Tesla (NASDAQ:TSLA) – Tesla

exited the top 10 largest US companies by market cap for the first

time in 13 months, surpassed by Visa (NYSE:V). The

stock drop reflected concerns about margins and demand. Elsewhere,

Tesla announced its departure from Australia’s

main automotive lobby, accusing it of misleading consumers about

fuel efficiency standards. The company requested an investigation

into the FCAI’s allegations and will cease membership in June. The

government plans to impose aggressive fuel efficiency standards.

Additionally, Tesla reported that its German

factory would face electricity shortages until March 17, following

an alleged criminal attack leaving the Berlin gigafactory without

power, affecting production. The company estimates significant

losses, while German industry calls for better protection of

critical infrastructure.

Victoria’s Secret (NYSE:VSCO) – After

forecasting next year’s sales at $6 billion, below the $6.19

billion expectation, Victoria’s Secret shares fell

31.4% in Thursday’s pre-market. The company reported a net income

of $181 million in the fourth quarter, with revenue of $2.08

billion, and same-store sales fell 6%.

Nvidia (NASDAQ:NVDA) – Directors of

Nvidia Corp. sold about $180 million in shares in

recent days, spurred by the stock’s advance into record territory.

The sales included 200,000 shares by Tench Coxe and 12,000 by Mark

Stevens.

Apple (NASDAQ:AAPL) – Apple

has intensified its rivalry with Epic Games, blocking the Fortnite

maker from launching its own online marketplace on iPhones and

iPads in Europe. The companies are in a prolonged legal battle,

while Apple faces concerns over iPhone demand in

China. The EU questioned Apple, citing a potential

violation of antitrust rules.

Meta Platforms (NASDAQ:META) – Forty US states

and Washington, DC, have called on Meta Platforms

to curb the “dramatic” rise in scammers hijacking Facebook and

Instagram accounts. New York’s Attorney General leads the charge,

demanding immediate measures to protect users.

International Business Machines (NYSE:IBM) –

IBM unveiled on Wednesday that its initial tests

of Adobe‘s (NASDAQ:ADBE) generative AI tools

resulted in productivity improvements. With 1,600 designers using

these tools, IBM significantly shortened project

timelines.

Booking Holdings (NASDAQ:BKNG) –

Kayak, owned by Booking, launched

AI-powered tools for travel planning, including Ask Kayak and Kayak

PriceCheck, to facilitate purchasing decisions and price

comparisons. The tools utilize chatbot technology and extensive

research to find ideal destinations and flights, aiming to simplify

the user experience.

Boeing (NYSE:BA) – Boeing,

criticized for not providing employee names following the 737 MAX

incident, finally yielded to NTSB pressure. The FAA requires

Boeing to address quality issues after an audit

revealed problems in the manufacturing process control.

Mobileye (NASDAQ:MBLY) –

Mobileye‘s shares surged on Wednesday, boosted by

optimistic comments at an investor conference. The company

reiterated sales expectations, bringing relief to investors after a

previous drop.

Stellantis (NYSE:STLA) – A joint venture

between Stellantis and Leapmotor, approved by the

Chinese regulator, will allow Stellantis to build

and sell electric vehicles outside China. The initiative received

green light from China’s National Development and Reform Commission

(NDRC) while awaiting approvals in other markets. Additionally,

Stellantis revealed a 5-year investment plan for

Latin America, with 5.6 billion euros earmarked from 2025 to 2030.

In Mirafiori, Italy, Stellantis extended reduced

operations due to low demand for the Fiat 500 electric and

Maserati. The shutdown will last until April 20, affecting 2,200

workers. Italy launched a 1 billion dollar (950 million euros) plan

to promote eco-friendly vehicles, but it is not yet in effect.

Rush Street Interactive (NYSE:RSI) –

Rush Street Interactive‘s shares rose 19.3% in

pre-market trading after fourth-quarter results exceeded analysts’

expectations. The company also forecasts annual revenues between

$770 million and $830 million, surpassing Wall Street

estimates.

Enbridge (NYSE:ENB) –

Enbridge, a North American pipeline operator,

raised its short-term profit forecast and will invest $500 million

in pipeline and storage expansions on the US Gulf Coast. The

anticipated growth, driven by acquisitions, aims to meet rising

demand, maintaining optimism in its pipeline capabilities.

Brown-Forman (NYSE:BF.A) –

Brown-Forman suffered a 7.2% pre-market drop due

to lower-than-expected third-quarter sales. Net income reached $285

million, or 60 cents per share, while sales fell 1% to $1.069

billion, below estimates.

Foot Locker (NYSE:FL) – Foot

Locker‘s shares are slightly down after plummeting on

Wednesday, even after beating quarterly estimates but delaying

financial forecasts. Fourth-quarter adjusted earnings per share

were 38 cents, above the predicted 32 cents, with sales of $2.38

billion, surpassing the $2.28 billion estimate.

Estee Lauder (NYSE:EL) – Valisure, an

independent US lab, detected high levels of benzene in acne

treatments from brands like Clinique, owned by

Estee Lauder, Up & Up, by Target, and

Clearasil, by Reckitt Benckiser. They urged the FDA to investigate

and withdraw the products, citing cancer concerns.

AstraZeneca (NASDAQ:AZN) –

AstraZeneca plans to invest 826.80 million dollars

(650 million pounds) in Britain to strengthen vaccine research,

development, and manufacturing, the government announced. The

investment includes 450 million pounds for facilities in Liverpool

and 200 million pounds for expansion in Cambridge.

Novo Nordisk (NYSE:NVO) – Novo

Nordisk selected Japan as the first Asian market to launch

its weight loss drug Wegovy, due to a lack of awareness of obesity

as a disease and associated stigma. The company seeks to educate

and expand treatment in the country.

UnitedHealth (NYSE:UNH) – The US will

accelerate Medicare/Medicaid payments to hospitals affected by a

hacker attack on UnitedHealth. Medical

associations criticize the government’s response as inadequate,

calling for additional measures, including financial

assistance.

Berkshire Hathaway (NYSE:BRK.A) –

Berkshire Hathaway acquired about 3.7 million

shares of Liberty Sirius XM Holdings (NASDAQ:LSXMA) in recent days,

raising its stake to approximately 23% in the company. This

reflects intermittent purchases throughout the year.

Goldman Sachs (NYSE:GS) – Goldman

Sachs revised its S&P 500 stock buyback forecast,

expecting a 13% increase, to $925 billion in 2024, driven by

stronger-than-expected tech profits.

Bank of America (NYSE:BAC) – Bank of

America expects a 10% to 15% increase in its investment

banking revenues in the first quarter compared to the previous

year, driven by increased capital market activity, while

Citigroup (NYSE:C) and JPMorgan

Chase (NYSE:JPM) have more conservative projections.

UBS (NYSE:UBS) – UBS‘s CEO

criticized European regulators for allowing the US to dominate the

banking sector post-2008 crisis. CEO Sergio Ermotti highlighted the

lack of regulatory and political unity in Europe, resulting in less

competitive European banks globally.

New York Community Bancorp (NYSE:NYCB) –

NYCB said on Wednesday that it raised $1 billion,

with investors like Liberty Strategic Capital, led by former US

Treasury Secretary Steven Mnuchin, and appointed a former currency

comptroller as CEO. Fitch Ratings downgraded New York

Community Bancorp to BB+, while Moody’s downgraded it from

Ba2 to B3 after finding “material weaknesses” in loan risk

management.

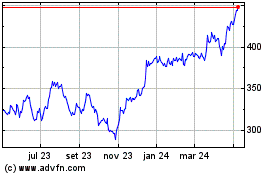

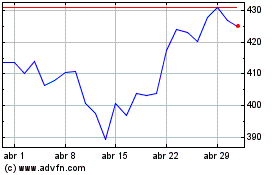

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Goldman Sachs (NYSE:GS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024