms (NASDAQ:META) involvement in digital assets, citing

concerns about financial stability. In a letter to Meta executives,

including Mark Zuckerberg and Javier Olivan, she questioned the

company’s potential expansion into digital currency and blockchain,

based on recent trademark filings. Waters seeks clarification on

Meta’s plans in web3, digital wallets, and other related projects,

examining the company’s potential research and development in

stablecoins and relevant partnerships. This investigation reflects

Waters’ long-standing criticism of the crypto industry and her

belief in the need for strict regulation, especially for stablecoin

issuers.

Brink’s Company and BitGo form strategic partnership in the digital

world

Brink’s Company, known for its armored trucks, invests in and

forms a partnership with BitGo, a cryptocurrency custody company.

Brink’s will be responsible for secure logistics and vault services

for BitGo, expanding its presence in the blockchain sector. This

partnership does not alter the governance boards of the companies

but strengthens Brink’s presence in a rapidly evolving digital

landscape, combining its expertise in physical security with

BitGo’s leadership in digital security and asset custody.

Bitget diversifies crypto with Amulet (AMU) listing

Bitget, one of the leading cryptocurrency exchanges and Web3

companies, announces the inclusion of Amulet (AMU) in its

Innovation, Solana Ecosystem, and DeFi zones, highlighting its

continued support for diversifying blockchain ecosystems. The

Amulet Protocol represents an innovation in decentralized risk

protection, offering compatibility with multiple blockchains,

including Solana and Ethereum. Bitget reinforces its commitment to

providing access to innovative projects, having added over 350 new

listings in 2023, expanding the range of digital assets available

to its users.

Doom from 1993 resurrects on the Dogecoin blockchain, thanks to

developer Mini Doge

Mini Doge, an innovative developer, has announced the porting of

the iconic 1993 game Doom to the Dogecoin blockchain. Using

“inscriptions” technology based on the DRC-20 standard, the game is

now accessible with full-screen support and mouse control. Game

data is extracted directly from the Dogecoin blockchain, although

the initial launch may take about a minute. This release has

generated increased online activity, similar to what has been

observed with inscriptions on the Bitcoin blockchain. However,

inscriptions have faced criticism, including cybersecurity warnings

from the US National Vulnerability Database (NVD) regarding the

Ordinals protocol in Bitcoin.

Tornado Cash developer legal defense fund receives widespread

support

The legal fund established for Tornado Cash developers Roman

Storm and Alexey Pertsev has already raised over $350,000, with

support from Edward Snowden, a former NSA analyst. Roman Storm, a

dual US and Russian citizen, is under house arrest in Washington

and will face trial in 2024 on money laundering and sanctions

violation charges. Meanwhile, Roman Semenov, also accused, has not

been detained. The US Department of Justice accuses the

cryptocurrency mixing service of moving over $1 billion, and

Pertsev has been in custody in the Netherlands since 2023. Storm

expressed concern about his future but remains hopeful, encouraging

donations for his legal defense, while Snowden highlights the

importance of privacy, stating that “Privacy is not a crime.”

Mailer Lite phishing attack results in $600,000 loss

Mailer Lite, a well-known digital marketing platform, fell

victim to a sophisticated phishing attack that led to a loss of

over $600,000, revealed Blockaid, a web3 security and privacy

company. Attackers exploited a vulnerability in Mailer Lite to

impersonate web3 organizations, sending emails that appeared

authentic but contained dangerous links to cryptocurrency

wallet-draining websites. They took advantage of pending DNS

records previously associated with Mailer Lite by these companies

to create deceptive emails. Among the victims of the attack are

CoinTelegraph, WalletConnect, Token Terminal, and De.Fi, as

identified by crypto expert ZachXBT.

Hut 8 responds to JCapital’s report with misinformation criticism

Hut 8 Mining Corp. (NASDAQ:HUT) has countered allegations in a

report from JCapital Research, labeling it “a deliberate attempt to

spread misinformation.” The company criticized the report for being

riddled with inaccuracies, distorted data, and baseless

accusations. CEO Jaime Leverton emphasized that they will not let

misinformation and defamatory attacks divert their focus. The

company’s shares continue to struggle to recover, with a more than

3% recovery during Wednesday’s trading, following a -30.1% drop in

the past 7 days.

Core Scientific returns to Nasdaq after post-bankruptcy

restructuring

Core Scientific (NASDAQ:CORZ), a Texas-based bitcoin mining

company, announced its return to trading on Nasdaq on Wednesday

following a successful reorganization in response to its 2022

bankruptcy filing. The company managed to eliminate $400 million in

debt by converting debts owed to creditors and convertible

noteholders into equity. CEO Adam Sullivan expressed optimism about

the company’s future, highlighting plans to expand mining capacity

and venture into other high-value computing areas. Core Scientific,

which faced challenges due to cryptocurrency price declines and

market issues, plans to increase its mining capacity by over 50% in

the next four years. On the other hand, mining companies Marathon

Digital (NASDAQ:MARA) and Riot Platforms (NASDAQ:RIOT) have

experienced significant declines following Bitcoin’s (COIN:BTCUSD)

volatility and the approval of Bitcoin ETFs in the US.

BIS defines CBDCs and tokenization as strategic focus for 2024

The Bank for International Settlements (BIS) has set its

strategic goals for 2024, emphasizing Central Bank Digital

Currencies (CBDCs) and tokenization. The plan includes continued

engagement with fintechs, with a favorable stance toward CBDCs, and

the digitization of financial instruments, as evidenced by the

Promissa Project. This project aims to modernize promissory notes

using blockchain for increased efficiency and transparency.

Meanwhile, the Aurum Project, in collaboration with the Hong Kong

Monetary Authority, focuses on privacy in retail CBDC transactions,

with a proof-of-concept phase to be completed by early 2025. BIS is

also exploring other areas, including cybersecurity and sustainable

finance, through multiple projects, reflecting its broad interest

in digital financial technologies.

FINRA identifies potential violations in crypto communications

The Financial Industry Regulatory Authority (FINRA), a financial

sector regulator, has found that 70% of brokerage communications

about cryptocurrencies may have violated its fairness and balance

guidelines. Under the supervision of the SEC, FINRA is focused on

ensuring that information provided to the public is accurate and

not overstated. The review, which began in November, indicated

deceptive comparisons of cryptocurrencies to traditional assets and

false statements about the applicability of securities laws.

NFT Paris 2024: Europe’s largest Web3 gathering

Returning to the Grand Palais Éphémère on February 23 and 24,

2024, NFT Paris celebrates its exponential success since its debut

in 2022. From 800 initial participants to 18,000 in 2023, the event

has become a landmark in the Web3 industry. In 2024, it will expand

its scope to include more aspects of the Web3 ecosystem, featuring

industry leaders, cutting-edge companies, and renowned artists.

Indonesia’s crypto tax revenue declines in 2023 despite Bitcoin’s

rise

Indonesia’s Ministry of Finance reported cryptocurrency tax

revenue of $31.7 million in 2023, a 62% decrease compared to the

previous year. Indonesia imposes double taxation on crypto

transactions, including income tax and value-added tax (VAT).

Despite a 159% increase in Bitcoin (COIN:BTCUSD), the country saw a

51% decrease in crypto transaction volume and a reduction in tax

revenue. Local exchanges criticized the high tax rates, proposing

changes to crypto taxation. Meanwhile, the presence of illegal

exchanges in the country challenges the formal tax system.

Taiwan authorities seek ACE Exchange president’s detention for

fraud

Prosecutors in Taiwan have requested the detention of Chenhuan

Wang, president of ACE Exchange, on suspicion of money laundering

and fraud. The request follows the arrest of David Pan, the

company’s founder, who is accused of orchestrating a fraud scheme.

Prosecutors have summoned Wang and four more suspects following

police operations. Pan and an accomplice are accused of luring

investors into worthless cryptocurrencies, and now Wang is

suspected of involvement. Despite the events, ACE Exchange claims

that its operations continue as usual and reiterates its commitment

to legality. Chenhuan Wang, also a partner at the Chien Yeh law

firm, is on leave from his duties while the case is treated as his

personal investment.

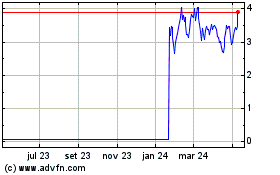

Core Scientific (NASDAQ:CORZ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

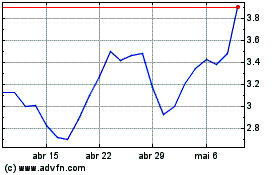

Core Scientific (NASDAQ:CORZ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024