Berkshire Hathaway (NYSE:BRK.A) –

Berkshire Hathaway reduced its stake in

Apple (NASDAQ:AAPL), selling 10 million shares,

while holding over 905 million. It also increased its position in

Chevron (NYSE:CVX), reduced it in

HP (NYSE:HPQ), and Paramount

Global (NASDAQ:PARA). Ther company kept investors guessing

on what could be a major new investment by Warren Buffett.

Nvidia (NASDAQ:NVDA), Alphabet

(NASDAQ:GOOGL) – Nvidia briefly surpassed

Alphabet on Wednesday to become the third most

valuable U.S. company after Amazon. The high

demand for AI chips boosted its market value to $1.825 trillion.

Wall Street is eagerly awaiting the quarterly report next week.

Nvidia shares are down 0.5% in Thursday’s

pre-market.

Taiwan Semiconductor Manufacturing (NYSE:TSM) –

TSMC saw its market capitalization jump by about

$42 billion on Wednesday, driven by investor bets on chip demand.

This increase led the company to surpass Visa Inc.

(NYSE:V), becoming the 12th most valuable globally. Enthusiasm was

fueled by increased sales in January and optimistic growth

outlooks, especially in the wake of OpenAI‘s

ChatGPT release. TSMC anticipates a recovery in

smartphone and computing demand, while analysts point to the

growing need for cutting-edge chips. The company recently discussed

AI chip supply challenges with Nvidia.

TSMC shares are up 1.1% in Thursday’s

pre-market.

Nvidia (NASDAQ:NVDA) – Bridgewater

Associates significantly increased its stake in

Nvidia, raising it by 458% at the end of last

year, while also expanding its exposure to other leading technology

companies. The firm founded by Ray Dalio disclosed these changes in

financial filings.

Alphabet (NASDAQ:GOOGL) –

Google will offer an automated version of ChromeOS

for Windows devices, potentially reducing PC discards after Windows

10 support ends. ChromeOS Flex will maintain security updates,

allowing users to extend their devices’ lifespan.

Microsoft (NASDAQ:MSFT) –

Microsoft stated that state hackers from Russia,

China, and Iran are using OpenAI technology,

backed by the company, to enhance their tactics.

Microsoft revealed this usage, implementing a ban

against these groups as concerns over AI abuses increase.

Meta Platforms (NASDAQ:META) – On Wednesday,

Meta added Broadcom‘s CEO, Hock

Tan, to its board of directors. Broadcom

(NASDAQ:AVGO) is a key partner of Meta in its data

center projects and chip development, crucial for fast data

movement and processing for AI systems.

Nokia (NYSE:NOK) – Nokia

launched “MX Workmate,” an AI tool for industrial workers,

generating alerts about machine failures and suggesting production

improvements. Using AI language models, it aims to help interpret

complex data. Full implementation may take up to a year and a half,

as testing and adjustments continue.

Sony Group (NYSE:SONY) and Honda

Motor (NYSE:HMC) – A joint venture between Sony

Group and Honda Motor will launch three

electric vehicle models by the middle of this decade. An SUV will

be released in 2027, followed by a compact in 2028 or later, after

a sedan in 2025, aiming to compete with Tesla

(NASDAQ:TSLA).

Pfizer (NYSE:PFE) – Pfizer

agreed to pay $93 million to settle antitrust charges from drug

distributors. The settlement, still subject to judge approval,

comes after a decade of litigation over allegations of conspiracy

with Ranbaxy.

GSK (NYSE:GSK) – GSK completed

the acquisition of Aiolos Bio, a biotech company

focused on respiratory and inflammatory diseases. The initial

payment was $1 billion, with up to an additional $400 million in

success milestones.

Catalent (NYSE:CTLT) –

Catalent cut its workforce by about 300 employees

as part of its ongoing restructuring, incurring expenses of

approximately $12 million. The company, which beat revenue

estimates, recently accepted a purchase offer from Novo

Nordisk (NYSE:NVO).

Morgan Stanley (NYSE:MS) – Morgan

Stanley plans to cut hundreds of jobs in its wealth

management unit, representing less than 1% of the staff. This move

reflects the ongoing cost reduction efforts amid economic

uncertainty.

Barclays (NYSE:BCS) – Barclays

is considering a bid for Societe Generale to

expand its wealth management division. SocGen

started an auction for its Kleinwort Hambros unit, valued at up to

£700 million, as part of its strategic overhaul. In other news,

Barclays’ vice-president, Nazia Lawrence, is suing the British bank

for approximately 230,000 pounds, claiming racial, religious, and

sexual discrimination. Legal documents reveal her disappointment

with the unequal treatment compared to white colleagues.

KKR and Company (NYSE:KKR) – KKR &

Co agreed to acquire a stake in Cotiviti

from Veritas Capital. Financial details were not

disclosed, but the deal will strengthen KKR’s healthcare

portfolio.

Doordash (NYSE:DASH) – George

Soros‘ investment fund acquired new stakes in low-cost

U.S. airlines, including JetBlue (NASDAQ:JBLU),

Spirit Airlines (NYSE:SAVE), and Sun

Country Airlines (NASDAQ:SNCY), while increasing its bets

on Doordash (NYSE:DASH). It also sold stakes in

Arm Holdings (NASDAQ:ARM) and

Broadcom (NASDAQ:AVGO).

Shell (NYSE:SHEL) – Shell may

drop out of the bidding for an offshore wind farm in Norway due to

profitability doubts. Challenging conditions and market uncertainty

raise concerns. The company is considering alternatives like

floating wind turbines.

BHP Group (NYSE:BHP) – BHP,

the world’s largest miner, expects losses of $5.7 billion due to

the Samarco dam breach in Brazil and the

restructuring of its nickel business in Australia. Its upcoming

half-year results should reflect profit stability, driven by high

iron ore prices.

Lockheed Martin (NYSE:LMT) –

Biden plans to request fewer F-35 fighters in the

next federal budget, affecting Lockheed Martin.

About 70 aircraft are expected to be ordered for 2025, down from

the 83 forecasted. Lockheed recorded 98 deliveries

in 2023, compared to 141 in 2022. Shares are stable in Thursday’s

pre-market after falling 2.4% on Wednesday.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – Colorado’s attorney general filed a lawsuit to block

Kroger‘s $25 billion acquisition of

Albertsons, claiming consumer harm.

Kroger plans to divest stores to calm antitrust

concerns. This lawsuit is the second challenging the merger.

Hershey (NYSE:HSY) – Chocolate manufacturers

Hershey and Cadbury are planning

price increases to offset record cocoa costs, facing a consumer

demand drop due to inflation. Prices are rising, prompting

manufacturers to launch new products to stimulate demand.

Earnings

Cisco Systems (NASDAQ:CSCO) – The stock values

of technology companies declined by 5.6% in Thursday’s pre-market

following the release of quarterly results. Cisco

reported earnings of $0.87 per share on $12.79 billion in revenue,

against the consensus estimates from LSEG of $0.84 per share in

revenue of $12.71 billion. The net profit dropped to $2.63 billion,

or 65 cents per share, from $2.77 billion, or 67 cents per share,

in the same quarter of the previous year, while revenue fell 6%

year over year. Additionally, Cisco unveiled a

restructuring plan that would result in the elimination of 5% of

jobs.

Applovin (NASDAQ:APP) – The technology

company’s shares increased by more than 17% in pre-market trading

after presenting impressive results for the fourth quarter and

providing promising projections for the future.

Applovin recorded a profit of 49 cents per share

on revenue of $953 million. Analysts surveyed by LSEG had

forecasted a profit per share of 35 cents with revenue of $928

million.

Twilio (NYSE:TWLO) – The value of the customer

engagement company’s shares decreased by 11.4% in pre-market

trading. For the current quarter, Twilio announced

revenue projections that fell short of the financial market’s

expectations, predicting a range between $1.025 billion and $1.035

billion. Analysts surveyed by LSEG were expecting revenues of

$1.049 billion. Additionally, the number of active customers also

fell short of StreetAccount’s estimates, totaling 305,000 instead

of the expected 311,000.

Fastly (NYSE:FSLY) – Shares of the cloud

services company fell about 24.8% in pre-market trading due to

indicators of a slowdown in sales growth. Fastly‘s

revenue in the fourth quarter totaled $138 million, below Wall

Street’s expectations of $140 million as reported by LSEG.

Furthermore, the company forecasted a slowdown in revenue for the

current quarter.

JFrog (NASDAQ:FROG) – The software company’s

shares rose 21.3% in pre-market trading after its fourth-quarter

report revealed better-than-anticipated results.

JFrog recorded an adjusted earnings per share of

19 cents on revenue of $97 million. Analysts surveyed by LSEG had

estimated earnings per share of 12 cents with revenue of $93

million.

Informatica (NYSE:INFA) – The business

technology company released fourth-quarter results that exceeded

expectations. Informatica announced an adjusted

profit of 32 cents per share on revenue of $445 million. Analysts

surveyed by LSEG had predicted earnings of 30 cents per share on

revenue of $432 million.

Equinix (NASDAQ:EQIX) –

Equinix projected adjusted core earnings for the

fiscal year 2024 between $4.09 billion and $4.17 billion,

surpassing the expectations of $4.05 billion. The estimated revenue

for the first quarter is between $2.13 billion and $2.15 billion,

compared to estimates of $2.14 billion.

NerdWallet (NASDAQ:NRDS) –

NerdWallet reported a loss of 3 cents per share in

the fourth quarter, while analysts had anticipated a positive

profit of 10 cents per share, as indicated by LSEG.

Occidental Petroleum (NYSE:OXY) –

Occidental Petroleum exceeded estimates for

fourth-quarter earnings, presenting its best quarterly result in

three years and reducing expenses. OXY projected a

marginal increase in oil and gas production to 1.25 million barrels

per day (boepd) this year. The adjusted profit was $0.74 per share,

surpassing the estimates of $0.71 per share.

Albermarle (NYSE:ALB) – The lithium

manufacturer’s stock value decreased by 3.4% following the release

of the quarterly report. Albermarle‘s net sales

fell 10% in the fourth quarter compared to the previous year, and

the company recorded a net loss due to a pre-tax charge and a tax

valuation charge in China.

Tripadvisor (NASDAQ:TRIP) – In the last

quarter, Tripadvisor announced an adjusted profit

of 38 cents per share and revenue of $390 million. Analysts

surveyed by LSEG had predicted earnings of 22 cents per share and

revenue of $374 million.

Stellantis (NYSE:STLA) –

Stellantis warned of a challenging year ahead

after a 10% drop in operating profit in the second half of 2023,

attributed to strikes and pressures in the global automotive

market. The results exceeded expectations, but the outlook for 2024

is vague. Stellantis‘ adjusted operating profit

fell to 10.2 billion euros. The margin dropped to 11.2%. Adjusted

operating profit in North America fell 16% to 5.271 billion euros,

with a margin of 13%.

Ventas (NYSE:VTR) – Ventas

reported a 4.1% increase in its fourth-quarter FFO, reaching 76

cents per share. For 2024, the company forecasts a normalized FFO

between $3.07 and $3.18 per share, below analysts’ estimates of

$3.21 per share.

Coinbase Global (NASDAQ:COIN) –

Coinbase Global shares rose 4.8% in pre-market

trading ahead of the cryptocurrency trading platform’s

fourth-quarter earnings scheduled for after market close. Analysts

expect Coinbase to report earnings of 2 cents per

share on revenue of $826 million.

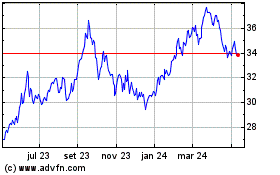

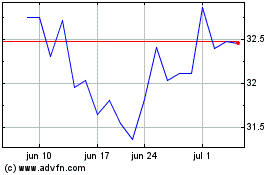

Honda Motor (NYSE:HMC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Honda Motor (NYSE:HMC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024