Arcus Biosciences (NYSE:RCUS), Gilead

Sciences (NASDAQ:GILD) – Arcus

Biosciences‘ shares rose 19.5% in pre-market trading on

Tuesday following news of a $320 million investment by

Gilead Sciences, which also led to a revision of

their collaboration agreement. This change aims to boost the growth

of their joint development programs and includes the appointment of

Johanna Mercier from Gilead to the

Arcus board.

Super Micro Computer (NASDAQ:SMCI) –

Super Micro Computer announced projected net sales

between $3.7 billion and $4.1 billion for the March quarter,

surpassing analysts’ expectations of $2.87 billion. Super

Micro‘s value has tripled since May 2023 due to strong

demand for AI servers. CEO Charles Liang believes growth will

continue for many quarters, and the company is at an advantage due

to its market agility and relationships with semiconductor

manufacturers. However, investors are also wary of a potential

downturn, as has happened with other server suppliers in the

past.

Amazon (NASDAQ:AMZN), iRobot

(NASDAQ:IRBT) – Amazon and the robotic vacuum

manufacturer iRobot announced the termination of

their merger plans due to opposition from EU and US antitrust

regulators. Amazon cited the impossibility of

regulatory approval in the EU as the reason. Regulators were

concerned that Amazon could harm

iRobot‘s rivals on its online marketplace. The FTC

was also prepared to reject the deal before its cancellation.

Additionally, iRobot plans a significant

restructuring, cutting 31% of its workforce.

Microsoft (NASDAQ:MSFT) –

Microsoft has appointed Johanna Faries as the

president of the Blizzard Entertainment gaming publishing unit,

part of the Activision Blizzard acquisition. Matt Cox is the new

Senior Vice President and General Manager of Call of Duty.

Teradyne (NASDAQ:TER) –

Teradyne, a supplier of semiconductor testing

equipment, has moved about $1 billion in production out of China

due to US export regulations. This affected its operations and

sales in China, resulting in a market share drop from 16% to 12% in

the three months ending on October 1st.

Calix (NYSE:CALX) – Calix, a

broadband software company, experienced a 22% drop in pre-market

trading on Tuesday after reporting a fourth-quarter loss and

projecting first-quarter revenue between $225 million and $231

million. This forecast was below the previous year’s $250 million

and analysts’ expectations of $267.5 million in revenue.

F5 (NASDAQ:FFIV) – In the fiscal first quarter,

F5 reported adjusted earnings of $3.43 per share,

beating analysts’ expectations, along with revenue of $693 million,

which also exceeded forecasts. The company anticipates

second-quarter sales between $675 million and $695 million,

compared to analysts’ predictions of $673 million.

Sanmina (NASDAQ:SANM) –

Sanmina forecasted second-quarter revenues between

$1.825 billion and $1.925 billion, exceeding FactSet’s expectations

of $1.8 billion. Adjusted earnings per share are projected between

$1.20 and $1.30, above analysts’ estimates of $1.02. In the first

quarter, the company reported a net income of $57.07 million and

revenue of $1.87 billion, with shares falling 8.8% over the past 12

months.

Albemarle (NYSE:ALB) –

Albemarle, the world’s leading lithium producer,

laid off over 300 employees, about 4% of its workforce, as part of

a cost-cutting strategy due to falling metal prices used in

electric vehicle batteries. The move aims to save at least $50

million in 2024, although the company has not disclosed specific

figures.

Cleveland-Cliffs (NYSE:CLF) –

Cleveland-Cliffs announced a fourth-quarter loss

that, although smaller than the previous year, was accompanied by

$5.11 billion in revenue that fell short of expectations. The steel

company forecasts that the adjusted profit in the first quarter,

before interest, taxes, depreciation, and amortization, will

“significantly exceed” the $279 million recorded in the fourth

quarter. This resulted in a 2.6% drop in shares in Tuesday’s

pre-market trading.

Exxon Mobil (NYSE:XOM) – Investors are

concerned about Exxon Mobil avoiding the US

securities regulator by suing shareholders over resolutions, as the

SEC has made it harder to avoid these resolutions under the Biden

administration. Currently, fewer companies are rejecting

shareholder resolutions, and the change in SEC rules has encouraged

activist shareholders, resulting in an increase in resolutions

submitted.

BP (NYSE:BP) – Activist investor Bluebell

Capital Partners criticizes BP Plc for its planned

reduction in oil and gas production, arguing that the company

should abandon this goal. Bluebell emphasizes the importance of

balancing strategy considering the ongoing demand for oil and the

transition to low-carbon energy. BP‘s new CEO,

Murray Auchincloss, has the opportunity to review the strategy, but

Bluebell is not calling for a complete halt to clean energy

investments. The campaign increases pressure on Auchincloss, who

replaced Bernard Looney, the architect of BP‘s

clean energy strategy. BP plans to invest more

than half of its annual spending on oil and gas by 2030, despite

the ongoing focus on clean energy.

Boeing (NYSE:BA) – An influential industry

leader expressed concerns about Boeing, warning

that additional production problems could lead to stricter

regulations. The president of Air Lease Corp, Steven Udvar-Hazy,

called on Boeing to demonstrate leadership in

aircraft design. He mentioned the explosion incident on an Alaska

Airlines 737 MAX 9 jet but downplayed systemic concerns.

Boeing withdrew a request for an exemption from

safety standards for the 737 MAX 7, which is awaiting

certification. The decision came after opposition from Senator

Tammy Duckworth, who was concerned about the anti-icing system that

could cause dangerous debris. Instead, Boeing will

opt for an engineering solution during the certification

process.

Gol (NYSE:GOL) – A US bankruptcy judge allowed

the Brazilian airline Gol to borrow the first $350

million of its proposed bankruptcy financing, deemed “desperately”

needed to maintain normal operations. The financing has a high

interest rate and additional costs, while Gol‘s

shares have significantly dropped. The company filed for Chapter 11

bankruptcy protection due to significant debts and post-pandemic

challenges.

VinFast (NASDAQ:VFS) – The Vietnamese electric

vehicle company VinFast announced plans to

establish an electric vehicle business network in the Philippines,

according to a statement issued by its parent company, Vingroup.

The investment in the Philippines is scheduled to start this

year.

Stellantis (NYSE:STLA) –

Stellantis has started mass production of hydrogen

fuel cell vans in Europe, expanding its lineup of zero-emission

commercial vehicles. Larger vans will be manufactured in Poland,

and medium-sized ones in France. The production faces tensions with

the Italian government. Stellantis expects to sell

over 10,000 units annually by 2025, with a range of up to 500

kilometers and refueling times of 4 to 5 minutes.

Ford Motor (NYSE:F) – US House Committee

chairpersons have called for an investigation into four Chinese

companies allegedly linked to sensitive issues related to

Ford‘s battery plant in Michigan.

Ford faces concerns about its partnership with

CATL but states that it follows strict regulations and human rights

standards. Lawmakers also called for investigations related to

sanctions evasion and ties to North Korea.

Toyota (NYSE:TM) – Toyota

retained its title as the world’s best-selling automaker for the

fourth consecutive year, recording record annual sales of 11.2

million in 2023. However, its president, Akio Toyoda, apologized

for scandals at group companies, including Daihatsu and Hino

Motors, which damaged the brand’s reputation in terms of quality

and safety. Toyota faces governance challenges

after irregularities in certification testing procedures for cars

and engines. Toyota also recently issued a “Do Not

Drive” warning to owners of about 50,000 older vehicles in the US

due to problems with Takata airbag inflators. This measure aims to

prevent potentially deadly explosions associated with these

inflators. To date, more than 30 deaths and hundreds of injuries

have been linked to Takata airbag inflators worldwide.

Whirlpool (NYSE:WHR) –

Whirlpool revised its 2024 projections,

forecasting sales of $16.9 billion, below estimates of $17.68

billion, and an adjusted annual profit between $13 and $15 per

share, compared to analysts’ average expectation of $15.48 per

share. The company reported that it eliminated about $800 million

in costs in 2023 and expects to cut up to $400 million more this

year.

WPP (NYSE:WPP) – The British advertising group

WPP announced that its net revenue, after

pass-through costs, grew by 0.9% last year. They predict similar

results in 2024, with a slight improvement in operating profit

margin. The company has also set a medium-term revenue growth

target of over 3%, driven by investments in technology.

EchoStar (NASDAQ:SATS) –

EchoStar Corp., parent company of Dish Network,

ended an exchange offer of over $5 billion in debt due in the

coming years for new notes, without disclosing the reason. The

previous offer to exchange $4.9 billion in convertible debt for new

securities is still in effect. Dish (NASDAQ:DISH)

faces a challenge in managing its debt of over $20 billion, leading

creditors to split into groups and hire consultants.

Diageo (NYSE:DEO) – Diageo,

the world’s largest spirits maker, experienced a 0.6% drop in

organic net sales in the first half, below estimates, due to a

decline in Latin America. Organic operating profit fell by 5.4%,

worse than expected, but the company anticipates an improvement in

the second half.

Chipotle Mexican Grill (NYSE:CMG) –

Chipotle Mexican Grill plans to hire 19,000 new

employees for the busy season, targeting Generation Z workers. The

company is introducing benefits such as retirement plans and access

to mental health resources to attract and retain this young

workforce.

UBS (NYSE:UBS) – The combined market share of

UBS and Credit Suisse in the

Swiss fund sector fell to 37.6% in 2023 as UBS

integrates Credit Suisse and some investors avoid

overexposure to a single institution. The Swiss fund market grew by

3.7%, reaching 1.37 trillion Swiss francs in 2023. Switzerland is

the third-largest asset management market in Europe, after the UK

and France. Moreover, as UBS moves forward with

the integration of Credit Suisse, it faces

regulatory concerns due to its size. Investors fear ongoing

conflicts with Swiss regulators over the bank’s size.

Deutsche Bank (NYSE:DB) – The CEO of

Deutsche Bank expressed concerns about the threat

of right-wing extremism in Germany, especially related to the rise

of the nationalist Alternative for Germany (AfD). He warned that

this could impact investment and confidence in the country’s

democratic values. Critical state elections this year are also

mentioned as crucial for the future of democracy in Germany and

business in the country.

Morgan Stanley (NYSE:MS) – Morgan

Stanley analysts are optimistic about major US banks due

to expectations of less burdensome regulations on capital levels,

which could lead to stock buybacks. They upgraded recommendations

for Goldman Sachs (NYSE:GS),

Citigroup (NYSE:C), and Bank of

America (NYSE:BAC) and consider the large-cap banking

group attractive. The regulatory reform, known as “Basel III End

Game,” could be less severe, allowing significant stock buybacks

due to the high levels of excess capital held by the largest US

banks.

HSBC Holdings (NYSE:HSBC) –

HSBC was fined $73 million in the UK for failing

to comply with deposit protection rules, incorrectly excluding

billions of pounds of customer money from a protection program. The

fine reflects the seriousness of the failures that occurred between

2015 and 2022.

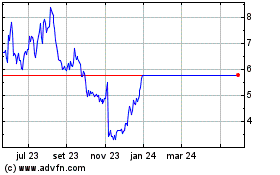

DISH Network (NASDAQ:DISH)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

DISH Network (NASDAQ:DISH)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024