Alphabet (NASDAQ:GOOGL) – Google has renamed

its chatbot Bard to Gemini, powered by a new artificial

intelligence. Consumers can pay $19.99/month for Gemini Advanced,

which includes a more powerful AI model and two terabytes of cloud

storage, competing with Microsoft

(NASDAQ:MSFT).

Amazon (NASDAQ:AMZN) – Amazon and BMW triumphed

in an action against sellers of counterfeit goods in Spain.

Counterfeits, including products such as valve caps and keychains,

led to a lawsuit in the Spanish Community Trademark Court in

Alicante. Details on penalties have not been disclosed.

Meta Platforms (NASDAQ:META) – Meta is ending

the lease of seven office floors in Singapore, scheduled to expire

in September, as reported by The Business Times. This follows a

decision not to renew communicated last June.

Cisco Systems (NASDAQ:CSCO),

Splunk (NASDAQ:SPLK) – The EU has set a deadline

until March 13 to decide on Cisco Systems’ $28 billion offer for

Splunk. The deal aims to reduce Cisco’s dependence on networking

equipment, facing regulatory hurdles due to antitrust concerns.

Walt Disney (NYSE:DIS) – Walt Disney’s $1.5

billion investment in Epic Games values the gaming company at $22.5

billion, reflecting a decline in value over the past two years. The

deal will allow for the creation of a vast Disney universe in the

gaming world.

Duke Energy (NYSE:DUK) – Under legislative

pressure, Duke Energy in the US plans to phase out Chinese CATL

batteries on military bases, aligning with cybersecurity concerns.

Changes may affect the energy supply chain. Legislation proposes

avoiding Chinese batteries until 2027.

ExxonMobil (NYSE:XOM) – ExxonMobil plans to end

its operations in Equatorial Guinea soon, after nearly three

decades of oil exploration. The transfer of investments to the

government will occur in the second quarter, aligning with the

company’s global strategy.

Baidu (NASDAQ:BIDU) – China’s Baidu is

partnering with Lenovo to integrate its generative AI into

smartphones, following similar collaborations with Samsung and

Honor. Lenovo will incorporate Baidu’s Ernie model into its

devices.

AstraZeneca (NASDAQ:AZN) – Novo Nordisk’s

(NYSE:NVO) acquisition of Catalent (NYSE:CTLT) highlights the

importance of major pharmaceuticals having control over their

supply chain. AstraZeneca, a Catalent client, is strengthening its

internal capacity to reduce external dependence, aiming for

autonomy and continuity in drug production.

Novo Nordisk (NYSE:NVO) – Novo Nordisk is

preparing to launch a revolutionary weight loss pill but faces

production challenges. As competitors advance, the company seeks to

balance supply and demand, acknowledging that injections remain an

effective choice for many patients.

Tesla (NASDAQ:TSLA) – Elon Musk, CEO of Tesla,

is considering layoffs while financial reports show the company is

behind in revenue per employee. While Tesla generated nearly $97

billion in 2023, each employee brought in about $690,000, compared

to more than $1 million from GM (NYSE:GM) and $937,000 from Ford

(NYSE:F).

General Motors (NYSE:GM) – General Motors has

appointed Kurt Kelty, a former Tesla executive, as vice president

of its battery unit. Kelty led battery development at Tesla for 11

years before joining Sila Nanotechnologies. The move comes as GM

expands its battery production capacity to meet the growing demand

for electric vehicles.

Getaround (NYSE:GETR) – San Francisco-based

Getaround plans to lay off about a third of its staff in North

America to cut costs and seek long-term profitability. The

company’s shares are up 3.5% in pre-market trading on Friday.

HSBC (NYSE:HSBC), Alphabet

(NASDAQ:GOOGL) – HSBC partners with Google to finance rapidly

expanding climate tech companies. This alliance, driven by the

Google Cloud Ready-Sustainability program, seeks to accelerate

solutions to climate change, responding to the growing demand for

business innovation and sustainability.

Barclays (NYSE:BCS) – Barclays, the UK’s

leading oil and gas lender, will stop direct financing to new

fossil fuel fields and limit loans to companies expanding this

production, as part of the Transition Financing Framework (TFF).

The move responds to pressure for more sustainable energy policies.

Moreover, Barclays plans to acquire most of Tesco Plc’s banking

business, strengthening its presence in the UK’s retail banking

sector. The transaction includes a £600 million payment and

establishes a 10-year strategic partnership. Barclays CEO CS

Venkatakrishnan faces pressure to present a simplified and

sustainable business plan to shareholders. With shares falling and

a complex business model, there are calls for higher returns.

Goldman Sachs (NYSE:GS) – Goldman Sachs is

reducing its presence in Hong Kong, giving up office spaces in Lee

Garden Three, reflecting the trend of global banks cutting costs.

The move adds pressure to an already weakened commercial real

estate market in the city.

Earnings

Cloudflare (NYSE:NET) – The cloud services

provider saw a 26% increase in pre-market trading on Friday.

Cloudflare announced adjusted earnings of 15 cents per share and

revenue of $362 million. Analyst forecasts, according to LSEG, were

for earnings of 12 cents per share and revenue of $353 million.

Additionally, the projection for the full-year adjusted earnings

per share was positive.

Expedia (NASDAQ:EXPE) – Expedia shares are down

14% after warning of a moderation in revenue in 2024 due to falling

airfare prices. CEO Peter Kern will step down, succeeded by Ariane

Gorin. Fourth-quarter earnings were $1.72 per share on revenue of

$2.887 billion. Gross bookings grew 6%, to $21.672 billion.

Hershey (NYSE:HSY) – Hershey outlined a

two-year restructuring program to save about $300 million before

taxes, following projections below expectations. The company

reported net earnings of $349 million, or earnings of $1.70 per

share, compared to net earnings of $396 million, or earnings of

$1.92 per share, in the same quarter last year. Analysts surveyed

by FactSet expected adjusted earnings of $1.95 per share. Hershey

also increased its quarterly dividend by 15%.

Pinterest (NYSE:PINS) – Pinterest forecast

first-quarter revenues below Wall Street estimates, facing strong

competition from major social media players. Fourth-quarter revenue

was $981 million versus $991 million expected, according to LSEG.

EPS was 53 cents per share, adjusted, against the estimate of 51

cents per share. Shares are down -11.4% in pre-market trading.

Take-Two Interactive (NASDAQ:TTWO) – Take-Two

shares fell -9.2% in pre-market trading on Friday after the video

game publisher issued a bleak projection for the current quarter.

Additionally, Take-Two slightly missed earnings expectations,

recording 71 cents adjusted per share compared to the 72 cents per

share expected by FactSet.

CleanSpark (NASDAQ:CLSK) – Shares of the

bitcoin mining company rose 19.5% in pre-market trading after

reporting better-than-expected results for the first fiscal

quarter. Reported earnings were 14 cents per share, surprising

analysts who expected a 26-cent per share loss, as indicated by

FactSet. Revenue for the quarter reached $73.8 million, exceeding

expectations of $71 million.

Illumina (NASDAQ:ILMN) – Shares of the genomics

company fell 2.8% after indicating that annual revenues will remain

stable, contrary to analysts’ expectation of a 0.6% increase,

according to LSEG. In the fourth quarter, Illumina exceeded

estimates with an adjusted earnings per share of 14 cents, and its

revenue also exceeded expectations.

Bill Holdings (NYSE:BILL) – In the last fiscal

quarter, Bill reported a net loss of $40.4 million, or 38 cents per

share, compared to a net loss of $95.1 million, or 90 cents per

share, in the same fiscal quarter last year. Sales increased 22%,

totaling $318.5 million, exceeding expectations of $299 million.

Adjusted earnings per share were 63 cents, above expectations. The

company expects annual sales between $1.23 billion and $1.25

billion, with adjusted earnings per share of $2.09 to $2.31,

surpassing expectations. However, cost cuts and economic

uncertainty continue.

Affirm Holdings (NASDAQ:AFRM) – Affirm shares

rose ahead of the earnings report but fell 12% in pre-market

trading on Friday. The company exceeded expectations, but its

conservative outlook disappointed investors, despite raising the

gross merchandise volume (GMV) forecast to over $25.25 billion.

Fiscal second-quarter revenue was $591 million, with net revenue of

$242 million. GMV was $7.5 billion, with net loss reduced to $166.9

million. Projections for the March quarter are for GMV between $5.8

billion and $6.0 billion, with revenues between $205 million and

$215 million, less transaction costs.

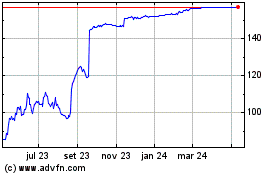

Splunk (NASDAQ:SPLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Splunk (NASDAQ:SPLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024