Toncoin soars after Telegram’s IPO announcement

Toncoin (COIN:TONCOINUSD), the cryptocurrency of the TON

Network, saw its price surge over 70% in just two days following an

announcement by Pavel Durov, founder of Telegram, about plans for

an Initial Public Offering (IPO) for the app. Despite the

separation of the entities in 2020 due to legal challenges with the

SEC, Telegram continues to support TON as its blockchain of choice

for Web3 infrastructure. This news boosted TON’s market value from

$9.5 billion to $15.5 billion, approaching its all-time high.

Coinbase raises $1 billion with convertible bonds, avoiding share

dilution

Coinbase Global (NASDAQ:COIN) plans to capitalize on the crypto

market’s resurgence by raising $1 billion through convertible

bonds, a strategy that preserves its share value by avoiding the

issuance of new shares. Inspired by Michael Saylor’s MicroStrategy

(NASDAQ:MSTR) approach, the exchange opted for a private offering

of convertible senior notes, allowing conversion into shares or

cash by 2030, an alternative to selling shares that could dilute

current shareholders’ participation.

Bitcoin halving: impacts and expectations for 2024

On Wednesday morning, Bitcoin (COIN:BTCUSD) briefly hit

$73,406.1 before retreating to $72,556.50 at the time of writing.

Ethereum (COIN:ETHUSD) climbed to $4,054.47 before falling back to

$3,970.60.

The scheduled Bitcoin halving event in April 2024 will cut the

block rewards for miners in half, from 6.25 BTC to 3.125 BTC. This

pre-programmed occurrence in the Bitcoin network generates a lot of

uncertainty, including potential bankruptcies of miners, changes in

hash rate, and fluctuations in Bitcoin’s price.

“We are almost 1 month away from the halving, and along with

it, I believe a market correction may appear. Historically during

the halving, we have a quick, yet not so subtle correction. Don’t

be alarmed if BTC drops approximately 30% close to the halving

before starting to rise again,” commented analyst Fernando

Pereira from Bitget.

The introduction of Bitcoin ETFs in the spot market, which

pushed Bitcoin’s price to new highs, adds a new layer of complexity

to the upcoming halving. Experts debate whether the halving will

accelerate institutional interest in Bitcoin, considering its

unique monetary policy and its effect on supply. While some see the

halving as a transformative event, others believe its impacts may

be mitigated by factors such as the adoption of layer 2

technologies and the growth of Bitcoin ETFs.

BlackRock’s Bitcoin ETF reaches $15 billion in assets

The BlackRock ETF (NASDAQ:IBIT) saw its assets under management

soar to $15 billion on March 12, after receiving record inflows

since its launch two months earlier. This growth reflects a

significant increase in Bitcoin asset management, with IBIT leading

with over 212,000 bitcoins. In contrast, the Grayscale ETF

(AMEX:GBTC) experienced a 38% drop in its assets. This movement

highlights a strong investor preference for new spot Bitcoin ETFs,

totaling over 422,000 bitcoins ($31 billion) in assets, while

global Bitcoin investment vehicle management surpassed 1 million

bitcoins ($78 billion).

OKX gets green light from Singapore for payment operations

OKX, a subsidiary of the global exchange in Singapore, received

preliminary approval from the Monetary Authority of Singapore (MAS)

to act as a payment institution, expanding its capabilities to

include cryptocurrency and international remittance services. This

Major Payment Institution (MPI) license represents a strategic

advance for OKX in a key market. The approval emphasizes OKX’s

commitment to regulatory compliance and signals its support for

Singapore’s regulatory environment, positioning it for future

expansion in local banking services and integrations.

Nigeria pressures Binance for user data and detains executives

Nigeria is requesting data from Binance on its top 100 Nigerian

users and a full transaction record for the past six months,

according to the Financial Times. This demand comes as two Binance

executives, Tigran Gambaryan and Nadeem Anjarwalla, remain detained

in Nigeria for three weeks, staying at a National Security Agency

facility following a government invitation. The detention is linked

to a dispute over $26 billion in untraceable funds, with the

Nigerian government considering Binance a barrier to efforts to

stabilize the local currency, in addition to pending tax issues.

Binance is cooperating with authorities to resolve the

situation.

Goldman Sachs and partners complete tests on Canton blockchain

network

Goldman Sachs (NYSE:GS), BNY Mellon (NYSE:BK), Cboe Global

Markets, and other entities have completed tests on the Canton

Network of Digital Asset Holdings, a pioneering project that

interconnects various financial sector institutions. During the

pilot phase, over 350 simulated transactions involving tokenized

assets and other financial operations were conducted, aiming to

explore the benefits of blockchain in risk reduction and process

optimization.

Sei Labs reinvents Ethereum with parallel processing technology

Sei Labs, founded by former Robinhood (NASDAQ:HOOD) and Coatue

professionals, introduced The Parallel Stack, a free project aimed

at accelerating and reducing the cost of Ethereum usage for

developers. This effort stands out for applying parallel processing

to enhance the efficiency of Ethereum blockchain transactions,

promising to transform the network’s performance and scalability.

Additionally, the startup plans to expand its innovations with Sei

V2, a parallelized EVM that processes multiple transactions

simultaneously, making the technology more accessible to global

developers.

Strategic partnership between Astroport and Osmosis revolutionizes

liquidity in Cosmos

Astroport, an innovative decentralized exchange from Cosmos, has

teamed up with Osmosis, the leading DEX by volume in this

ecosystem, to launch passive concentrated liquidity pools (PCL).

This collaboration between two of Cosmos’s most dynamic platforms

aims to enhance the trading experience and optimize capital usage.

The PCL pools will offer efficient and automated liquidity

management, minimizing losses and maximizing profits without

constant intervention. The integration benefits both protocols,

expanding reach and liquidity, while providing complementary pool

options to cater to various investor profiles, from professionals

to casual users seeking simplicity. This advance promises to

significantly increase trading volume and efficiency in the Cosmos

ecosystem (COIN:ATOMUSD).

Innovation and efficiency in PancakeSwap V4 DEX

PancakeSwap, a leading decentralized exchange platform,

announced the launch of its fourth version, promising to

revolutionize on-chain swaps with new features aimed at reducing

costs and improving efficiency for users. According to Chef Mochi,

the lead developer, the update will address critical issues of

current automated market makers, such as rigidity in price

formation, high gas fees, impermanent losses, and a lack of

advanced execution features. With innovative features like hooks

for custom add-ons, custom pool types, pool merging for cost

savings, and flash accounting for gas fee reduction, V4 aims to

optimize the trading experience. Initially available on Ethereum

and BNB Chain networks, the new version aims to solidify

PancakeSwap’s market position, maintaining its relevance with over

$2.4 billion in assets under management.

TRON and AWS collaborate to simplify node deployment

TRON DAO announced a significant partnership with Amazon Web

Services (AWS) (NASDAQ:AMZN), making it easier to quickly and

effectively launch a TRON Full Node on AWS. This collaboration

lowers technical barriers, allowing both users and developers to

contribute to a stronger, more decentralized blockchain ecosystem.

Using the latest version of TRON, GreatVoyage-v4.7.3(Chilon),

ensures access to cutting-edge features and security. The

integration highlights TRON’s commitment to advancing the

decentralized internet, providing developers with the necessary

tools to create innovative DApps with AWS’s robust

infrastructure.

EU sets guidelines for multi-currency stablecoins under MiCA

regulation

The European Banking Authority (EBA) unveiled new guidelines for

stablecoins linked to multiple currencies, part of the innovative

Markets in Crypto-Assets (MiCA) regulation of the European Union.

In collaboration with the European Securities and Markets Authority

(ESMA), the EBA developed rules within MiCA, including a recent set

of Regulatory Technical Standards (RTS) focused on asset reference

tokens (ARTs), differentiating from single-currency-linked

stablecoins. Set to be implemented in phases, MiCA will bring new

regulatory obligations for stablecoin issuers starting in the third

quarter of 2024.

Indonesia sets rules for crypto and financial innovation

The Financial Services Authority of Indonesia (OJK) established

new regulations to foster technological innovation in the financial

sector, applicable to cryptocurrency starting in January 2025.

These guidelines guide institutions like banks and insurers in the

safe adoption of new technologies, including the establishment of

sandboxes and consumer protection. The measure paves the way for

OJK’s regulatory supervision of cryptography, in collaboration with

local and international regulators, to strengthen crypto

policy.

Thailand exempts crypto gains from double taxation

On Tuesday, the Thai government approved a measure that

eliminates double taxation on cryptocurrency profits, removing the

need to declare capital gains from investment tokens on income tax.

This decision, aimed at stimulating financing through digital

tokens, follows other recent tax incentives in the country,

including a VAT exemption on crypto profits until 2023 and tax

benefits for token-issuing companies, applicable from January 1,

2024.

Spirit Blockchain and Vesta Equity form strategic partnership in

real estate tokenization

Spirit Blockchain Capital Inc. and Vesta Equity Inc. announced a

strategic partnership to innovate in the real estate market through

Spirit’s investment in Vesta. This collaboration aims to expand

real estate investment options and introduce new opportunities

through residential equity tokenization, allowing homeowners to

unlock capital without incurring debt and investors to acquire

fractions of properties. The partnership promises to transform the

real estate sector, combining the expertise of both companies in

blockchain and digital investments.

Cleartoken raises $10 million for crypto clearing services

Cleartoken, an innovative crypto clearinghouse, announced on

Wednesday that it raised over $10 million in an initial investment

round from prominent names like Nomura’s Laser Digital, as well as

Flow Traders, GSR, LMAX Digital, and Zodia Custody. The company

focuses on providing an efficient clearing and settlement platform

for the digital asset market, promising security and reduced

counterparty risks. Cleartoken, seeking full regulation in the UK,

plans to introduce settlement and clearing services in the next 18

months, aiming to position the UK as a global leader in this

emerging sector.

SEC orders First Trust and SkyBridge to withdraw ETF application

The SEC instructed First Trust Advisors and SkyBridge Capital,

led by former White House Communications Director Anthony

Scaramucci, to withdraw their Bitcoin ETF application, due to a

lack of response to previous agency communications. The original

application, made in March 2021 and rejected in January 2022, was

not resubmitted after the SEC approved other Bitcoin ETFs.

Judge approves Dentons’ hiring by Terraform Labs in litigation with

the SEC

A US judge authorized Terraform Labs to hire the renowned law

firm Dentons for its defense in a lawsuit filed by the SEC and

co-founder Do Kwon, despite opposition from creditors and

regulatory bodies. The controversy arose after Terraform directed

$166 million in legal fees, limiting the availability of funds for

creditors. However, Dentons agreed to return $48 million to

Terraform and accept greater future judicial oversight, following

the company’s bankruptcy in January 2024, triggered by the collapse

of the Terra platform and its LUNA tokens in May 2022.

MakerDAO initiates Endgame phase with new tokens in 2024

MakerDAO, the entity behind the Dai stablecoin, plans to

introduce the initial phase of the Endgame in the summer of 2024,

revealed founder Rune Christensen. This launch will introduce two

new tokens, NewStable and NewGovToken, while maintaining the

current operations of Dai and the governance token. The update will

allow users to migrate to the new tokens, which will bring

innovative features like staking and digital farming. The Endgame

transition will begin with a new brand identity, followed by the

launch of the new tokens, targeting the diversification of use

between crypto and widespread adoption.

Yuga Labs seeks sanctions against Ryder Ripps for destroying NFT

keys

Yuga Labs, creator of the Bored Ape Yacht Club NFTs, requested a

US court to sanction Ryder Ripps for deliberately erasing the

private keys of his RR/BAYC NFTs, alleging obstruction of justice.

Ripps responded, denying the accusations and stating he complied

with the court order except for lost access to wallets. The dispute

intensifies after court decisions favorable to Yuga Labs, demanding

the destruction or delivery of infringing NFTs.

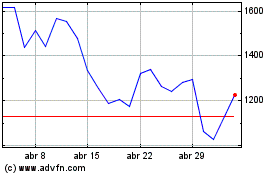

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024