Positive Reaction To CPI Data May Lead To Rebound On Wall Street

12 Março 2024 - 10:08AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Tuesday, with stocks likely to regain ground following the

pullback seen over the two previous sessions.

The futures advanced following the release of the Labor

Department’s highly anticipated report on consumer price inflation

in the month of February.

The Labor Department said its consumer price index climbed by

0.4 percent in February after rising by 0.3 percent in January. The

increase matched economist estimates.

Excluding food and energy prices, core consumer prices also rose

by 0.4 percent in February, matching the increase seen in January.

Economists had expected core prices to rise by 0.3 percent.

The report also said the annual rate of consumer price growth

ticked up to 3.2 percent in February from 3.1 percent in January.

The year-over-year growth was expected to be unchanged.

Meanwhile, the annual rate of core consumer price growth slowed

to 3.8 percent in February from 3.9 percent in January. Economists

had expected the pace of growth to decelerate to 3.7 percent.

While core price growth slowed by slightly less than expected,

the slowdown may still add to optimism about the outlook for

interest rates.

Treasury yields saw considerable volatility immediately

following the release of the report but have moved modestly lower

since then.

After coming under pressure over the course of last Friday’s

session, stocks saw further downside in early trading on Monday.

The major averages regained ground as the day progressed, however,

with the Dow closing modestly higher.

While the Dow inched up 46.97 points or 0.1 percent to 38,769.66

after falling nearly 240 points in early trading, the S&P 500

edged down 5.75 points or 0.1 percent to 5,117.94 and the Nasdaq

fell 65.84 points or 0.4 percent to 16,019.27.

The early weakness on Wall Street came amid uncertainty about

the outlook for interest rates ahead of the release of key economic

data.

On Thursday, the Labor Department is due to release a separate

report on producer price inflation in the month of February.

Producer prices are expected to rise by 0.3 percent in February,

matching the increase seen in January, while the annual rate of

producer price growth is expected to accelerate to 1.1 percent from

0.9 percent.

Reports on retail sales, industrial production and consumer

sentiment are also likely to attract attention in the coming

days.

Despite the recovery attempt by the broader markets,

semiconductor stocks still saw significant weakness on the day,

with the Philadelphia Semiconductor Index falling by 1.4

percent.

Within the sector, semiconductor equipment maker Applied

Materials (NASDAQ:AMAT) slumped by 2.0 percent despite raising its

quarterly cash dividend from $0.32 to $0.40 per share.

Notable weakness also remained visible among steel stocks, as

reflected by the 1.2 percent loss posted by the NYSE Arca Steel

Index.

On the other hand, gold stocks showed a strong move to the

upside on the day, driving the NYSE Arca Gold Bugs Index up by 2.5

percent.

The rally by gold stocks came amid a modest increase by the

price of the precious metal, with gold for April delivery inching

up $3.10 to $2,188.60 an ounce.

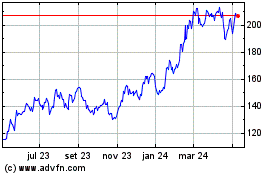

Applied Materials (NASDAQ:AMAT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

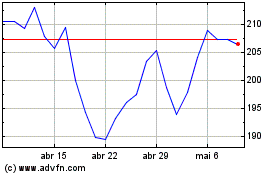

Applied Materials (NASDAQ:AMAT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024