Goldman Sachs’ Q1 net revenue totals $14.21B

15 Abril 2024 - 3:36PM

IH Market News

Goldman Sachs Group Inc. (NYSE:GS) announced on Monday that its

net revenue for the first quarter of 2024 was $14.21 billion, while

net earnings were $4.13 billion.

According to the report, diluted earnings per common share (EPS)

stood at $11.58, and the annualized return on average common

shareholders’ equity (ROE) was 14.8% for the there months to March

31, 2024.

“Our first quarter results reflect the strength of our

world-class and interconnected franchises and the earnings power of

Goldman Sachs. We continue to execute on our strategy, focusing on

our core strengths to serve our clients and deliver for our

shareholders,” David Solomon, Chairman and CEO of Goldman Sachs

said.

Goldman Sachs shares rose more than 2% following the earnings

report’s release trading in New York.

Executives at rivals JPMorgan Chase and Citigroup cited

improving conditions for dealmaking on Friday when the lenders

reported profits that beat market expectations.

As a leading advisor for mergers and acquisitions, Goldman has

advised on some of last year’s biggest deals, including Exxon

Mobil’s $60 billion purchase of Pioneer Natural Resources.

With corporations regaining some confidence to raise money in

capital markets, equity and bond underwriting business

rebounded.

The Federal Reserve has so far managed to steer the economy

toward a so-called soft landing, in which it raises interest rates

and tames inflation while avoiding a major downturn.

Higher fees from underwriting debt and stock offerings as well

as advising on deals lifted Goldman’s investment banking fees up

32% to $2.08 billion.

Revenue from trading in fixed income, currencies and commodities

rose 10% to $4.32 billion, while equities revenue jumped 10% to

$3.31 billion.

Global volume of mergers and acquisitions climbed 30% in the

first quarter to about $755.1 billion from a year ago, according to

data from Dealogic.

Platform solutions, the unit that houses some of Goldman’s

consumer operations, garnered 24% higher revenue.

Goldman is slimming down its ill-fated consumer banking

operations after they lost billions of dollars. It has already

taken big writedowns on GreenSky, a home improvement lender it

bought and sold two years later.

CEO Solomon, who once championed the retail push, has drawn

criticism for the strategy.

Top proxy adviser Institutional Shareholder Services (ISS) urged

shareholders to vote for the bank to split its chairman and CEO

roles, both of which are currently held by Solomon. ISS cited his

“missteps and steep losses” in a report to investors.

Goldman has also scrapped its co-branded credit cards with

General Motors, and a similar partnership it has with tech giant

Apple is facing an uncertain future.

The bank’s provisions for credit losses jumped to $318 million

compared to a net benefit of $171 million a year ago, due to

potential defaults in credit cards and wholesale loans.

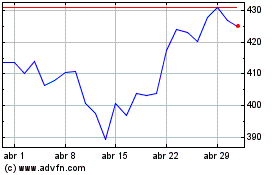

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

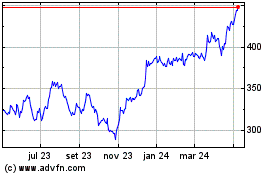

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024