Intuitive Machines (NASDAQ:LUNR) –

Intuitive Machines made history on Thursday when

its Odysseus spacecraft became the first commercial probe to

successfully land on the moon. The mission, carrying NASA

instruments, landed at the lunar south pole, marking a significant

milestone in commercial space exploration and collaboration with

the US space agency. Shares are up 47.58% in Friday’s

pre-market.

Goldman Sachs (NYSE:GS) – Goldman

Sachs analysts do not foresee a cut in US interest rates

in May. They expect four 25 basis point cuts this year, as

policymakers’ rhetoric indicates no rush. Fed Governor Christopher

Waller suggests waiting for more inflation data for future

decisions.

JPMorgan Chase (NYSE:JPM) –

JPMorgan CEO Jamie Dimon sold about $150 million

in bank shares, marking his first sale since 2005. He and his

family plan to sell 1 million of their shares. The sale does not

affect future leadership, and Dimon received $36 million in

2023.

Nvidia (NASDAQ:NVDA) – Nvidia

added $277 billion to the stock market in its biggest daily gain on

Thursday, driven by an exceptional quarterly report, raising its

market cap to $1.96 trillion. The positive results sparked a

recovery in the AI sector. Moreover, Nvidia

highlighted Huawei as a key competitor in

artificial intelligence chips, also mentioning

Intel (NASDAQ:INTC), AMD

(NASDAQ:AMD), Broadcom (NASDAQ:AVGO), and

Qualcomm (NASDAQ:QCOM).

Alphabet (NASDAQ:GOOGL) –

Google is temporarily suspending its AI tool for

creating images of people due to inaccuracies in some historical

representations. This underscores the company’s efforts to compete

with rivals like OpenAI and Microsoft.

Google acknowledges the issue and is working on

adjusting the model.

Meta Platforms (NASDAQ:META) – The Oversight

Board will include Meta‘s Threads platform under

its jurisdiction, allowing users to appeal content moderation

decisions. With over 130 million users, the board will review

decisions based on Instagram‘s community

guidelines, aiming for transparency and respect for human

rights.

Apple (NASDAQ:AAPL) – Apple

criticized Spotify Technology (NYSE:SPOT) on

Thursday due to its longstanding dispute with the European Union,

which could result in a $539 million fine. Apple

stated that Spotify does not pay for the services

provided, while Spotify accuses

Apple of anti-competitive practices in the App

Store.

DoorDash (NYSE:DASH) – After

DoorDash reported mixed fourth-quarter results,

its shares fell. However, Morgan Stanley (NYSE:MS)

upgraded its shares to Overweight and raised the target price to

$145. The company continues to deliver solid results, driven by

DashPass subscribers, with potential for further growth.

AT&T (NYSE:T) – AT&T

stated that the outage affecting thousands of users in the US was

not caused by a cyberattack but by an incorrect process during

network expansion. Investigations, conducted by the FCC and other

agencies, are ongoing to determine the exact cause.

Verizon (NYSE:VZ) – Verizon is

collaborating with Volkswagen Audi AG to equip the

automaker’s test track in Neustadt, Germany, with a 5G network,

aiming to test smart vehicle technology. The project includes

simulations of communications and driving, involving partnerships

with Nokia (NYSE:NOK), AWS, and Smart Mobile

Labs.

TSMC (NYSE:TSM) – TSMC

inaugurates its first factory in Japan, highlighting its

significance for Tokyo to revive its semiconductor industry. The

investment reflects TSMC‘s dominant position in

the sector and Japan’s growing concern over Chinese technology.

Equinix (NASDAQ:EQIX) –

Equinix plans to invest $390 million in Africa

over the next five years, expanding its operations in South Africa

and West Africa. The company is also exploring opportunities in

East Africa, including building or acquiring data centers.

Tesla (NASDAQ:TSLA) – Tesla

agreed to correct software in 8,700 vehicles in China to reduce

accident risks. The recall involves Model S, Model X, and Model 3

and addresses rear camera integrated circuit issues affecting the

driver’s vision when reversing.

Toyota Motor (NYSE:TM) – Toyota

Motor extended the shutdown of two production lines until

March 1st at Japanese plants due to irregularities in diesel engine

tests. The decision to reopen will be made on March 1st.

Stellantis (NYSE:STLA) – CEO Carlos Tavares’s

total compensation in 2023 reached €36.49 million, a 56% increase

from the previous year. Stellantis highlighted its

superior financial performance and an average of €70,404 for its

employees in 2023.

General Motors (NYSE:GM) – General

Motors‘ autonomous car unit Cruise plans to resume testing

its robotaxis with safety drivers on public roads in the coming

weeks, possibly in Houston and Dallas, after suspending operations

in October due to incidents. Regulators and the public are being

addressed to rebuild trust.

Spirit AeroSystems (NYSE:SPR) – Spirit

AeroSystems, a fuselage manufacturer, stated on Thursday

that it cannot estimate the financial impact of the incident that

led to the temporary suspension of production of Boeing’s (NYSE:BA)

737 MAX 9 planes. The company warned about the possibility of a

reduction beyond expectations in production levels.

American Airlines (NASDAQ:AAL) – A federal

judge in Fort Worth, Texas, ruled that American

Airlines could face a lawsuit alleging poor oversight of

retirement funds for using asset managers who sought sustainable

investment strategies. Judge Reed O’Connor allowed the lawsuit to

proceed, citing potential violations of the ERISA law.

WisdomTree (NYSE:WT) –

WisdomTree‘s shares have outperformed the market

for a year. In February, founder and CEO Jonathan Steinberg

increased his stake, buying 303,781 shares for $2.2 million.

Steinberg now owns 9.2 million shares, including restricted stock

awards. He expressed optimism about the company’s future.

Reddit – Reddit revealed a

reduced net loss of $90.8 million and revenue growth of about 21%

in 2023. Its US public IPO is scheduled for March, marking a

significant milestone for the platform, although still trailing

rivals like Facebook and Twitter.

OpenAI CEO Sam Altman is listed as one of the major shareholders of

Reddit Inc. according to the regulatory document

released for its initial public offering. Entities affiliated with

Altman hold 8.7% of the shares, including 789,456 Class A shares

and 11.4 million Class B shares. The largest shareholder, Advance

Magazine Publishers Inc., owns about one-third of the votes. Altman

has long-standing ties with the company, having served as interim

CEO for a short period in 2014. Reddit plans to

expand its business, including data licensing deals with AI

companies.

Novavax (NASDAQ:NVAX) –

Novavax saw a significant increase on Thursday

after reaching an agreement with Gavi for its Covid-19 vaccine. CEO

John Jacobs highlighted the importance of the agreement for

ensuring fair access to vaccines.

JD.com (NASDAQ:JD) – Investors looking for

bargains in China might overlook JD.com‘s cheap

shares until the company demonstrates success overseas. Its plan to

acquire British retailer Currys faces skepticism,

while brutal competition and heavy spending raise questions about

its profitability. JD.com also faces external

challenges from Chinese competitors and

Amazon.

Baidu (NASDAQ:BIDU), NetEase

(NASDAQ:NTES) – Baidu and NetEase

will release their earnings amid increased control by China over

tech companies, raising concerns about potential restrictions. Tech

giants have been investing in data centers in Africa, taking

advantage of the growing demand for connectivity and storage.

Earnings

Mercado Libre (NASDAQ:MELI) – After reporting

earnings of $3.25 per share in the fourth quarter, remaining stable

compared to the same period last year, the e-commerce company’s

shares fell 8.7% in Friday’s pre-market. Operating profit,

excluding items, reached $572 million, below analysts’ expectations

surveyed by FactSet, who expected $668.5 million.

Block (NYSE:SQ) – After beating fourth-quarter

revenue expectations, the payment company’s shares increased 13.3%

in Friday’s pre-market. Block reported revenue of

$5.77 billion, slightly exceeding analysts’ expectations surveyed

by LSEG, who expected $5.70 billion. Additionally, the company is

forecasting a gross profit of at least $8.65 billion in 2024,

representing an increase of at least 15% from the previous

year.

Booking Holdings (NASDAQ:BKNG) – Despite

reporting a beat in fourth-quarter earnings and revenues, the

online travel company’s shares fell more than 9.3% in Friday’s

pre-market, although daily bookings increased by 9%. Moreover,

Booking Holdings announced it would start paying a

quarterly cash dividend of $8.75 per share.

Grab Holdings (NASDAQ:GRAB) – Grab

Holdings announced its first quarterly profit.

Grab projected fiscal revenues for 2024 between

$2.70 billion and $2.75 billion, below the average analysts’

estimate of $2.80 billion. The company also revealed a $500 million

share buyback program. Grab Holdings shares are up

1.90% in Friday’s pre-market.

Intuit (NASDAQ:INTU) – The financial software

company’s shares fell approximately 1.7% in the pre-market after

reporting second-quarter fiscal revenue of $3.39 billion. This

performance was in line with analysts’ expectations surveyed by

LSEG. Moreover, the adjusted profit exceeded Wall Street’s

expectations, reaching $2.63 per share, compared to the $2.30 per

share predicted by analysts.

Insulet (NASDAQ:PODD) – After announcing a

revenue growth forecast below expectations, the medical device

company’s shares fell more than 6.2% in Friday’s pre-market.

Insulet forecasts revenue growth of 17% to 20%

year-on-year in the first quarter, while analysts surveyed by

FactSet expected 24.3% growth.

Sleep Number (NASDAQ:SNBR) – Sleep

Number‘s shares rose more than 10% in Friday’s pre-market,

with the company reporting a quarterly loss of $15 million, or

$0.68 per share, compared to earnings of $37 million, or $1.60 per

share, in the same period last year. Sales fell 14%, to $430

million.

Live Nation (NYSE:LYV) – Live

Nation reported revenue of $5.84 billion, surpassing LSEG

analysts’ estimates, who expected $4.79 billion. However, the

entertainment company recorded a slightly lower operating profit

consensus in the fourth quarter. Shares are up 3.8% in Friday’s

pre-market.

Nu Holdings (NYSE:NU) – Nu Holdings saw its

adjusted net income soar to US$ 395.8 million in 4Q23, a 247.8%

increase from the previous year. In 2023, the profit totaled US$ 1

billion, reversing the US$ 9.1 million loss in 2022. Revenue grew

by 57% to US$ 2.4 billion, driven by a 23% increase in ARPAC. ROE

stood at 23%, while gross profit reached US$ 1.143 million, with a

48% margin. Nubank reached 93.9 million customers, an increase of

19 million from the previous year. The delinquency rate stood at

4.1% for delays between 15 and 90 days and 6.1% for delays

exceeding 90 days. The interest-earning credit portfolio grew by

91% in one year, reaching US$ 8.2 billion in December.

Vale (NYSE:VALE) – Vale

reported a net profit of $2.42 billion in the fourth quarter, 35%

below analysts’ expectations. The provision related to

Samarco totaled $1.2 billion, bringing the total

to $4.21 billion. EBITDA grew by 37%, and sales revenue increased

by more than 9%.

Newmont Corp (NYSE:NEM) – Newmont

Corp plans to divest eight non-essential assets and reduce

the workforce to cut debt after acquiring Newcrest

for $17.14 billion. The company exceeded quarterly profit estimates

but saw its shares fall due to impairment expenses and production

forecasts below expectations.

VinFast (NASDAQ:VFS) – In the last quarter of

2023, VinFast‘s net loss reached $650.1 million,

1.3% higher than in 2022. VinFast plans to

increase deliveries to 100,000 units in 2024, against almost 35,000

in 2023. Fourth-quarter revenue was $437 million, totaling $1.2

billion for the year. The company’s market cap rose to $85 billion

but has since fallen to $12 billion.

Carvana (NYSE:CVNA) – After the car dealer

stated it expects an increase in retail units sold by 2024, shares

rose 26.9% in Friday’s pre-market. However,

Carvana reported a fourth-quarter loss of $1 per

share and revenue of $2.42 billion, falling below analysts’

estimates surveyed by LSEG.

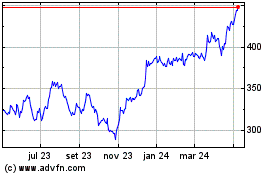

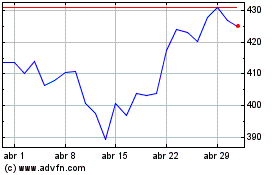

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024