U.S. Futures Waver Ahead of Fed Decision Amid Mixed Corporate Earnings; Oil Prices Slide

31 Janeiro 2024 - 8:29AM

IH Market News

U.S. futures are mixed in Wednesday’s pre-market ahead of the

Federal Reserve announcement, with expectations focused on interest

rate maintenance and future monetary policy guidance by Jerome

Powell. Meanwhile, Alphabet (NASDAQ:GOOGL) and Microsoft

(NASDAQ:MSFT) are experiencing declines following mixed

results.

As of 05:37 AM, Dow Jones futures (DOWI:DJI) rose by 25 points,

or 0.06%. S&P 500 futures fell by 0.54%, and Nasdaq-100 futures

retreated by 1.22%. The yield on 10-year Treasury bonds was at

4.024%.

In the commodities market, West Texas Intermediate crude for

March fell by 1.30% to $76.81 per barrel. Brent crude for March

dropped by 1.16% to around $81.91 per barrel. Iron ore with a 62%

concentration, traded on the Dalian exchange, fell by 3.08% to

$135.42 per metric ton.

Today’s U.S. economic agenda starts at 08:15 AM with the ADP

report on private sector job creation in January, followed by the

Q4 Employment Cost Index. The Chicago PMI for January will be

released at 09:45 AM, and oil inventories up to January 26th will

be announced at 10:30 AM. The day concludes at 2:00 PM with the

Fed’s interest rate decision and Jerome Powell’s press conference.

The Fed is expected to maintain the interest rate range between

5.25% and 5.5%.

On Wednesday, Asian markets showed mixed results, affected by

negative Chinese manufacturing indicators and cautious expectations

regarding the Fed’s interest rate decision. Notable declines were

observed in Shanghai (-1.48%) and Hong Kong (-1.39%), while Tokyo

(+0.61%) and Australia (+1.06%) posted gains.

European markets are showing varied performance as global

investors anticipate the Fed’s new monetary policy decision and

analyze corporate financial results. Noteworthy are the financial

statements released by pharmaceutical companies Novo Nordisk and

Novartis, Santander bank, and H&M retail chain before the

market opens.

U.S. stock indices had a mixed performance on Tuesday, with the

Dow reaching a new record high and the Nasdaq falling due to

profit-taking in the tech sector, in anticipation of results from

major companies like Alphabet (NASDAQ:GOOGL) and Microsoft

(NASDAQ:MSFT). The uncertainty ahead of the Federal Reserve

announcement also influenced the market. Meanwhile, economic data

showed an unexpected increase in job openings and an improvement in

consumer confidence.

In the lead-up to Wednesday’s quarterly earnings, scheduled to

present financial reports are Boeing (NYSE:BA),

Novo Nordisk (NYSE:NVO),

Mastercard (NYSE:MA), Phillips 66

(NYSE:PSX), Roper Technologies (NYSE:ROP),

Thermo Fisher (NYSE:TMO), Nasdaq

(NASDAQ:NDAQ), Boston Scientific (NYSE:BSX), among

others, before the market opens.

After the close, earnings from Qualcomm

(NASDAQ:QCOM), Corteva (NYSE:CTVA), Align

Technologies (NASDAQ:ALGN), MetLife

(NYSE:MET), Wolfspeed (NYSE:WOLF),

AvalonBay Communities (NYSE:AVB), Century

Communities (NYSE:CCS), and more will be awaited.

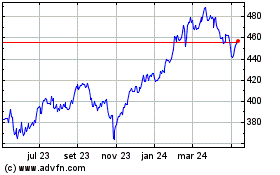

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

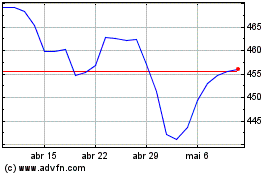

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025